Africa is conservatively forecast to reach peak gas production at 470 billion cubic meters (Bcm) by the late 2030s, equivalent to about 75% of the expected amount of gas produced by Russia in 2022, according to Rystad Energy research. In early March, the European Union announced it aims to reduce its dependence on Russian gas by two-thirds by the end of this year alone and is currently headed for a supply crunch that will reverberate around the globe.

Even with the number of gas projects being developed or currently delayed, Africa still has significant production potential. The continent is forecast to increase its gas output from about 260 Bcm in 2022 to as much as 335 Bcm by the end of this decade. If oil and gas operators decide to up the ante on their gas projects on the continent, near and mid-term natural gas production from Africa could surpass the above conservative forecasts.

Russia has historically been the dominant natural gas supplier to Europe, with an average of about 62% of overall gas imports to the continent over the past decade. Africa has also been a consistent gas exporter to Europe during that time, with an average of 18% of European gas imports coming from Africa.

Projects in Africa are, however, historically seen as having increased risk and can be delayed or go unsanctioned due to high development costs, challenges accessing financing, issues with fiscal regimes and other above-the-ground risks. Recent signals from oil and gas majors such as BP, Eni, Equinor, Shell, ExxonMobil and Equinor indicate a shift, however, in strategy towards further investment in Africa, with several projects that were previously on ice – including liquefied natural gas (LNG) projects – as they consider restarting or accelerating previously shelved projects in response to rising global demand.

"The geopolitical situation in Europe is changing the landscape for risk globally. While LNG flows from the US are substantial, demand is much higher. Asian and European importers will need to consider African priorities as they develop projects, as many African producers are focusing on supplying energy locally as well as to intra-African markets along with catering to global markets. Existing pipeline infrastructure from Northern Africa to Europe and historical LNG supply relationships make Africa a strong alternative for European markets, post the ban on Russian imports," says Siva Prasad, senior analyst at Rystad Energy.

Source: BP Statistical Review of World Energy 2011 - 2021; Rystad Energy UCube; Rystad Energy research and analysis

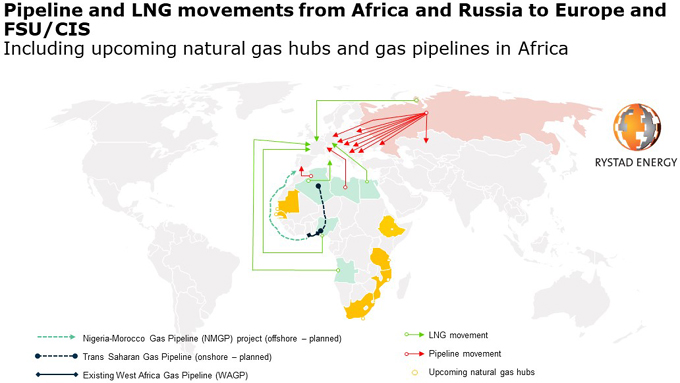

African nations that have historically been gas suppliers to Europe are well placed to scale up their exports. Africa’s advantage is that it already has existing pipelines connected with the wider European gas grid. Current pipeline exports from Africa to Europe run through Algeria into Spain and from Libya into Italy. Talks of long-distance pipelines connecting gas fields in Southern Nigeria to Algeria via the onshore Trans Saharan Gas Pipeline (TSGP) and the offshore Nigeria Morocco Gas Pipeline (NMGP) have picked up in recent months. While the TSGP aims to utilize existing pipelines from Algeria to tap into European markets, NMGP aims to extend the existing West Africa Gas Pipeline (WAGP) all the way to Europe via West African coastal nations and Morocco. Further afield, African LNG exports have predominantly come from Nigeria and Algeria, with smaller volumes from Egypt, Angola, and a fraction from Equatorial Guinea. In addition, large-scale discoveries offshore in Mozambique, Tanzania, Senegal, Mauritania, and South Africa have the potential to yield additional natural gas exports once developed.

Europe is now considering how gas-rich African nations can be helped to scale up production and exports in the years to come. The European Union’s decision earlier this year that all natural gas investments are equivalent to investments in “green” energy signal that African gas is considered sustainable. The supply crisis driven by security interests may push Europe to fund projects that will also help with energy affordability back home. For instance, Europe could be a key financer of the proposed $13-billion TSGP project.

BP’s Russia exit: A boost for uncontracted gas in Senegal-Mauritania

BP chief executive Bernard Looney has said the decision to exit Russia is not only the right thing to do but is also in the company's long-term interests. The UK giant recently booked pre-tax charges of $24 billion and $1.5 billion in its first-quarter 2022 financial results due to its decision to pull out of Russia. The company is now looking to African projects to seize the opportunity to target European markets with gas supplies.

BP has several big gas projects in Senegal and Mauritania – the Greater Tortue Ahmeyim (GTA), Yakaar-Terenga and BirAllah LNG projects. LNG volumes from the 2.5 million tonnes-per-annum (tps) GTA floating LNG (FLNG) Phase 1 have already been sold, and some gas from Yakaar will be used as feedstock for Senegal’s gas-to-power plant. Meanwhile, gas from GTA LNG Phase 2, the remaining gas from Yakaar–Teranga and BirAllah are still uncontracted and these volumes could benefit from what is expected to be a supply-constrained LNG market in the coming years. GTA FLNG Phase 2 has a planned capacity of 2.5 million tpa, while the Yakaar–Teranga and BirAllah LNG facilities could have capacity of 10 million tpa. However, front-end engineering and design (FEED) on Yakaar–Teranga, which was kicked off in November 2021, will determine the final capacity for the project, and BP is also currently carrying out studies to see whether to accelerate development of the Bir Allah project targeting sales to Europe. Like BP, other major companies might also look towards their African gas portfolios to address the likely gas supply deficit.

Eni plans ramp up of African gas to Italy

Italian major Eni has said that it can alleviate Europe’s dependence on Russian gas to an extent through supply from its African projects, including in Algeria, Egypt, Nigeria, Angola and Congo-Brazzaville. In the past month, Italy, in association with Eni, signed deals to boost gas imports from the North African nations of Algeria and Egypt, and then more recently, two more gas supply agreements with two Sub-Saharan African nations, Congo-Brazzaville and Angola. Other African nations where Eni holds important upstream portfolios on the back of which the Italian authorities could potentially sign gas-related deals include Mozambique, Nigeria, Ghana, Cote d’Ivoire and Libya. Nigeria is currently in the process of ramping up capacity at the Nigeria LNG project from 22 million to 30 million tpa through its Train 7 scheme and debottlenecking, and Eni is a stakeholder in many upstream fields that provide feed gas to the LNG plant as well as in the processing plant.

Equinor, Shell and ExxonMobil exit Russia: Re-focus for Mozambique and Tanzania LNG assets

Equinor, ExxonMobil and Shell, like BP, have significant LNG portfolios in Africa that are yet to be developed, and they can look to these massive gas resources to counter the potential gas supply deficit in the future. ExxonMobil has a 25% stake in Area 4 in Mozambique, with significant potential to add further expansion trains. Mozambique was expected to benefit from the EU’s move to classify gas investments as green, even after an Islamist insurgency in the gas-rich Cabo Delgado province had paralyzed planned investments. The current scenario of a potential gas supply crunch could see the country accelerate the development of its gas resources. The US major’s pullback from Russia could lead to it finally sanctioning its envisaged Rovuma LNG scheme in Mozambique.

The announced exits from Russia by Anglo-Dutch major Shell and Norwegian state-controlled giant Equinor could see the pair refocus on the long-stalled Tanzania LNG development. The increased demand for natural gas driven by the ongoing war in Ukraine and pullbacks from Russian supplies could also drive a renewed focus on exploration and development in Nigeria to feed these LNG exports over an extended period. Numerous other projects on the continent could also be fast-tracked to increase gas exports.

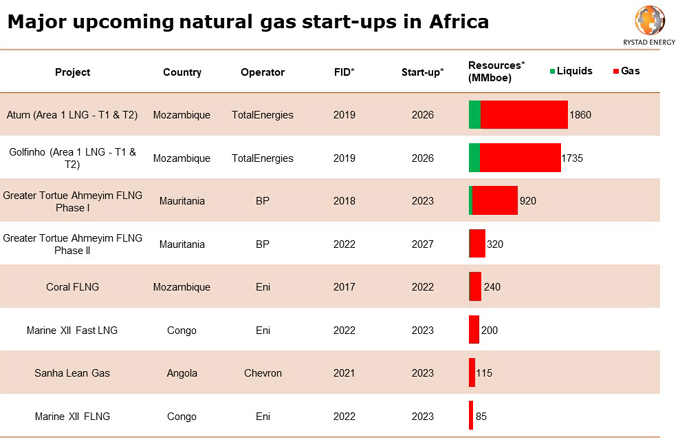

Source: Rystad Energy UCube; *conservative estimates

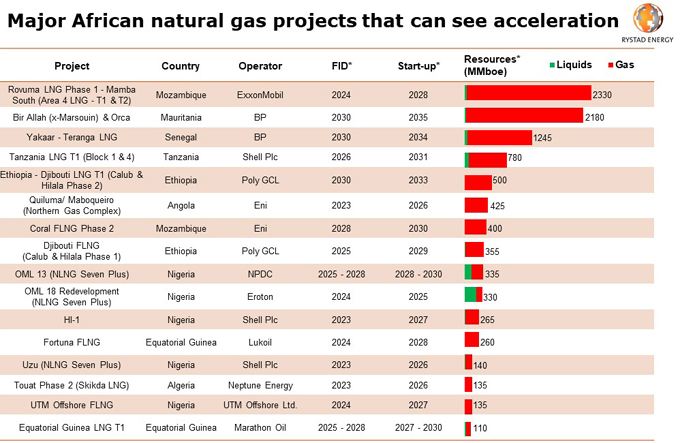

Source: Rystad Energy UCube; *conservative estimates

KEYFACT Energy

KEYFACT Energy