Over the next 20 years, the global energy mix is set to become far more diversified, with renewables and fossil fuels all providing a significant share of world energy. Falling oil demand may lead to greater competition among oil producers as the pursuit of market share intensifies.

The following article, based on the analysis in bp’s Energy Outlook 2020, considers the impact of declining oil demand on oil-producing nations.

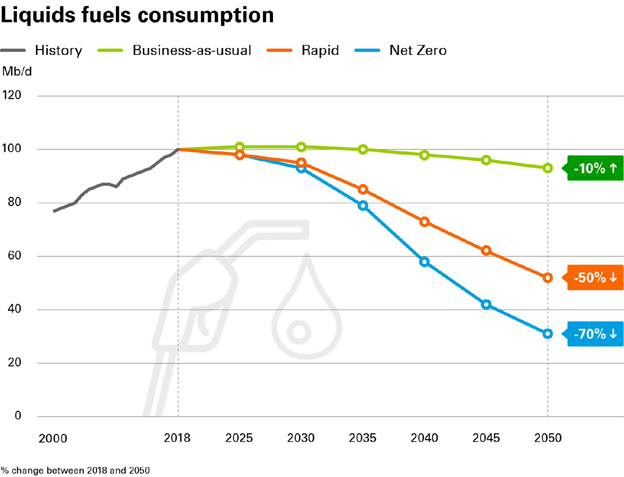

Oil demand falls in all three bp Energy Outlook 2020 scenarios, driven primarily by the declining use of oil in the transport sector.

These declines in global oil demand, especially in OECD countries, present oil-producing countries with both challenges and opportunities, and sparks widescale competition as the pursuit of market share intensifies, shaping a new composition of global oil supplies.

The sources of competitive advantage in such a world come mainly from lower cost of supply coupled with gradual economic diversification. Other factors, such as lower carbon intensity of the crude produced, location, and associated gas supplied, also become increasingly important for major oil exporting economies.

Why it matters

The speed of these supply adjustments affect not only trade flows and geopolitical relationships, but also the pace and scope of the energy transition. This is particularly true for those oil-producing countries whose revenues drop as global consumption declines.

Revenues from exports of natural gas revenues are more resilient, reflecting the stronger demand outlook. This helps oil and natural gas-producing economies mitigate the impact of declining oil export revenues.

What’s OPEC’s role?

As demand declines in the Energy Outlook scenarios, resource owners compete to ensure their resources are produced and consumed. The bigger the drop in demand, the greater the increase in competition. This greater competition increases the urgency for oil producing economies to diversify their economies and so increase their ability to pursue a stronger market share strategy.

OPEC’s competitive strategy means that in Rapid its share of total liquids production grows rapidly from a low of close to 25% in the early-2030s to around 45% by 2050 as accelerated economic diversification reduces the fiscal breakeven price of OPEC countries and allows it to gain share from non-OPEC producers.

This intense competition for market share, coupled with the higher costs of non-OPEC production, means around two-thirds of the total fall in liquids production in Rapid by 2050 is borne by non-OPEC supplies. In fact, OPEC’s share grows by almost 15 percentage points between 2030 and 2050.

In Business-as-usual (BAU), demand is more resilient (when compared to Rapid), such that competition between producers is less strong. In this scenario, OPEC increases its production from the mid-2030s onwards, with its market share rising by less than 10 percentage points between 2030 and 2050 to just over 40%.

Energy Outlook 2020

Explore the report, download the data or watch the replay of Spencer Dale's 2020 presentation.

KeyFacts Energy: bp UK country profile

KEYFACT Energy

KEYFACT Energy