Let’s start 2021 with a shot of optimism. We know our economies are in a mess, unemployment at new highs, Covid deaths continue, our downtowns empty, too many For Lease signs abound and we are still WFH, but for the first couple of weeks in the new year there is a comforting combination of oil price recovery, vaccines-in-circulation, and an increase in oil consumption. As vaccines start hitting our arms, an army for forecasters and talking-heads assure us of a consumption turnaround in the second half of this year and wait for it even – an M&A market bursting with stalled deals. It certainly will be a buyers market.

Oil prices continue to climb since late October - can you have believed Brent Crude at over $US56/bbl this week compared to the low $US20’s back in May 2020? Have no doubt this is a solid trend of the price rebound. Firstly, a shout-out to the parents in the park: Saudi Arabia, for taking he lead to pull back one million bopd of production given that the rest of rest of Opec+ were less than 100% compliant with their allocated cutbacks. Granted, the Saudis and Russians created the price destruction in the first place, but I can live with Saudi’s vested self-interested production cuts. One thing is for sure – no way would US Permian producers cut back one million bopd. (As an aside we think The Great Reckoning of the Permian may be upon them this year – more on that later in the year).

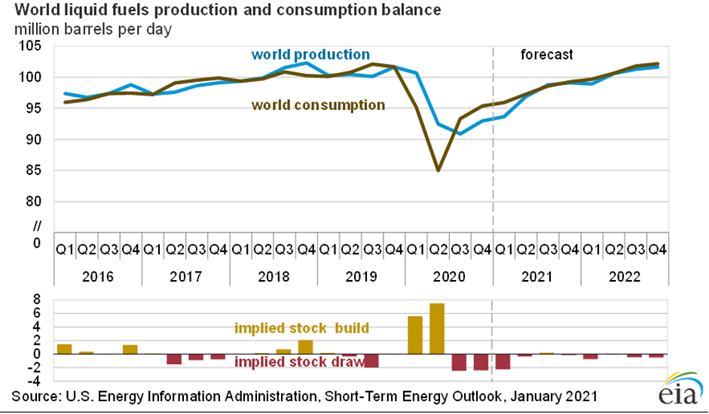

Oil Demand – Look at the IEA consumption forecast –increases of 5.6million in 2021 and 3.3million bopd in 2022 in Global Oil consumption in 2021 (global total of ~95-97million bopd – near 2018 levels). We also have China to thank for the steady uptick in oil prices, plus some overenthusiastic market sentiment in support. It simply makes geopolitical sense for China to project confidence and kick-starting industrial recovery ahead of everybody else. With Wuhan in the rearview mirror – locking-in feedstock to replenish their strategic oil reserves, feed their refineries before consumption starts in earnest by the second half of this year makes for good politics and business. As Covid restrictions get lifted in Q2 – Q3 expect to see additional consumption driven by transportation revival and the crimping of Middle East capacity. India will follow suit of with its vast appetite for transportation fuel and early ramp up oil consumption for their local refineries.

A more stable international upstream oil & gas sector. 2021 will be the year the upstream sector will brush the dust off and gather momentum after deep Capex cuts in 2020. We anticipate modest Capex increases 2021 especially once Brent crosses onto the $US60-$US70 range. However, it all depends on size. The majors (ENI, BP, Total, Shell, Exxon) will continue prioritize only on the biggest and long-life projects and dispose of lower value assets. A rich food chain of assets – look out for the disposition announcements in the tens of billions of dollars - food for the next tier of sub-majors/IOC. Independents and Private Equity E&P companies will likely execute on their new growth strategies. Niche players concentrating older life assets will do well. Upstream startups will probably find it no easier in 2021 will have appeal to investors.

This is going to be a busy year – Reasons to be Cheerful.

* With apologies to Ian Drury and the Blockheads.

KEYFACT Energy

KEYFACT Energy