Eco (Atlantic) Oil & Gas, the oil and gas exploration company with licences in the proven oil province of Guyana and the highly prospective basins of Namibia, announces its results for the year ended 31 March 2021, alongside a corporate and operational update.

Financials:

- As at 31 March 2021, the Company had working capital of US$13 million and no debt.

- In June 2021, the Company raised an additional US$4.9m in the form of a private placement.

- As at 31 March 2021, the Company had total assets of US$17.0 million, total liabilities of $1 million and total equity of US$16.0 million.

- The Company has materially decreased its total non-exploration expenses for the year ended 31 March 2021, including general and administration expenses and compensation costs by 33%.

Operations;

Eco Atlantic Oil & Gas

- Orinduik Block offshore Guyana - all seismic data reprocessing has now been completed and multiple light sweet oil drilling prospects are currently being reviewed by the Company and its licence partners (the "JV Partners"), with high-graded candidates being considered for the next drilling programme which Eco intends to drill in 2022. The intention is to provide further definition to the upper and lower Cretaceous interpretation and target selection for drilling. Target selection is expected in Q3 2021.

- The Company, together with its strategic partner and substantial shareholder Africa Oil Corp., continues to evaluate additional asset opportunities in both West Africa and South America with a focus on near-term high-impact exploration opportunities.

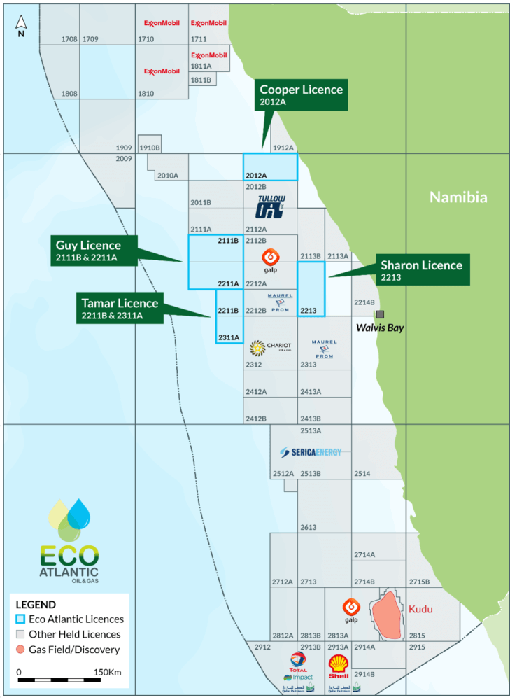

- On 30 November 2020, the Company successfully negotiated the reissuance of its four licences in Namibia's Walvis Basin for 10 years, which received final Government confirmation on 5 February 2021.

- On June 28, 2021, the Company announced that it had closed a transaction with JHI Associates Inc. ("JHI"), a private company and holder of 17.5% WI in the Canje block offshore Guyana, to acquire up to a 10% interest in JHI on a fully diluted basis (the "JHI Transaction") and to appoint Keith Hill, a non-executive Director of the Company, to the board of directors of JHI.

- The JHI Transaction increases Eco Atlantic's presence in the Guyana-Suriname basin, providing exposure to near-term drilling programme including at least three wells, with the first two firm wells on the Canje Block drilling in 2021 and at least one on the Orinduik Block in 2022, subject to partner approval.

- On July 5, 2021, the Company announced that it received a detailed update from JHI regarding the Jabillo-1 well in the Canje Block, offshore Guyana, which reached its planned target depth and was evaluated, but did not show evidence of commercial hydrocarbons. JHI also updated that spudding of the committed Sapote 1 well on the Canje block is scheduled for mid-August 2021, with a drilling time of up to 60 days.

Solear Ltd. (formerly Eco Atlantic Renewables post period end)

- On January 26, 2021, the Company announced the formation of a new joint venture company, to source, acquire and develop an exclusive pipeline of potential high yield solar projects. At the time of launch, the new entity was to be called Eco Atlantic Renewables, however, in order to further reflect the standalone nature of the business the company has been re-named Solear Ltd. ("Solear").

- Eco agreed to provide a secured loan of up to US$6 million to Solear. The Loan, which carries a 2% annual interest, is expected to be repayable from the proceeds of either a public or private financing, through operating cash flow, and/or a project monetization event.

- In January 2021, Solear completed its first acquisition of a fully contracted, permitted, and build ready 11MW solar project in Greece, known as the Kozani Project.

- Solear's near-term objective is to develop its pipeline of solar assets with competitive rates of return through acquisition, development and construction of solar assets, led by an experienced renewable energy team.

Outlook:

Guyana

- Guyana continues to be one of the most prolific exploration regions in the world, with over nine billion barrels of oil discovered in the last five years. Eco and its JV Partners have already delivered two substantial oil discoveries on the Orinduik Block and the Block continues to offer significant upside potential. With the recent increase in oil prices, the JV partners will revisit the Jethro discovery commercialisation potential.

- Eco is fully funded for further drilling on the Orinduik Block and, with its JV Partners, is assessing all opportunities available to drill at least one exploration well into the light oil cretaceous stacked targets as soon as practical. The Company is fully aligned with its JV partners on careful target selection, based on the reprocessed 3D seismic data on the block and nearby oil discoveries, for the next drilling campaign and Eco expects to be able to update the market on further drilling plans in Q3 2021.

- The JHI Transaction provides the Company with immediate exposure to a current active drilling program in the Canje Block offshore Guyana. JHI has announced that the Block Operator ExxonMobil confirmed its plan to spud a second exploration well, Sapote 1, by mid-August 2021.

- The Orinduik Block JV partners are Eco Atlantic (15% working interest ("WI")), Tullow Guyana B.V. ("Tullow") (Operator, 60% WI) and TOQAP Guyana B.V. ("TOQAP") (25% WI) a company jointly owned by TotalEnergies E&P Guyana B.V. (60%) and Qatar Petroleum (40%).

Namibia

- The Company's successful negotiation of the reissuance of its four licences in the Walvis Basin, Offshore Namibia, lead to the expansion of its acreage position. As announced on 30 November 2020, the Company's updated licences in Namibia cover approximately 28,593 km², with over 2.362 BBOE of prospective P50 resources.

- Eco has a strategically significant acreage position in-country and is progressing its various work programmes across its four blocks offshore Namibia. The Company has witnessed considerable interest from multiple international oil companies in Namibia.

- The Company continues to monitor upcoming drilling activity in the region, which could potentially see up to four exploration wells drilled on behalf of ExxonMobil, Total, Maurel & Prom, and Shell in the next 12 months.

Corporate:

- The Company continues to keep a strict control over costs throughout the business, which continues to generate material savings as reflected in the 54% decrease in G&A for the year and has ensured that Eco remains well capitalised with a strong balance sheet.

Gil Holzman, President and Chief Executive Officer of Eco Atlantic, commented:

"The past year has seen Eco make significant strides across a number of different aspects of its business. In terms of oil and gas exploration, we have made material progress in Namibia, through the successful negotiation and reissuance of our four licences in the Walvis Basin, and in Guyana we have completed a landmark transaction with JHI, ensuring near-term exposure to low risk, high impact drilling activity. We see the JHI Transaction as an important step for us, as we look to broaden our presence in Guyana, with the potential for increased future collaboration with the region's existing players. We also remain very upbeat about recommencing drilling activity on the Orinduik Block and we look forward to updating our investors on the timing of this during Q3 2021. We were also very encouraged to learn about the Whiptail discovery made by ExxonMobil and partners on the Stabroek block yesterday adding to the estimated discovered recoverable resource of 9 billion barrels of oil equivalent and further highlighting the basin's prospectivity.

"We remain strongly committed to achieving exploration success at our high value assets in Namibia and Guyana, and we are very pleased to be able to demonstrate strong progress with regard to both over the past year.

"Our strategic investment into Solear Ltd. has added another attractive asset to the Company's portfolio and shows our determination to deliver value for shareholders through prudent, selective use of our cash reserves. We are excited to update the market in the coming months on Solear's progress, as we believe our investment into the business presents compelling, near-term opportunities and the potential to achieve ambitious long term strategic growth targets in an evolving energy market.

"Despite the ongoing macroeconomic backdrop, we remain very positive about what the future holds for Eco Atlantic. We have a resilient business model, a strong cash position and a number of significant near-term catalysts which we believe have the potential to create considerable value for shareholders. As ever, I look forward to keeping all of our stakeholders updated on our progress over the coming months."

KeyFacts Energy: Eco Atlantic Guyana country profile l Eco Atlantic Namibia country profile

KEYFACT Energy

KEYFACT Energy