Highlights:

- Increase of 43% in the volume of gas initially contained within the Viking Wx field which provides substantial upside potential for the overall project and economics

- Completion of Viking Wx geo‐cellular static reservoir model with 368 Bcf gas‐initially‐in‐place (GIIP) volume confirmed, an increase of 112 Bcf

- Phase I GIIP is now 603 Bcf

- Workshops with infrastructure owners are in process to identify the optimal tie‐in and transportation options

- Greenfield Concept Select report received from Petrofac identifying a dual platform

- development as the optimum development concept for Victoria & Viking Wx gas fields

- UK natural gas spot price reached record of 117 pence per therm during August 2021 due to continuing European gas market constraints Project team remains on schedule and within budget with further key deliverables scheduled for the coming months.

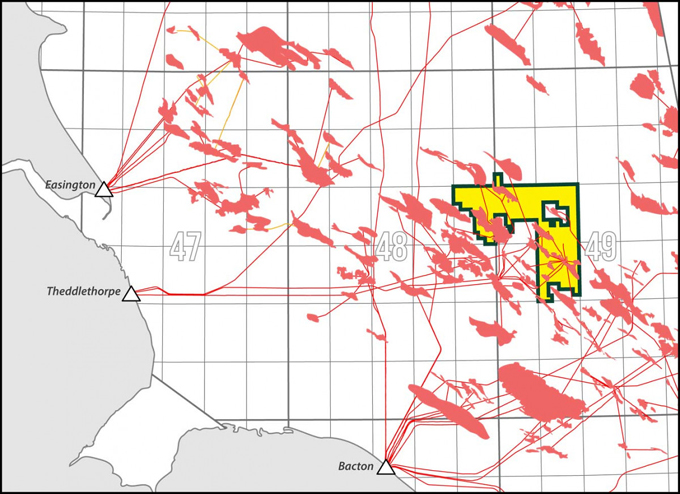

Hartshead Resources today announced the identification of an additional 112 Bcf of gas‐initially‐in‐place (GIIP) in the Viking Wx gas field, equivalent to a 43% increase. This takes the total Phase I GIIP to 603 Bcf, including the Viking Wx and Victoria gas fields. This operational update follows the delivery of the Viking Wx geological model by Xodus Group (Xodus) with associated revised GIIP estimates, and the completion of cost and revenue estimations for multiple greenfield development scenarios, to be used to screen, rank and select development concepts. The Phase I Gas Field Development Planning work program remains on schedule and within budget.

Subsurface Interpretation & Modelling

The construction of the Viking Wx geo‐cellular static field model has been completed by Xodus providing a calculated GIIP volume of 368 Bcf. The model is based on new analysis and interpretation of seismic and well data performed by Xodus. The GIIP is comparable to the calculation made by Hartshead and independently as part of the recent CPR:

| SOURCE | Gas‐Initially‐In‐Place (Bcf) |

| Xodus (deterministic – best technical case) | 368 |

| CPR (deterministic – mid case)(1) | 259 |

| CPR (stochastic – P50)(1) | 262 |

| Hartshead (stochastic – P50)(2) | 256 |

(1) Volumetric estimates are from Oilfield Production Consultants, Independent Competent Persons Report (CPR), dated October 2020

(2) Hartshead Resources management estimates

As well as confirmation of existing GIIP estimates, an extension to the gas field has been identified as a fault block in the south‐east part of the field. This fault block contains 40 Bcf of additional gas in place (included in the new total field estimate) and will be evaluated as an additional target location for development drilling, which is expected to add recoverable resources to the Phase I development. Adjacent and to the northeast of the field, an undrilled structure has also been identified that will be evaluated as a potential, near field, exploration prospect that could also add further gas volumes to the Phase I development. This undrilled prospective structure is not currently included in the total field GIIP estimate.

The building of the geo‐cellular static reservoir model for the Victoria field is progressing and completion is expecting within the next month.

The Viking Wx static field model will now be used to construct a full field dynamic reservoir simulation model to match against historic gas production from the field. Once history matched this model will be used to optimise frac and well placement and generate production profiles and updated recoverable resource estimates.

Development Well Planning

Fraser Well Management (FWM) has completed the drilling and completion cost estimates for production wells (platform & sub‐sea) for the various Phase I greenfield development concepts, this follows a review of the potential well trajectories from single and dual drill centre options.

These costs have now been incorporated with greenfield platform & pipelines costs to evaluate the various development options.

Production Facilities Planning

All cost estimates (CAPEX, OPEX, ABEX) have been completed for the various greenfield development options for Phase I, including a single platform for both fields, one platform for each field, a mix of platform and sub‐sea infrastructure and fully sub‐sea development.

The Greenfield Concept Select Report identifying the preferred greenfield development concept has be issued by Petrofac, which is based on these costs, the drilling cost estimates and the gas production revenue projections.

The preferred Greenfield Development Concept is via two wireline capable production platforms, one at Viking Wx and one at Victoria. This development concept provides slightly superior economic performance and a reduction in drilling risk when compared to a single platform development. In addition, it is envisaged that production from Viking Wx will tie in subsea to the Victoria export pipeline, thus allowing both platforms to operate independently and mitigates outages on one platform stopping production from the other.

Further work is now required to identify the preferred gas transportation route and host facilities in order to finalise functionality requirement for the Viking Wx and Victoria platforms.

Commercial Gas Transportation

Discussions continue with several owners of gas transportation and processing infrastructure local to the Phase I development area. A number of workshops have been held with the operators of potential host platforms and pipelines to identify the optimum gas transportation route for gas produced as part of the Phase I development. Further workshops are planned with a view to commencing engineering feasibility studies for the tie‐in of Hartshead’s facilities and gas offtake.

QHSE

Petrofac have kicked off the safety and environmental workstreams with three workshops that were held during July and August 2021.

Importantly, an introductory meeting has been held with the UK Government’s Environmental Management Team (EMT), part of the Department for Business, Energy & Industrial Strategy (BEIS). An EMT Manager has been appointed by BEIS to liaise with Hartshead on all environmental matters. The UK Government BEIS department work closely with the UK OGA on many aspects of UK North Sea License regulation and stewardship and have a key stakeholder role to play in the UK Government’s 2050 net zero target.

Gas Markets

Structural supply‐side constraints in LNG and reduced capacity from Norway and Russia continue to dominate European gas markets which are reflected in the recent UK spot gas price reaching 117 pence per therm(3) (p/therm) and a near‐term NBP futures (Jan 2022 contract) of circa 120p/therm compared to 47.5 p/therm at the time of the acquisition of HRL in February 2021. The UK gas futures curve also points to a winter 2024/25 price in excess of 50p/therm. Hartshead’s internal economic evaluation of the Phase I development is based on a gas price assumption of 45p/therm highlighting the potential for economic upside should market conditions persist.

Chris Lewis, CEO, commented:

“An increase in the gas volume at Wx is certainly good news and an excellent result. I look forward to the revised production profiles and seeing what positive impact this has on recoverable volumes, 2C resources and project economics. In addition, development planning for Phase I is progressing well with further key deliverables scheduled for the coming months. Workshops with infrastructure owners are proving valuable in understanding and assessing the best tie‐in and transportation options for our gas, once we commence production, and I look forward to being able to report on further progress with this as we continue discussions.”

KeyFacts Energy: Hartshead UK country profile

KEYFACT Energy

KEYFACT Energy