Baron Oil, the AIM-quoted oil and gas exploration company, today announced the alignment of interests in relation to the Chuditch PSC, by way of a share exchange, whereby Baron has agreed to acquire the remaining 15% of SundaGas Timor-Leste (Sahul) Pte. Ltd. ("TLS") in exchange for the issuance of 1,157,202,885 new Baron ordinary shares (representing 9.99% of the Company's enlarged share capital) to SundaGas Pte. Ltd ("SGPL").

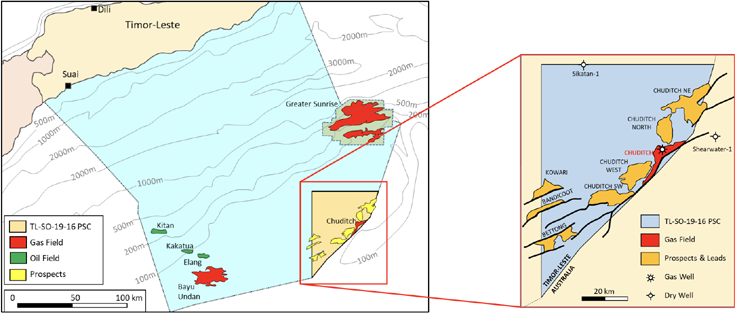

TLS is the parent company of the Timor-Leste subsidiary SundaGas Banda Unipessoal Lda. ("Banda"), which is the Operator of and 75% interest holder in the offshore Timor-Leste TL-SO-19-16 PSC (the "Chuditch PSC" or the "PSC"). SGPL is the parent company of SundaGas Resources Pte. Ltd. ("SGR"), which in turn holds the 15% interest in TLS which Baron did not own, and which was carried by Baron under the terms of the Earn In Agreement announced on 24 March 2021. The Chuditch PSC is located approximately 185 kilometres south of Timor-Leste, 100 kilometres east of the producing Bayu-Undan field, 50 kilometres south of the Greater Sunrise potential development, and covers approximately 3,571km2 in water depths of 50-100 metres. The PSC contains the Chuditch-1 gas discovery.

Under the terms of the Share Exchange, Baron will issue 1,157,202,885 new ordinary shares of 0.025 pence each ("Ordinary Shares") as consideration, equivalent to 9.99% of the Company's enlarged ordinary share capital (the "Consideration Shares"). The Consideration Shares will be issued to SGPL, the parent company. Under the terms of the Earn In Agreement announced in March 2021, Baron has responsibility to carry SGR's share of financial contributions until the end of the PSC's Firm Commitment Period in November 2022. This carry will subsequently be extinguished following completion of the Share Exchange.

Through the Share Exchange, Baron will become the sole shareholder of TLS and have a 75% effective interest in the Chuditch PSC, with the remaining 25% interest in the PSC held by a subsidiary of the Timor-Leste state oil company Timor Gap, E.P., with its interest carried to development by Banda.

SGPL and its principals have entered into a relationship agreement (the "Relationship Agreement") with Baron which contains provisions typical of an agreement of this nature. The Relationship Agreement includes a lock-in which prohibits the selling, disposing of any interest or creating any charge over the Consideration Shares, except with Baron's prior consent, until: (i) 30 June 2022, whereupon SGPL may sell up to 50% of the Consideration Shares in an orderly manner in liaison with the Company's brokers and (ii) thereafter, the earlier of Banda confirming its intent to enter Contract Year 3 of the PSC or 31 December 2022, at which point the restrictions on disposals in relation to the Consideration Shares shall cease (although for a period of 12 months thereafter SGPL may only deal in the Consideration Shares in an orderly manner in liaison with Baron's brokers). The Relationship Agreement also provides, inter alia, that SGPL will vote the Consideration Shares as directed by Baron in a manner that is consistent with the recommendation of the Company's Board.

Through the Share Exchange, SGPL will become a significant shareholder in Baron and SGPL's team, which is currently under contract to TLS and operating the Chuditch PSC, will remain in place. Under the terms of an Amended Services Agreement between SGPL and TLS, SGPL will continue to be paid fees for management and administrative services. This Agreement has been extended to the end of December 2022. There is no right for either party to give notice of earlier termination except with mutual written consent. In addition, for the duration of this Agreement, the Chief Executive of SGPL will be a Director of TLS and Banda alongside Baron's Chief Executive and Technical Director. No material changes to the overall PSC work programme budget are anticipated.

SGPL will assign its prior cost pool to Baron (representing approximately US$584,000). The current US$1.0 million Bank Guarantee arrangements (SGPL having contributed US$667,667 and Baron US$333,333) remain unchanged.

SGPL's team members have extensive operating experience in South East Asia, including with Hess, Conoco, Murphy, Kerr McGee and Sun before founding Mitra Energy (now Jadestone) in 2005 and then SGPL in 2016. The team has a significant record of achieving successful farmouts which span multiple countries and includes transactions with super major oil and gas companies, large and smaller regional players and private equity.

In order to successfully monetise this potentially significant asset, a key objective for the Chuditch PSC in 2022 will be to attract drill funding for which there are multiple options and alternatives. By retaining, aligning and incentivising the existing SGPL team the Directors believe that the prospects of achieving this goal are enhanced. The Board believes that Baron's increased net share of estimated Mean non-SPE PRMS compliant prospective resources to 2,645 BCF (440 MMBOE) in relation to the PSC is more than sufficient to attract attention from the major regional gas players and other potential partners.

For the year ended 31 March 2021, TLS's unaudited total comprehensive loss was US$618,326 and its unaudited total assets as at 31 March 2021 were US$1,092,548.

As SGPL through its subsidiary SGR currently holds more than 10 per cent. of TLS's ordinary shares, the Share Exchange is deemed to be a related party transaction pursuant to rule 13 of the AIM Rules for Companies. Accordingly, the directors of Baron consider, having consulted with the Company's nominated adviser, Allenby Capital Limited, that the terms of the Share Exchange are fair and reasonable insofar as the Company's shareholders are concerned.

Application has been made for the 1,157,202,885 Consideration Shares to be admitted to trading on AIM ("Admission") and the date on which Admission is expected to become effective is on or around 21 June 2021. Upon Admission, the Company's issued ordinary share capital will consist of 11,583,612,461 Ordinary Shares with one voting right each. The Company does not hold any Ordinary Shares in treasury. Therefore, the total number of Ordinary Shares and voting rights in the Company will be 11,583,612,461. With effect from Admission, this figure may be used by Shareholders in the Company as the denominator for the calculations by which they will determine if they are required to notify their interest in, or a change to their interest in, the Company under the FCA's Disclosure Guidance and Transparency Rules.

Andy Butler, Chief Executive of SundaGas Pte. Ltd commented:

"We are delighted to become a significant Baron shareholder and to continue our strong working relationship with the Baron team. The alignment of interests further enhances our ability to achieve the common objective of delivering on the substantial prospective resources of the Chuditch PSC."

Andy Yeo, Chief Executive of Baron commented:

"We consider that the Share Exchange is value accretive and further increases our prospective resource base. We believe that our alignment with the experienced South East Asian based SGPL team will improve the chances of success of attracting drill funding in 2022, which will benefit both existing and our new shareholders."

KeyFacts Energy: Baron Oil Timor Leste country profile

KEYFACT Energy

KEYFACT Energy