- ATP 2021 Joint Venture enters into a Heads of Agreement with AGL Wholesale Gas Limited

- HoA targets parties executing a Gas Sales Agreement by year end

- Subject to agreeing a GSA and satisfaction of conditions precedent, gas supply to AGL to commence mid 2022 until end 2026, estimated at between 9 PJ and 16 PJ (gross)

- Pricing at a mix of fixed and variable market rates

- Includes a pre-payment by AGL of $15 million to the Joint Venture for funding the Vali Field work to first gas

- Vali Field independently evaluated reserves: Gross 1P of 47.5 PJ (23.7 PJ net), 2P of 101.0 PJ (50.5 PJ net) and 3P of 209.8 PJ (104.9 PJ net)

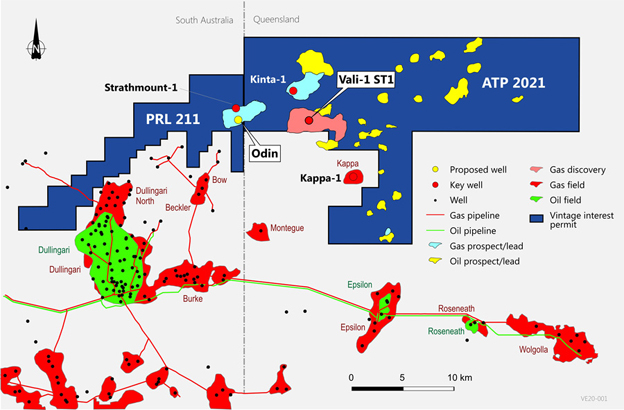

ATP 2021 (Vintage 50% and operatorship, Metgasco Ltd 25% and Bridgeport (Cooper Basin) Pty Ltd 25%)

Vintage Energy today announced a conditional Heads of Agreement (“HoA”) between the ATP 2021 Joint Venture parties (“JV”) and AGL Wholesale Gas Limited (“AGL”) for the sale of all gas produced from the Vali Field from field start-up (mid-CY2022) through to the end of CY2026. This is anticipated to be a minimum of 9 PJ and up to 16 PJ of gross sales gas over the contract term, to be sold on a mix of firm and variable pricing at market rates.

The terms set out in the HoA will form the basis of a fully termed Gas Sales Agreement (“GSA”) which will include AGL providing an upfront payment of $15 million to the JV in three tranches as the project moves to first gas, subject to execution of the GSA and the satisfaction of its conditions precedent. The JV funds will be used specifically for the Vali Field to fund the work program, including the completion of all three Vali wells and the tie-in of the Vali Field to the nearby Moomba pipeline network.

Vintage Managing Director, Neil Gibbins said,

“Once more I am delighted with how things are progressing as we fast approach becoming a domestic east coast gas producer.

“The Heads of Agreement for the proposed sales of up to 16 PJ of gas to AGL will deliver significant cash flow to the Joint Venture over the term of the contract and also provide the Joint Venture with an upfront payment for funding capital works required to achieve first gas. These are great outcomes for Vintage and all the participants in the agreement.

“I see this agreement as validation that the Vali gas field will be commercialised. Along with our recently announced tripling of reserves for the Vali Field, which took the gross 2P reserves to 101.0 PJ (50.5 PJ net to Vintage, or 50,500,000 GJ), we are now close to supplying meaningful amounts of gas into the Australian east coast market. With strengthening gas prices in the domestic and international markets, it should be very clear to all that the Vali Field is a sizeable and valuable asset for Vintage and its shareholders.

“We are excited to have AGL as a buyer of Vali Field gas and look forward to providing them with a consistent supply of gas for the initial supply term of four to five years.”

A competitive process was undertaken for the sale of gas from the Vali Field. The JV has executed the HoA with AGL, which contains the key commercial terms to a fully termed GSA. This HoA provides the greatest amount of flexibility for the JV in terms of gas delivery at the strongest price and represents approximately 9% to 16% of the 2P reserves from the Vali Field as announced by Vintage previously.

The HoA includes a number of conditions precedent to a definitive GSA including a condition that a raw gas processing agreement with the Moomba infrastructure owners, for the processing of Vali gas to sales gas standards, is entered into. Discussions with the Moomba infrastructure owners regarding a processing agreement are progressing. The HoA provides for an exclusivity period during which time the formal documentation for a GSA is expected to be negotiated and executed.

KeyFacts Energy: Vintage Energy Australia country profile

If you would like to sign up to KeyFacts Energy's free daily news-alert service click here to join our growing list of subscribers.

KEYFACT Energy

KEYFACT Energy