TransGlobe Energy today announced its financial and operating results for the three months and year ended December 31, 2021. All dollar values are expressed in United States dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS:

- 2021 sales averaged 13,478 boe/d in 2021 with an average realized price of $58.79/boe; average realized price on Egyptian sales of $62.94/bbl and Canadian sales of $38.40/boe;

- Funds flow from operations of $44.8 million ($0.62 per share) in 2021;

- 2021 net earnings of $40.3 million ($0.56 per share), inclusive of a $31.5 million non-cash impairment reversal and a $0.1 million unrealized loss on derivative commodity contracts;

- The Company ended the year with positive working capital of $21.0 million, including cash of $37.9 million;

OPERATIONAL HIGHLIGHTS:

- 2021 production averaged 12,854 boe/d (Egypt 11,336 bbls/d, Canada 1,518 boe/d), a decrease of 4% from 2020 primarily attributable to natural declines in Egypt, partially offset by the re-commencement of Eastern Desert drilling and well optimization activities;

- Inventoried entitlement crude oil in Egypt decreased to nil as at December 31, 2021 from 227.9 Mbbls as at December 31, 2020;

- Ended the year with 46.1 MMboe of 2P reserves, up 19% from 2020 year end of 38.9 MMboe;

- Drilled and completed eight development oil wells and performed six recompletions in the Eastern Desert in Egypt;

- Drilled one exploration well and performed one recompletion in the Western Desert in Egypt;

- Drilled three horizontal Cardium oil wells and completed one standing well at Harmattan in Canada;

CORPORATE HIGHLIGHTS:

- As previously announced, the amendment, extension and merger of the Company's Eastern Desert concession agreements into a single agreement was ratified by Egypt's Parliament and signed into law by the President in December 2021;

2022 (TO DATE) HIGHLIGHTS:

- As previously announced, TransGlobe signed the Merged Concession agreement at an official signing ceremony with the Ministry of Petroleum held on January 19, 2022;

- The Company remitted the initial modernization payment of $15.0 million and signature bonus of $1.0 million as part of the conditions precedent to the official signing of the Merged Concession agreement;

- In accordance with the Merged Concession agreement, TransGlobe made another modernization payment to EGPC in the amount of $10.0 million on February 1, 2022;

- January 2022 average production of 12,291 boe/d, February 2022 average production of 12,392 boe/d;

- A cargo of Gharib blend crude shipped at the end of January 2022, marketed by Mercuria Energy Trading;

- Declared a dividend of $0.10 per common share, which will be paid in cash on May 12, 2022 to shareholders of record on April 29, 2022.

In 2021 compared with 2020, TransGlobe:

- Reported a 4% decrease in production volumes compared to 2020. This was primarily attributable to natural declines in Egypt, partially offset by the re-commencement of Eastern Desert drilling and well optimization activities;

- Ended 2021 with nil crude oil inventory, a decrease of 227.9 Mbbls over inventoried crude oil levels at December 31, 2020. This was primarily due to annual sales volumes exceeding production volumes and the Q3-2021 cargo lifting that resulted in an overlift;

- Reported positive funds flow from operations of $44.8 million (2020 - $30.4 million). The increase in funds flow from operations from 2020 is primarily due to higher commodity prices, partially offset by lower production and excess cost oil in West Bakr;

- Petroleum and natural gas sales increased by 61%, primarily due to a 76% increase in average realized sales prices, partially offset by a 13% decrease in sales volumes in 2021;

- Reported net earnings of $40.3 million (2020 - net loss of $77.4 million) inclusive of a $0.1 million unrealized derivative loss on commodity contracts and a combined $31.5 million non-cash impairment reversal on the Company's petroleum and natural gas ("PNG") assets;

- Ended the year with positive working capital of $21.0 million, including $37.9 million in cash as at December 31, 2021;

- Spent $26.8 million on capital expenditures, funded entirely from cash flow from operations and cash on hand; and

- Repaid $18.9 million of long-term debt with cash on hand.

2022 Capital Budget

The Company's 2022 capital program of $57.7 million (before capitalized G&A) includes $33.1 million for Egypt and $24.6 million for Canada. The 2022 plan was prepared to focus on value accretive projects within its portfolio, maximize free cash flow to direct at future growth opportunities and to increase the Company's production base and return to shareholder distributions. The 2022 drilling program includes 17 Egypt wells and 7 Canadian Cardium wells in South Harmattan.

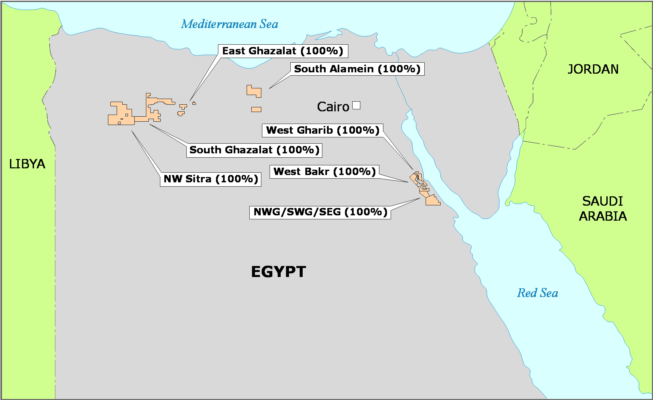

Egypt

The 2022 $33.1 million Egypt capital program is predominantly weighted towards 13 development wells within the Eastern Desert, including two Arta Nukhul horizontal multi-stage completion wells. Additionally, two exploration wells are planned for the second half of the year along with a further two water injection wells, bringing the total planned number of wells in Egypt to 17. The Egypt capital program includes $12.6 million of other spending, of which half relates to materials, including long-lead capital items which are expected to provide continuity into 2023. With the finalization of the Merged Concession agreement, the primary focus of the 2022 Egypt plan is to accelerate the exploitation of the Company's Eastern Desert acreage while optimizing the potential of modern, horizontal multi-stage completion wells in accessing the Company's contingent resource base.

The 13 well development program, already underway, consists of nine vertical development wells in K-field, the two previously mentioned horizontal wells in Arta field, and two further vertical wells in Arta field.

Egypt production is expected to average between 10.0 and 10.8 Mbbl/d for the year.

Canada

The $24.6 million Canada program consists of drilling seven (seven net) horizontal wells all targeting the Cardium light oil resource at South Harmattan along with additional maintenance/development capital. The Cardium drilling program in 2022 consists of six 1-mile and one 2-mile wells. Two of these wells are expected to be drilled in Q1-2022. The remaining five wells are expected to be drilled in late June through August, and all wells are expected to be completed and brought on-stream in late summer to early fall 2022.

Canada production is expected to average between 2.4 and 2.6 Mboe/d for the year.

KeyFacts Energy: TransGlobe Energy Egypt country profile

KEYFACT Energy

KEYFACT Energy