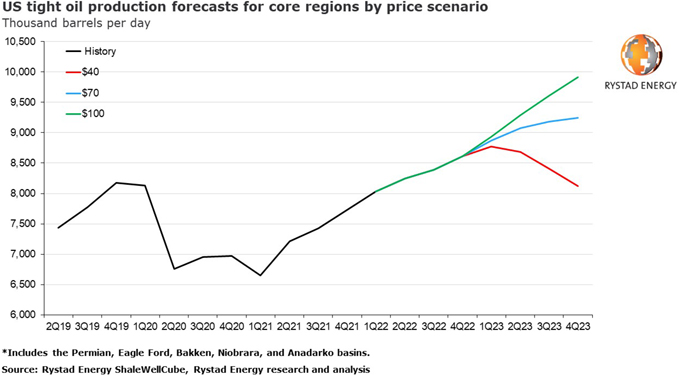

Up to 2.2 million barrels per day (bpd) of US tight oil could be unleashed in the event of a supercycle – with oil prices remaining around or above $100 per barrel – driven by growing demand and continued supply tightness, Rystad Energy predicts.

Tight oil output in the core producing regions of the US – the Permian, Eagle Ford, Niobrara, Bakken and Anadarko – in the fourth quarter of 2021 was around 7.7 million bpd, continuing an upward trend but short of the pre-pandemic levels. Production in these regions is expected to surpass the 2019 high of 8.1 million bpd by the second quarter of this year and expand further if a supercycle materializes.

If oil prices reach and remain around $100 per barrel, total production from these core regions would hit 9.9 million bpd by the fourth quarter of 2023, marking a 2.2 million bpd surge from the same quarter in 2021.

High oil prices are encouraging operators to increase production as supply from sources outside the US remains tight. Global Covid-19 concerns are waning and countries are removing or relaxing restrictions, causing a surge in demand for oil that the current supply would struggle to meet. In addition, geopolitical uncertainty in major exporting countries is worsening, threatening to disrupt trade flows amid already limited availability.

Total unconventional output – including oil, gas and natural gas liquids (NGL) – from these core US oil regions has already returned to pre-Covid-19 levels, totaling around 15.6 million boepd in the fourth quarter of 2021. Total output is expected to keep climbing and reach an all-time high of more than 16 million boepd by the end of March this year.

“Although high prices would in theory trigger a burst in tight oil production, acute supply chain bottlenecks, a lag between price signals and its impact on production, and winter weather-related disruptions will slow growth. Added to this are expectations that spot sand prices will rise to a $50-$70 per ton range – a level unheard of in the industry’s modern history – which will hit operators’ wallets,” says Artem Abramov, Rystad Energy’s head of shale research.

Learn more with Rystad Energy’s ShaleWellCube.

Examining the possibilities

Looking at different scenarios, a price range between $70 and $100 per barrel would lead to a significant upsurge in output in the fourth quarter of 2022, while a prolonged run of $90-$100 per barrel would result in a further increase to the already recovering rig activity from the second quarter of 2022. In a $40 scenario, production will return to 2021 levels by 2024.

Looking beyond 2023, $100 WTI will allow the industry to average at an annual growth of about 960,000 bpd, from the fourth quarter of 2021 through to the fourth quarter of 2025. A $70 world will still allow for a sustainable growth cycle, but the average annual pace will be limited to about 560,000 bpd.

In a $100 per barrel scenario, a gradual deployment of additional rigs would materialize from the second quarter of this year, driven by both private operators and public independent producers. A fundamental shift in the operational philosophy of public E&Ps is emerging, with many responding to a global call on tight oil growth. Recent communications from ExxonMobil and Chevron on their ambitious Permian growth plans reaffirms this trend.

There is a marked change happening now in the Permian and some other basins, with industry sentiment becoming buoyant again. Various supply chain bottlenecks might delay the uptick in activity, but they will not act as a complete showstopper as the industry has repeatedly demonstrated that all such bottlenecks get resolved in time.

These projections cover unconventional activity in core tight oil regions of all the lower 48 states, excluding the Gulf of Mexico. For the rest of the lower 48 conventional production and condensate in shale gas regions, excluding the Gulf of Mexico, oil output has recently stabilized in the 1.7 million-1.8 million-bpd range and can even recover towards 1.9 million bpd over the next four years in a favorable price environment amid an increase in infill drilling in mature fields and a robust condensate production outlook in wet and liquids-rich parts of select gas basins. Against this backdrop, the pre-Covid-19 lower 48 oil production peak of 10.4 million bpd would be within reach already by late-2022 or early-2023.

In a $70 scenario, supply from the lower 48 states is expected to trend towards 12 million bpd by late-2025, while a sustained $100 environment will allow US onshore oil volumes to grow to 13.5 million bpd over the next four years.

KeyFacts Energy Industry Directory: Rystad Energy

KEYFACT Energy

KEYFACT Energy