SDX Energy has announced the proposed disposal of 33% of the shares in the entity that holds its interests across its South Disouq concession and its intention to initiate a share buyback program of up to US$3.0 million in H2 2022. All monetary values are expressed in United States dollars net to the Company unless otherwise stated.

Mark Reid, CEO of SDX, commented:

"I am very pleased to announce that we have entered into an agreement to dispose of 33% of our interests in the South Disouq concession for a consideration of US$5.5 million, which is a significant premium to the asset's value within our market capitalisation.

We intend to use the proceeds to initiate a share buyback program of up to US$3.0 million in H2 2022 with the remainder to be used for investment into innovative, portfolio growth opportunities which I look forward to updating the market on in due course.

In summary, this transaction allows us to achieve a number of our strategic objectives.

- Firstly, it permits us to return capital to our shareholders which has been a long-term goal;

- Secondly, it provides capital to support growth projects across the portfolio; and

- Thirdly, it provides a clear value read across of 6.1 pence per share for the full value of South Disouq

We will retain 67% of our pre-transaction interests in the South Disouq concession, remaining as operator, continuing to benefit from the cash-generation of the fields, while reducing our risk exposure on the two South Disouq exploration wells to be drilled this year."

Proposed disposal of 33% of the shares in the entity that holds SDX's interests in South Disouq for US$5.5 million and decision to initiate a share buyback program of up to US$3.0 million in H2 2022

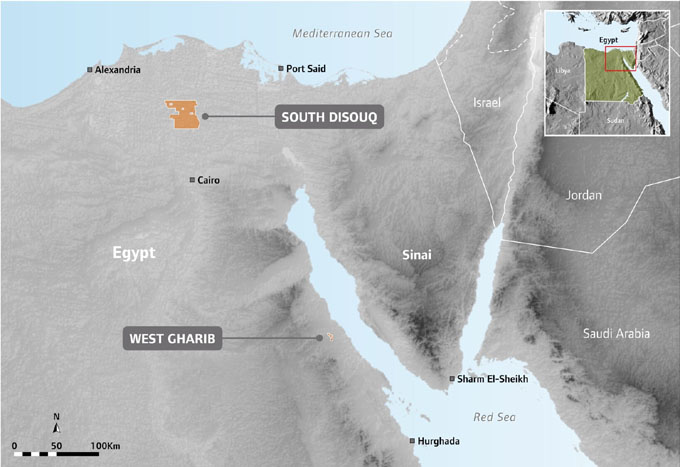

- Share Purchase Agreement signed with Energy Flow Global Limited, a private company with upstream and oilfield services activities in Egypt, the Middle East and Asia, to dispose of 33% of the equity in Sea Dragon Energy (Nile) B.V. (("Nile) B.V."), the entity that holds SDX's gas producing, development and exploration assets in the South Disouq concession, located in the Nile Delta.

- Transaction effective date of 1 February 2022, with US$5.5 million cash consideration to be received throughout Q2 and Q3 2022 by way of contributions to SDX's remaining capital and operational expenditure in South Disouq.

- FY 2020 profit before tax relating to the 33% equity being disposed equated to US$0.24 million.

- Disposal proceeds allow the Company to plan for a share buyback program returning up to US$3.0 million to shareholders in H2 2022 once the consideration has been fully received, and investing the remainder into growth initiatives across the portfolio.

- Completion of the transaction is subject to the release of the share pledge held by the European Bank for Reconstruction and Development on the shares in (Nile) B.V. that are being transferred to Energy Flow Global Limited. Energy Flow Global will have the right to appoint a representative to the Board of Directors of (Nile) B.V.

KeyFacts Energy: SDX Energy Egypt country profile

KEYFACT Energy

KEYFACT Energy