As part of our 'at-a-glance' guide to company global operational activity, we feature New Age (African Global Energy).

NewAge is a privately held oil & gas exploration and production company with a portfolio of assets in five African countries: Nigeria, Congo-Brazzaville, South Africa, Ethiopia and Cameroon.

KeyFacts Energy NewAge country profile highlights

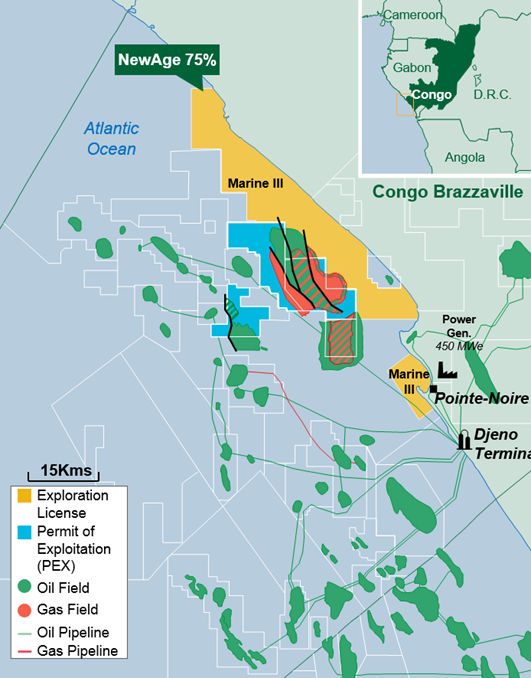

REPUBLIC OF CONGO

NewAge currently holds an interest in the Marine III offshore exploration licence which has a resource composition of approximately 66 % oil / 34 % gas.

NewAge first entered the Republic of Congo in 2010 by acquiring an interest in the Marine XII joint venture. This was followed by a highly successful exploration and appraisal campaign, yielding three oil and three gas discoveries in four development permits. A successful early oil development of the Nene field resulted in first oil at the end of 2014, just eight months after obtaining the production permit and 16 months from discovery. First production from the Litchendjili field was achieved in July 2015. In September 2019, NewAge successfully divested its non-operated interest in the Marine XII licence to PJSC LUKOIL for $800 million.

| Congo-Brazzaville | Marine III |

| Operator | NewAge Congo (75%) |

| Other participants | SNPC (25%) |

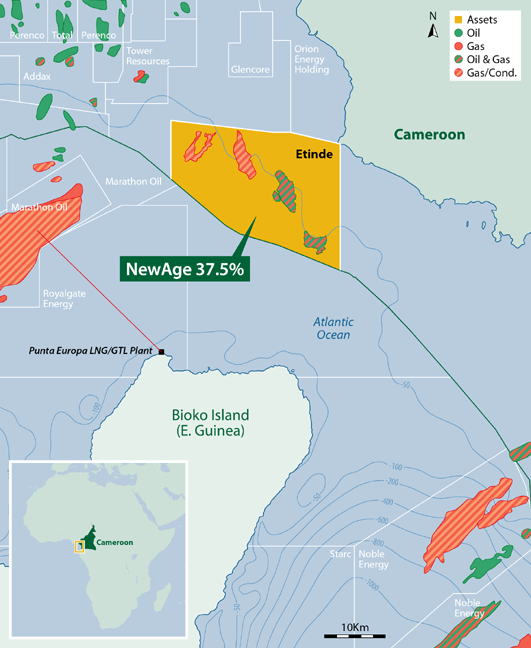

CAMEROON

The Etinde Permit (former Block 7) lies in shallow water in the Rio del Rey Basin, offshore Cameroon, and comprises four proven reservoir intervals within the Pliocene and Miocene formations.

The principal discoveries lie within the Miocene Isongo formation with the Upper Isongo and Intra Isongo reservoirs having tested wet gas and oil in several wells across the block. The deeper Middle Isongo formation has proven productive in the western part of the block by two wells. A secondary pay interval is the Biafra formation which tested dry gas in very high quality sands in three wells within the Pliocene. In addition to the proven reservoirs, a rich portfolio of undrilled prospects and leads provides significant upside to the future potential of the block.

Following the successful 2018 appraisal campaign, the joint venture has moved the Etinde project to a development planning phase. Several development screening concept studies are now underway to optimise the development of the Etinde Field, with the aim of agreeing development concept selection with all stakeholders during 2019/2020. A Final Investment Decision is expected by early 2021, with first production envisaged in 2023.

| Cameroon | Etinde |

| Operator | NewAge (37.5%) |

| Other Participants | Lukoil (37.5%), Euroil (Bowleven) (25%) |

| Discoveries | Etinde gas condensate field (multiple reservoirs) |

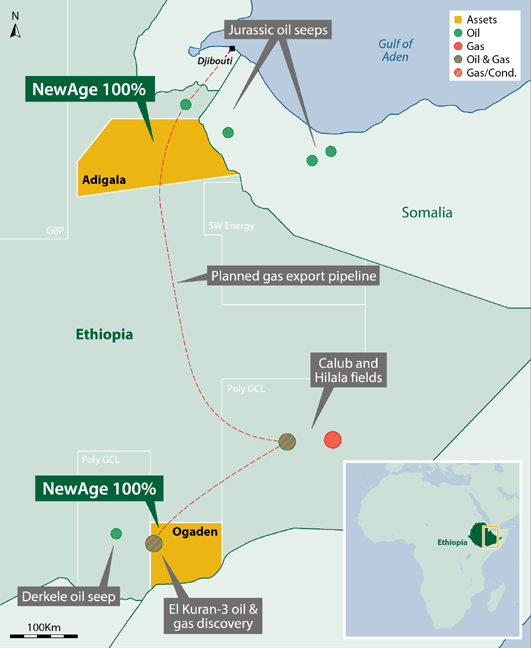

ETHIOPIA

NewAge currently holds a significant position in the Ogaden Basin to the south of the country, and is in the process of negotiating revised terms for a second licence towards the north, the Adigala exploration block, which had previously been held in partnership with other JV partners

NewAge made an oil and gas discovery in the Ogaden licence in 2014. This discovery is close to the Calub and Hilala gas fields, the only significant discoveries to date in Ethiopia, from which Poly GCL, the operator of these fields, has contracted to export the gas via an LNG development in Djibouti.

| Ethiopia | Ogaden – Block 8 | Adigala Block |

| Operator | NewAge (100%) | NewAge (100%) – under negotiation |

| Discoveries | El Kuran | n/a |

| Work programme | Pre-development studies | n/a |

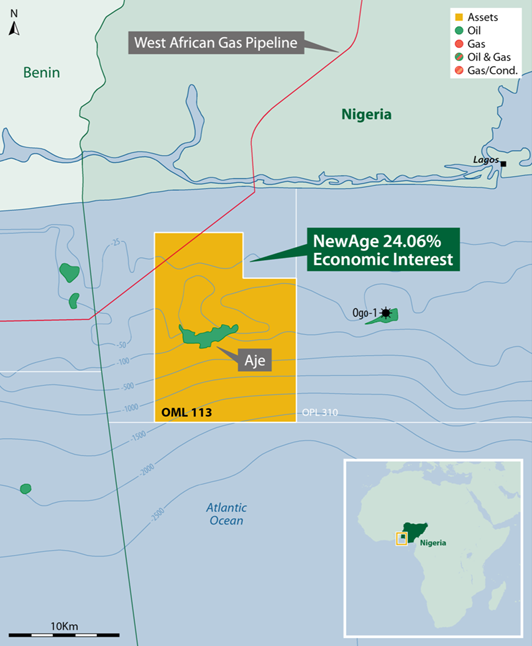

NIGERIA

Licence OML 113, operated by Yinka Folawiyo Petroleum, is in the Dahomey-Benin Basin, offshore Nigeria, and contains the Aje field as well as a number of exploration prospects.

The Aje oil and gas field, located about 24 Km from the coast in water depths ranging from 100 to 1,000 metres, was discovered in 1996. Unlike the majority of Nigerian Fields which are productive from Tertiary sandstones, Aje has multiple oil and gas condensate reservoirs in the Turonian, Cenomanian and Albian age sandstones. Five wells have been drilled to date. Aje-1 and -2 tested oil and gas condensate at high rates. Aje-4, drilled in early 2008, logged significant pay and confirmed the presence of four productive reservoirs. Aje-5 was drilled in 2015 as part of the Phase 1 oil development, following Government approval in 2014. The field was declared commercial in February 2009, and Financial Investment Decision approved in 2014. Further potential on the block was defined following the 3D seismic acquisition in 2014 across OML 113 and the adjacent block OPL 310.

The Aje Field Development Plan was approved in March 2014. An early production phase is focused on development of the Cenomanian oil reservoir. It includes two subsea production wells, tied back to a floating, production, storage and offloading (FPSO) vessel. Gas sales would be to the West African Gas Pipeline or to the Lagos LNG market. Final Investment Decision was taken in October 2014 following government approval of the initial oil phase. First oil was achieved in early May 2016.

A full field development phase to produce Aje gas condensate resources in the Turonian and Albian sands is being considered.

| Nigeria | Aje Field – Block OML113 |

| Operator | Yinka Folawiyo Petroleum (41.875%) |

| NewAge (24.06%) Energy Equity Resources (16.875%) Panoro Energy (12.19%) ADM Energy (5%) |

|

| Discoveries | Aje Field, fully defined by 4 wells with 3 reservoirs |

SOUTH AFRICA

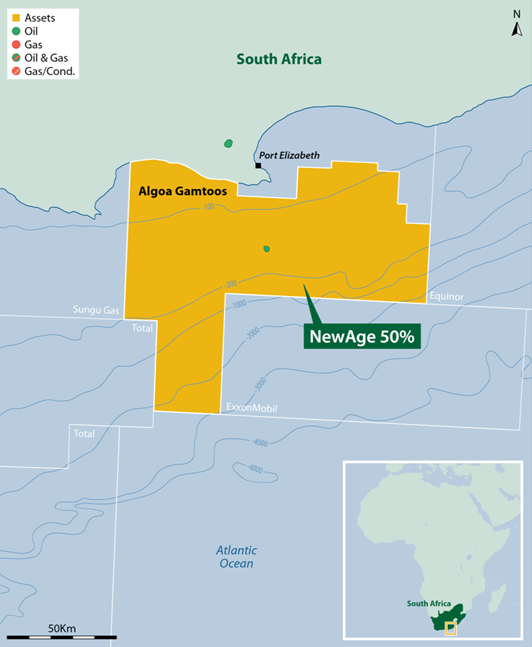

NewAge have operated the Algoa-Gamtoos licence since 2009 and collected 2D and 3D seismic over the licence.

The Algoa-Gamtoos licence consists of three prospective basins, Algoa to the east, Gamtoos to the west and the Outeniqua deepwater rift oil play to the south.

Historical exploration on the shelf proves that the Algoa-Gamtoos basins have a working petroleum system, but to fully understand and exploit these syn-rift basins more seismic data and new exploration concepts are required. In the adjacent licence, Total recently announced the Brulpadda-1AX well as a major gas condensate discovery with 57 metres of net pay.

Brulpadda discovery

The Outeniqua Basin, where the discovery was made, extends into the deepwater section of the Algoa-Gamtoos licence at similar depths and a lead identified by NewAge in the licence is analogous to the discovery well and contributes 1.1 billion mean STOIIP of current leads.

| South Africa | Algoa Gamtoos |

| Operator | NewAge (50%) |

| Other Participants | Tower Resources (50%) |

LEADERSHIP

Chengyu Fu - Chairman

David (“Dato”) Sandroshvili – Chief Financial Officer and Head of London Office

David Peel – EVP Operations

Robin Carvell-Spedding – VP Legal & Compliance

Katie Taylor – HR Director

CONTACT

New Age (African Global Energy) Ltd

2nd Floor, Gaspé House, 66-72 Esplanade, St Helier, Jersey, JE1 1GH

New Age Congo Ltd

Immeuble Elisabetah, 3 Rond-Point du Port, Quartier NDINDJI, Arrondissement 1

P.O Box 1759 – Pointe-Noire, Republic of The Congo

T +242 06 840 7678

New Age Cameroon Offshore Petroleum SA

P.O Box 12238, 2nd Floor Diamond Building, Rond-point Clinic Soppo

Rue Njo Njo, Bonapriso, Douala, Cameroon

T +237 2 33 42 26 26

New African Global Energy SA (Pty) Ltd

Unit 511, The Cliffs Block 2, Carl Cronje Drive, Tygerfalls Boulevard

Bellville 7536, Cape Town SA

T +27 21 974 1750

New Age Ethiopia Ltd

Park Lane Tower Building, Bole Sub-City Kebele 03/05, Addis Ababa, Ethiopia

T +251(0)116 670 228

From small private operators through to multi-national companies, KeyFacts Energy's database includes over 600 ‘first-pass’ preliminary review profiles, available on request.

KeyFacts Energy NewAge company/country profiles: Republic of the Congo l Ethiopia l Nigeria

South Africa l Cameroon

KEYFACT Energy

KEYFACT Energy