Even though 2020 was the year oil and gas producers reduced output to balance the pandemic-hit demand, Australasia’s production did not only stay resilient, but it also rose a little, a Rystad Energy report reveals. We estimate combined petroleum output across all products was 1.210 billion barrels of oil equivalent last year, little changed from 1.208 billion boe in 2019.

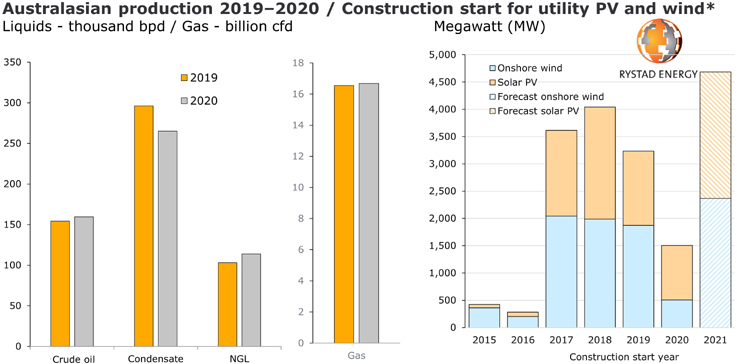

Within this, Australasia – Australia, New Zealand, Timor-Leste and Papua New Guinea – produced an average 160,000 barrels per day (bpd) of crude oil, an increase of about 3% from 2019. The largest contributor to crude oil production growth was Woodside’s Greater Enfield project, which is estimated to produce about 28,000 bpd. The region pumped condensate at an average rate of 265,000 bpd in 2020, down approximately 10% from 2019, while natural gas liquids (NGLs) increased roughly 10% to about 114,000 boepd.

In terms of gas output, Rystad Energy estimates Australasian production averaged 16.6 billion cubic feet per day (cfd) in 2020, relatively flat year-on-year. The top gas-producing project in the region was Chevron’s Gorgon with an estimated output of close to 2.1 Bcfd (LNG and domestic gas).

Capital expenditures excluding exploration fell to US$6.5 billion in 2020, down 34% from US$9.9 billion in 2019. Before the pandemic struck, Rystad Energy had expected US$11.5 billion in non-exploration capital expenditures, which means the actual capex was 43% below our initial estimates. The decline was largely driven by spending cuts implemented by companies to weather the crash in benchmark commodity prices.

The industry’s bottom line decreased as expected. We estimate free cash flow from operations slipped by about 9% to US$20.7 billion in 2020. On the exploration side, spending fell to a historic low of close to US$930 million, a 53% decline compared to 2019, and the lowest level of exploration spending since 1994.

Post-tax impairments in Australasia are estimated to be more than US$15 billion, with Shell taking the biggest impairment at US$8.2 billion for the QCLNG and Prelude FLNG projects. Woodside announced US$4.37 billion in post-tax impairments on its portfolio, followed by Total at US$800 million for its Australian gas assets, Santos with US$560 million, Origin Energy at US$530 million, and Oil Search announcing US$300 million in impairments relating to its assets in Papua New Guinea.

Upstream capital and operating expenditures have been sharply reduced alongside exploration budgets. Woodside, one of the largest producers in Australia, halved its total expenditure to about US$2.4 billion in 2020, and other companies with a strong presence in Australia like Santos, Beach Energy and Origin Energy also slashed their 2020 spending plans.

Projects that were to be sanctioned over the 2020–2022 period have been deferred due to the prevailing situation. Rystad Energy expects these delays will reduce Australasia’s capital expenditure between 2020 and 2022 by approximately US$5 billion.

What’s coming from 2021 onwards?

New upstream oil and gas projects worth about $15 billion will be sanctioned in Australasia this year, according to Rystad Energy’s forecast, representing a huge boost compared to the $1.2 billion committed to new projects in 2020.

This jump in activity, however, is almost entirely dependent on the anticipated final investment decisions (FIDs) being taken for the Scarborough and Barossa liquefied natural gas projects in Australia. Without these major FIDs, we anticipate new commitments this year of only $526 million in the region, representing a 57% drop from 2020 for major E&P companies. Virtually all sanctioning activity expected this year in the region will be in Australia.

The Scarborough/Pluto Train 2 project on the north coast of Western Australia, which operator Woodside is expected to formally sanction this year, dominates the list of FID candidates. Our estimate for Scarborough capital expenditure is $11.1 billion, which would represent 72% of all the potential investment commitments in the region for the full year. Meanwhile, the estimated capex associated with the other large Australian project likely to reach FID – Santos’ Barossa gas field development – is $3.7 billion.

The impact of project delays is most apparent in Rystad Energy’s production forecasts for the 2024 to 2030 period. We now expect that Australian gas production in 2030 will be 101 million barrels of oil equivalent (boe) lower than our previous forecast – a drop of about 9%. Overall, we continue to see a relatively balanced East Coast gas market, with potential for higher prices, and a shortfall in the West Coast gas market. These dynamics were addressed in a recent commentary on what lies ahead for Australia’s upstream sector this year.

On a combined liquids and gas basis, we now forecast a 2030 production of 1.26 billion boe. This is 188 million barrels of oil equivalent below our previous forecast – representing a 13% drop. As expected, the lower forecast is primarily the result of the deferrals in gas projects.

Rystad Energy’s UCube and RenewableCube.

2021 to be record year for renewables

This year is set to be a busy one for Australian renewable energy players, with an expected 5.3 gigawatts of utility PV, wind and battery projects expected to complete commissioning. Activity will be concentrated to the West Murray region for utility PV commissioning and western Victoria for wind.

New utility PV and wind construction is set to bounce back in 2021 from a four-year low in 2020. Rystad Energy estimates the additions at 2.1 GW in utility PV projects, 2.8 GW of wind and 0.45 GW from batteries, however beyond 2021 appears challenging as grid capacity for new connections becomes limited.

When it comes to projects that break ground, the record for new construction starts in the utility PV sector was set in 2018, when 2.1 GW started construction. This year is set to challenge that record as several large-scale projects have secured power purchase agreements (PPAs) and are expected to begin construction in 2021.

Utility wind construction in Australia is also gearing up for a record year in 2021. About 2.9 GW of utility wind assets have currently signed PPAs but have yet to start construction.

KEYFACT Energy

KEYFACT Energy