As part of our recently launched 'at-a-glance guide to company global operational activity' today we feature Cairn Energy.

From our selection of over 600 oil and gas companies, users now have access to ‘first pass’ preliminary review data comprising; company description, overview of global assets, key operational activity, updated Energy Transition developments, contact details and leadership.

This now means that our Energy Country Review subscribers can choose to review our database of profiles by individual country or global company operational activity.

Cairn is one of Europe’s leading independent oil and gas exploration and development companies and has been listed on the London Stock Exchange for 30 years.

The company has explored, discovered, developed and produced oil and gas in a variety of locations throughout the world as an operator and partner in all stages of the oil and gas lifecycle.

Cairn’s exploration activity is principally in frontier and emerging basins where the greatest potential value exists. The Group’s production assets, located in mature basins, provide the cash flow to sustain exploration and development activity.

In the UK and Norway, Cairn have built an extensive portfolio across a variety of plays in the Barents Sea, UK North Sea, Norwegian Sea and Norwegian North Sea.

Cairn secured three new licences in Mexico. Two licences are located in the prolific but under-explored Sureste basin, offsetting recent world class oil discoveries.

The company has an operated exploration agreement on acreage in the Demerera plateau offshore Suriname with seismic activity and significant future drilling opportunity.

The company's headquarters is in Edinburgh, Scotland, supported by operational offices in London, Norway, Senegal and Mexico.

Cairn has played an active role in developing India’s oil and gas reserves, helping to build the country’s domestic oil industry and working to enhance its energy security. In keeping with its model of creating, adding and realising value, in 2006, Cairn’s Indian subsidiary, Cairn India Limited (CIL), was listed on the Indian stock exchanges and in 2012 Cairn sold the majority of its stake in CIL. Since then Cairn has focused on rebuilding the business to create, add and realise value once again through exploration, development and production.

Production and reserves

The North Sea production assets delivered 2020 annual net production of just over 21,000 bopd, (cum. 7.81m bbl) in line with revised full year guidance. Kraken performance remained strong throughout the year, while Catcher was constrained in the fourth quarter due to operational issues. Catcher production averaged ~51,200 boepd (2019: ~67,200 boepd) gross for the year and Kraken averaged ~37,500 bopd (2019: ~35,600 bopd).

The Group 2P reserves decreased during the year by 116.8 mmboe from 149.7 mmboe to 32.9 mmboe. This was principally as a result of disposals (106.5 mmboe relating to Sangomar and Nova) but also accounts for production in the period (7.8 mmboe) and revisions (2.5 mmboe), the latter primarily related to a change in oil price assumptions for the Group.

HISTORY

Historically, Cairn focused on South Asia where it created significant value for shareholders and stakeholders, particularly through its discovery, development and production of oil in Rajasthan, India. This was the largest onshore discovery in India for more than 25 years with the potential to provide more than 30% of India’s daily crude oil production and generate many billions of US dollars in revenue for the Government of India.

In 2006 the Indian business, Cairn India Limited (CIL), was listed on the Indian stock exchanges and in 2012 Cairn sold the majority of its stake in CIL and returned cash to shareholders as part of its business model to create, add and realise value for shareholders. Between 2006 and 2012 Cairn returned US$4.5 billion to shareholders.

Having created a legacy asset for India, Cairn then focused on rebuilding the business to create, add and realise value once again through exploration, development and production. The company made the largest global offshore discovery of 2014 in Senegal which is now in the development planning stage, and participated in the development of two of the largest projects in the UK North Sea, Catcher and Kraken, which began production in 2017.

In March 2021, Cairn, together with Cheiron (its consortium partner), announced the proposed acquisition of a portfolio of upstream oil and gas production, development and exploration interests from Shell in the Western Desert, onshore Egypt.

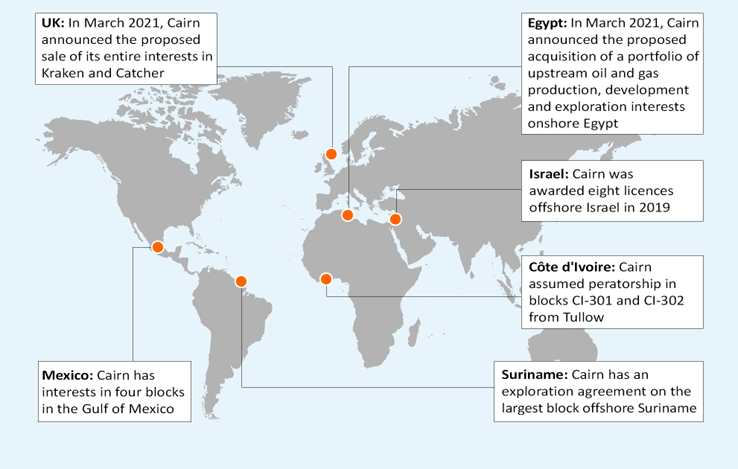

GLOBAL OPERATIONS

UK

In 2012 Cairn acquired non-operated interests in two of the largest developments in the UK North Sea, Kraken and Catcher. During 2017 both projects achieved first oil production.

On 9 March 2021, Cairn announced the proposed sale of its entire interests in both fields to Waldorf Production Ltd. The divestment is expected to complete in H2 2021.

Cairn holds a 20% non-operated interest in Catcher and a 29.5% non-operated interest in Kraken, these projects provide production and cash flow to Cairn.

Net oil production to Cairn from the Catcher and Kraken fields in 2020 averaged just over 21,000 barrels of oil per day.

Catcher

The Catcher Area Fields are a combination of the Catcher, Varadero and Burgman fields ~170 km east of Aberdeen.

Average 2020 gross production from the Catcher Area (Cairn 20% WI) was 50,200 bopd.

Kraken

Kraken is a large heavy oil accumulation located in the East Shetland basin, ~125km east of the Shetland Islands.

Average 2020 gross production from Kraken (Cairn 29.5% WI) was 37,500 bopd.

EGYPT

In March 2021, Cairn, together with Cheiron (its consortium partner), announced the proposed acquisition of a portfolio of upstream oil and gas production, development and exploration interests from Shell in the Western Desert, onshore Egypt in a deal valued at US$646 million (US$323 million net to Cairn), with additional contingent consideration of up to US$280 million (US$140 million net to Cairn) if certain requirements are met. Capricorn Egypt, a wholly owned subsidiary of Cairn, will acquire 50% of the Assets, with the remaining 50% acquired by Cheiron. The Acquisition is in line with Cairn’s strategy of seeking to grow, diversify and extend its production base. The portfolio offers low cost production, near-term development and exploration potential, provides immediate operating cashflow contribution and adjusts the company's overall hydrocarbon split towards gas.

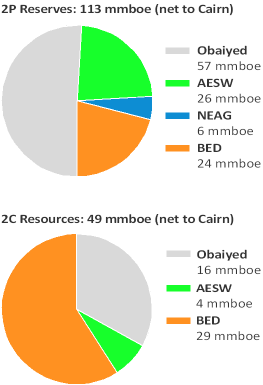

The transaction adds working interest 2P reserves of 113 mmboe as at 31 December 2020 as well as 2021 forecast working interest production of between 33,000-38,000 boepd with an opex/bbl of <US$6/boe, with significant potential to increase production levels in future years.

MEXICO

In 2017 Cairn extended their reach along the Atlantic Margin by securing acreage in Mexico.

Cairn has interests in four blocks in the Gulf of Mexico, two as Operator (Blocks 9 and 15) and two as non-Operator (Blocks 7 and 104).

In Block 10 in the Sureste basin, an oil discovery was confirmed on the ENI-operated Saasken-1 exploration well (15% non-operated WI) during Q1 2020, with Operator preliminary estimates of 200 to 300 million barrels of oil in place. Following regulatory approval of the Operator’s updated exploration plan, the JV is preparing a second exploration well on the licence in H1 2021. The appraisal plan for the Saasken discovery, with the option to drill an appraisal well, is being assessed by CNH.

On Block 9 (50% WI), Cairn completed its second operated well in Mexico in Q1 2020. The exploration objectives were dry and the well was permanently plugged and abandoned. Cairn continues to update its assessment of the prospectivity of Block 9 (50% WI).

On Block 7 (30% WI), the Ehecatl-1 well, operated by ENI, completed operations during Q2 2020 and was permanently plugged and abandoned. The Operator ENI and Cairn are working to identify prospects for drilling a second exploration well, currently planned for 2022.

SURINAME

Cairn has an exploration agreement (Cairn operator 100% WI) on the largest block offshore Suriname.

The licence covers an area of ~13,000 km² on the Demerara plateau in the Guyana-Suriname basin, where significant discoveries continued to be made in 2020 and 2021.

Acquisition of 3D seismic is being considered to develop potential drilling opportunities in both shallow and deep-water areas of the block.

Cairn completed its 2020 drilling programme in Mexico in Q1 with an oil discovery on the non-operated Saasken-1 exploration well in Block 10. The JV is working to appraise the discovery and to exploit nearby synergies in order to assess the potential for commercial development.

The JV also plans a second exploration well on the Block 10 licence in H1 2021.

CÔTE D’IVOIRE

Cairn has assumed Operatorship (90% WI) in blocks CI-301 and CI-302 from Tullow which has exited both licences. Cairn remains in the Tullow-operated CI-520 (30% WI). The JV has exited blocks CI-518, CI-519, CI-521 and CI-522 effective end Q4 2020. The proposed 2021 work programme for blocks CI301 and CI-302 is focused on completing the planned 2D seismic acquisition, when safe to do so.

MAURITANIA

In March 2020, Cairn Energy exercised an option with Total to take 40% of Mauritania’s deepwater Block C7. Subject to government approval, Total’s 90% operator’s stake will drop to 50% with state firm ONHYM’s share remaining at 10%.

ISRAEL

Cairn was awarded eight licences offshore Israel in 2019, in the country's second offshore bid round.

Cairn is Operator of the licences with a 33.34% WI alongside two JV partners: Ratio Oil Exploration (33.33% WI) and Pharos Energy plc (33.33% WI). Seismic processing is ongoing to improve the imaging of existing seismic in order to mature prospectivity.

LEADERSHIP/CONTACT

The Board is committed to promoting high standards of corporate governance and understands that an effective, challenging and diverse board is essential to enable the company to deliver its strategy in line with shareholders’ and stakeholders’ long-term interests, whilst also generating confidence that the business in conducting itself in a responsible manner.

Simon Thomson Chief Executive

James Smith Chief Financial Officer

Nicoletta Giadrossi Chair

Keith Lough Non-Executive Director

Peter Kallos Non-Executive Director

Alison Wood Non-Executive Director

Catherine Krajicek Non-Executive Director

Erik Daugbjerg Non-Executive Director

Head office

50 Lothian Road, Edinburgh, EH3 9BY

T: +44 131 475 3000

London office

4th Floor, Wellington House, 125 Strand, London, WC2R 0AP

T:+44 (0)208 049 7620

Senegal office

Immeuble Focus One, 14 avenue Birago Diop, 1er etage, Point E, Dakar, Senegal

T: (+221) 33 869 6101

Mexico office

Capricorn Americas México, Torre Mayor, Avenida de la Reforma 505, Piso 36, Colonia Cuauhtémoc, Delegación Cuauhtémoc, 06500 Ciudad de México

Tel: +5255 1328 7900

KeyFacts Energy: Cairn Energy UK country profile

KEYFACT Energy

KEYFACT Energy