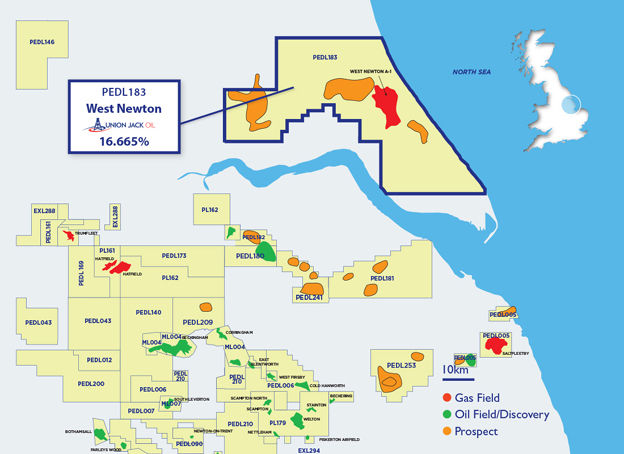

Union Jack Oil has announced details of a conceptual development plan for West Newton, in which the Company has a 16.665% interest.

Highlights:

- The Joint Venture partners are progressing with a conceptual development plan for West Newton as, predominantly, a gas development project, following completion of the significant work carried out both internally and scoping exercises and modelling by independent third-party experts ('Conceptual Development Plan')

- Encouraging post Extended Well Test ('EWT') technical and financial analysis:

- Indicates the potential for good well productivity from proposed new horizontal wells,and

- Underpins the strong economic returns of the project

- Conceptual Development Plan envisages a phased eight well gas development, which will target recoverable hydrocarbon volumes of 35 million barrels of oil equivalent with a sales gas component of 203 billion cubic feet (“Bcf”) and involves:

- An initial five well development drilling campaign, with first gas anticipated as soon as 2025, modelling plateau production rates of 44 million cubic feet per day of sales gas

- A further three wells drilled in 2028-2030, to maintain plateau production of sales gas

- Economic modelling by the Operator calculated a gross pre-tax NPV(10%) of US$448 million and a pre-tax IRR of 87%, based on recoverable sales gas and small volumes of associated liquids, for the development*

- Potential also exists for future gas discoveries within the Greater West Newton area to be tied into West Newton infrastructure; not currently included in the modelling

- The Joint Venture partners intend to drill low-cost wells and in a manner which phases the development capex cost, significantly de-risking the financial profile of the project

- Immediate next steps include:

- Completion of a Competent Persons Report expected in Q3 2022

- First horizontal appraisal well is planned for H1 2023 that will materially de-risk the project at a modest cost and will then allow a decision on a field development plan to be taken

Project Background

Following the results of the EWT programme at West Newton A-2 and B1-Z in 2021, the Company, together with its Joint Venture partners and third-party experts including RPS and CoreLab, have worked to understand how to deliver significant commercial hydrocarbon flow from future wells at West Newton. Following post EWT analysis, it is now understood that two key issues which constrained hydrocarbon production during last year’s tests were local formation damage and a lower than anticipated benefit from the acidisation process, as the acid stimulation used is now interpreted as only having interacted with a small section of the perforated intervals.

Crucially, analysis completed by CoreLab demonstrated actual fluid flow through many of the reservoir samples supporting the view that optimised development well designs could deliver good hydrocarbon productivity by drilling horizontal wells. Furthermore, this has enabled the Joint Venture to formulate a development concept for the West Newton field based on eight horizontal production wells and the associated gas and liquid infrastructure.

In addition, it is estimated that the eight horizontal wells would recover substantially all the recoverable gas from West Newton of 203 Bcf, which equates to 25 Bcf of recoverable sales gas per well. The initial five wells are expected to deliver the plateau production rate of 44 million cubic feet of sales gas, to be followed by three wells to be drilled between 2028 and 2030 extending plateau production.

Economic modelling indicates significant cash flow generation from the first year of production, anticipated in 2025, with cumulative gross cash flow calculated at circa US$1.3 billion. The Gross NPV(10%) of the project is modelled to be US$448 million pre-tax with a pre-tax IRR of 87%.* Initial scoping work indicates a total pre-production capex of US$139 million for drilling and completion of the initial five well development, all production facilities and tie-in to the gas grid with the following three wells to be drilled to be funded from operating cash flow.

Further, future successful drilling results on follow-on exploration targets identified within the Greater West Newton Area (the Spring Hill, Withernsea and Ellerby Prospects) would be designed to utilise parts of the Conceptual Development Plan’s infrastructure and add significant further potential value to the West Newton project.

* Based on RPS forecast of UK NPB gas price effective April 2022.

David Bramhill, Executive Chairman of Union Jack commented:

"We are delighted by the results of work completed by RPS Group and CoreLab and the resulting Conceptual Development Plan, which has demonstrated West Newton’s potential as an extremely valuable gas development opportunity.

"Located in an area that has access to both significant and relevant regional infrastructure and, with substantial additional exploration potential within the wider licence, the Conceptual Development Plan and a subsequent development decision at West Newton could deliver substantial volumes of low-carbon sales gas into the UK’s energy market and could also facilitate further exploration activity and development potential within the Greater West Newton Area.

"These studies and the resulting Conceptual Development Plan now see the commencement of an exciting new drilling phase for West Newton which will see Union Jack drill a high-impact well in 1H 2023 and multiple development wells at West Newton in the coming years."

KeyFacts Energy: Union Jack Oil UK country profile

KEYFACT Energy

KEYFACT Energy