As part of our recently launched 'at-a-glance' guide to company operational activity, today we feature Everard Energy.

From our selection of over 600 oil and gas companies, users now have access to ‘first pass’ preliminary review data comprising; company description, overview of global assets, key operational activity, updated Energy Transition developments, contact details and leadership.

This now means that our Energy Country Review subscribers can choose to review our database of profiles by individual country or global company operational activity.

Everard Energy Limited, formerly named HH LAPS Limited, was purchased from Avista Capital Partners in December 2019 by John Martin, Patrick Kennedy, Simon Lunn and Simon Tortike who were the former management team of Hansa Hydrocarbons. HH LAPS was a wholly-owned UK subsidiary of Hansa Hydrocarbons, a private company founded in 2007 to pursue a strategy of developing stranded gas assets in the Southern Permian Basin of NW Europe. Avista Capital Partners provided an initial funding of $100 million in July 2008. In 2013 Hansa Hydrocarbons purchased the interests in the Malory, Lancelot and Guinevere fields from Noble Energy. With the exception of its UK subsidiary (HH LAPS), Hansa Hydrocarbons was sold to Discover Exploration in 2018.

Hansa Hydrocarbons was named after the Hanseatic League, which was a medieval trading alliance founded on the principals of cooperation and with a similar geographical footprint. To continue the Hanseatic theme, the company is named after Edward Everard (1699-1769), who was an important merchant, brewer and Mayor of King’s Lynn in the 18th Century. With the decline of the influence of the Hansa, in 1751 Everard bought the Hanseatic Warehouse in Kings Lynn from the Mayor of Lubeck for £800 and he subsequently largely rebuilt the site in c. 1755. The company logo is a modern, dynamic, reinterpretation of the traditional estoile that appears commonly in heraldry of the time, including featuring in the coat of arms of Edward Everard.

Everard Energy has a strong management team with extensive international oil and gas experience, including over over 50 years of collective experience in the Southern Permian Basin of NW Europe. Working together over this period they have delivered significant value to shareholders including the play opening Ruby (N05-1) gas discovery in the Netherlands.

OPERATIONS

Malory Field

Perenco (Operator) 76% , Everard 24%

The Malory Field was discovered in 1997 by Mobil operated well 48/12d-9. It encountered a 76m gas column in good quality Rotliegendes Leman Formation sandstones, with a gas down to at the top of the Carboniferous. A DST flowed at 30.6 mmscf/d and core data confirms permeabilities up to 1651 mD.

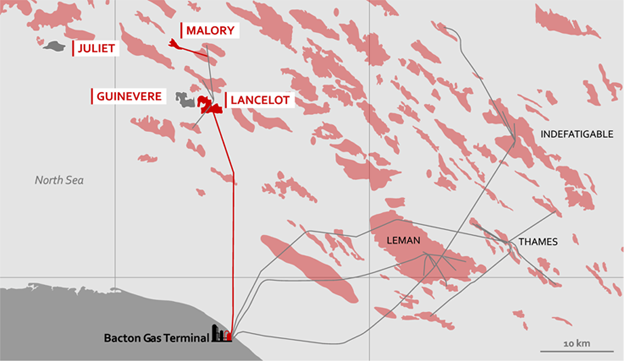

The field was developed via an unmanned platform tied back via the Excalibur export pipeline connecting to the Lancelot Area Production System (LAPS) at the Lancelot subsea Tee, where it is evacuated to the Perenco Bacton Gas Terminal processing facilities in Norfolk. Production from the 48/12d-9 well commenced in October 1998. The original mapped GIP at Annex B submission was 99 bcf, although by January 2021 the cumulative production was in excess of 160 bcf from the single well.

Perenco UK took over operatorship of the field in 2007 and the current interests in the Malory Field unit are Perenco 76% and Everard Energy 24%. In 2020 the gross production (sales) from Malory averaged between 6 to 7 mmscf/d. Since 2016 decline curve analysis has shown a clear hyperbolic trend with production at Malory anticipated to continue beyond 2030. The cause of the hyperbolic trend and associated pressure support is unproven but is likely to be due to either recharge from an adjacent Rotliegendes fault block or the Carboniferous beneath the reservoir.

Lancelot Field and Lancelot Area Production System (LAPS)

Perenco (Operator) 98% , Everard 2%

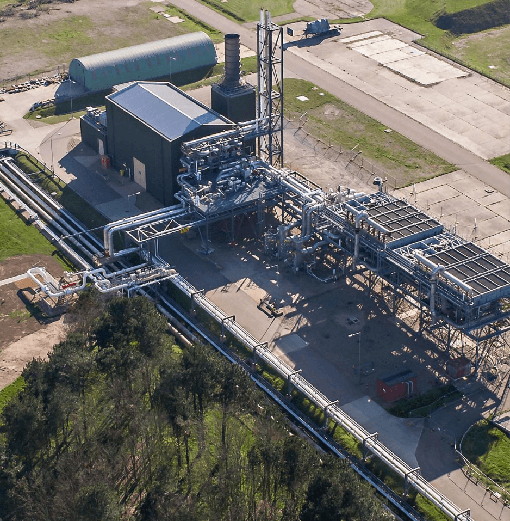

The Lancelot Field was discovered in 1986 by the Mobil operated well 48/17a-2. The field came on stream in July 1993 and gas and condensate from the 1 vertical and 3 horizontal development wells are evacuated via the Lancelot Area Production System (LAPS) pipeline. The gas and condensate are received at the LAPS owned onshore slug-catcher and compressor in Norfolk, from where it is delivered over the fence to the Perenco operated Bacton Gas Terminal.

Perenco UK took over operatorship of the field in 2007 and the current interests in the Lancelot Field unit are Perenco 98% and Everard Energy 2%. Cumulative production from the field as of January 2021 was ca. 200 bcf. Production from the field is currently shut in.

Everard Energy also owns 2% of the Lancelot Area Production System (LAPS) which continues to attract significant third-party business. Three new compression services agreements have been entered into in the last four years. In 2017 production from the Perenco operated INDE area fields arriving onshore was diverted into the available ullage in the LAPS compressor. In 2021 Perenco’s new offshore SHARP compression module will boost combined flows of the Perenco-operated INDE and Leman area fields through the LAPS compressor, providing a significant life extension for the LAPS shore facilities and the Bacton Gas Terminal. Independent Oil and Gas funded a FEED study and works in 2020 to enable future gas production from IOG’s Thames pipeline reception facility to pass through the LAPS compressor.

DECOMMISSIONING

Guinevere Field

Perenco (Operator) 75% , Everard 25%

The decommissioning of the Perenco operated Guinevere Field (Everard Energy 25%) has largely been completed. The two platform production wells were plugged and abandoned without the use of drilling rig in early 2017. The export pipeline to the Lancelot platform was flushed clean and air-gapped at Lancelot to render the platform hydrocarbon free by December 2017, and the subsequent heavy lift activity to remove and recycle the topsides and jacket were completed during in early 2020. These works were completed on time, under budget and without incident. The remaining remedial pipeline decommissioning is planned to be completed in 2021.

Juliet Field

Perenco (Operator) 81% , Everard 19%

The Juliet Field is operated by Neptune Energy and consisted of two subsea wells tied back to the Pickerill A platform. The field ceased production in 2018 and the subsea facilities were flushed clean to Pickerill A and disconnected, completing its hydrocarbon free status. All subsea facilities in the Juliet 500m zone were removed in 2019, and the remaining facilities in the vicinity of Pickerill A will be removed in 2021 The two production wells will be abandoned by Neptune as part of a multi-well campaign in 2022. The 48/17b-10 Juliet discovery well was plugged and abandoned in 2013.

LEADERSHIP

John Martin, Chief Executive Officer

Patrick Kennedy, Chief Financial Officer & Company Secretary

Simon Lunn, Chief Technical Officer

Simon Tortike, Developments Director

CONTACT

Everard Energy Limited

Central Court, 25 Southampton Buildings

London, WC2A 1AL

United Kingdom

KeyFacts Energy: Everard Energy UK country profile

KEYFACT Energy

KEYFACT Energy