By Laura Sandys, Non Executive Director at SGN, and Energy Systems Catapult

A decarbonized energy system works very differently to a fossil-fuel based one - which is why it demands a new approach to costs.

A new model must include the value to the system of demand-side assets, such as solar PV and heat pumps.

Here are three recommendations for policy-makers that can help to drive this necessary change.

We are missing a big trick when it comes to how we decarbonize our energy system. We are trying to squeeze a capital-intensive set of renewable technologies into market and value arrangements, all of which are designed around a commodity-based fossil fuel past.

Until we recognise that the decarbonized system has very different characteristics, a different cost base and new and varied value streams, we will end up paying for an inefficient, under-optimised, much slower and less fair transformation.

At the heart of the problem is that we are obsessed with the price of the commodity; many investment decisions and analysis are still calibrated using the levelized cost of electricity. In the new world this is far too simplistic, and is becoming less and less representative of the cost and value of our new system.

The new system cost base is moving from the cost of the electron to system management, network costs and the amount of storage required. In addition, the very new component that needs to be better understood is the potential and significant value of decarbonization assets that we will need in our homes and for motoring.

The key component that has sat on the sidelines for too long is the true value of flexibility, demand shifting and optimization, and self supply. While owners of EVs, heat pumps or self-generation can receive some limited benefits from operating them flexibly, this does not reflect the full value of these actions to the wider system. Let us also consider that consumers will need millions and millions of these types of assets across the system to decarbonize – but we are not rewarding them appropriately.

This 'mis-costing' of the energy system is why ReCosting Energy, inspired by the World Economic Forum's work on whole system costs, has developed new metrics that aim to appropriately cost our energy system – looking way beyond the value of the electricity itself. Working with the UK Government's modelling team, and great teams from Frontier Economics and LCP, we have developed a new set of metrics that use whole system costs, but importantly do what we think is a first: comparing and competing demand-side assets with generation assets.

The components of whole electricity system costs. Image: Frontier Economics

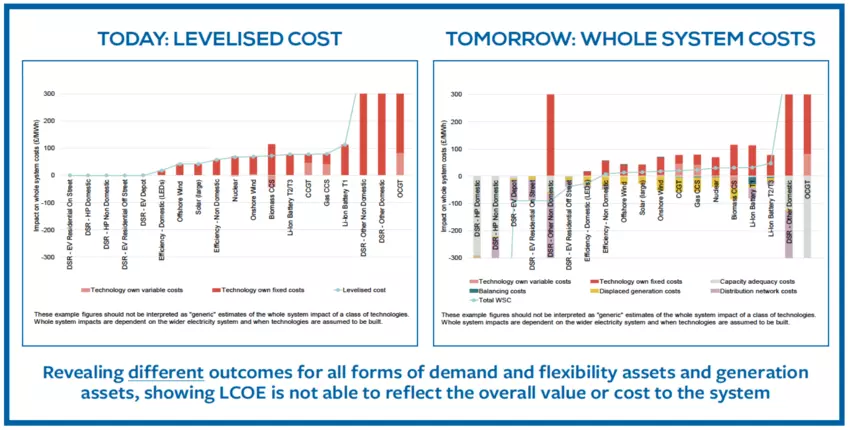

The model above firstly looks at whole system costs. These criteria were first developed in 2016 by Frontier Economics for DECC (UK Department for Energy and Climate Change) but seem to have not been as widely used by government in making investment decisions as they should.

We then broadened the “normal” analysis – simply comparing different generation assets – by adding demand-side assets and comparing them equally with generation assets. Our ambition here was to show that demand-side assets need to be equally valued to those of generation in our new system.

Why the levelised cost of electricity approach is no longer fit for purpose. Image: Challenging Ideas

This revealed several important issues:

1. Levelised cost of electricity is no longer fit as an evaluation tool for the new system

2. It is possible to compare demand-side and generation technologies alongside one another.

3. Most importantly that non-generation, demand-side assets from energy efficiency, EVs and heating actually deliver overall system savings

This model used a simple “the cost per additional MW added to the system” by the various interventions. However, our work aims to stimulate others to take on this modelling framework to start to value all assets – whether demand or generation – equally, providing policy-makers and investors with a much wider range of options.

Our ambition is that these metrics must start to drive change within a policy area that is still dominated by generation considerations, and does not regard demand-side assets as equal. Here are three recommendations for making that happen:

1. Demand must be seen as equal to generation in terms of policy and regulatory development.

2. This means that investors in assets which reduce or shift demand (including households deciding how to operate technologies such as heat pumps and EVs) should receive the same benefits from these actions that generation would – because buying these 'valuable' assets is as big a financial ask for a family, as developing an offshore wind farm is for an investor.

3. Fundamentally the market changes from 'supplying' as much as it can of the commodity to creating a new market in which optimised demand and optimised supply 'compete' with one another.

This last point truly unlocks benefits to whole system costs, requires new services for consumers, and drives costs down across both the supply and demand side of the system. It is a new market paradigm fit for the future.

KEYFACT Energy

KEYFACT Energy