Key Developments:

- Announced an oil discovery at Uaru-2 on the Stabroek Block, offshore Guyana; adds to the previously announced gross discovered recoverable resource estimate for the block of approximately 9 billion barrels of oil equivalent (boe)

- Expect to have at least six floating production, storage and offloading vessels (FPSOs) on the Stabroek Block by 2027

- See potential for up to 10 FPSOs on the Stabroek Block to develop the current discovered recoverable resource base

- Agreed to sell nonstrategic interests in Bakken acreage for total consideration of $312 million, with an effective date of March 1, 2021; the sale is expected to close within the next few weeks

- Agreed to sell the Corporation's interests in Denmark for total consideration of $150 million, with an effective date of January 1, 2021; the sale is expected to close in the third quarter of 2021

- Received net proceeds of $70 million from the public offering of 3,450,000 Hess-owned Class A shares in Hess Midstream LP; following the offering, Hess’ ownership in Hess Midstream LP is approximately 46%

First Quarter Financial and Operational Highlights:

- Net income was $252 million, or $0.82 per common share, compared with a net loss of $2,433 million, or $8.00 per common share in the first quarter of 2020. Adjusted net loss(1) in the first quarter of 2020 was $182 million, or $0.60 per common share

- Higher natural gas liquids (NGL) prices increased net income by approximately $75 million as compared to the prior-year quarter and lowered first quarter 2021 Bakken NGL volumes received as consideration for gas processing fees under percentage of proceeds (POP) contracts by 8,000 barrels of oil equivalent per day (boepd)

- Oil and gas net production, excluding Libya, was 315,000 boepd and Bakken net production was 158,000 boepd

- Cash and cash equivalents, excluding Midstream, were $1.86 billion at March 31, 2021

Updated 2021 Production Guidance:

- Net production, excluding Libya, is now forecast to be 290,000 boepd to 295,000 boepd from previous guidance of approximately 310,000 boepd, reflecting a 7,000 boepd reduction in expected NGL volumes received as consideration from POP contracts for gas processing fees due to higher NGL prices which improve financial results, a reduction of 6,000 boepd from asset sales, and the balance primarily from adverse winter weather in North Dakota

1. “Adjusted net income (loss)” is a non-GAAP financial measure.

Hess Corporation today reported net income of $252 million, or $0.82 per common share, in the first quarter of 2021, compared with a net loss of $2,433 million, or $8.00 per common share, in the first quarter of 2020 that included impairment and other after-tax charges of $2,251 million. On an adjusted basis, the net loss in the first quarter of 2020 was $182 million, or $0.60 per common share. The improvement in adjusted after-tax results compared with the prior-year period primarily reflects higher realized selling prices, contribution from the sale of two VLCC cargos and lower depletion, depreciation and amortization expenses.

“Our company continues to successfully execute our strategy to grow our resource base, have a low cost of supply and sustain cash flow growth,” CEO John Hess said. “As our portfolio generates increasing free cash flow, we will first prioritize debt reduction and then the return of capital to our shareholders through dividend increases and opportunistic share repurchases.”

Operational Highlights for the First Quarter of 2021

Bakken (Onshore U.S.): Net production from the Bakken was 158,000 boepd compared with 190,000 boepd in the prior-year quarter, primarily due to reduced drilling activity, lower NGL and natural gas volumes received under percentage of proceeds contracts due to higher commodity prices, and the impact of adverse winter weather. NGL and natural gas volumes received under percentage of proceeds contracts were 19,000 boepd in the first quarter of 2020 and 20,000 boepd in the fourth quarter of 2020, but were reduced to 11,000 boepd in the first quarter of 2021 due to higher realized NGL prices lowering volumes received as consideration for gas processing fees. Higher NGL prices increased net income by approximately $75 million as compared to the prior-year quarter. During the first quarter of 2021, 11 wells were drilled, 10 wells were completed, and 4 new wells were brought online. In February, the Corporation increased the number of operated rigs from one to two.

During the first quarter of 2021, the Corporation completed the sale of 4.2 million barrels of Bakken crude oil transported and stored on two very large crude carriers (VLCCs) during 2020, which contributed net income of approximately $70 million in the first quarter.

In April, the Corporation entered into an agreement to sell its Little Knife and Murphy Creek nonstrategic acreage interests in the Bakken for total consideration of $312 million, subject to customary closing adjustments, with an effective date of March 1, 2021. The sale consists of approximately 78,700 net acres, which are located in the southernmost portion of the Corporation's Bakken position and are not connected to Hess Midstream LP infrastructure. Net production from this acreage during the first quarter of 2021 was approximately 4,500 boepd.

Net production from the Bakken is forecast to be 155,000 to 160,000 boepd for full year 2021, reflecting the impact of lower NGL volumes received as consideration for gas processing fees under POP contracts due to higher NGL prices, the sale of the Corporation’s nonstrategic acreage interests, and adverse winter weather.

Gulf of Mexico (Offshore U.S.): Net production from the Gulf of Mexico was 56,000 boepd, compared with 74,000 boepd in the prior-year quarter, reflecting the sale of the Corporation's interest in the Shenzi Field in the fourth quarter of 2020 and natural field decline. Net production from the Shenzi Field was 12,000 boepd in the first quarter of 2020.

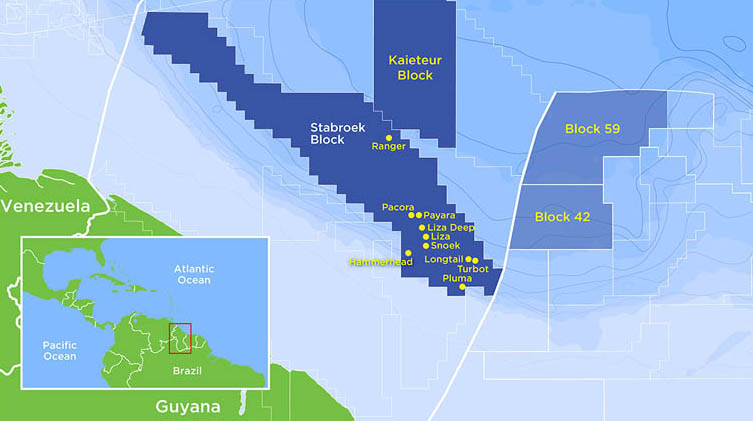

Guyana (Offshore): At the Stabroek Block (Hess – 30%), the Corporation’s net production from the Liza Field was 31,000 barrels of oil per day (bopd) compared with 15,000 bopd in the prior-year quarter. The Liza Destiny FPSO reached its nameplate capacity of 120,000 gross bopd in December 2020 and remained at this level during the first quarter of 2021. In mid-April, production from the Liza Destiny FPSO was curtailed for several days after a leak was detected in the flash gas compressor discharge silencer. Production has since ramped back up and is expected to remain in the range of 100,000 to 110,000 gross bopd until repairs to the discharge silencer are completed in approximately three months. Following this repair, production is expected to return to, or above, nameplate capacity.

Startup of Phase 2 of the Liza Field development, which will utilize the Liza Unity FPSO with an expected capacity of 220,000 gross bopd, remains on track for early 2022. The third development, Payara, will utilize the Prosperity FPSO with an expected capacity of 220,000 gross bopd; first oil is expected in 2024. A fourth development, Yellowtail, has been identified on the Stabroek Block with anticipated startup in 2025, pending government approvals and project sanctioning. We expect to have at least six FPSOs on the Stabroek Block by 2027 with the potential for up to 10 FPSOs to develop the current discovered recoverable resource base.

The Uaru-2 well encountered approximately 120 feet of high quality oil bearing sandstone reservoir, including newly identified intervals below the original Uaru-1 discovery. The well was drilled in 5,659 feet of water and is located approximately 6.8 miles south of the Uaru-1 well. The Uaru-2 discovery will add to the discovered recoverable resource estimate of approximately 9 billion boe.

The Stena DrillMax is currently appraising the Longtail discovery, which will include a planned sidetrack. The Noble Don Taylor will drill the Mako-2 well after Uaru-2, and the Stena Carron is currently drilling the Koebi-1 exploration well. The Noble Tom Madden, the Noble Bob Douglas and the Noble Sam Croft, which recently arrived at the Stabroek Block, are primarily focused on development drilling.

South East Asia (Offshore): Net production at North Malay Basin and JDA was 64,000 boepd, compared with 58,000 boepd in the prior-year quarter, reflecting higher natural gas nominations due to a recovery in economic activity.

Denmark (Offshore): In March, the Corporation entered into an agreement to sell its interests in Denmark for total consideration of $150 million, subject to customary closing adjustments, with an effective date of January 1, 2021. Net production from Denmark during the first quarter of 2021 was 6,000 boepd. The sale is expected to close during the third quarter of 2021.

Midstream:

The Midstream segment had net income of $75 million in the first quarter of 2021, compared with net income of $61 million in the prior-year quarter, primarily due to higher minimum volume commitments and tariff rates.

Corporate, Interest and Other:

After-tax expense for Corporate, Interest and Other was $131 million in the first quarter of 2021, compared with $123 million in the first quarter of 2020. Interest expense increased $6 million compared with the prior-year quarter primarily due to interest on the Corporation's $1 billion three year term loan entered into in March 2020.

Capital and Exploratory Expenditures:

E&P capital and exploratory expenditures were $309 million in the first quarter of 2021, down from $631 million in the prior-year quarter. The decrease is primarily driven by a lower rig count in the Bakken and lower development drilling in the Gulf of Mexico and Malaysia. Midstream capital expenditures were $23 million in the first quarter of 2021, down from $57 million in the prior-year quarter.

KeyFacts Energy: Hess US country profile

KEYFACT Energy

KEYFACT Energy