Financial highlights:

- Loss from operations for the 6 months period is £929,089 (2020: full year Loss of £1,689,521).

- Cash balance, at period end of £2,258,567 (2020 year end: £1,325,751).

- A further £1,083,298 (US$1,500,000) held as restricted cash and £487,477 by way of a loan to FRAM Exploration Trinidad Ltd. for the investment in the Pilot CO2 EOR Project .

- Fully-funded for Morocco drilling programme and Pilot CO2 EOR Trinidad.

- £3,285,000 (before expenses) raised through two over-subscribed Placings.

- 1,020,000 warrants issued exercisable at £0.105 before 12 March 2025.

- 600,000 warrants issued exercisable at £0.157 before 18 June 2025.

- No debt

Operational highlights:

- MOU-1, first exploration well for 35 years in Guercif Basin, Morocco commences on schedule.

- Initial drilling confirms extension of gas-producing Rharb Basin into Guercif Basin.

- Significant gas readings encountered whilst drilling.

- Phase 3 of Trinidad Pilot CO2 EOR Project commenced and 469 metric tonnes of anthropogenic CO2 injected.

- Changes in CO2 injection parameters result in an accelerated reservoir pressure increase of up to 4 months ahead of pre-injection forecasts.

- Exclusivity over surplus liquid CO2 supply extended until 2023.

- Submission made to Cork County Council Development Plan to highlight role of the Mag Mell

- FRSU Project in the context of security and diversification of Ireland's energy supply.

Post reporting date highlights:

- MOU-1 completed for subsequent rigless testing.

- Six zones selected for perforating within the pre-drill seismic amplitude "bright spot"

- Re-correlation of the interval to be perforated supports MOU-1 having tested the western edge of the MOU-4 Prospect (CPR (2020) gross Best Estimate resources of 393 BCF).

- Environmental Impact Assessment commenced for step-out wells to MOU-1 within the MOU-4 Prospect.

- Compressed Natural Gas development option independently costed for profile of 10 mm cfgpd.

- Operator of the Inniss-Trinity Incremental Production Services Contract unilaterally elects to shut down the CO2 EOR Pilot Project .

- Predator Oil & Gas Trinidad Ltd. considering its next steps under the terms of the Inniss-Trinity Well Participation Agreement.

- £1,300,000 (before expenses) raised through an over-subscribed Placing.

- Lonny Baumgardner appointed as Chief Operating Officer and Ronald Pilbeam steps down from the Board.

Operational overview

Morocco

Despite COVID restrictions, the MOU-1 well commenced drilling on schedule at 01:00 hours on Sunday 20th June 2021.

The well was forecast to take up to 20 days to drill and to run wireline logs.

At the end of the period under review the well had reached its 95/8" casing point at 729 metres TVD KB.

Significant dry gas readings were encountered in the shallow section including formation gas shows, in line with drilling experiences in the gas-producing Rharb Basin to the west.

Initial drilling results in the shallow section confirmed the gas-generating potential of this area of the Guercif Basin, which had only before been tested by one well in 1972, long before the gas potential of the Rharb Basin was understood and realised.

During the period under review SLR Consulting (Ireland) Ltd completed an independent study for the Company of scoping capital and operating costs for a CNG development option utilising potential gas produced at Guercif. The model assumed a scoping gas delivery profile of 10 mm cfgpd (3.65 BCF of gas annually) trucked to industrial customers and to the end of existing gas pipelines in the Rharb Basin. The preferred site of a CNG facility at the MOU-4 Prospect location is only 1.5 kilometres from the highway running westwards and connecting with Morocco's most significant industrial centres. Trucks would run on CNG rather than diesel fuel. Start-up CNG costs net to the Company (75%) facilities CAPEX estimates are US$12.21 million and net (75%) CNG operating costs are estimated at US$2.09/mcf. Costs exclude drilling costs and potential requirement for booster compression later in field life. At an average gas sales price of US$11/mcf to the Moroccan industrial market the commercial model for CNG gas sales is attractive.

As a consequence of the COVID pandemic the original term of the Initial Period of the Guercif Petroleum Agreement has been extended by one year to 18 September 2022.

Trinidad

Phase 3 of the of the Inniss-Trinity Pilot CO2 EOR project commenced in the period under review . The planned operations were in accordance with the Company's Project Proposal PRD25092019 submitted by the Operator (FRAM Exploration Trinidad Ltd. or "FRAM") of the Inniss-Trinity Incremental Production Services Contract, or "IPSC", as a consequence of which Heritage Petroleum Trinidad Ltd., the licence holder, granted FRAM a two-year extension to the IPSC and the Ministry of Energy and Energy Industries approved the commissioning of the CO2 EOR facilities at Inniss-Trinity.

It was planned for CO2 to be injected into the AT-13 well continuously over a period of up to 275 days during which production time rates would be recorded at AT-5X.

It became apparent very quickly that the AT-13 well was not suitable for CO2 injection at higher pressures and regulatory approval was sought and subsequently granted for CO2 injection to return to the original 2020 CO2 injector well AT-5X. AT-12, defined in the submitted Proposal PRD25092019 as a production well and included in the AT-4 Block Pilot CO2 EOR Project, remained available for continuous production. It was determined that additional wells within the AT-4 Block would be surveyed and investigated for potential workovers and the return to production. AT-6, AT-7 and AT-10 were considered for the restoration of production and IN-6 was considered as a candidate for perforating in the unperforated Herrera #2 Sand. Workover well costs were generated and approved internally.

From April 2021 469 metric tonnes of CO2 were injected through AT-5X. Operations were limited to daylight hours due to best practice HSE restrictions for handling CO2 at a time of COVID restrictions.

Curtailing injected daily CO2 volumes and restricting injection pressures had a beneficial effect on the rate of reservoir pressure build-up whilst establishing a preferred orientation and pattern for accelerated CO2 migration routes. Of five wells where pressure data could be interpreted, two were broadly in line with pre-injection forecasts whereas three showed accelerated reservoir pressure build-up relative to the pre-injection estimates. In the most notable case one well reached a static bottom hole pressure of 1,089 psi on 9 June 2021, whereas the pre-injection forecast estimated that this pressure was only to be achieved over four months later.

The encouraging results provide valuable information for the design and resulting effectiveness of CO2 EOR projects for the Herrera reservoir sands.

The implementation of CO2 EOR technology, the operational experience and the significant empirical database, combined with exclusivity over Trinidad's surplus liquid CO2 supply until at least 2023, has placed the Company in a unique position to offer CO2 EOR collaboration agreements to operators of mature producing fields onshore Trinidad.

The establishment of the CO2 EOR Steering Committee by the Government of Trinidad and Tobago during the reporting period has been the commercial catalyst for the Company to engage with local operators regarding CO2 EOR technology and services that the Company can provide to align operators with the strategically important Government initiative.

Ireland

During the period under review the Company changed the name of its subsidiary Predator LNG Ireland Ltd. to Mag Mell Energy Ireland Ltd., a name from Irish mythology that reflects the ethos behind the move to offshore LNG facilities below the horizon that can contribute with very much reduced environmental impact to security of energy supply during the Energy Transition.

In June a submission was made to the Draft Cork County Council Development Plan detailing the Mag Mell FSRU LNG Project and the potential benefits for the industries and communities of Cork, which historically has been the hub of Irish indigenous gas production. The vital role this project could have in addressing security of energy supply during the Energy Transition was also outlined in the Company's published document for the purpose of facilitating informed public consultation.

At the same time the Company made a submission to the Department of Housing, Local Government and Heritage in respect of the Public Consultation on the Marine Protected Area ("MPA") Advisory Group's Report entitled "Expanding Ireland's Marine Protected Area Network."

The steps taken are to ensure that the Mag Mell FSRU LNG Project was fully in the public domain ahead of a planned meeting later in the year of the Oireachtas Committee on the Environment to examine energy security, LNG and power usage by data centres.

Partnership building has been a key objective of the Company. The establishment of a FSRU technical and commercial solution specific to the environment and conditions of the Celtic Sea offshore Ireland is a significant tool to use to meet conditions for regulatory approvals and to develop partnerships to attract project finance to allow a Financial Investment Decision to be made. This is a long process, but the "Energy Crisis" post the reporting period has potentially provided a greater sense of urgency to address volatile energy markets during the Energy Transition.

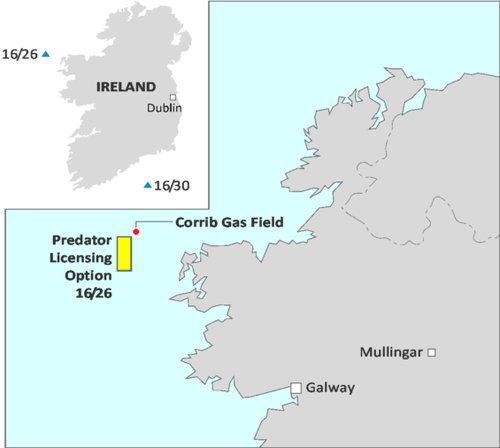

The Company remains at the disposal of the regulatory authorities to accelerate the potential award of successor authorisations for the Corrib South and Ram Head projects. Both these projects are potentially valuable assets for indigenous gas production and gas storage that could assist an orderly progress through the Energy Transition.

KeyFacts Energy: Predator Oil & Gas country-company profiles: Ireland l Morocco l Trinidad and Tobago

* Premium profile information includes; description, overview of assets, current and planned operational activity, capex, local and corporate locations, news archive, farm-in opportunities and 'one-click' access to company 'Linkedin People'. Contact KeyFacts Energy to discover how you can secure access to over 2,600 'country-specific' company profiles from 144 countries.

KEYFACT Energy

KEYFACT Energy