"Potential for 172 MMboe 2C contingent resource estimates to be developed from a fully electrified platform"

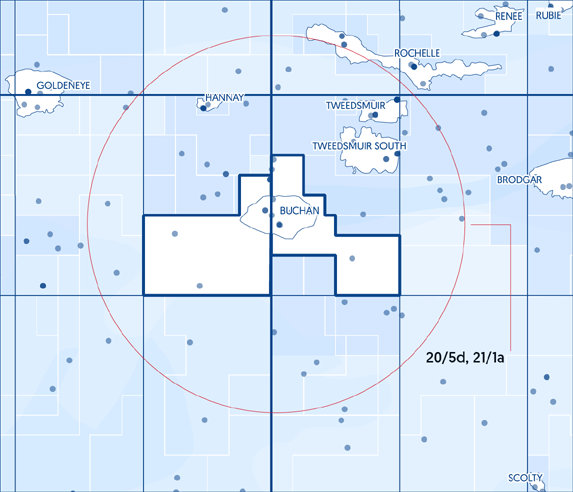

Jersey Oil & Gas (AIM: JOG), an independent upstream oil and gas company focused on the UK Continental Shelf ("UKCS") region of the North Sea, is pleased to announce the key findings of its detailed and comprehensive Concept Select Report ("CSR") in respect of its Greater Buchan Area ("GBA") Development Project which contains an aggregate 172 million barrels of oil equivalent ("MMboe") 2C contingent resource estimates of light sweet crude and associated gas. The planned development is centred on resuming production at the Buchan oil field and producing the J2 and Verbier oil discoveries as well as other existing and yet to find discoveries within the GBA as future upside.

Highlights

- A three-phase development centered around a single integrated wellhead, production, utilities and quarters platform located at the Buchan field - the GBA hub

- The development concept is based on P50 Technically Recoverable Resource estimates of, in aggregate, 172 MMboe of light sweet crude and associated gas within the Core GBA, which includes the Buchan oil field and J2 and Verbier oil discoveries

- JOG aims to deliver production from the planned GBA Development Project at an industry leading carbon intensity level due to Platform Electrification, as seen in certain fields in the Norwegian sector

o Overall carbon emissions from the GBA with platform electrification estimated by management at <1kg/boe

- Project economic estimates by management for the Core GBA selecting Platform Electrification as our preferred low carbon power solution, are:

o Pre-tax free cashflow of US$6.4 billion with an NPV (pre-tax) of US$1.7 billion

o Payback period under 3 years

o Project internal rate of return ("IRR") greater than 25%

- Development costs (Capex and Opex) based on today's values are estimated to be approximately US$30/boe

o Capex estimate for Phase 1 of approximately £1 billion (including 20% contingency)

o Opex estimate during plateau production of US$8/boe to US$9/boe

- The GBA hub nameplate capacity has been set at 40,000 barrels of oil per day ("bopd") with expected plateau production of more than 3 years

- Significant upside potential from 4 drill ready exploration prospects within the GBA that have combined prospective resource estimates totaling an additional 219 MMboe

o The close proximity of the GBA exploration prospects, will enable their development, on discovery, as low cost subsea tie-backs to the planned GBA hub

o A discovery in line with P50 estimates at any of the drill ready exploration prospects has the potential to extend plateau production significantly and materially increase project economics

- With the preferred development concept identified, JOG is now ready to launch its planned and previously announced farm-out process for the GBA

Andrew Benitz, CEO of Jersey Oil & Gas, commented:

"The GBA has the scale to be extremely low carbon through platform electrification at the same time as offering highly favourable project economics. As a result of a significant amount of work from Jersey Oil & Gas' excellent project team, working with specialist contractors, consultants and service providers, we are well on track to deliver on our Licence commitment to deliver the Concept Select to the Oil and Gas Authority ("OGA") by July this year.

"We now plan to launch a farm-out process, which we expect to be highly attractive to a wide range of oil companies in light of the project's scale, economics and low carbon potential through platform electrification, characteristic of certain fully electrified fields offshore Norway."

Summary of Concept Select Findings

Delivering Concept Select has been a comprehensive work effort led by our project team requiring over 14,000 JOG hours and 18,000 contractor hours. In early 2020, JOG completed an Appraise phase assessment of the various development options for the GBA. This option screening phase concluded that development of the GBA's resources via a fixed production platform located at the Buchan field, offered the optimum solution when considering environmental factors, safety issues, technical feasibility, execution risk, schedule, capital and operating costs, project economics, availability and operability.

Subsequently, the Company has progressed this development option through the Concept Select phase, with work commencing in April 2020. The objective of this Select Phase was to deliver a single, economically acceptable concept to develop the GBA in order to take the project forward into the Define Phase.

The selected concept for the GBA Development is planned to be executed in three Phases. Phase 1 will deliver a single integrated wellhead, production, utilities and quarters (WPUQ) Platform located at the Buchan field. Production from the reservoirs will be supported by injection of both produced water and seawater. The facility will be normally manned. The Buchan wells will be drilled utilising a heavy-duty jack-up (HDJU) located over a 12 slot well bay. The Phase 1 facilities will be designed to accommodate Phase 2 and Phase 3 of the development. Phase 2 will develop the J2 West, J2 East and Verbier East discoveries via a subsea tie-back to the GBA platform. Phase 3 will develop the Verbier West discovery via connection to the Phase 2 subsea infrastructure. Field life is anticipated to be 31 years.

The Buchan location benefits from close proximity to existing export infrastructure for both oil and gas. Selection of the final oil and gas export routes will be subject to a detailed economic and risk assessment through formal requests for service issued in February 2021. Initial negotiations with pipeline operators will be conducted in accordance with Oil & Gas UK's Infrastructure Code of Practice. It is scheduled that this work will be completed to inform FEED (Front End Engineering and Design), currently planned to take place later this year.

Work has also been conducted to identify the optimum type of artificial lift for the production wells. Gas lift and electrical submersible pumps (ESPs) were investigated. The use of ESPs was shown to deliver a higher production rate and thus greater recoverable volumes over the same period than gas lifted wells.

KeyFacts Energy: Jersey Oil and Gas UK country profile

KEYFACT Energy

KEYFACT Energy