IOG, the Net Zero UK gas and infrastructure operator focused on high return projects, provides an update on the Blythe well 48/23a-H1, the second Phase 1 development well.

Highlights

- Blythe well successfully drilled, cleaned up and flow tested to a maximum gas rate of 45.5 mmscf/d through an 80/64th inch choke within two months of spud

- Gas in place and recoverable volumes at Blythe are estimated to be in line with prognosis

- Good improvement in drilling performance over the Elgood well

- Phase 1 First Gas guidance reiterated for Q4 2021

- Initial Blythe Hub production rates expected to be within planning case range

- At current gas prices, 2021-22 cash flows expected to substantially exceed planning case

- Noble Hans Deul jack-up rig mobilising shortly to Southwark to continue the Phase 1 development drilling programme

The well was drilled by the Noble Hans Deul jack-up rig to a Total Depth of 10,750ft Measured Depth (MD), intersecting 1,238 ft of good quality Permian Leman Sandstone reservoir along hole between 9403 ft MD and 10,641 ft MD, with a net:gross ratio of 95%, porosity at 10.6% and average log-derived permeability of 5.0 milliDarcies (mD). Based on this initial data, the Blythe gas in place and recoverable volumes are estimated to be in line with pre-drill expectations.

Drilling performance saw a notable improvement over Elgood thanks to close collaboration between the Company's drilling, subsurface and HSE teams with the key drilling contractors Noble Corporation, Schlumberger and the Well Operator, Petrofac.

Over recent days the well was successfully cleaned up and flow tested to a maximum gas rate of 45.5 mmscf/d through an 80/64th inch choke. One operational challenge experienced during drilling was the loss of drilling mud due to natural fracturing in the reservoir. This necessitated the use of Lost Circulation Materials (LCM) down-hole which may have constrained the clean-up flow rate with drilling mud being recovered to surface during clean-up. Due to drilling fluid and LCM being recovered during clean-up, further analysis is required to determine the amount of condensate produced.

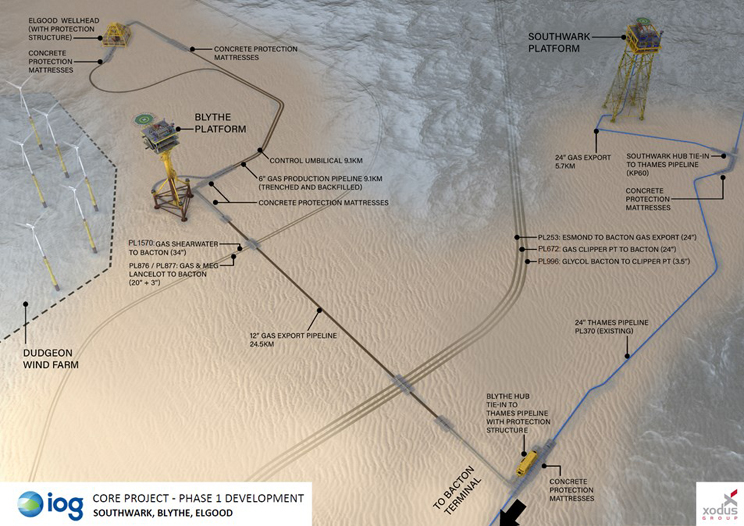

The Blythe field is planned to be produced through the Blythe normally unmanned platform, via the 12" pipeline laid earlier this year, which connects to the main 24" Saturn Banks pipeline to Bacton. The Company continues to expect First Gas from both the Blythe and Elgood fields in Q4 2021 once the final subsea and onshore installations are complete. The Noble Hans Deul rig is expected to mobilise shortly across to Southwark, the third of the Phase 1 fields, where it will spud the next production well through the Southwark platform.

Based on early indications from the Elgood and Blythe clean-up well tests, the Company expects that initial production rates from the Blythe Hub upon start-up will be within its planning case range. Specific production guidance is expected to be available once onstream. In light of exceptionally high forward gas prices, management expect that the Company's cash flows over 2021-22 could substantially exceed its planning base case.

Andrew Hockey, CEO of IOG, commented:

"Delivering the Blythe well within two months and achieving a maximum well test rate of 45.5 mmscf/d gas is another important step forward for IOG. Phase 1 First Gas is now coming firmly into sight which is a testament to the dedication of the whole IOG team and the excellent collaboration with our contractors.

We are now integrating the well data into our planning for the start-up of both Blythe and Elgood in Q4. The improvement in drilling performance at Blythe is also very encouraging as we progress on to Southwark and then on to drill the Goddard and Southern Hub appraisal wells in mid-2022.

Gas market conditions not just for this coming winter but throughout the forward curve indicate the potential for very strong cash flow generation for IOG over the coming years. We plan to start executing a sensible hedging strategy once onstream, while we also maintain our prudent planning price deck as we work up the next phases of growth.

As a committed Net Zero company we firmly believe that domestic gas produced at very low carbon intensity is an indispensable part of the UK's energy transition and IOG's gas will make a positive contribution in that regard."

KeyFacts Energy: IOG UK country profile

KEYFACT Energy

KEYFACT Energy