Demand for Land Rigs expected to be c. 30% higher in 2025, from the lows of 2020, driven primarily by China, GCC countries and Russia

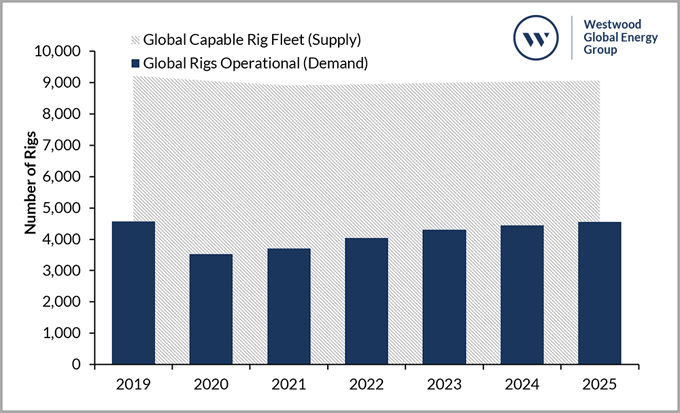

2020 was a catastrophic year for the onshore land drilling market, with operators slashing budgets and cancelling / reducing drilling programs globally. As a result, the number of onshore wells drilled dropped by c. 30% to an estimated c. 38,000, resulting in a drop in rig demand (c. 1,000 rigs) from c. 4,570 in 2019 to c. 3,520 in 2020. With the land rig market already significantly oversupplied in 2019, average global utilisation levels plummeted to an estimated c. 40% in 2020.

FIGURE. 1: GLOBAL LAND RIG SUPPLY AND DEMAND EXPECTATIONS, 2019 – 2025

SOURCE: WESTWOOD’S GLOBAL LAND DRILLING RIGS

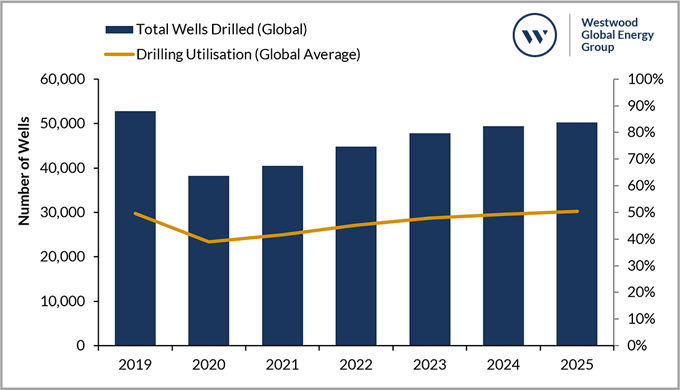

Over the forecast (2021 – 2025) period, Westwood expects demand for rigs to increase from the lows of 2020, despite Operators’ propensity to maintain capital discipline. In Westwood’s Base Case scenario, we expect the number of wells drilled to grow year-on-year to c. 50,200 by the end of the forecast period, up c. 30% from 2020 levels. With an identified capable global rig fleet of c. 9,060 rigs and estimated demand of c. 4,560 rigs by 2025, the average market utilisation is expected to improve to c. 50%.

FIGURE. 2: GLOBAL WELLS DRILLED AND DRILLING UTILISATION, 2019 – 2025

SOURCE: WESTWOOD’S GLOBAL LAND DRILLING RIGS

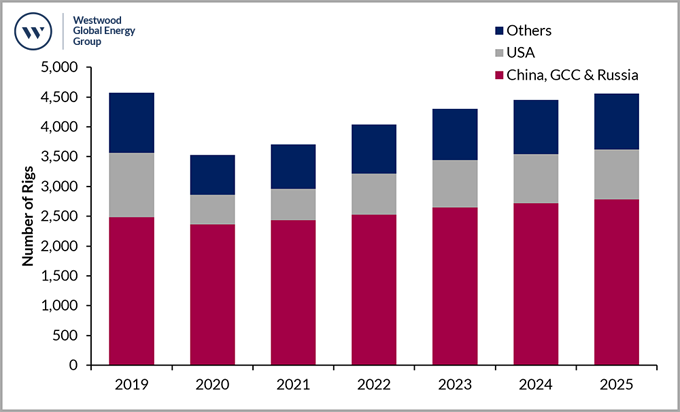

A larger proportion of forecast rig demand is expected to be driven by NOC dominated countries compared to the recent past. Countries in the GCC region and to a certain extent Russia and China, were more resilient to the COVID-19 induced commodity price crash in 2020; compared to IOC dominated countries, such as the US and Canada. Strong drilling activity is expected in these NOC dominated countries leading up to 2025, resulting in utilisation levels of c. 75% by 2025, (c. 25% higher than the global average).

China, driven by government mandates to increase domestic production, is estimated to have seen a greater number of wells drilled in 2020 than in 2019, overtaking the US as the largest driller globally. It is expected to maintain the year-on-year growth trajectory through to 2025. The number of rigs operational is expected to reach c. 1,300 by 2025 (highest globally), resulting in a utilisation rate of c. 80%. There is upside potential for higher rates of activity if shale / unconventional developments progress at a faster rate than currently anticipated.

Russia is expected to continue to see high levels of rig demand over the forecast period as it continues drilling to meet export commitments. An average of c. 6,400 wells a year are expected 2021 – 2025, with demand for more than c. 1000 rigs a year and utilisation of c. 70%. The GCC countries, though hampered by OPEC+ commitments at the start of the forecast, are expected to see strong growth in the later years, driven by production capacity upgrades (Saudi Arabia and the UAE) and extensive EOR drilling activity (Oman).

Overall, these countries are expected to represent c. 60% of total rig demand over the forecast period. Demand in other key markets, such as the US, is not expected to return to previous levels (witnessed during 2016 – 2019) under Westwood’s Base Case scenario.

FIGURE. 3: AVERAGE NUMBER OF RIGS OPERATIONAL, 2019 – 2025

SOURCE: WESTWOOD’S GLOBAL LAND DRILLING RIGS

Although activity levels in the US have improved during H1 2021, E&P operators are increasingly focused on profitability (cash flows) and creating shareholder value, over production growth. In 2025, Westwood estimates that c.14,800 wells will be drilled in the US, resulting in demand for c. 840 rigs (c. 70% higher than 2020), but well below the c. 1,080 rigs estimated for 2019.

Summary:

Improved oil prices, sentiment and global demand recovery is expected to drive an uptick in demand for land rigs leading up to 2025. This uptick is likely to be underpinned by NOC dominated countries (e.g. GCC, China, Russia) accounting for c. 60% of rig demand over the forecast period. Upside potential exists to our forecast, contingent on the pace of unconventional / shale developments in China, Argentina etc. The Energy Transition momentum and ESG considerations, could lead to an evolution in operator led rig specifications particularly in North America from an emissions reduction perspective.

Ben Wilby, Senior Analyst, Onshore Energy Services l Arindam Das, Head of Onshore Energy Services

KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy