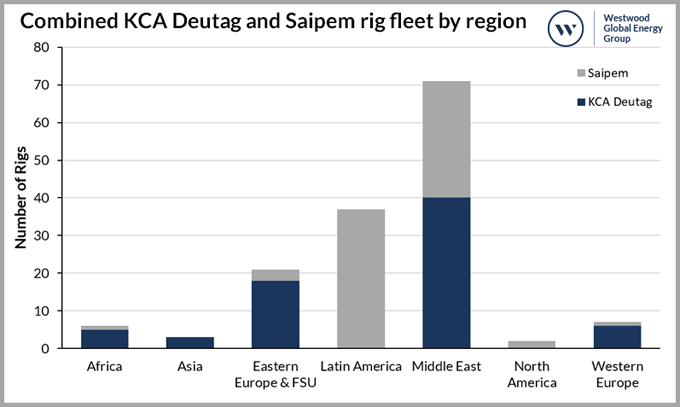

As we reach the second half of 2022 oil and gas (O&G) prices remain at high levels. Russia’s invasion of Ukraine continues to rumble on while increased production quotas for OPEC+ countries is doing little as the majority struggle to increase their production. This has all been good news for onshore drilling levels, where increased demand is translating into larger levels of drilling activity. This quarter has also seen a large amount of merger and acquisition (M&A) activity in the industry, including KCA Deutag’s acquisition of Saipem Onshore Drilling. The deal, worth $550 million in cash and 10% equity interest in the Group, will see KCA Deutag add 75 rigs across six regions to its fleet, the majority located in Latin America (37) and the Middle East (31). The fleet is relatively high spec with 69% having a drawworks HP of over 2,000. Closing for the Middle East and other markets is expected in 4Q 2022 with Latin America set to follow.

COMBINED KCA DEUTAG AND SAIPEM RIG FLEET BY REGION

M&A Activity

It has been a busy month for M&A activity across the globe, especially in the US where numerous shale leaseholds have changed hands:

| Companies | Country | Cost | Notes |

| BP & Cenovus Energy | Canada | $465 mn | BP exiting Canadian oil sands – selling stake in 50 kbpd Sunrise project to Cenovus |

| Centennial Resource & Colgate Energy | USA | $525 mn & 269.3 mn shares | Merger of equals transaction creating largest pure-play E&P company in Delaware basin |

| ConocoPhillips | USA | $100 mn | ConocoPhillips planning sale of non-core assets in Eagle Ford shale play. 2.3 kbpd for sale, equating to 231 drilling locations |

| Continental Resources | USA | $4.3 bn | Offer for 17% of the company, returning full ownership of the business to Hamm family |

| Devon Energy & RimRock | USA | $865 mn | 38,000 acres in the Williston basin |

| ExxonMobil & BKV Corp | USA | $750 mn | BKV closed on purchase of natural gas upstream and associated midstream infrastructure from ExxonMobil.160,000 acres of Barnett Shale assets with average working interests of ~93% in over 2,100 wells with operatorship positions |

| KCA & Saipem | Global | $550 mn and 10% equity interest in the group | KCA acquiring Saipem’s onshore rig fleet totalling 75 rigs |

| Shell | Nigeria | N/A | Shell announced its planning to divest stake in Shell Petroleum Development Company JV (SPDC). Final offers received from local firms Heirs Oil & Gas and ND Western |

| TotalEnergies | Nigeria | N/A | TotalEnergies looking to sell its 10% stake in onshore oil producing licences as part of the SPDC |

| Tullow Oil & Capricorn Energy | Africa | Merger: Tullow 53%, Capricorn 47% | Capricorn and Tullow Oil primarily offshore but have onshore assets. Capricorn owns several onshore blocks in Egypt, while Tullow has onshore assets in Kenya |

| Whitecap Resources & ExxonMobil | Canada | $1.47 bn | Whitecap acquiring Exxon’s Canadian shale assets; 576,000 acres in Montney and 72,000 acres in Duvenay |

Middle East

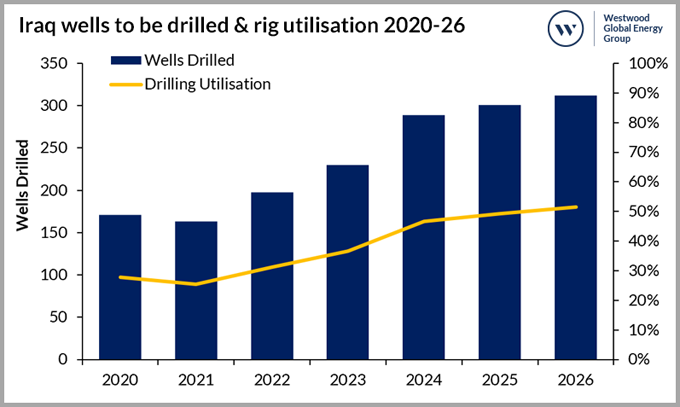

Iraq

The Iraqi Drilling Company and Weatherford have begun drilling at Nasiriyah, an oilfield, which produces ~70 kbpd, is a key project for increasing Iraq’s production capacity. Increasing production capacity will require a significant increase in activity, even if geopolitical, security, geological and infrastructure issues are likely to prevent them reaching their target of 8 mmbbl/d.

IRAQ WELLS TO BE DRILLED & RIG UTILISATION 2020-26

A consortium led by China CAMC Engineering (CAMCE) signed an EPCC deal worth $410 million with Kuwait Energy Basra to supply the central gas processing facility for the Faihaa field in Block 9, Iraq. CAMCE will partner with CNOOC and will aim to increase the gas processing capacity to 130 mmcf/d by the end of 2024.

Saudi Arabia

Saudi Aramco has continued to invest in unconventional plays as it looks to raise oil production to 13 mmbbl/d with National Energy Services Reunited (NESR) awarded a $300 million contract for fracturing, testing, wireline, coiled tubing, slickline services, associated logistics and site services. The contract, which runs for three years, includes a two-year extension option.

UAE

ADNOC, through its subsidiary ADNOC Onshore, awarded an EPC contract to Archirodon Construction Overseas Company on 17 June 2022. The contract, worth $173 million, will run for three years aiming to increase the production capacity of the Asab oil field by 12%. This is yet another contract awarded by ADNOC as it plans to spend $127 billion to increase its production capacity to 5 mmbbl/d by 2030. This will involve the drilling of thousands of wells utilising ADNOC’s onshore rig fleet which consists of 67 land drilling rigs.

ADNOC also announced new onshore discoveries which are expected to unlock a total of 650 mmbbl of oil reserves. One at the Bu Hasa oilfield (500 mmbbl), another in Block 3 (100 mmbbl) and the third in the Al Dhafra Petroleum Concession (50 mmbbl).

Iran

Activity appears to be ramping up in Iran which is aiming to increase production from 2.5 mmbbl/d to 5.7 mmbbl/d by 2030, something that will require substantial growth in onshore drilling to achieve. Westwood’s identified rig fleet for Iran consists of 110 rigs with the National Iranian Drilling Company owning 67 of these.

In May, the National Iranian Oil Co. (NIOC) outlined plans to award contracts worth $7.5 billion, for the expansion of the Azadegan oilfield. Azadegan is Iran’s largest oilfield, containing 32 billion barrels of oil in place but recovery factors of 5.1% in the south and 4.5% in the north have slowed production. South Azadegan currently produces 140 kbpd and, despite targeting 320 kbpd by March 2023, NIOC’s director of corporate planning has stated that output would likely only reach 220 kbpd by that date. NIOC subsidiary PEDEC and Petropars are responsible for the field and in March 2022 kicked off a 10-well drilling campaign.

Oman

On 14 April, Maha Energy AB signed a Letter of Award (LoA) with Global Business Services, for the drilling of a minimum of six wells on Block 70. The drilling contract would have seen Maha Energy utilise the 1,000 HP GBS-1 (formerly OGI-4) drilling rig for two appraisal wells, followed by four horizontal pilot production wells, on the Mafraq structure, however in early July Maha Energy announced that the rig was no longer available due to technical deficiencies uncovered during pre-mobilisation inspections. Also, BP Oman has signed a two-year extension for a land rig services contract with Abraj Energy that will see the local player continue to supply land rig services at BP’s Block 61 developments.

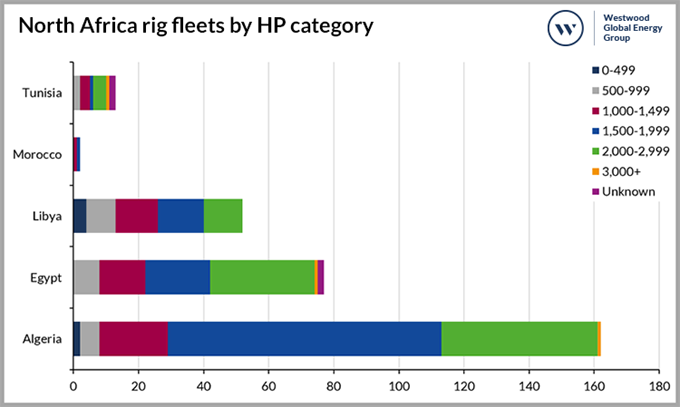

North African countries push ahead of busy 2H 2022

North Africa

NORTH AFRICA RIG FLEETS BY HP CATEGORY

Libya

A series of major oilfields in Libya have reopened after being shut-in following ongoing civil unrest. The crisis risks disrupting an expected ramp-up in drilling activity in Libya, following a relatively stable 2021 which saw supermajors pledge support for further developments and the government announce a target of 2.1 mmbbl/d over the next few years, well above current peak levels of 1.3 mmbbl/d.

Sarir Oil Operations, a JV of Wintershall Dea and the Libyan state oil company, launched a tender process for three onshore rigs to begin drilling in 4Q 2022. Sarir requires two 2,000 HP rigs to drill development wells in the Al Wahat region, one rig for two years and the other for one year, though both are likely to include extension clauses. The third rig is a 1,000 HP workover unit, also for activity in Al Wahat for two years. In further promising news, Repsol confirmed plans to return to exploration drilling in Libya, with activity centred around Sharara, the largest oilfield in the country.

Algeria

In Algeria, Neptune Energy’s Touat gas project will come back onstream in the second half of the year, having been shut-in last November due to issues with the gas processing facility’s mercury removal unit. The company also announced that the second phase of the project is moving forward, which will see 16 wells drilled across eight fields.

Phase one of the Hassi Bir Rekaiz Project is onstream with production of 13 kbpd targeted. The Project consortium consists of PTTEP (49%) and Sonatrach (51%). Phase one consisted of developing two discoveries, Bou Goufa and Rhourde Ez Zita, with 17 wells connected to existing treatment facilities in Rhourde El Baguel. Phase two is expected to tap into the eight other discoveries in the project and increase production volumes to 50-60 kbpd by drilling 139 production wells.

Eni and Sonatrach signed a Memorandum of Understanding (MoU) to fast-track a series of gas projects. The MoU allows evaluation of the gas potential of a series of fields discovered by Sonatrach and opportunities for accelerated development, with gas production potential of ~3 bcm/y. This is a boost for Sonatrach, which has seen a decline in activity in recent years as low O&G prices deeply impacted the funds available for reinvestment, sending rig utilisation to an average of 34% in 2020 and 2021.

Morocco

Sound Energy confirmed they will make final investment decision (FID) at the Tendrara project by the end of 2022. Tendrara was initially going to be developed as one large project but was split into smaller phases after Sound failed to raise the necessary funding for a full-field development. Phase 2 will include a central processing facility and a 120km export pipeline for an expected production rate of 66 mmcf/d. Much of the pre-FEED work for phase 2 is complete with permits for drilling, CPF, pipeline and EIA all approved.

Predator Oil and Gas is close to starting its three-well drilling campaign onshore Morocco and is talking to two potential partners to help fund activity following renewed interest. The company plans to drill two appraisal wells at the MOU discovery with a third well (known as MOU-Northeast) targeting a 655 ft gross reservoir. The civil works contract has been awarded to Skayavers Sarl and the 1,000 HP Star Valley 101 drilling rig has been contracted for the campaign.

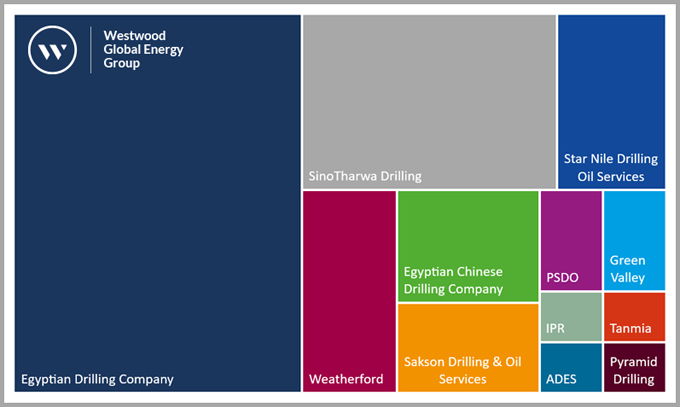

Egypt

A series of drilling programmes have been undertaken in Egypt. In April, Eni announced three new wells were onstream adding 8,500 boepd to production from the Meleiha concessions. Apex International Energy also had success in Egypt’s Western Desert with the Fajr-8 development well, production testing rates of 2,440 bpd in Southeast Meleiha. TransGlobe Energy has been utilising the 950 HP EDC-64 rig for its Eastern Desert drilling campaign. TransGlobe drilled and completed four development wells in the K field, K-78, K-75, K-74, and K-73, with drilling ongoing at K-77. The Arta-76 and NWG-1E wells were also drilled this quarter. SDX Energy completed the MSD-24, MSD-20, SD-12X East and MA-1X wells. MA-1X was drilled by the 1,500 HP SinoTharwa-owned ST-2 rig, reaching a depth of 6,400 ft. Upon completion of the MA-1X well the rig was released. On the 29 June, SDX spud the MSD-23 infill development well, the fifth in a 13-well development campaign on the Meseda and Rabul oil fields.

RIG CONTRACTORS IN EGYPT BY FLEET SIZE

Key projects in Kenya and Uganda continue to progress

Sub Saharan Africa

Tullow Oil’s South $3.4 billion Lokichar project in Kenya, the first major oil project in the African nation, is currently at the approval stage while the operator is also searching for investors. Phase 1 of the project is set to include the drilling of 321 wells with production expected to commence in 2026.

In Uganda, China’s Offshore Oil Engineering Company started construction of the ground facilities for CNOOC’s Kingfisher oilfield development. The facilities are scheduled for completion within 36 months and will allow for up to 40 kbpd to be processed at the field. 20 development wells and 11 water injection wells are planned at the development initially, all drilled onshore and extended horizontally.

CNOOC has also shown intent to continue exploration in Uganda, bidding on the Pelican Crane block, located in the Lake Albert Basin, in partnership with the Ugandan National Oil Company (NOC). This is the same basin of both CNOOCs Kingfisher and TotalEnergies Tilenga projects. CNOOC reportedly aims to use any finds from this block as backup resource for the Kingfisher development. The two projects will be accountable for driving increased drilling rates in Sub Saharan Africa over the next few years.

Zimbabwe

Invictus Energy is nearing the spud of its first wildcat wells in Zimbabwe. The 1,200 HP Exalo Rig 202 has been mobilised from Tanzania with spudding of the first well, Mukuyu-1, expected in H2. The company has also contracted Baker Hughes to carry out services including cementing, mudlogging, wireline, drilling fluids and mud engineering, tubular running, finishing and abandonment, directional drilling and logging, liner hangers, drill bits, reservoir technical services and project management.

Namibia

On 28 June, ReconAfrica spud the 8-2 wildcat well in Namibia’s Kavango Basin. The well is part of a three-well campaign in the PEL 73 block and follows the drilling of two stratigraphic wells last year that established the presence of a working petroleum system and conventional reservoirs. ReconAfrica is utilising its own 1,000 HP Jarvie-1 rig, which will drill 8-2 to a depth of 2,800 metres targeting the primary Karoo Rift Fill play and secondary Pre-Karoo Mulden and Otavi formations.

Argentina paves the way for foreign investment

Latin America

The government of Argentina continued to support development of the Vaca Muerta shale play this quarter, chiefly by announcing that foreign exchange controls for the shale O&G industry would be eased. At the same time, state-owned energy company Enarsa launched a tender for the phase 1 construction of a 36-inch pipeline from Tratayen, in the Neuquen basin, to Salliquelo, in the Buenos Aires province, totalling 563 km. The winning bidder will also build ancillary infrastructure, which will connect to the existing Gasoducto Norte system. Tenaris was the sole bidder in a tender to supply steel pipe for the project, bidding $436.6 million to supply the 656 km of 30” and 36” diameter steel pipeline. The pipeline is essential in growing takeaway capacity from the Vaca Muerta shale play.

Ecuador

Ecuador has plans to increase crude production to 580 kbpd by the end of 2022, 22% higher than 2021. This would require a significant uplift in drilling activity and while Westwood expects them to fall short of this goal, a series of moves are expected to help them raise production. One such move is the restructuring of many contracts from fee-based oil service contracts to production-sharing agreements. Negotiations over this change began on 19 April 2022, with the government expecting deals to be in place by September 2022.

The first well at the Ishpingo field, which was drilled by CNPC, reportedly came onstream with a production rate of 3.6 kbpd. Development of the ITT project has been controversial due to the location but with proven reserves of 458 mmbbl, 40% of Ecuador’s reserves, the project is vital to Ecuador increasing its domestic production. Following start-up of the first well at Ishpingo, a further 36 are scheduled to be drilled.

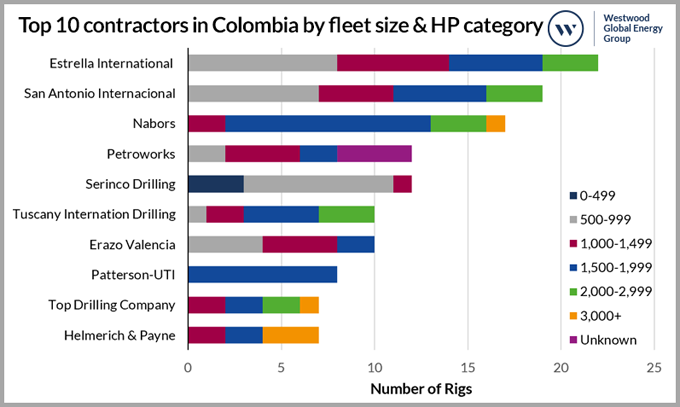

Colombia

Colombia also saw political changes with Gustavo Petro elected as President in June. Prior to the election Petro pledged to stop any unconventional oil and gas developments and is also reportedly against granting new exploration licences in a bid to phase out fossil fuels. It is currently unclear what impact this will have on Colombia’s fleet of 168 land rigs.

TOP 10 CONTRACTORS IN COLOMBIA BY FLEET SIZE & HP CATEGORY

Gran Tierra Energy completed three infill producers and two water injections at the Acordionero field. The rig is now in the central pad to drill up to 11 further wells. The Moqueta field, is also earmarked for drilling this year, the first since 2016, while the company also has a series of exploration drilling programmes with up to three exploration wells planned in both Ecuador and Colombia.

Arrow Energy drilled the RCE-2 and RCE-1 wells, with RCE-2 producing at a rate of 1,000 bopd while RCE-1 is undergoing testing prior to being put on production. Arrow Energy submitted a development plan including additional wells targeting the Carbonera C-7, the Middle Gacheta and the Lower Gacheta formations. NG Energy International announced the commencement of drilling at the Magico-1 well, using the Independence Rig 61, a 1,500 HP hydraulic rig.

Trinidad & Tobago

The gas pipeline from the Coho facility to the Central block is nearing completion allowing production of 10 mmcfd to start. Touchstone is also preparing to side-track the successful Royston-1 exploration well and is awaiting approval of the Cascadura EIA. Once approval has been granted an additional well pad at Cascadura will be constructed for the two future budgeted development wells.

Trinity E&P spud the first of six wells of its 2022 campaign, targeting an aggregate 450 to 1,100 mmbbls of reserves. The campaign includes infill wells, a horizontal well and a deeper appraisal well. The drilling is fully funded and is expected to cost $14-17 million.

Cuba

On 23 May 2022 Melbana Energy spud the Zapato-1 exploration well in Block 9, Cuba. The well is the second exploration well in the block following Alameda-1. Zapato-1 will target prospective resources of 95 mmbbl of oil and is being drilled by Sherritt International Rig-1.

North America & Canada

USA

Operators in the US had a boost when President Joe Biden’s administration announced it will resume selling drilling leases on federal lands. The US Bureau of Land Management is expected to release a sale notice for leases to allow drilling on 144,000 acres of federal land. The restart of leasing comes with a higher royalty rate of 18.75%, up from the previous 12.5% rate.

14 out of 50 public US onshore E&Ps tracked by Westwood have revised their 2022 capex upwards by 9% on average—a total of $1.5 billion extra capex. Capex increases have largely been centred around higher completion costs, particularly sand. While sand shortages will affect production growth potential, they are not expected to interfere with increasing drilling activity brought on by higher commodity prices. However, increasing rig rates, labour shortages, and steel tubular shortages may moderate rig count growth through 2022 and 2023.

Rig counts in the gas basins of Appalachia and Haynesville have declined in recent weeks, due to a decline in the natural gas price after Freeport LNG announced a multi-month outage at its Freeport facility. Rig counts in the Permian oil basin have steadily climbed by 53 rigs since the start of the year to 330. Rig counts in the remaining major US onshore oil basins (Eagle Ford, MidCon, DJ, and Williston) have grown by 47 rigs combined since the start of the year.

Apache announced it is returning to the Alpine High play, three years after ending drilling activity due to low natural gas prices, with the recent increase in price prompting the company to return to the play.

Asia

China

On 19 May 2022, PetroChina sanctioned a development plan for extracting shale gas at the Yang 101 block in the Sichuan basin. The project will cost $505 million (3.4 billion yuan) and has potential to establish 5 bcm/y throughput by 2025 and 20 bcm/y by 2035. The plan includes seven well pads, for 44 horizontal production wells with vertical depths ranging from 3,500 to 5,500 metres and horizontal extensions of 1,500 to 2,500 metres. Additional facilities and in the region of 3,000 more wells are planned to reach the 20 bcm/y target by 2035.

India

Operator Cairn Oil and Gas signed a deal with Baker Hughes related to geothermal energy as part of its commitment to become a net zero company by 2050. The companies will study re-purposing O&G wells in high temperature formations, which will then be followed by a pilot project testing the concept prior to the full-scale execution of the project.

Indonesia

Indonesia Energy Corporation (IEC) announced an oil discovery at its Kruh-27 well, which encountered approximately 132 ft of oil sands between the depths of 3,058 and 3,190 ft and is on production already. The drilling rig has moved to the second well, Kruh-28. Two further wells are planned in the Kruh block in 2H 2022 with a total of 18 planned in the Kruh Block by the end of 2024. Each well is expected to cost approximately $1.5 million and produce over 100 bopd over the first year.

JGC was awarded an EPC contract for gas processing facilities at Jadestone Energy’s Akatara gas field in the Lemang PSC, South Sumatra. The facility will have a capacity of 25 mmcfd with the Akatrara gas field expected to produce up to 18.8 mmcfd. Production is expected to start in 1H 2024.

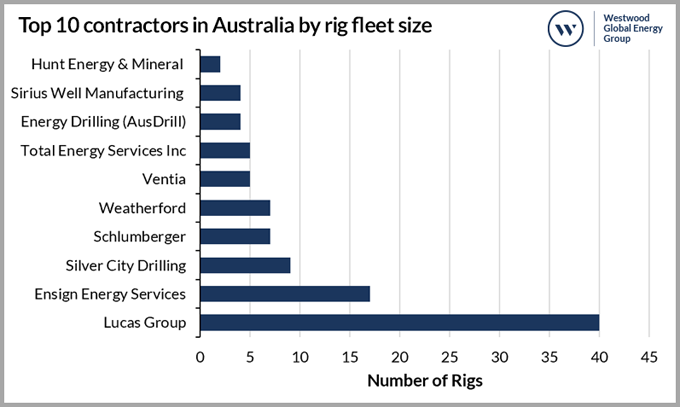

Australasia

Australia continued to see operators committing to and fulfilling drilling programmes, including Strike Energy, Galilee Energy, Buru Energy and Beach Energy.

| Company | Rig | Details |

| Strike Energy | Ensign 970 | West Erregula-3 well drilled |

| Tamboran Resources | Ensign 970 | Rig contracted to drill Maverick 1H well in Beetallo basin in 3Q 2022 |

| Cue Energy | N/A | Currently drilling PV-12 exploration well with progress slower than expected. Cue also has plans for six workovers and two infill wells at Mereenie field during 2023 |

| Beach Energy | Schlumberger Rig 184 | Bangalee-1 well drilled and suspended as an oil producer. Followed up with Hummocky-1 exploration well |

| Galilee Energy | Silver City Rig 23 | Completed sixth and final well in its 2022 campaign (Glenaras-29) |

| Blue Energy | Silver City Rig 23 | Rig to be released from Galilee Energy following completion of campaign and moved to the North Bowen Basin for appraisal drilling |

TOP 10 CONTRACTORS IN AUSTRALIA BY RIG FLEET SIZE

Eastern Europe & FSU

Kazakhstan

A major upgrade to the Tengiz field in Kazakhstan has seen further delays. The project is split into two phases; the wellhead pressure management project, designed to help maintain current production levels, is now expected to come onstream by the end of 2023 while the second phase, which aims to boost production to over 1 mmboed is expected onstream in 1H 2024. The project will require a significant number of wells to be drilled, accounting for much of the onshore drilling activity within Kazakhstan.

Romania

Serinus Energy announced that its exploration drilling programme is ahead of schedule as it prepares to drill two wells near the Moftinu gas field, with a third to follow, subject to the results of the first two. The wells will target the Canar and Moftinu Nord prospects, with the first well, Canar-1, set to spud in early July.

Uzbekistan

Sanoat Energetika Guruhi (SEG) reported an unconventional oil discovery of 730 mmbbl of heavy oil in Uzbekistan’s Zarafshan depression, making it the largest oil find in Uzbekistan. Since exploration activity started in May 2021, SEG has drilled 50 shallow exploration wells ranging from 400 to 750 metres depth, during which SEG utilised technical assistance from Russia’s Kontiki Exploration. Around 500 wells are planned for the initial development phase, targeting production of 6 kbpd before ramping up to 20 kbpd by 2025.

Western Europe

Germany

In Germany, Neptune Energy awarded a contract to drill the Z-17 well in the Adorf gas field, north-west Germany, to KCA Deutag. Operated with power from the grid, the rig will use electrical motors, removing an estimated 1,000 tonnes of CO2 emissions from the drilling operation. The Z-17 well was spud on 30 June 2022.

UK

Two wells that were due to be plugged and abandoned following a regulatory order, have been given a reprieve. Cuadrilla Resources now has until mid-2023 to evaluate the wells and see if gas can be extracted safely and economically. The wells, which have been met with fierce local opposition since planning stages, were drilled into the Bowland shale at a depth of 2,250 metres vertically and 750 metres horizontally. Following drilling, light earth tremors were recorded, leading to a suspension of operations before a fracking moratorium brought all operations to a halt. The UK regulator reported that no wells were drilled onshore in 2021. The government has also granted approval for new drilling to establish the size of the natural gas field at Loxley, south of London, despite Surrey County Council opposing the drilling.

Todd Jensen

Research Analyst, Onshore Energy Services

tjensen@westwoodenergy.com

KEYFACT Energy

KEYFACT Energy