Serica Energy today provides the following operations update.

Mitch Flegg, Chief Executive of Serica Energy, commented:

"Serica has made significant progress during the second half of 2021. The impact of the substantial investment programmes undertaken in 2020 and 2021 has been increased production levels providing responsibly sourced gas to the UK domestic market, protecting security of supply, and reducing reliance on imports as part of the transition to a lower carbon future.

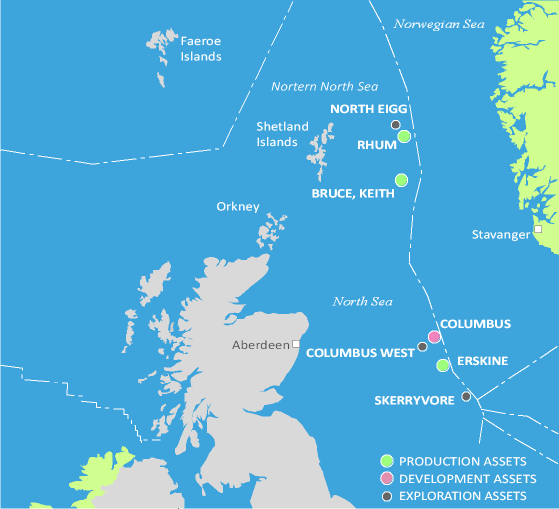

Commodity prices have been exceptionally strong during the period with a resulting positive impact on income. Additionally, from 1 January 2022 Serica will retain 100% of the cashflow from its BKR assets (2021: 60%) and so will benefit further from the increased production levels. Serica has no debt, limited decommissioning liabilities, growing cash reserves and so is well positioned to continue to invest in further projects (including North Eigg) and other opportunities to add shareholder value.”

Columbus

As previously announced, hydrocarbons from the C1z development well started flowing into the Arran subsea system on 24 November. The commingled Arran and Columbus production streams are now being exported to the Shearwater platform for processing and onward export to the gas and liquid sales points.

Early production has been constrained due to a temporary unavailability of full capacity in the export system however during the first 14 days of production, average gross Columbus production rates of 6,300 boe/d have been achieved of which over 80% is gas. Full capacity in the export system is expected to be available to Columbus by mid-January 2022.

Hedging

Serica continues to maintain a modest gas price hedging programme with approximately 20% of retained gas and liquids production covered in the second half of 2021, thereby allowing the company to benefit from full market prices on around 80% of its production. A similar percentage of gas hedging is projected for 2022.

Forward Programme

The BKR net cash flow sharing arrangements come to an end on 31 December 2021. From 1 January 2022, Serica enter a new phase for the Company where they will be retaining 100% (2021: 60%) of the net cash flow from the BKR fields, benefitting fully from the increase in production levels.

Serica intends to continue with its programme of investing in its portfolio of assets. A rig has now been contracted for the drilling of the high-impact North Eigg exploration well in the summer of 2022. North Eigg is a gas prospect located close to Serica’s BKR fields and it is expected that a successful discovery could be tied back to existing infrastructure in a carbon neutral manner.

Plans are also in place for a Well Intervention campaign to take place in 2022 to improve the production potential of several Bruce and Keith wells during subsequent years.

Growing cash balances offer increasing options for further investment, acquisition, and distributions. Serica’s Board continues to evaluate the optimum balance between these elements to deliver further shareholder returns.

KeyFacts Energy: Serica Energy UK country profile

KEYFACT Energy

KEYFACT Energy