Oil companies are constantly seeking to access new exploration opportunities or to share the risk of failure with other companies on others. A common way to do this is through farm-ins and farm-outs where a company transfers some of its equity interest in an exploration licence (farms-out) to another company (the farminee) through a form of financial transaction. Often this involves the farminee carrying a share of the sellers forward costs and/or making payments towards sunk costs.

Farm-out levels drop to a record low in 2020

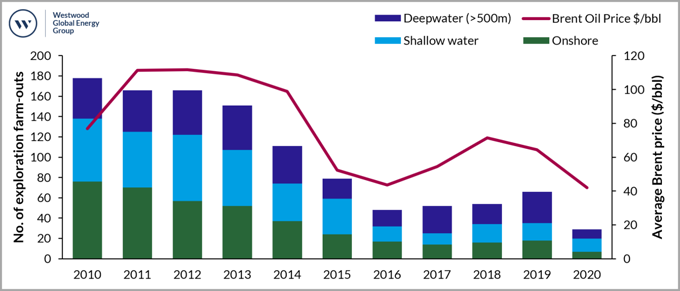

The 2020 oil price crash and Covid-19 pandemic were the catalysts for a 56% decrease in farm-out deals compared to 2019. The farm-out market had been showing signs of recovery since the low in 2016, until the events of 2020 resulted in the number of completed exploration farm-outs dropping to the lowest level in the last decade.

FIGURE 1: EXPLORATION FARM-OUT DEALS SINCE 2010 WITH AVERAGE BRENT SPOT PRICE

SOURCE: WESTWOOD WILDCAT AND EIA

29 farm-outs were reported as completed in 2020. Deepwater and onshore deals decreased by 70% and 60% respectively whilst shallow water deals were the most resilient, dropping by 24%, dominated by deals in maturing / mature plays in NW Europe. The onshore market has struggled, with no activity seen in LACAS or Africa during 2020.

Despite the downturn farm-outs/ins are still used by many companies as a means to manage their exploration portfolios. Shell and Qatar Petroleum completed three farm-ins each, whilst Total and Equinor traded out of equity in six and four deals respectively.

Better prospects have been farmed-out

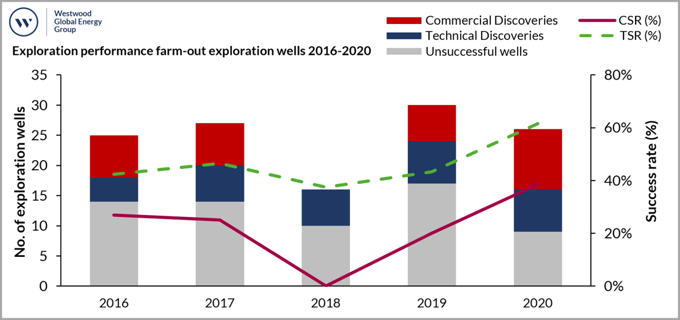

The commercial success rate from farm-out drilling in 2020 was at a 5-year high at 38%. 10 commercial successes came from the 26 wells that were drilled that had seen equity transfer through farm-out. The largest farm-out discovery was at Maka Central-1, offshore Suriname where Total accessed Block 58 via a 50% farm-in to Apache.

FIGURE 2: THE GROSS NUMBER OF EXPLORATION FARM-OUT WELLS DRILLED 2016-2020 AND ASSOCIATED SUCCESS RATES

SOURCE: WESTWOOD WILDCAT

The improved performance in farm-out wells was a result of wells drilled offshore UK and Norway, where the commercial success rate from farm-out wells in 2020 was 66%, higher than the 46% success rate achieved from all wells drilled in those two countries.

Farm-ins, still play an important role in accessing drilling opportunities and the higher success rates in farm-out wells achieved in 2020 may stimulate the market.

Emerging play opportunities carry a premium

Licences in emerging plays were valued, on average, 1.5 times higher than those in frontier plays, and almost 3.5 times those of maturing/mature play over the last five years. Companies will pay a premium to access emerging plays which have been de-risked compared to frontier plays and success rates tend to be higher and pool sizes are much larger than more mature plays.

It’s a buyers’ market

Counter cyclic explorers can take advantage of good deal terms, and less competition in the present market. 50% of deals in 2020 saw the buyer pay no more than their proportional share of future costs. Other deals saw buyers pay between 1.25 and 2.5 their share to access attractive opportunities.

Exploration is under increased scrutiny in many companies but there is still an appetite to access drilling opportunities via farm-ins. It is currently a buyers’ market with plenty of opportunities for those who still have an appetite for exploration.

Vikesh Mistry, Senior Analyst, vmistry@westwoodenergy.com

KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy