Calima Energy has received firm commitments to raise A$20 million in gross proceeds via an institutional placement of 100,000,000 new fully paid ordinary shares (New Shares) to institutional and sophisticated investors at an issue price of A$0.20 per share (Placement).

The Placement was strongly supported by existing shareholders and new Australian and international institutional investors and was significantly oversubscribed.

In the immediate term, the net proceeds will reduce the amount drawn on the Company’s revolving credit facility which also reduces hedging requirements under the facility.

Short-Medium term capital investments:

- C$2.1 million – Complete Q1 Wells – Stimulation and tie in Pisces 3; completion and tie-in of Gemini wells

- C$1.6 million - Waterflood – facilitates the timing of investment vs. return (invest in slow decline production and increase reserves)

- C$1.5 million - North Thorsby completion - Fracture stimulation, 3rd party gas tie-in, and single well battery. With success, considerable expansion of booked drilling inventory

- C$2.0 million - Expansion to the Thorsby main battery to accommodate further H2 2022 development

- C$2.0 million - Forward planning – supply chain management, getting ahead of logistics bottlenecks, committing to services, and pre-purchasing tangible equipment

This will strengthen the balance sheet to optimise capital management and reduce volatility in working capital drawdowns

Glenn Whiddon, Chairman:

“I would like to thank all stakeholders for their support and welcome a number of key institutional shareholders to the Company. Emerging resource companies succeed with excellent assets and quality management, with the downside protected through a strong balance sheet. This raise will ensure these criteria are met while providing upside to rising energy prices.

The raise was led by Canacccord Genuity (Australia) with significant investor interest also generated from our UK bankers, Auctus Advisors and Hannam & Partners. I would like to thank them all for their efforts and the collaborative approach to the raising.”

Jordan Kevol, CEO and President:

“We believe that this shows a significant recovery of investment into the oil and gas sector with WTI now trading around ~US$90 WTI and natural gas around C$4, both of which are multi year highs. It has been nearly 8 years since we have had these levels of commodity prices. The global market fundamentals around supply and demand are both setting up well for this bull run to not be short lived. Calima is well capitalised to take advantage of this environment.”

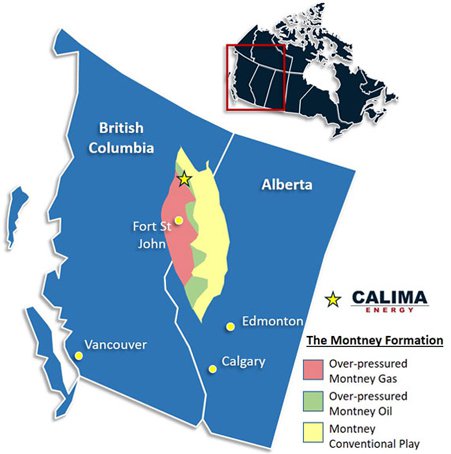

KeyFacts Energy: Calima Energy Canada Onshore country profile

KEYFACT Energy

KEYFACT Energy