From our selection of over 500 continually updated energy company profiles, KeyFacts Energy today feature Predator Oil & Gas.

Predator Oil & Gas Holdings plc is an oil and gas exploration company with the objective of participating with FRAM Exploration Trinidad Ltd. in further developing the remaining oil reserves and sequestrating anthropogenic carbon dioxide in the producing Inniss Trinity oil field onshore Trinidad, primarily through the application of C02 EOR technology. Potential for cash flow exists by executing a successful Pilot Enhanced Oil Recovery project using locally sourced liquid carbon dioxide for injection into and storage within the oil reservoirs ("C02 EOR"). Near-term expansion and production growth potential is focussed on upscaling the C02 EOR operations in the Inniss-Trinity oil field, subject to all necessary approvals.

Predator is operator of the Guercif Petroleum Agreement onshore Morocco which is prospective for Tertiary gas in prospects less than 10 kilometres from the Maghreb gas pipeline. A drilling programme, subject to the lifting of COVID-19 restrictions, targeting material prospective gas resources is scheduled for Q2 2021.

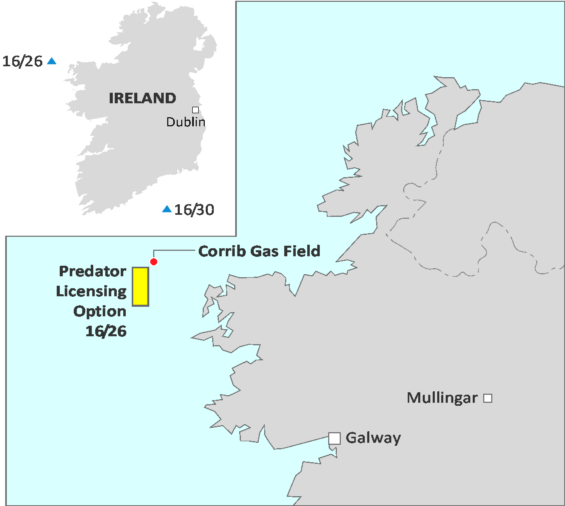

In addition, Predator also owns and operates exploration and appraisal assets in licensing options offshore Ireland, for which Successor Authorisations have been applied for, adjoining Vermilion's Corrib gas field in the Slyne Basin on the Atlantic Margin and east of the Kinsale gas field and Barryroe oil field in the Celtic Sea.

The Company has a highly experienced management team with a proven track record in the oil and gas industry.

TRINIDAD

Inniss Trinity oil field Well Participation Agreement

Trinidad lies within the Eastern Venezuelan Basin which is one of the largest oil provinces in the World. The Inniss Trinity field lies in the southern part of Trinidad where, as a result of thrust faulting during the Middle Miocene orogeny, several NE-SW trending anticlinal folds developed. Several oil fields which produce from similar age turbidite reservoirs are located along the trend, including Penal-Barrackpore, Cory Moruga, and Moruga West. The Miocene Herrera turbiditic sands are the main oil reservoirs and underlain by Cretaceous marine shales which are the main oil source rocks. Oil reservoirs occur between 500 and 3,500 feet in the IPSC area.

Predator entered into an agreement on 17 November 2017, the Inniss Trinity Well Participation Agreement (“WPA”) which facilitated Predator Funding 100% of the cost of 2 infill production wells in the mature onshore Inniss Trinity oil field under the terms of an Incremental Production Service Contract (“IPSC”) held and operated by FRAM Exploration Trinidad Ltd (“FRAM”) with 100% equity. The ISPC is between FRAM and Heritage, the State oil company and licence holder.

The WPA was amended in July 2018 to defer Predator’s participation, subject to regulatory approval, in the infill development drilling operations in the Inniss-Trinity oil field by 12 months to focus on Enhanced Oil Recovery assisted by carbon dioxide injection (“CO2EOR”). CO2 EOR operations are considered by all stakeholders to potentially be commercially more attractive and to offer the possibility of higher returns for investors for approximately the same amount of existing Predator capital as would have been deployed for executing the infill drilling programme.

Under the amended WPA, Predator will fund the cost of acquiring and upgrading surface facilities for Pilot CO2 EOR operations and the supply of a minimum of 5,400 metric tonnes of CO2 to the CO2 injector well and will fund all costs associated with the initial phase of Pilot CO2 EOR operations up to a maximum Consideration Cap of USD 800,000.

Subject to a successful Pilot CO2 EOR, the extension of the IPSC to 31 January 2022 and the Company’s Pilot CO2 EOR economics, Predator will fund the cost of expanding CO2 EOR operations up to a maximum Consideration Cap of USD 700,000 using production revenues generated from the Pilot CO2 EOR.

The WPA allows Predator to recover 100% of its costs from anticipated production from the pilot CO2 EOR operations after deduction of State and Heritage royalties of 22.5% and operating costs, which are capped at US$ 10/brl, and the offset of cumulative historical FRAM tax losses against 50% Petroleum Profit Tax. In the event that realised oil price (after deduction of the Heritage discount) is greater than US$50.01/brl and less than US$90/brl the Heritage royalty increases such that the combined State and Heritage royalties are 29.5%.

The Pilot C02 EOR is the first C02 EOR project to be undertaken with the State-owned Heritage Petroleum Company, the new entity resulting from the re-structuring of Petrotrin.

Map source: KeyFacts Energy

Onshore Trinidad Pilot CO2 EOR

- Planned CO2 injection in the Inniss-Trinity field into AT-5X commenced on 18 May 2020 for a period of 30 days, with a total of 380 metric tonnes of CO2 successfully injected during the period

- 30 days following cessation of the initial CO2 injection, oil production increased sharply in a CO2 EOR monitoring well. Production was sustained at an average rate 88% higher than the average rate for the CO2 EOR monitoring well in the month prior to the start of CO2 injection

- At the end of the monitoring period in November, planned CO2 injection re-commenced at AT-13. This time an immediate response in the CO2 EOR monitoring well was observed with an increase in production of 60% relative to the average pre-injection production rate in the five days preceding injection

- Enhanced incremental oil production for the single CO2 EOR monitoring well is estimated to be approximately 2,200 barrels of oil since the commencement of CO2 injection

- CO2 sensors have detected no increased CO2 emissions at surface at AT-5X and AT-13 above the pre-injection background base line, demonstrating the effectiveness of subsurface sequestration of CO2

IRELAND

Map source: KeyFacts Energy

Atlantic Margin - Corrib South

Predator has a 50% interest in licencing option 16/26 (“Corrib South”) together with its partner, Theseus (50%)

Corrib South lies only 20 km. south of the Corrib subsea gas gathering manifold making it a candidate for a potential subsea tie-back. Spare capacity is forecast to be available in the Corrib infrastructure within the likely time framework for drilling and potentially developing Corrib South.

The area of minimum closure for Corrib South is covered by the same 3D seismic survey that extends over the Corrib gas field.

The reservoir target in Corrib South are the Sherwood sandstones, the producing gas reservoir in the Corrib gas field, Mercia salt, as at the Corrib field, is expected to seal the reservoir which is also likely to have been charged from similar gas-prone Westphalian source rocks.

The size of the Corrib South structure in the maximum case, which depends on pre-2000 vintage 2D seismic coverage to the southwest, is similar to that of the Corrib gas field. Drilling and water depths are similar.

Celtic Sea – Ram Head

LO 16/30 -Predator Oil & Gas Ventures: 50% (Operator), Theseus Ltd: 50%

Located 40kms east of the Kinsale gas field and gas pipeline to shore in the Celtic Sea Basin. It contains the Ram Head Prospect, formerly identified and drilled by Marathon in 1984 when dry gas was discovered in 49/19-1 well.

The reservoir targets are Middle and basal Upper Jurassic sandstones. The new technology has provided enhanced information in relation to the potential quality of proven Jurassic gas reservoirs and Cretaceous oil sands penetrated by the Marathon well.

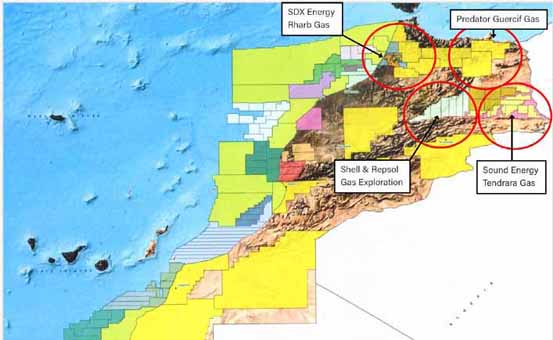

MOROCCO

Guercif Licence

Predator has a 75% interest in the Guercif Licence together with its partner ONHYM, the State oil company.

The Guercif Licence is located onshore Morocco and comprises four Exploration Permits, I, II, III and IV. It covers an area of 7,269 km² and lies approximately 250 kilometres due east of and on trend with the Rharb Basin where shallow gas production has been established by SDX Energy Plc for several years. Guercif also lies approximately 180 kilometres due north-west of Tendrara where deep discovered gas is currently being appraised and potentially developed by Sound Energy.

Map source: Predator Oil & Gas

Background

In December 2018, an application for an exclusive licence for hydrocarbon exploration and appraisal onshore northern Morocco was accepted by the Office National des Hydrocarbures et des Mines ("ONHYM") acting on behalf of the State.

The formal award of the exclusive licence is subject to the provision by Predator of a Bank Guarantee prior to a formal Signing Ceremony.

The licence will be for 8 years, split into 3 phases with an Initial Period of 30 months followed by First and Second Extension Periods of 36 and 30 months' duration

respectively.

Highlights:

- Exclusive licence for exploration covering an area of 7,269km² and comprising the Guercif Permits I, II, III and IV, lying east of the producing gas fields of the Gharb Basin and northwest of the Tendrara gas project.

- Predator will be operator through its wholly-owned subsidiary Predator Gas Ventures Ltd with 75% equity interest and ONHYM 25%. ONHYM has the right to "back-in" for up to and including 25% equity in the event of a hydrocarbon development by paying its share of forward costs.

The work programme for the Initial Period will include 250 kilometres of reprocessing of existing seismic data and the drilling of one well to a minimum depth of 2,000 meters to test a large seismic anomaly interpreted as being indicative of the presence of shallow Tertiary gas, similar to the producing Gharb Basin.

The Guercif Licence is also prospective for deeper Triassic gas and Jurassic oil and gas which can be evaluated in the First and Second Extensions.

The initial target for gas lies just 9 kilometres north of the Maghreb - Europe gas pipeline, which has spare capacity in the event of a major gas discovery, which is the desired objective of Predator's exploration planning Government taxes are confined principally to a 5% royalty for gas and 30% Corporation Tax but with a total exemption for the first 10 years of production.

Exploration History

Guercif has been very lightly explored with only 4 deep exploration wells drilled by Elf in 1972 (GRF-1), Phillips in 1979 (TAF-1X), ONAREP (the forerunner of ONHYM) in 1985 and 1986 (MSD-1 and KDH-1) and 2 shallow stratigraphic wells drilled by BRPM for coal exploration in the 1950’s.

TransAtlantic re-entered, logged and tested the MSD-1 well, originally drilled in 1985, in 2008 but the logging and testing failed to establish the presence of hydrocarbons in the Jurassic.

Historical exploration focus was entirely on the Jurassic and was completed before the shift in focus took place that resulted in shallow (Tertiary) gas production in the Rharb Basin and successful deep (Triassic) gas appraisal drilling at Tendrara.

In this context, therefore, Guercif has never been explored for these more recent targets and this is the new focus for Predator Gas Ventures Ltd. (“PGV”).

KEY PERSONNEL

Dr Stephen Staley Chairman

Paul Griffiths Chief Executive Officer

Ronald Pilbeam Project Development Director

Louis Castro Non-Executive Director

CONTACT

Predator Oil & Gas Holdings Plc

3rd Floor, Standard Bank House, 47 - 49 La Motte Street, St. Helier, Jersey JE2 4SZ, Channel Islands

Tel: +44 (0) 203 934 6630

info@predatoroilandgas.com

www.predatoroilandgas.com

* KeyFacts Energy hold a database of over 500 oil and gas company profiles, allowing users to instantly access operational activity, geographic locations and key personnel in our succinct 2-page reviews. For more information about this bespoke low-cost service, contact us.

Predator Oil & Gas company/country profiles: Trinidad and Tobago l Ireland l Morocco

KEYFACT Energy

KEYFACT Energy