By Hans Jacob Bassoe & Teresa Wilkie, Esgian

On conclusion of the transaction, the new industry giant will own one of the largest and highest value fleets in the market, not to mention holding the biggest market cap in the industry.

Today it has been confirmed that Noble Corporation continues its consolidation spree with its second M&A transaction this year, the first was its acquisition of Pacific Drilling and this time it will combine with Maersk Drilling. The new arrangement will primarily occur through an all-stock transaction split 50/50 to each company with the new entity to keep the Noble Corporation name.

Merging of the two players, which is set to close in mid-2022, will result in significant consolidation within both the North Sea jackup and ultra-deepwater floater markets. As Esgian reported back in May, such consolidation has been called upon by many in the industry for several years, due to the continually overly fragmented and competitive market which has dampened upside cycles and limited the ability to mitigate oversupply.

How will this transaction change the overall market?

The duo has also stated that the deal is expected to “generate estimated annual run-rate synergies of USD 125 million, which will create significant value for shareholders.” Meanwhile, some estimates indicate that the combined market capitalisation of the two companies could be as much as ~$3.4 billion, which would make it the leading market capital in the industry surpassing Valaris at ~$2.8 billion.

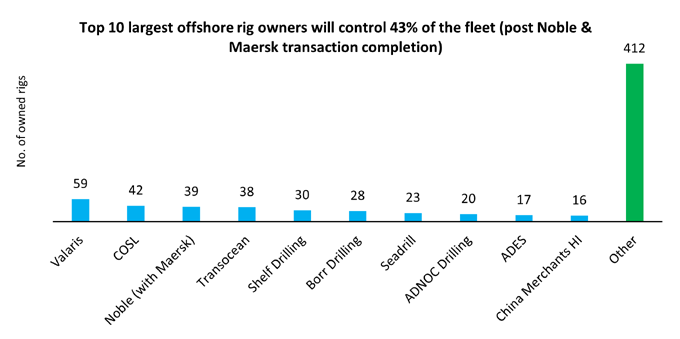

In terms of fleet size, the new Noble Corp will take over from Transocean as the third largest driller, owning just one unit more than it. The fragmentation in the overall rig owner segment will also decrease by approximately 3%, with the top 10 largest rig owners now set to control 43% of the fleet. This still isn’t all that much, but it’s a move in the right direction.

Of the combined fleet, 30 of the rigs are currently working or have future contracts in place and only two of the units are cold stacked. According to Esgian Rig Analytics, the two companies also currently have just under 30 years of total firm backlog in place for its units.

Figure 1: Top 10 largest rig owners by fleet size (post Maersk/Noble transaction completion). Source: Esgian Rig Analytics

The merger will not only create an industry giant, but also make the new Noble Corp. an even stronger player in the ultra-deepwater and harsh environment jackup markets. The combined entity will own the second largest fleet of 7th Generation drillships, while it will own the largest fleet of harsh environment jackups globally.

The combined fleet value likely to be one of the highest

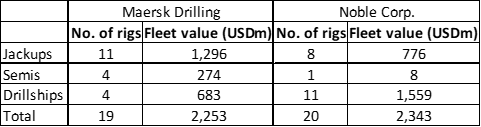

The Noble Corp and Maersk Drilling fleet distribution is well balanced and both companies own almost the same number of rigs with comparable fleet values.

As standalone companies, Esgian Rig Values estimates the Noble Corp. and Maersk Drilling’s fleet values at $2,343 million and $2,253 million, respectively. Most of Maersk Drilling’s value is tied up in its harsh environment jackups working in the North Sea, while Noble Corp have a large fleet of modern 7th Generation drillships.

Figure 2: Maersk Drilling & Noble Corp. rig count and values (values are charter free). Source: Esgian Rig Values

Although Esgian Rig Values will shortly conduct further analysis, with these current values in mind and following the merger, the new entity has the potential to own one of the highest value fleets in the world. The new Noble Corp. will own a good mix of modern rigs. Although these rig designs have lost considerable value since the peak in 2014, the potential upside of the new Noble Corp. fleet value could be substantial.

The merger of Noble Corp and Maersk Drilling will position the new entity as one of the largest players in the market. Now that the offshore rig market has begun a new recovery, with demand and utilisation already increasing on the back of higher and more stable oil prices, the New Noble Corp. will be well positioned amongst its peers to take full advantage of the start in the new upcycle.

KeyFacts Energy Industry Directory: Esgian

If you would like to sign up to KeyFacts Energy's free daily news-alert service click here to join our growing list of subscribers.

KEYFACT Energy

KEYFACT Energy