From a selection of 144 Energy Country Profiles, KeyFacts Energy feature Colombia in the continuing series of snapshot reports, with selected information taken from our popular 'Energy Country Review' database.

Colombia’s upstream oil and gas industry is a critical pillar of its economy, though it has recently faced structural and political headwinds. The country is Latin America’s fourth-largest oil producer and a significant exporter of both crude oil and natural gas, with most production concentrated in onshore basins like Llanos, Magdalena Medio, Putumayo, and Catatumbo.

The sector is anchored by Ecopetrol, the state-controlled oil company, which handles the majority of production and reserves. Private and foreign firms—such as Gran Tierra, Parex Resources, Canacol Energy, and Frontera Energy—also play major roles, operating under contracts with the National Hydrocarbons Agency (ANH).

Crude oil production averaged 772,000 barrels per day in 2024, though output is declining due to aging fields, limited exploration, and recent political decisions halting new licensing rounds. Natural gas production also fell to around 950–990 million cubic feet per day, while proven gas reserves dropped to 2.06 trillion cubic feet, equivalent to just 5.9 years of consumption—a level seen as critical.

Despite modest growth in proven oil reserves in 2024 (up 0.74% to 2.035 billion barrels), the country’s energy security is increasingly strained. Exploration is down, and Colombia has ramped up LNG imports to compensate for declining domestic gas supplies.

The Petro administration has aimed to transition away from fossil fuels, pausing new oil and gas contracts while promoting renewable energy. However, critics argue this has chilled investor confidence and jeopardized long-term production sustainability.

In summary, Colombia’s upstream industry remains economically vital but is at a crossroads—balancing energy transition goals with declining reserves, lower production, and rising dependency on imports.

| Oil production | 772,621 thousand bpd |

| Proved oil reserves (year-end) | 2.035 thousand million barrels |

| Natural Gas production | 960 MMcf/d |

| Natural Gas proved reserves (year-end) | 2.064 trillion cubic feet |

Country Key Facts

| Official name: | Republic of Colombia |

| Capital: | Bogotá |

| Population: | 53,415,527 (2025) |

| Area | 1,141,748 km² (440,831 square miles) |

| Form of government: | Parliamentary Republic |

| Language: | Spanish |

| Religions: | Roman Catholic |

| Currency: | Colombian peso (COP) |

| Calling code: | +57 |

E&P COMPANIES

Canacol Energy

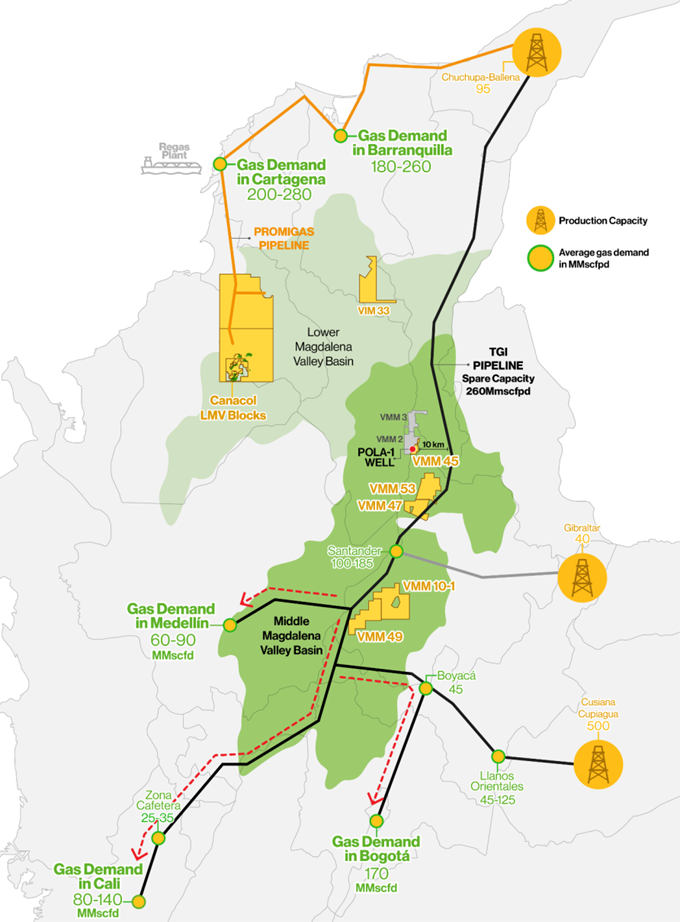

Canacol Energy is the largest independent conventional natural gas exploration and production company in Colombia, supplying approximately 20% of the country’s natural gas needs. The company operates over 1.9 million net acres in 10 exploration and production gas contracts in Colombia, located in the Lower & Middle Magdalena Basins.

Canacol is part of the energy transition towards a cleaner energy matrix in Colombia. Natural gas is increasingly important for Colombia as the country phases out oil and coal as energy sources, replacing them with natural gas in a transition to a cleaner, more renewable energy matrix.

Continued production declines in the major country's large natural gas fields, coupled with growing energy demand and an increasing preference for clean-burning natural gas over coal or oil, are the ingredients of a very favorable business climate for Canacol.

Production from the country’s two largest state-owned gas fields, both discovered in the 1970s and which currently supply around 75% of the market, has been steadily decreasing since 2014. In 2012, Canacol decided to focus exclusively on conventional natural gas, where consistently high and stable prices, combined with exceptionally low production costs, support cash flow predictability and stability. Our successful exploration drilling programs have allowed Canacol to both replace the declining production from the large fields and keep up with rapidly growing gas demand, ensuring that Colombia’s gas requirements are and will continue to be met for the foreseeable future.

KeyFacts Energy: Canacol Energy Colombia country profile

CHEVRON

As a result of Chevron’s acquisition of Noble Energy in October 2020, two exploration plays in Colombia were added to Chevron’s portfolio.

Chevron has a 40% owned and operated working interest in Colombia-3 and Guajira Offshore-3 blocks located off Barranquilla and Santa Marta’s shores, covering more than 988,000 net acres (3,998 sq km). Exploration activities continued in 2020.

In April 2020, the company completed the sale of its interests in the offshore Chuchupa and onshore Ballena natural gas fields.

KeyFacts Energy: Chevron Colombia country profile

CNOOC International

CNOOC International holds assets in both shale gas and conventional oil in Colombia and was one of the first companies to explore for shale gas in the country.

Shale Gas

In 2012, three gas wells were drilled on two of four blocks that CNOOC International holds close to Bogota. The four blocks occupy a total area of approximately 600,000 hectares, or 1.5 million acres.

Conventional Oil

Over the last 20 years, CNOOC International has drilled seven conventional oil exploratory wells in Colombia. One of these wells resulted in an oil field that is operated by our partner Petrobras. CNOOC International has a 50% working interest.

KeyFacts Energy: CNOOC International Colombia country profile

CONOCO PHILLIPS

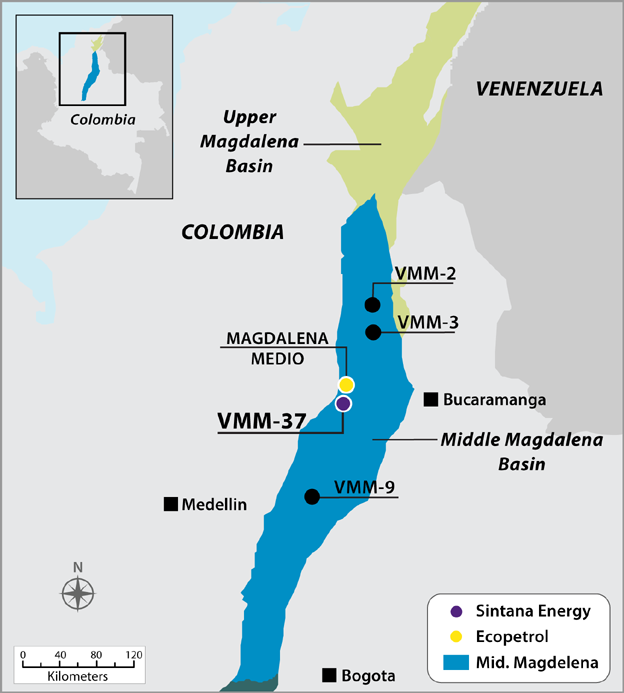

ConocoPhillips have an 80 percent working interest in the Middle Magdalena Basin Block VMM-3 extending over approximately 67,000 net acres. In addition, the company have an 80 percent working interest in the VMM-2 Block, which extends over approximately 58,000 net acres and is contiguous to the VMM-3 Block. The contracts for this project are currently in force majeure due to the lack of a defined environmental licensing required for the execution of unconventional exploratory activities. Additionally, the government of Colombia supports a ban on such activities.

KeyFacts Energy: ConocoPhillips Colombia country profile

ECOPETROL

Ecopetrol S.A. is the largest company in Colombia, the fourth largest Latin American oil company, and one of the top 40 largest oil companies in the world.

Ecopetrol S.A. is an integrated company participating in the hydrocarbon value chain, from exploration and production of oil and gas, to marketing and processing fuels and value added products. It owns and operates the two main refineries of Colombia.

Ecopetrol S.A. operates a transportation network of over 9,000 kilometers of pipelines connecting its production to refineries, consumption centers, and ports in the Atlantic and Pacific coasts of Colombia.

Ecopetrol S.A. also invests in research and development, and runs the most important hydrocarbon investigation center in Colombia, the Instituto Colombiano del Petróleo.

The Ecopetrol Business Group currently comprises more than 30 companies, in businesses ranging from hydrocarbon exploration, production, transportation to refining, petrochemicals and biofuels, with operations in Colombia, Brazil, Peru and the United States.

KeyFacts Energy: Ecopetrol Colombia country profile

Equión Energía

Equión Energía, formerly BP Colombia are a hydrocarbon exploration and production company whose shareholders are Ecopetrol S.A. (51%) and Repsol (49%). Since 1986, the company have developed responsible and sustainable oil activities in Casanare (Cusiana, Cupiagua, and other fields).

KeyFacts Energy: Equinor Colombia country profile

FRONTERA ENERGY

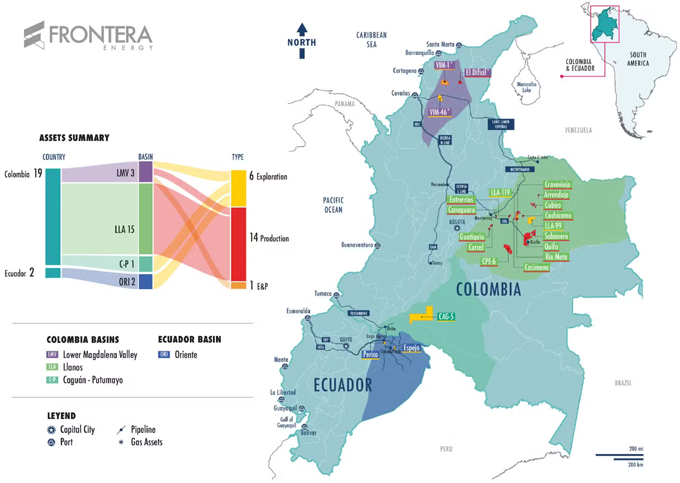

Frontera Energy is active in Colombia's energy landscape through upstream operations in the mature Llanos and Magdalena basins.

During the first quarter of 2025, Frontera produced 39,010 boe/d from its Colombian operations (consisting of 27,167 bbl/d of heavy crude oil, 9,531 bbl/d of light and medium crude oil, 2,274 mcf/d of conventional natural gas and 1,913 boe/d of natural gas liquids).

KeyFacts Energy: Frontera Energy Colombia country profile

GEOPARK

In the first quarter of 2012, GeoPark entered into Colombia by acquiring three privately held E&P companies that were later merged into GeoPark Colombia S.A.S. These acquisitions provided the Company with an attractive platform of reserves and resources in Colombia, including a 45% operated working interest in the Llanos 34 Block.

The Llanos 34 block in Colombia is a large-scale project in one of the most attractive oil basins in Latin America

KeyFacts Energy: GeoPark Colombia country profile

GRAN TIERRA ENERGY

Gran Tierra’s operations in Colombia reflect a focused strategy emphasizing cash flow generation, enhanced recovery, and near-field exploration upside. With steady production growth, efficient drilling campaigns, and major 2025 investment plans in place, the company is positioning itself for sustained growth across its Latin American assets.

Gran Tierra Energy has positioned Colombia at the heart of its strategy, dedicating around 55% of its 2025 capital program—approximately $105–$120 million - primarily to its Colombian assets. This investment heavily targets the Suroriente and Acordionero fields, alongside ongoing work in the Putumayo and Middle Magdalena Basins.

KeyFacts Energy: Gran Tierra Colombia country profile

HOCOL

Hocol, a subsidiary of Ecopetrol, is a prominent exploration and production (E&P) company operating across several key regions in Colombia. The company’s operations are strategically distributed to balance oil and gas assets, and its evolution in the Colombian energy sector reflects both historical depth and modern technological integration.

Hocol’s origins trace back to 1956 in the Valle Superior del Magdalena region, specifically in the departments of Huila and Tolima. This area remains central to its operations, where Hocol has discovered and developed fields such as La Cañada, La Hocha, San Francisco, Balcón, Palermo, and Monal. The region has seen significant modernization in recent years, with Hocol implementing advanced SCADA systems, remote monitoring, and satellite communications to optimize field performance. These upgrades have reversed production decline trends and enhanced operational efficiency.

In the Llanos Basin, particularly in Meta and Casanare, Hocol has engaged in intensive exploration and production activities. Partnering with companies like GeoPark, Hocol has made significant discoveries across blocks Llanos 123, 124, 86, 87, and 104. Fields like Saltador‑1, Toritos‑1, and Bisbita have contributed to a gross production of nearly 4,000 barrels per day from Llanos 123 alone.

KeyFacts Energy: HOCOL Colombia country profile

Houston American Energy (HUSA)

Houston American Energy Corporation (HUSA) operates in Colombia through its interest in the CPO-11 block, located in the prolific Llanos Basin within the Meta Department. This block is operated by Hupecol Meta, LLC, and HUSA holds its Colombian interests indirectly by participating as a minority partner in Hupecol Meta. The CPO-11 block spans over 639,000 gross acres, with a designated area called the Venus Exploration Area covering approximately 69,000 acres where HUSA has a more significant share.

Over the past few years, Houston American has gradually increased its stake in this project. As of late 2022, the company owned about 16% of the Venus area and 8% of the remainder of the CPO-11 block. Drilling operations commenced with the Saturno ST-1 vertical well, followed by Venus 2A, both of which were considered promising early steps in the development of the field. In 2023, the company reported that two horizontal wells, Venus 1H and Venus 2H ST1, had been completed and were producing by the end of 2024.

KeyFacts Energy: Houston American Energy Colombia country profile

INTEROIL

Interoil Exploration and Production ASA is an independent oil and gas exploration and production company, headquartered in Oslo, Norway and with offices in Bogotá, Colombia.

The Interoil portfolio consists of two producing licenses in Colombia, one exploration concession, and seven production concessions in Argentina. The licenses in Colombia were acquired through company acquisitions and open bid-rounds for licenses organised by the authorities.

KeyFacts Energy: Interoil Colombia country profile

MAUREL & PROM

In February 2025, M&P signed a definitive agreement with NG Energy International Corp., for the acquisition of a 40% operating working interest in the Sinu-9 gas permit in Colombia.

The Sinu-9 gas block lies in the Lower Magdalena Valley, 75 km from Colombia’s Caribbean coast, and covers an area of approximately 1,260 square kilometres in the department of Córdoba. Sinu-9 entered production in November 2024 under the ongoing long-term trial of the Magico-1X and Brujo-1X wells. The infrastructure is in place for production of up to 40 mmcfd at 100% (16 mmcfd net to the acquired 40% working interest), and further development is expected to significantly increase production beyond this initial level.

KeyFacts Energy: Maurel & Prom Colombia country profile

NG ENERGY

NG Energy International has extensive technical and capital markets expertise with a proven track record of building companies and creating significant value in South America. In Colombia, the Company is executing on this mission with a rapidly growing production base and an industry-leading growth trajectory, delivering natural gas into the premium-priced Colombian marketplace with projected triple digit production growth over the next 2-3 years towards a production goal of 200 MMcf/d. To date, the Company has raised over US$200 million in debt and equity and has constructed and commissioned 3 gathering, processing and treatment facilities and associated pipelines with gross processing and transportation capacity of 60 MMcf/d expected in Q3 2025 with significant capital contributions from insiders who currently own approximately 32% of the Company.

In February 2025, Maurel & Prom entered into a definitive agreement with NG Energy International to acquire a 40% operating working interest in the Sinu-9 gas licence in Colombia.

KeyFacts Energy: NG Energy Colombia country profile

OCCIDENTAL

Occidental first entered Colombia in the early 1980s, discovering the Caño Limón oilfield in 1983. That field, located in Arauca Department’s Llanos Basin, is now Colombia's second-largest and has been in production since 1986. It was co-developed with the state-owned Ecopetrol and currently produces around 73,000 barrels per day. Crude is transported via the 780 km Caño Limón–Coveñas pipeline, jointly owned by Occidental and Ecopetrol.

Beyond Caño Limón, Occidental had significant onshore operations across the Llanos Norte, Middle Magdalena and Putumayo basins. These assets—comprising 14 blocks, including producing and exploratory fields—were sold to The Carlyle Group in October 2020 for approximately US $825 million. Occidental retained an offshore exploration presence through its subsidiary, Anadarko Colombia

Since the divestment, SierraCol Energy (formerly Occidental’s Colombian onshore division) has taken over daily field operations, producing around 43,000 barrels oil equivalent per day and managing 19 blocks across three basins.

Besides onshore activity, Occidental remains involved in Colombian offshore oil and gas exploration through four awarded Caribbean coast blocks (COL‑1, COL‑2, COL‑6, COL‑7), representing a future focus for upstream expansion.

KeyFacts Energy: Occidental Colombia country profile

ONGC Vidish (OVL)

ONGC Videsh (OVL), the overseas arm of India’s ONGC, holds a prominent presence in Colombia, centred on its onshore Block CPO‑5 in the Llanos Basin. Awarded in Colombia’s 2008 bid round, OVL operates the 1,992 km² Block with a 70 percent interest, while Geopark (now Petrodorado South America) covers the remaining 30 percent.

Production in CPO‑5 is concentrated in fields such as Mariposa, Indico, Sol‑1 and Urraca. The Mariposa‑1 well—drilled in 2017—pioneered commercial production from the Lower Sands (LS‑3) in the Une Formation. It was followed by Indico‑1 in December 2018, flowing light crude at about 5,200 barrels per day and yielding over 3 million barrels to date.

Building on these successes, Indico‑2 was spudded on September 21, 2020, reaching a depth of approximately 10,925 ft. It encountered a remarkable 147 ft of net pay within the LS‑3, tested at an impressive 6,300 bpd with extremely low water cut (~0.11%). This discovery represented OVL’s fourth commercial oil well in the block.

ONGC Videsh has transformed CPO‑5 into a multi-field asset, with sustained commercial production and ongoing exploration. Its success in Llanos Basin reinforces OVL’s reputation for technical capability and bodes well for future expansion in Colombia.

KeyFacts Energy: ONGC Videsh Colombia country profile

PAREX RESOURCES

Parex Resources operates as Colombia’s largest independent conventional oil and gas company, focusing its portfolio across the Llanos and Magdalena basins. Their strategic growth centers on both production and exploration, often in partnership with Ecopetrol.

In the Magdalena basin, Parex holds a 50% working interest in the VIM‑1 block, which came online in 2021. They employ gas cycling to enhance oil recovery there and plan to replicate that model throughout the VIM area and in northern Llanos and foothill trends.

North of the Llanos, they share Arauca and LLA‑38 blocks (each 50% WI), with crucial exploration progress topped by the Arauca‑8 well that began production in 2024. Parex is evaluating initial performance and considering near‑field development and infrastructure extensions. Adjacent in the northern Llanos, the Capachos block—also at 50% WI and operative since 2018—offers superior reservoirs and attractive royalties. Parex is working on optimizations, recompletions and nearby exploration opportunities there.

Parex’s Colombia operations blend steady cash flows from mature heavy‑oil fields with a growing exploration platform—especially for gas—in the Llanos foothills and Putumayo. Their collaborative agreements with Ecopetrol are central to unlocking this value through shared operatorships and carried capital.

KeyFacts Energy: Parex Resources Colombia country profile

PERENCO

Perenco Colombia, a key subsidiary of Anglo‑French Perenco Holdings founded in 1993 and based in Bogotá, has maintained a strong presence in Colombia’s Llanos Basin, operating multiple mature and marginal oil fields under both association and concession agreements.

Perenco Colombia focuses on maximizing recovery from mature fields via infill drilling and enhanced oil recovery, while leveraging seismic data-driven development. It manages a stable mid‑teens thousand barrels-a-day output.

A centerpiece of its Colombian portfolio is the La Gloria Norte heavy-oil field in Casanare, which achieved peak output around 2014 and has since recovered approximately 93 % of its recoverable reserves. Production is expected to continue until around 2033.

The Coren field in block Corocora is another core asset, producing conventional oil since around 2018, with recovery levels nearing 96.5 % and an economic limit anticipated by 2027.

In response to natural decline, Perenco has ramped up investment in enhanced recovery techniques and satellite drilling. In October 2024, they drilled three new development wells across the Paravare and Chaparrito fields in Casanare: PRV‑03 at Paravare, now delivering roughly 500 bopd thanks to an electro-subs pump; and CHP‑04 and CHP‑05 at Chaparrito, which, together with the earlier CHP‑03 well, now deliver about 6,230 bopd—making Chaparrito responsible for about 40 % of the company's Colombian output.

KeyFacts Energy: Perenco Colombia country profile

PETROBRAS

Petrobras, operating in Colombia through its subsidiary Petrobras International Braspetro, has a dual presence: offshore deepwater exploration in the Caribbean Sea and onshore fuel and lubricant distribution across the country.

Offshore, the centerpiece is the GUA‑OFF‑0 (formerly Tayrona/Uchuva) block—a deepwater gas discovery about 77 km off Santa Marta, drilled to ~800 m depth. Drilling began with Uchuva‑1 in 2022, followed by the Sirius‑2 (formerly Uchuva‑2) well in June 2024. Formation tests have confirmed over 6 trillion cubic feet (Tcf) of gas in place, and production efficiency has been described as “high”.

Petrobras holds a 44.44 % operator stake in the consortium, with Ecopetrol holding 55.56 %.

Onshore, Petrobras launched operations in Colombia in 1972. It operates the Villarrica Norte block in Tolima—focused on conventional hydrocarbons—as well as a robust fuel and lubricant distribution network of over 120 service stations and two plants (Bogotá and Santa Marta), with direct sales to industrial and institutional clients.

KeyFacts Energy: Petrobras Colombia country profile

PetroSantander

PetroSantander operates in Colombia as a niche, independent conventional oil and gas company specializing in modest, mature onshore fields within Santander department, with its operations centrally managed through PetroSantander Colombia GmbH, a Bogotá‑based foreign legal entity registered in 1987. Its portfolio includes ownership and operational roles in several traditional oil and gas fields in the region—most notably Corazón (also referred to as Corazón West) and Payoa.

KeyFacts Energy: PetroSantander Colombia country profile

SierraCol Energy

SierraCol Energy operates a large portfolio – comprised of nineteen onshore blocks: eleven producing and eight exploration – that is well diversified in terms of basins, distinct geological plays and development schemes from primary recovery to improved recovery.

The Company's key assets are Caño Limón and La Cira Infantas, two of Colombia’s most prolific and long-lived fields with further upside potential from ongoing development and exploration opportunities.

In January 2025, Repsol’s partner in SierraCol Energy Arauca exercised its preemptive rights under the terms of the LLC Agreement to acquire 25% of Repsol’s interest in SierraCol Energy Arauca (“Llanos Norte”) in Arauca Department, Colombia.

KeyFacts Energy: SierraCol Colombia company profile

SINTANA ENERGY

Sintana Energy’s presence in Colombia centers on the VMM‑37 block in the Middle Magdalena Basin, where the company, through its subsidiary Patriot Energy Sucursal Colombia, holds a non‑operating interest in both conventional and unconventional plays. Initially, Sintana held 100% of the exploration contract (granted in March 2011), but later farmed out 70% to ExxonMobil, leaving Sintana with 30% non‑operated participation. ExxonMobil became the designated operator, focusing on Project Platero – an unconventional resources pilot known as a CEPI (Comprehensive Research Pilot Project).

Sintana’s Colombian strategy hinged on exploiting unconventional resources in the VMM‑37 block via a partnership with ExxonMobil. This effort hit obstacles due to shifting regulation and social opposition, compounded by Exxon’s exit in mid‑2023. Sintana has responded with arbitration, but operational progress remains stalled. At present, it holds a substantial but idle interest and is exploring potential paths forward—such as securing a new operator or resolving disputes—while pivoting some attention to its Namibian assets.

KeyFacts Energy: Sintana Energy Colombia country profile

TECPETROL

Tecpetrol Colombia operates a mature, heavy-oil development in Pendare, with fully integrated exploration, processing, safety, social, and digital capabilities. Production remains steady in the low five digits (bpd), backed by robust infrastructure and continuous improvement. With CPF expansion ongoing and operations slated at least through the coming years, Tecpetrol is positioning Pendare as a sustainable and technologically advanced project with a long-term horizon ahead.

Tecpetrol has been firmly rooted in Colombia’s oil and gas sector since around 2009, most notably through its pivotal Pendare Field in Puerto Gaitán, in the Los Llanos Orientales Basin. Over the course of more than a decade, the company—via its subsidiary Tecpetrol Colombia S.A.S.—has invested heavily in developing this heavy oil field, consistently scaling up exploration, production, and processing infrastructure.

KeyFacts Energy: Tecpetrol Colombia country profile

VETRA EXPLORATION

Vetra is a well-established local upstream player involved in conventional onshore production and exploration across major basins, balancing operated and non-operated partnerships, and continuing to position itself for future growth through its concession portfolio.

Vetra Exploración y Producción Colombia S.A.S. is one of the country’s most significant private, independent oil and gas producers. Founded in 2003, Vetra operates primarily in the Putumayo, Llanos, Magdalena Medio, and Catatumbo basins. In 2013, a consortium of private-equity firms (Acon Investments and CIPEF) acquired the company, reflecting its strong position and growth ambitions in Colombia’s upstream sector.

KeyFacts Energy: VETRA Energia Colombia country profile

KeyFacts Energy: Company Profile l Colombia News

KEYFACT Energy

KEYFACT Energy