As part of our recently launched 'at-a-glance' guide to company global operational activity, today we feature Energean.

From our selection of over 600 oil and gas companies, users now have access to ‘first pass’ preliminary review data comprising; company description, overview of global assets, key operational activity, updated Energy Transition developments, contact details and leadership.

This now means that our Energy Country Review subscribers can choose to review our database of profiles by individual country or global company operational activity.

Established in 2007, Energean is a London Premium Listed FTSE 250 and Tel Aviv 35 Listed E&P company with operations in nine countries across the Mediterranean and UK North Sea. Since IPO, Energean has grown to become the leading independent, gas-focused E&P company in the Eastern Mediterranean, with a strong production and development growth profile. The Company explores and invests in new ideas, concepts and solutions to produce and develop energy efficiently, at low cost and with a low carbon footprint.

Energean’s production comes mainly from the Abu Qir field in Egypt and fields in Southern Europe and the UK. The company’s flagship project is the 3.5 Tcf Karish, Karish North and Tanin development, offshore Israel, where it intends to use the newbuild fully-owned FPSO Energean Power, which will be the only FPSO in the Eastern Mediterranean. Energean continues to work towards delivering first gas in 1Q 2022. Energean Israel Limited has signed firm contracts for 7.4 Bcm/yr of gas sales into the Israeli domestic market, which have floor pricing, take-or-pay and/or exclusivity provisions that largely insulate the project’s revenues against global commodity price fluctuations and underpin Energean’s goal of paying a meaningful and sustainable dividend.

2020 Highlights

- Completed the acquisition of Edison E&P for a net consideration of $203 million, approximately $1.0/2P boe

- Karish approximately 87% complete at 31 December 2020 (90% at 31 March 2021)

- Total gas sales and purchase agreements (“GSPAs”) in Israel now 7.4 Bcm/yr on plateau, utilising 93% of the Energean Power FPSO capacity

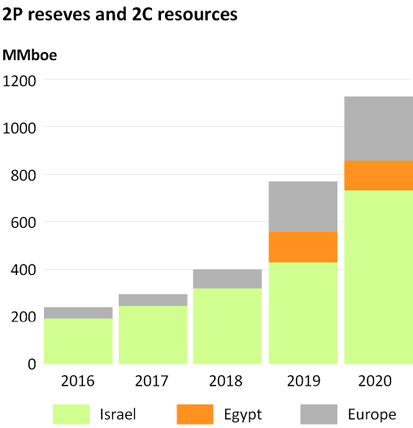

- Increased 2P reserves by 187% to 982 million barrels of oil equivalent (“MMboe”), 79% of which is gas

Outlook

- 2021 working interest production expected to be 36.0 - 41.0 kboepd, increased by 1 kboed due to the absorption of the Rospo Mare and Vega interests. Average working interest production in the three-months to 31 March 2021 was approximately 44.0 kboepd

- 2021 development and production capital expenditure guidance reduced to $470 – 550 million (from $510 - 590 million previously), of which $350 - 400 million relates to Karish

- and Karish North

- Future dividend policy to be defined, targeting inaugural dividend payment in 2022

- Energean continues to work towards first gas from Karish in 1Q 2022.

- Rig contract award for 2022 growth drilling campaign, offshore Israel, expected in 2Q 2021

- Contract awards for Karish North tie back and riser installation, and (separately) second oil train installation on the Energean Power FPSO

- Offtake agreement for Karish liquids expected 2H 2021

- Renewable energy usage to be rolled-out across operated assets and premises following successful implementation at Prinos

GLOBAL OPERATIONS

ISRAEL

The Company’s flagship development assets are the multi-tcf Karish, Karish North and Tanin fields, offshore Israel. Energean Israel (Energean's 100% subsidiary) holds 100% interests in the Karish and Tanin leases and in Blocks 12, 21, 23 and 31. It also holds 80% interests in four licenses in Zone D in Israel’s EEZ, with Israeli Opportunity holding the remaining 20%.

Karish

According to a CPR produced by DeGolyer and MacNaughton in November 2020, the Karish Field contains 1,409 bcf gas 2P reserves plus 61 mmbls liquids 2P reserves. This represents a total of 317 mmboe 2P reserves.

Energean made Final Investment Decision for the development project in March 2018. The Karish main field will be the first asset to be developed in the Karish and Tanin blocks by the Group. Karish was selected as the initial development as it is the largest discovery, is expected to provide the highest yield of liquid per volume of produced gas and is the closest discovery to shore.

TechnipFMC has been awarded a lump sum EPCIC Contract. Stena Drilling completed the drilling of three development wells during 2019.

The Company has decided to develop the Israeli fields using the "Energean Power" FPSO (Floating Production Storage Offloading) that will be installed 90 km offshore, making it the first FPSO ever to operate in the Eastern Mediterranean. The FPSO will have a gas treatment capacity of 800 MMscf/day (8 BCM/per annum) and liquids storage capacity of 800,000 bbls, which the Company believes provides a flexible infrastructure solution and, potentially the scope to expand output for potential additional projects.

First steel was cut on the FPSE in Cosco Yard, in Zhousan, China on November 26, 2018. "Energean Power" FPSO hull sailed away from the Cosco Yard in China on April 3rd, 2020. The hull arrived in Singapore on April 15th, 2020.

Following a shut down due to the COVID-19 pandemic, works at the Admiralty Yard resumed in June 2020, with first topsides lift completed in August 2020. Based on the excellent progress that has been made on the topsides, it is anticipated that the integrated Hull and Topsides will sail away from Singapore to Israel in autumn 2021. First gas from the project anticipated in 4Q 2021-1Q 2022.

CAPEX for the Karish development is estimated at US$1.7 billion.

Karish North

The Karish North well was spudded on March 15, 2019. The well reached an intermediate TD of 4,880 meters approximately 7 days ahead of schedule. A gross hydrocarbon column of up to 249 meters was encountered and a 27 meter core was recovered to surface.

The Karish North sidetrack was drilled 700m north of the original Karish North penetration with a key objective to confirm the Gas Water Contact (“GWC”). The sidetrack encountered a GWC at 4,791 meters true vertical depth subsea (“TVDSS”), 13 meters below the Gas Down To (“GDT”) that was encountered in the original wellbore. A thin rim of light oil or condensate was identified immediately above the GWC. The total mapped hydrocarbon column is confirmed at 310 meters.

A successful appraisal well was drilled in October 2019, confirming best estimate recoverable resources of 0.9 Tcf (25 BCM) plus 34 million barrels of light hydrocarbons.

The Karish North discovery will be commercialised via a tie-back to the Energean Power FPSO, which is located 5.4km from the Karish North well.

Karish North FDP was approved by the Israeli authorities in August 2020.

Karish North Final Investment Decision (FID) was made in January 2021 with first gas expected in 2H 2023.

Tanin

The Tanin field is an undeveloped asset in the Levantine Basin and is located north of Israel’s EEZ approximately 110km offshore Israel. The water depth is about 1,800m. Tanin is located approximately 40km from the Karish field.

Tanin forms a northern extension of the Leviathan field that is currently being developed by Noble, Delek and Ratio. The Tanin field was evaluated by Noble in 2011 using the discovery well “Tanin-1” which reached a total depth of 5,504m (TVDSS) in what is now referred to as the Tanin-A Block.

It discovered gas saturated Tamar A and B sands and proved up gas volumes in the connected Tanin B and Tanin C Blocks. Reservoir properties determined from log and side-wall core data indicate the sands are analogous to those discovered in the Tamar and Leviathan fields. The Tanin Lease contains, in addition to Blocks A, B and C, significant exploration potential (Blocks D, E and F in the Lease itself and other accumulations that may close outside the Lease area).

The field area is covered by the same 3D seismic data as the Karish field.

Within the Tanin Lease three additional structures at the Lower Miocene level have been identified from available 3D seismic data. Blocks A, B and C are interpreted to share a common gas water contact at between 5,070 and 5,095m (TVDSS).

The Tanin reservoir is shown in the Tanin-1 well to have similar good quality reservoir sands to those of the adjacent Tamar field (to the south) and Karish field (to the east), with high average porosity of approximately 22% and permeability of approximately 300mD. The reservoir pressure is approximately 610 bar and both temperature and pressure are normal for the reservoir’s depth. The Group has generated static and dynamic models to enable future development planning at Tanin.

DeColyer & MacNaughton CPR (November 2020) certified another 10.7 bcm of gas plus 2.3 mmbls of light hydrocarbon liquids prospective resources. Also, another 10.3 bcm of gas plus 2.2 mmbls of light hydrocarbon liquids prospective resources are shared with Energean's Block 12.

Blocks 12, 21, 23 and 31

In December 2017 Energean was successfully awarded five offshore exploration licenses within the Israeli Exclusive Economic Zone (EEZ).The licenses awarded comprise blocks 12, 21, 23 and 31.

All licenses are located in the proven “Tamar” sand play fairway and numerous prospects and leads have been identified.

CPRs produced by D&M (November 2020) and NSAI (August 218) have certified 4.15 tcf of gas and 43 million barrels of liquids risked prospective resources.

Another 10.3 bcm of gas plus 2.2 mmbls of liquids prospective resources are shared within Block 12 and Energean's Tanin field.

After having reprocessed 3D data, Energean committed to drill the prospect "Zeus" in block 12, targeting 0.6 Tcf gas resources.

A discovery would be commercialised through the Energean Power FPSO and further de-risk other prospects in Energean's acreage, such as "Hera" and "Athena" in Block 12 and "Poseidon" in Block 21.

Energean has also conducted a 3D seismic survey over block 23 (255 km2 in NE corner acquired) with primary objective "Hercules" (0.9 TCF). The Company has also conducted a 3D seismic survey over block 31 (181 km² in SW corner) with primary objective "Orpheus" (0.35 TCF).

All prospects will be further evaluated during the initial 3 year exploration period by interpretation of new 3D seismic acquisition and reprocessing of existing data sets. Based on the results of these studies future exploration drilling will take place during the second 3 year exploration phase.

Any future hydrocarbon discoveries will be developed via a tie-back to the FPSO that Energean will construct for the development of Karish and Tanin fields.

Blocks 55, 56, 61 and 62

Block D was offered in Israel’ Second Bidding Round.

Energean has identified a prospect within Zone D analogous to the prolific Tamar Sand fields (Karish, Tamar, Leviathan etc) offshore Israel.

The prospect is believed to extend towards the SW of the license contingent to further seismic processing.

EGYPT

The Egyptian portfolio is full-cycle, consisting of production at the 100% owned and operated Abu Qir field, development at the 100% owned and operated NEA field and exploration optionality.

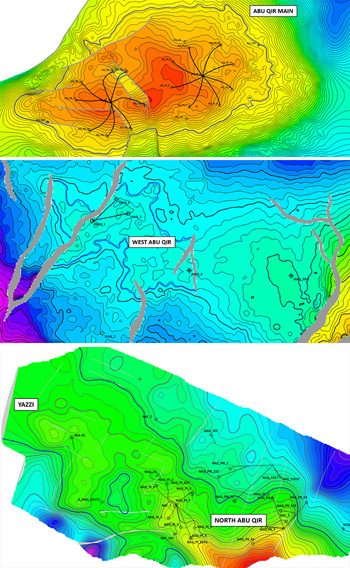

Abu Qir

The Abu Qir concession is the oldest gas production area in the Mediterranean Sea, located in the shallow waters of Abu Qir Bay in the West Nile Delta of Egypt. It remains one of the largest gas producing hubs in Egypt, and comprises three fields (Abu Qir, North Abu Qir and West Abu Qir) and a network of six production platforms interconnected by pipelines. Energean holds 100% W.I. in the concession.

Gas produced is treated onshore where gas, LPG and condensate sales streams are extracted. The onshore plant is linked to the local market by a series of product pipelines. Abu Qir is a long-life producing asset with net working interest 2P reserves of 88 mmboe.

The Abu Qir concession expires on 31 January 2033, inclusive of a five-year extension, and Energean expects production to continue through to licence expiry.

North El Amriya and North Idku

The NEA and NI concessions are both 100% owned by Energean and whilst operated through separate 50/50 JV companies they both fall under the overall management of Abu Qir Petroleum.

NEA contains two discovered and appraised gas fields (Yazzi and Python). NI – which is split into northern 21 and southern areas – contains four discovered gas fields, one of which is readied for development. Both areas contain additional mapped but undrilled prospects.

These fields will be developed as satellite fields to the Abu Qir gas-condensate offshore and onshore infrastructure. The combined development concept includes three subsea wells, to be drilled in water depths ranging from 30 to 85 metres, and tied back to the North Abu Qir III platform. A fourth well will be required to develop the NI-1 discovery. The infrastructure will be installed alongside the NEA development to allow the NI-1 well to be hooked up either in parallel with NEA or afterwards.

A final investment decision has been made in early 2021 with first gas expected in 2H 2022.

Two fields have been evaluated in the North El Amriya PSC: Python and Yazzi. The PSC expires on December 31, 2039. Reserves were projected to the end of the license or to an economic limit, whichever occurs first. The Python field is scheduled to be developed in conjunction with the previously discussed Yazzi field. The Python field was discovered in 2011. The field will produce gas and condensate from the Kafr El Sheikh Formation. Estimates of reserves for the field were based on volumetric analysis.

The terms of the North Idku PSC expire on December 31, 2039. Field A was discovered in 1999 and is expected to produce gas from the Kafr El Sheikh Formation.

North East Hap'y

In June 2020, ex. Edison E&P (now acquired by Energean) submitted a formal request to enter the second exploration period in the North East Hap’y Offshore block (W.I.30%). Although the exploration well drilled during the first exploration phase did not find commercial hydrocarbons, both the company and ENI are evaluating a large, Zohr-like structure for a potential well in the second exploration phase.

ITALY

Italian portfolio consists primarily of production and development, but also includes near-field, infrastructure-led optionality with a total of over 40 licences. In 2019, working interest production was 10.3 kboe/d, of which approximately 50% was operated and 50% was non-operated.

Ibleo Area

In Ibleo Area, Energean has a 40% W.I., while ENI holds 60% W.I. and is the Operator. The Cassiopea and Argo fields form part of a phased offshore gas development located in the Strait of Sicily, offering growth for Energean with the potential for production (via connection of a sequence of satellite fields) to extend through to the early 2040’s. It is the largest greenfield gas development in Italy and, once onstream, will be one of the country’s main producing gas fields. Net peak production is expected to be 10.3 kboe/d.

These fields will be developed via four subsea wells (consisting of two new wells and two recompletions), with an optimised subsea production system and sealine using existing facilities for shore approach, well control and chemical injection from an existing Eni platform, and onshore gas treatment, in synergy with Gela Refinery operations. Tie-in points have been included in the production system to 83 allow a series of low risk exploration prospects (Gemini, Centauro, Vela, etc.) and other existing discoveries (Panda, Panda West) to be tied in and hence maintain production.

Vega

Vega, operated by Energean, is an offshore oil field located in the Sicilian Channel. Energean has a 100% W.I. Energean has agreed with ENI to acquire the latter's WI and the request is pending approval from the Italian authorities.

The Vega A accumulation has produced since 1994 and was evaluated based on performance. The Vega B (Figure 9) accumulation will be developed with 12 horizontal drills, which are currently classified as contingent resources.

Rospo Mare

Rospo Mare, operated by Energean, is an offshore oil field located in the Adriatic Sea. Energean has a 100 W.I.

Reserves for the Rospo Mare field (Figure 12) were estimated based on performance supported by volumetrics. Two sidetracks, ARG ST and CR2C, are planned for 2022.

The offshore oil fields near the eastern coast of Italy produce from fractured carbonate reservoirs deposited during the Cretaceous and early Tertiary.

Clara North West

Clara North, operated by ENI, is an offshore gas field located in the Adriatic Sea. Energean has a 49% W.I., while ENI holds the remaining 51%.

The Clara Complex lies over 200 kilometers east of the city of Florence. The Clara Complex consists of the Clara East, Clara North, Clara Northwest, and Clara West fields. The Clara fields are located in the B.C13.AS and B.C14.AS concessions. These fields were evaluated based on production performance and volumetric analysis for the fields still producing, which are the Clara East and Clara Northwest.

The offshore gas fields east of Italy produce gas from clastic reservoirs deposited in a marine environment during the Pliocene and Pleistocene.

Sarago Mare

Sarago Mare, operated by Energean, is an offshore oil field located in the Adriatic Sea. Energean has an 85% % W.I., while GasPlus holds the remaining 15% W.I.

The Sarago Mare field began production in 2014, reserves were based on performance of producing wells.

The offshore oil fields near the eastern coast of Italy produce from fractured carbonate reservoirs deposited during the Cretaceous and early Tertiary.

GREECE

In Greece, Energean has 54 mmboe 2P reserves and 59 mmboe 2C resources. In addition, the Company has significant exploration potential in the licences held in Israel, the Adriatic, and Western Greece, which provides the basis for future organic growth.

Prinos

Energean is the Operator in the Prinos licence, Northern Greece, where has a 100 per cent working interest. Prinos North and Epsilon are currently the only producing fields in Greece.

Prinos North and Epsilon oil fields are located in the Gulf of Kavala, 18 km south of the mainland of Northern Greece, in water depth of 30 to 38 metres.

South Kavala

Energean is the Operator in the South Kavala licence, Northern Greece, where has a 100 per cent working interest.

Gas from the South Kavala field is produced periodically and used for Energean's facilities needs in Kavala.

The remaining gas reserves are approximately 2.6 Bcf.

The depleted field is suitable to be converted into an Underground Gas Storage (UGS) linked to the TAP pipeline that will transport gas 2 km from Energean’s onshore processing plant.

The annual volume throughput is estimated at 360 million Nm3 or 720 million Nm3 for one or two cycles per year, respectively.

The maximum daily extraction rate and natural gas injection rate in the National Natural Gas Transmission System is estimated at 4 million Nm3/d.

The maximum daily injection rate of the Underground Gas Storage with Natural Gas, is estimated at 5 million Nm3/d.

Katakolo

Energean is the Operator in the Katakolo licence, in Western Greece, where has a 100 per cent working interest.

The West Katakolo Exploitation area is part of the Katakolo block and covers 60 km2. NSAI has audited 14 mmboe 2P reserves and 4 mmboe 2C resources in the block.

In August 2017, the Greek Government approved the Field Development Plan (FDP) submitted by Energean. Energean has planned to make FID or decide a farm down upon the approval of the necessary environmental studies.

Ioannina

Energean has a 100 % working interest in the Ioannina licence.

The block covers an area of 4,187 km² and it is located onshore Western Greece.

A 2D seismic survey (400 km) has been conducted in 2019.

Ioannina holds best estimate gross prospective resources of 103 Bcf of gas and 187 mmbls of oil (NSAI CPR).

Block 2

Energean is the Operator and has a 75% W.I.in block 2, at the Ionian Sea, Greece. Hellenic Petroleum owns the remaining 25% Working Interest.

Work to date on the licence has identified that Block 2 contains part of a large, potential target comprising of a four-way closure at the Top Jurassic Apulia platform. The prospect is thought to be an analogue to the Vega field offshore Italy, in which Energean operates with a 60% working interest. The structure is covered by sparse 2D seismic which could be de-risked through the seismic programme that will be acquired as part of the minimum work programme.

Energean participates in the adjacent 84F.R-EL block offshore Italy, pending award.

West Patraikos

The West Patraikos offshore block is located in Western Greece and lies over the Ionian Basin.

Following the acquisition of Edison E&P, Energean holds 50% WI. Hellenic Petroleum is the Operator, holding the remaining 50%.

In the early ‘00s a well has been drilled with no results. In 2018, a 2D seismic survey has been conducted, while older seismic data have been reprocessed.

UNITED KINGDOM

UK business consists of production and appraisal assets. The producing asset base is mature with some decommissioning ongoing, although there is scope for decommissioning at the key fields, Scott and Telford, to be delayed beyond the currently expected start date of 2025. In January 2019, CNOOC announced the 250 mmboe (gross) Glengorm discovery, in which Edison E&P holds a 25% working interest.

Scott and Telford

The Scott and Telford fields, operated by CNOOC, are mature producing oil and gas assets located in the Central North Sea. In Scott, Energean holds 10%, CNOOC holds 42%, Total 27% and Dana 21%. In Telford, Energean holds 16%, CNOOC 80% and Total 4%.

Both are mature producing oil and gas assets located in the Central North Sea. Scott is a two-platform structure with twelve producing wells. Oil is transported from this asset to Cruden Bay via the Forties infrastructure network. Telford currently has three producing wells and is tied-back to the Scott platform. Oil and gas are transported from these assets via the Forties and Scottish Area Gas Evacuation System (SAGE) networks, respectively.

Glengorm

In January 2019, CNOOC Limited announced the largest UK North Sea gas discovery in ten years (according to Wood Mackenzie) on the Glengorm prospect, which is located in the West Central Graben region. Energean holds 25%, while CNOOC holds 50% and Total 25%.

The discovery is close to existing infrastructure and offers tie-back possibilities, such as the Elgin-Franklin platform and the Culzean platform, amongst others.

HP/HT –reservoir pressure is ~13,000 psi and TD temperature is 183°C.

Two firm appraisal wells to be drilled in 2020-21.

Isabella

The Isabella exploration well spudded in mid-October 2019 and in March 2020 was announced as a discovery with hydrocarbons encountered in the Upper Jurassic and Triassic sandstone reservoirs.

The discovery is a high-pressure, high-temperature discovery in a location close to existing infrastructure. Further analysis of the well results will be performed by the licence operator, Total E&P North Sea UK Limited, to determine future appraisal activity and recoverable resource estimates. The well has been plugged and abandoned.

Energean holds 10% W.I., Neptune holds 50% W.I., Total holds 30% W.I. and Delek Group (via Ithaca) holds the remaining 10% W.I.

CROATIA

The portfolio in Croatia consists of two fields located within the Izabela Block in the northern part of the Adriatic Sea, near the maritime border between Italy and Croatia, in water depths ranging from 30 to 40 meters.

Izabela

The Izabela field is in the central part of the block and the Irena field is located approximately 7 kilometers north of the Izabela field, in the northern part of the block.

The Izabela field is a multi-reservoir dry gas field that was discovered in 2004 and developed with dual-completion wells. The gas-bearing reservoirs are turbidites in the Carola Formation (PLQ-A5) of Lower Pleistocene age (Figure 2). Estimated porosity ranges from 24 to 31 percent, Sw ranges from 35 to 62 percent, and permeability varies from approximately 100 to 900 millidarcys. The Izabela field was evaluated using volumetric analysis of the gas in place coupled with recovery factors derived from anticipated abandonment pressures and the production performance of the wells..

Gas production started in 2014, and the Izabela field utilizes two production platforms and five producing wells. Some of the production strings in the Izabela field have been shut inintermittently to curb water production.

The Irena field is a structural-stratigraphic trap discovered in 2006 and contains a single dry gas reservoir in the Ravenna Formation of Pleistocene age. All reserves estimates for the Irena field were based on the volumetric estimate of gas in place coupled with analogous recovery factors. Estimated porosity and Sw are 38 percent and 15 percent, respectively.

MONTENEGRO

Energean holds a 100% working interest and is the Operator in blocks 4219-26 and 4218-30, offshore Montenegro.

Blocks 26 and 30

Energean holds a 100% working interest and is the Operator in blocks 4219-26 and 4218-30, offshore Montenegro.The two blocks are located offshore at a water depth of 50-100 metres, close to the Montenegrin coast, near Bar.

According to NSAI CPR, Energean’s prospects at Blocks 26 & 30, are combined best estimate unrisked prospective resources of 143.9 mmbbls of hydrocarbons liquids and 1,766.1 Bcf of gas.

In February 2019, Energean commissioned PGS for the acquisition of a new 3D seismic survey over the two exploration blocks. The PGS Ramform Titan, one of the best seismic acquisition vessels in the world ,deployed 14 geo-streamers, 6.5km for each streamer length, using a triple source array to cover a total area of 338km² .

The seismic survey started on the 8th of February 2019 and encountered good weather throughout achieving less than 5% downtime.

The survey was completed on the 20th of February with an excellent HSE record achieving good quality 3D seismic data. The 3D seismic survey fulfils the commitment to the MHA for both blocks 26 & 30.

MALTA

Malta offshore Area 3, represent a large under-explored acreage in the Central Mediterranean and appearwell placed in relation to existing hydrocarbon provinces with neighbouring areas including Sicily and Tunisia proven Basins.

Premium profile information includes; description, overview of assets, current and planned operational activity, capex, local and corporate locations, news archive, farm-in opportunities and 'one-click' access to company 'Linkedin People'. Contact KeyFacts Energy to discover how you can secure access to over 2,600 'country-specific' company profiles from 144 countries.

LEADERSHIP

- Karen Simon NON-EXECUTIVE CHAIR, INDEPENDENT

- Mathios Rigas CHIEF EXECUTIVE OFFICER

- Panos Benos CHIEF FINANCIAL OFFICER

- Dennis Anestoudis HEAD OF G&G

- Giorgio Cavallaro HEAD OF WELL ENGINEERING AND DRILLING

- Moran Erez GENERAL COUNSEL, ISRAEL

- Giuseppe Greco HEAD OF ENGINEERING, TECHNOLOGY, DECOMMISSIONING & ENERGY TRANSITION

- Stella Lena GROUP FINANCIAL CONTROLLER

- Shlomi Levi HEAD OF FINANCE, ISRAEL

- Maria Martin HEAD OF CORPORATE FINANCE

- Vincent Reboul-Salze HEAD OF FACILITY PROJECTS - ISRAEL

- Paolo Terdich HEAD OF PETROLEUM ENGINEERING & DEVELOPMENT STUDIES

- Milly Tornaghi HEAD OF EXPLORATION

- Giovanni Zambelloni HEAD OF PRODUCTION & OPERATIONS

- Vassilis Zenios HEAD OF FACILITY PROJECTS - EGYPT, ITALY, GREECE, CROATIA, UK

CONTACT

LONDON

3rd floor, Accurist House, 44 Baker Street, London, W1U 7AL, UNITED KINGDOM

Tel: +44 (0) 203 655 7200

LONDON

1 Cavendish Place, London, W1G 0QF, UNITED KINGDOM

Tel: +44 207 612 7114

ATHENS

32, Kifissias Avenue, Atrina Center, 151 25 Marousi, GREECE

Tel: + 302108174200

KAVALA

P.O. BOX 8, 64006 Nea Karvali, Kavala, GREECE

Tel: + 30 2510317201

HAIFA

Matam Building 23, First Floor, Andre Sacharov 9, Haifa, 3508409, ISRAEL

Tel: +972-4-629 5400

MILAN

Foro Buonaparte 31, 20121 Milan, ITALY

Tel: +39 02 62228330

PESCARA

Via Aterno, 49, Contrada Dragonara di Sambuceto, 66023 San Giovanni Teatino (CH), ITALY

Tel: +39 08544671

SYRACUSE

Viale Teracati, 102, 96100 Siracusa, ITALY

Tel: +39 0931-448111

CAIRO

Building 11, 273 Palestine Street , New Maadi, Cairo, EGYPT

Tel: +202 25166913

CAIRO

Block # 17, City Center, 5th settlement, New Cairo, EGYPT

Tel: +202 23222400

ALEXANDRIA

Abu Qir Petroleum Company

El Moltaka Bldg. Tutankh AMoun st., Crossing to El Shahid Tayar Mahmoud Shaker Smoha – Sidi Gaber Alex. (A.R.E) EGYPT

Tel: +203 4292713 - 4292775

ZAGREB

Donje Svetice, 14, 10000 Zagreb, CROATIA

Tel: +385 (1)4592732

PODGORICA

George Washington Blvd. 102, A78 - 4th floor, The Capital Plaza, 81000 Podgorica, MONTENEGRO

Tel: +382 20 675569

NICOSIA

22 Lefkonos Street, 1st floor, 2064, Strovolos, Nicosia, CYPRUS

Τel: +35722398398

KEYFACT Energy

KEYFACT Energy