- Black Mountain Energy successfully completed an A$11 million IPO via the issue of 55 million shares at A$0.20/share

- Indicative market capitalisation of A$51 million upon listing

- Backed by US-based Black Mountain group and focused on natural gas exploration, development, and production

- Black Mountain Energy holds EP371 in WA’s Canning Basin

- Funds from the IPO will progress EP371 towards development, including 2D seismic acquisition and processing, permitting, environmental activities, and baseline studies.

Black Mountain Energy will commence trading on the Australian Securities Exchange (ASX) following successful completion of an Initial Public Offer (IPO).

The Company has raised A$11 million via the issue of 55 million shares at A$0.20 per share in its IPO, giving it an indicative market capitalisation of A$51 million upon listing.

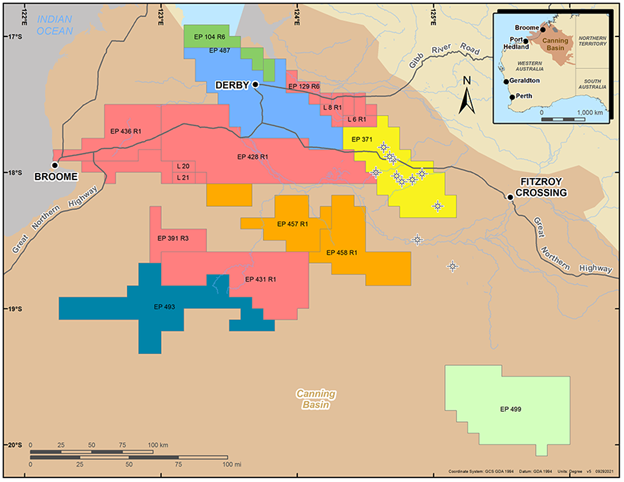

Black Mountain Energy, part of the US-based Black Mountain group, is an energy and resources company focused on natural gas exploration, development and production. Its key asset is Petroleum Exploration Permit EP371, known as Project Valhalla, in Western Australia’s Canning Basin.

Black Mountain Energy’s largest shareholder, BM Canning, is a private, entrepreneurial upstream oil and gas company with vast experience in the industry.

Black Mountain Energy Executive Chairman and CEO Rhett Bennett said:

"We are excited to bring our expertise to Australia and champion the effort to deliver responsibly developed and environmentally conscious natural gas supply. Our goal is to develop a resource that not only provides socio-economic uplift to our Traditional Owners, but also unlocks this new natural gas resource for the WA market, providing energy security, employment and investment into the Kimberley region."

EP371 covers more than 3,660km² in the Fitzroy Trough, west of the Fitzroy River. An Independent Technical Expert has estimated prospective gas resources of 11.8 trillion cubic feet (TCF) and contingent gas resources of 1.5 TCF1 (best estimates). The estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development. Further exploration, appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons.

Previously held in Joint Venture by Buru Energy and Mitsubishi, EP371 has three wells drilled to date. Buru withdrew from the project to focus on conventional oil operations and Mitsubishi took over Buru’s interest. Black Mountain Energy acquired the asset in 2019.

While WA has a domestic gas policy which prevents export of all new onshore gas to the eastern states or overseas, Black Mountain Energy was granted an exemption from the export restrictions by the Department of Jobs, Tourism, Science and Innovation (JTSI) in September 2021.

"This export ban previously made development of EP371 a challenge, however Black Mountain was granted an exemption due to the isolated nature of the project and to underpin foundation pipeline infrastructure that connects the Canning Basin to the Western Australian pipeline network. The Valhalla Project will provide new gas supply to the WA domestic gas market and benefits to the region through local employment and business opportunities," Mr Bennett said.

KEYFACT Energy

KEYFACT Energy