Britain faces bleak winter of soaring energy costs, firms on brink of collapse and blackouts

Daily Mail, 7 October 2021

Britain is facing a bleak winter of soaring energy costs, with gas prices rising by a staggering 37 per cent in a single day and pushing more energy firms to the brink of collapse while the National Grid warned of electricity shortages as the country faces its worst crisis since the first Covid outbreak last year.

Millions are facing a financial squeeze because of rising inflation driven by labour shortages, rising energy costs, a lack of HGV drivers and gaps in global supply chains, as it was revealed hard-pressed families face paying £1,700 more for energy in April and an extra £1,800 for other essentials by Christmas.

While Boris Johnson today brushed off the crisis and used his Manchester Tory conference speech to set out his vision for a 'high wage, high skilled, high productivity' economy, the price of wholesale gas surged by £1 a unit to 400p per therm this morning - up 37 per cent in a day and 600 per cent higher than the start of 2021.

Prices reversed course hours later, sending the UK contracts back to £2.87, after Russian President Vladimir Putin sought to stabilise the gas market by saying that state-backed monopoly exporter Gazprom could increase supplies to Europe. Critics accused Mr Putin of trying to stave off allegations that Moscow is trying to 'weaponise' gas supplies amid tensions between Russia and NATO powers over Ukraine.

On a day of worsening news, National Grid's chief executive John Pettigrew told the FT that Britain will face tighter electricity supplies this winter due to a lack of capacity in the system and a colder winter predicted, which means the cost of electricity will increase as gas prices spike to record high.

Investment experts Moody's also warned that more UK energy firms will go to the wall, which will push hundreds of thousands of people on to more expensive tariffs with new providers. While Britain's Energy Intensive Users Group, which represents steel, chemical and fertiliser firms, said production at some plants is already being halted 'at times of peak demand' due to energy prices. They have called on the Government to give financial support to keep businesses in the way a taxpayer-funded deal to curb CO2 shortages was done to keep two fertiliser plants running last month.

The explosive rise that will hit households and businesses is being fed by fears that a cost of living crisis has arrived as global oil prices also jumped to a three-year high of $83 a barrel. And as a result new figures show average petrol prices have hit 136.10p per litre, the highest level since September 2013.

Despite all this, the Prime Minister gave only a cursory mention of the crisis rocking Britain and merely indicated there are 'difficulties' to come - instead giving a rambling keynote speech to the Tory faithful at the party conference which was instead packed with jokes and almost entirely devoid of new policies.

Business leaders slammed Mr Johnson's speech, with the Confederation of British Industry warning that his economic policies could stoke inflation while the British Chambers of Commerce accused him of failing to provide firms with urgent answers 'to the problems they are facing in the here and now'.

Trade union leaders also lined up to condemn Mr Johnson. Unite's new general secretary Sharon Graham raged: 'Without serious action, this speech is nothing more than headline-chasing by a prime minister desperate to deflect from the serious and growing cost-of-living crisis happening on his watch.'

Manuel Cortes, general-secretary of the TSSA transport union, added: 'As ever, this political jester came up with nothing but hot air.' Another critic said: 'Britain burns while Johnson fiddles'.

Even Thatcherite think-tanks denounced the speech. Matthew Lesh of the Adam Smith Institute said: 'Boris' rhetoric was bombastic but vacuous and economically illiterate. Shortages and rising prices simply cannot be blustered away with rhetoric about migrants.'

UK industry could face shutdowns as wholesale gas price hits record high

The Guardian, 7 October 2021

Wholesale gas prices hit new all-time highs on Wednesday, prompting warnings that factories could be forced to shut down over winter or switch to more polluting fuels just as the UK hosts the Cop26 climate conference next month.

The crisis has already forced a wave of collapses among energy suppliers that has led to warnings of “desperate choices” for households likely to face higher bills as a result.

As power-hungry sectors such as steel, glass and chemicals fight their own battle with soaring gas and electricity costs, they warned of further shocks to both industry and consumers, including higher prices of goods and factories being forced to temporarily close.

Growing concern about the domino effect of high energy prices came as the cost of gas for delivery the next day reached 350p per therm on Wednesday, while gas for delivery in November reached 407p, both new records.

Prices fell back later, after Russia’s president, Vladimir Putin, indicated that the country, the largest supplier of gas into Europe, was prepared to help ease the crisis. But leading figures from energy-intensive industries said serious ramifications were already on the cards unless the government heeded their call for measures to reduce energy costs.

Trade body UK Steel said it was now “uneconomic” to make steel at certain times in the UK, with British firms facing double the electricity prices paid by rivals in Germany, France and the Netherlands. British Steel, based in Scunthorpe, has begun adding surcharges of up to £30 a tonne to its products to recoup higher energy costs, increasing costs for customers in the construction and automotive sectors.

David Bailey, a professor of business economics at Birmingham Business School, said consumers could end up feeling the pinch if steel remained expensive. “They’ll pass it on to consumers ultimately, so it could increase the price of cars,” he said.

Greater risk of blackouts this winter, Britons are warned

The Daily Telegraph, 7 October 2021

Britain faces a greater risk of blackouts this winter after a fire knocked out a cable importing electricity to Britain from France.

National Grid’s electricity system operator (ESO) believes supply will meet demand - but has cut its forecast of buffer supply.

Its officials are also warning of high costs for getting power generators to fire up at short notice to help balance the system.

Those costs are ultimately passed onto household bills - a further pressure when bills are climbing due to soaring wholesale costs of natural gas and electricity.

EU spooked by energy prices running wild & Net Zero in doubt

Bloomberg, 7 October 2021

European energy prices are spiraling out of control. Gas prices have surged 60% in just two days, pushing industry in the region to the breaking point and rattling financial markets.

The EU is sounding the alarm, with the Commission set to outline next week exactly what action member states can take to protect citizens from the soaring costs, without falling foul of state-aid rules.

For their part, environment ministers across the bloc are getting jittery, with a number of countries expressing growing concern over the EU’s plans to create a new emissions trading system for road transport and heating - something they deem will hit the poorest most.

But Frans Timmermans, the EU’s climate chief, is sticking to his guns, saying that rising carbon prices are only to blame for a fifth of the increase in electricity prices and that the solution is more renewables, not fewer. Whether he can keep the transition on track may depend on how quickly prices start to return to normal.

European industry buckles under a worsening energy squeeze

Bloomberg, 6 October 2021

European industry is being pushed closer to breaking point as the region’s energy crisis worsens by the day.

Power and gas prices are hitting fresh records almost daily, and some energy-intensive companies have temporarily shut operations because they’re becoming too expensive to run. As winter approaches and Europeans start to turn on their heaters, the squeeze will intensify, pushing more executives into tough decisions about keeping plants open.

Ammonia producer SKW Stickstoffwerke Piesteritz GmbH is among those that’s been forced into drastic steps. The German company, which burns through 640 gigawatt hours of natural gas each year, equivalent to about 50,000 households, said Tuesday it will cut production by 20% to offset rising gas prices.

“It doesn’t make sense to make ammonia at these price levels,” said Chief Executive Officer Petr Cingr. “A complete production stop looms if the government doesn’t act.”

On Wednesday, the European Union issued a fresh warning and said it will outline measures including tax cuts and state aid that governments can use to help.

“This price shock cannot be underestimated,” EU energy chief Kadri Simson said. “If left unchecked, it risks compromising Europe’s recovery.”

Those comments came a day after the U.K.’s Energy Intensive Users Group called on the government there to roll out emergency measures or face businesses shutting down this winter.

The crisis ripping through the region is the result of a supply crunch tangled up with a burst in demand after the Covid-19 pandemic. It threatens to put the brakes on the economic rebound by jacking up business costs and household energy bills, sending inflation to multi-year highs.

Many companies are trying to increase their energy efficiency, but any gains are being overwhelmed by the extent of the cost surge. The damage will worsen if the crisis evolves from a price shock to shortages, and more industries have to take the dramatic step of flicking the “off” switch.

There’s even a risk that governments intervene directly, as has happened in China. That could involve restrictions on industrial energy consumption to conserve dwindling supplies and keep homes heated over winter, especially at Christmas.

Front-month Dutch gas futures jumped as much as 22.4% on Wednesday after closing 20% higher on Tuesday. The U.K. equivalent benchmark jumped as much as 27.6%.

“It’s really scary,” said Carsten Rolle, head of the energy department at Germany’s BDI industry association. “The price rises make you dizzy.”

Last month, CF Industries Holding Inc., a major fertilizer maker, halted operations at two U.K. plants, citing high natural gas prices. Austria’s Borealis AG and Norwegian chemical firm Yara International ASA have also reduced output.

These measures will affect other industries, such as agriculture, adding to pressure on food prices. More widespread shutdowns would dent economic growth and put jobs at risk.

Options to alleviate the spikes seem to be limited. On the supply side, not much relief is expected from major natural gas producers, which have held back flows for their own domestic needs.

The longer the crisis drags on, the greater the chance of all-out supply shortages.

German giant BASF SE is already preparing for that, and says it’s secured long-term contracts with a range of gas providers to avoid getting hit by a crunch at any one supplier. The company’s Ludwigshafen facility, Europe’s largest chemical plant, has been designated “systemically relevant” by Germany’s grid operator, meaning its electricity supply wouldn’t be cut off in order to protect public supplies.

The impact of record gas, electricity and carbon prices has been greater on small and medium industrial producers, which have fewer financial protection options and are more exposed to volatility.

Already hurt by coronavirus lockdowns, many of Germany’s smaller firms decided against securing long-term energy supplies earlier this year and can’t afford to catch up now as gas prices are so high, according to Andreas Loeschel, professor of resource economics at Ruhr-University Bochum.

“So much depends on the the demand side of the equation,” he said, referring to the potential for a colder-than-expected winter. “A number of unlikely events are building up to cause a situation we’ve never seen before.”

Boris should kick-start a shale revolution to avoid an energy cost disaster

GWPF & Gaia Fawkes, 7 October 2021

If Boris Johnson wants to avoid a worsening energy crisis that could threaten his premiership sooner rather than later, if he wants to bring down the price of natural gas, if he wants to level up by creating a new and high-wage industry in the North of England, if he wants to energise Britain and improve energy security, he should abandon his foolish ban on shale gas extraction and kick-start the much delayed shale revolution in the UK.

As Britain faces a gas price shock and geo-political energy blackmail, it is worth reflecting that over the years Boris wrote a fair bit on fracking – the overly harsh sounding term for extracting shale gas – in a characteristically positive and boosterish way.

Fracking is what made America a net energy exporter, allowing it to meet carbon emission targets and achieve energy security from the Middle East. Americans hail fracking as an energy revolution. A decade ago, Boris too was describing the potential of fracking as “glorious news”:

“It [fracking] is glorious news for humanity. It doesn’t need the subsidy of wind power. I don’t know whether it will work in Britain, but we should get fracking right away.”

9 December 2012, Telegraph

A year later, he was calling on the Cameron government to “stop pussy-footing around”:

“we must stop pussy-footing around, and get fracking. Even if we have hundreds of fracking pads, they are nothing like as ugly as windmills, and they can be dismantled as soon as the gas is extracted.”

15 September 2013, Sun

The next year, he was arguing that giving the British people their mineral rights would incentivise landowners to get fracking:

“Give the British people their mineral rights, and get fracking at last. No landowner, large or small, has any automatic commercial interest in the discovery of shale gas beneath their property. No wonder the shires are in revolt against fracking.

“It is no surprise that everyone is a Nimby – or in this case, Numby – when they are told that what is under their back yard is not theirs, but belongs to the Queen!”

30 June 2014, Telegraph

By the next month the then-Mayor of London was advocating fracking for London:

“If reserves of shale can be exploited in London we should leave no stone unturned, or unfracked, in the cause of keeping the lights on”. -- 2 July 2014, letter in Times quoted in Guardian

Boris is now in a position to do something glorious, to stop pussy-footing around and leave no stone unturned or unfracked. So get on with it…

Matt Ridley: China is using the climate as a bargaining chip

The Spectator, 9 October 2021

China’s President Xi Jinping has apparently not yet decided whether to travel to Glasgow next month for the big climate conference known as COP26. That is no doubt partly because he’s heard about the weather in Glasgow in November, and partly because he knows the whole thing will be a waste of his time. After all, the fact that it is the 26th such meeting and none of the previous 25 solved the problem they set out to solve suggests the odds are that the event will be the flop on the Clyde.

But another reason he is hesitating was stated pretty explicitly by his Foreign Minister, Wang Yi: ‘Climate cooperation cannot be separated from the general environment of China-US relations.’ Roughly translated, this reads: we will go along with your climate posturing if you stop talking about the possibility that Covid-19 -started in a Wuhan laboratory, about our lack of cooperation investigating that origin, or about what we are doing to Hong Kong or the Uighur people.

The Chinese Communist party is using the COP as a bargaining chip. To keep us keen, Xi announced last month that China would stop funding coal-fired power stations abroad. ‘I welcome President Xi’s commitment to stop building new coal projects abroad — a key topic of my discussions during my visit to China,’ enthused Alok Sharma, the president of COP26. ‘A great contribution,’ said John Kerry, the United States climate envoy.

In truth, Xi is throwing us a pretty flimsy bone. He did not say when he would stop funding overseas coal or whether projects in the pipeline would be affected, so the impact on the world’s coal consumption will be minimal. And the gigantic expansion of coal burning in China itself continues. It already has more than 1,000 gigawatts of coal power, and has another 105 gigawatts in the pipeline. (Britain’s entire electricity generational capacity is about 75 gigawatts.)

China now burns half the world’s coal. According to the US Energy Information Administration, China is tripling its capacity to make fuel out of coal, about the most carbon-intensive process anybody can imagine. For reasons that are not clear, many western environmentalists are mad keen on China, despite its gargantuan appetite for coal, and won’t hear a word against the regime.

So it is only fair to ask just what concessions Britain and America have made to try to entice China into being helpful in Glasgow - and whether they are worth it. Was it a coincidence that a few weeks before Xi’s announcement, the Biden administration put out a report from its intelligence community that concluded it could not be sure either way whether the virus came out of the laboratory?

The report had all the hallmarks of having been watered down for political reasons. Joe Biden, Kamala Harris and John Kerry have carefully avoided mentioning China in recent speeches about human rights.

Likewise, was it a coincidence that there has been barely a peep recently out of the British government as the last vestiges of liberty are extinguished in Hong Kong? Even after China’s government slapped sanctions on British parliamentarians, sanctions against Chinese Communist party officials or the Hong Kong government are conspicuous by their absence. That the COP was delayed for a year doubled its value to China as a bargaining chip.

For reasons that are not clear, western environmentalists are mad keen on China, despite its appetite for coal. I am not suggesting there is an explicit policy of appeasement, but that politicians would not be human if they did not hesitate when deciding whether to be even mildly critical on these issues at a time when they badly want helpful Chinese announcements on climate policy to avert a flop. And China’s politicians would not be human if they did not exploit this. So it is worth asking whether the game is worth the candle.

After all, the history of these conferences is that they cost a fortune and attract tens of thousands of well-paid activists who talk all night and then announce something so meaningless they might as well not have bothered. There was the Kyoto Protocol (1997), which everybody signed and everybody ignored; the Bali Action Plan (2007), which merely recognised that ‘deep cuts in global emissions will be required’; the Copenhagen Accord (2009), which was just a bit of paper; the Cancun Agreements (2010), which agreed to set up - but not to fund - a fund. And these were the ones that claimed to achieve something.

For a moment, the Durban conference of 2011 looked different in that it agreed there would be enforceable emissions commitments from all parties by 2015. Nothing less than legally binding promises would do at Paris in 2015, we were told. As Paris approached, it became clear that America, China and India would sign no such binding commitments, so some genius came up with plan B: everybody would make a legally binding commitment to come up with non-legally-binding commitments to cut emissions. This was presented to a gullible media as a triumph. When I pointed out this sleight of hand in parliament, a government minister compared me to the North Korean regime, a low point in my respect for my party.

China’s leaders have long ago decided that the climate issue is simply something they can use as leverage with the West. A few minor announcements about more spending on solar power or less money for coal in Africa are a small price to pay for the West’s relative silence on human rights in Hong Kong, the release of the Huawei finance director in Canada and some easing of tariffs and sanctions. It’s a double whammy win for China: it cannot believe its luck as it watches us closing down our reliable and affordable power sources to buy from them wind turbines, solar panels and ingredients for batteries for electric cars.

Currently, the Chinese strategy is to divide and rule: they are all charm with Brits and all snarl with Americans and Australians. The Aussies got slapped with trade sanctions just for asking for an inquiry into how the pandemic started.

The Chinese Communist party newspaper the Global Times last month let it be known that it finds Britain more amenable than ‘erratic’ America: ‘Comparing with Kerry, Sharma showed a more readily cooperative attitude,’ it wrote, schoolmaster-style, and quoted the Foreign Minister as saying that Britain ‘won’t be as domineering as the US in talks with China over climate change cooperation, which will be used as a way to improve its deteriorating relations with China and secure the Chinese market after Brexit’.

In a forthcoming paper for the Global Warming Policy Foundation, Professor Jun Arima of Tokyo University, who was one of Japan’s chief climate negotiators, warns that: ‘The divided and acrimonious world that is being created by net zero policies will permit China to further enhance its global economic presence and influence while the developed, democratic world becomes economically, politically, and militarily weaker.’

Forget Net Zero: World energy consumption to increase almost 50% by 2050

Talk Business, 6 October 2021

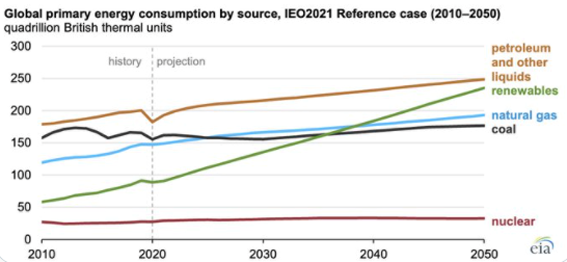

Excluding significant changes to policy or technology, global energy consumption is expected to rise by nearly 50% between 2020 and 2050, according to the U.S. Energy Information Administration (EIA).

The EIA released Wednesday (Oct. 6) its International Energy Outlook 2021 that shows strong economic growth, especially with developing economies in Asia, is expected to contribute to global increases in energy consumption despite pandemic-related declines and long-term improvements in energy efficiency.

If existing policy and technology trends continue, global energy consumption and energy-related carbon dioxide emission will rise through 2050 as a result of population and economic growth, according to the EIA.

The outlook’s reference case, which projects energy trends based on existing laws and regulations, shows renewable energy consumption has the strongest growth among energy sources through 2050. Liquid fuels remain the largest source of energy consumption, driven largely by the industrial and transportation sectors.

“Even with growth in renewable energy, without significant policy changes or technological breakthroughs, we project increasing energy-related carbon dioxide emissions through 2050,” said EIA Acting Administrator Stephen Nalley.

Renewables are expected to be the primary source for new electricity generation, but natural gas, coal, and increasingly, batteries will be used to help meet load and support grid reliability, according to the EIA. By 2050, electricity generation is projected to nearly double in developing countries that are not part of the Organization for Economic Co-operation and Development (OECD)....

“The fast-growing economies in Asia could combine to become the largest importer of natural gas and crude oil by 2050, given their significant increase in energy consumption,” Nalley said.

The International Energy Outlook 2021 includes energy consumption projections for 16 regions in the world. Projections for the United States are consistent with those in EIA’s Annual Energy Outlook 2021. Link here for the International Energy Outlook 2021.

And finally: South Pole froze over in coldest winter on record

MSN News, 5 October 2021

The South Pole just had its coldest winter on record.

Between April and September, a research station sitting on a high plateau in Antarctica, registered an average temperature of minus 78 degrees Fahrenheit (minus 61 degrees Celsius). That's the coldest temperature recorded since record keeping began in 1957, and about 4.5 F (2.5 C) lower than the most recent 30-year average, according to The Washington Post.

The previous record for the coldest winter was minus 77 F (minus 60.6 C) in 1976, Stefano Di Battista, a journalist wrote on Twitter. The Post learned of this record through Battista, but then confirmed the information with Richard Cullather, a research scientist at NASA's Global Modeling and Assimilation Office.

The frigid winter is likely caused by a strong polar vortex in the stratosphere, the second layer of the planet's atmosphere from Earth's surface, according to the Post. "Basically, the winds in the polar stratosphere have been stronger than normal, which is associated with shifting the jet stream toward the pole," Amy Butler, an atmospheric scientist at NOAA, told the Post. "This keeps the cold air locked up over much of Antarctica."

What's more, a strong polar vortex also leads to more ozone depletion in the stratosphere, which strengthens the polar vortex even more, according to the Post. Ozone is a gas made up of three oxygen molecules that is found high in the atmosphere. Ozone protects Earth's surface from harmful ultraviolet rays and depleting it can expand the ozone hole over Antarctica.

While Antarctica logged the coldest known average winter temperature, satellites have detected individual temperatures that are far lower; as low as minus 144 F (minus 98 C), according to the Post.

Thanks to the frigid temperatures, sea ice levels around Antarctica were at their fifth highest extent on record in August, the Post reported.

KeyFacts Energy Industry Directory: Global Warming Policy Forum

KEYFACT Energy

KEYFACT Energy