By Kathryn Porter, Watt-Logic

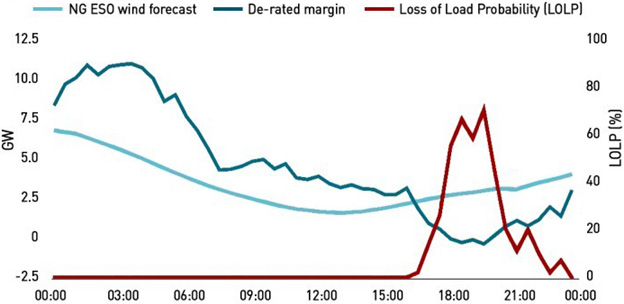

On Monday 18 July, National Grid ESO issued two Capacity Market Notices, the first at for 7pm which was cancelled after about half an hour, and the second for 8pm which was cancelled with fewer than 10 mins to go before the start of the relevant settlement period ie at 7:51pm. The Loss of Load Probability (“LOLP”) reached 70% meaning that the Reserve Scarcity Price, calculated by multiplying the LOLP by the Value of Lost Load which is currently set to £6,000 /MWh reached £4,200 /MWh.

System margin

Source: LCP Enact

So what happened and why?

Britain, in common with much of Europe, is experiencing a heatwave. This is a high pressure weather system, and these result in clear, sunny weather with low wind output – hot in summer and cold in winter. The UK does not have widespread domestic air conditioning, so unlike countries which habitually experience high summer temperatures, hot weather does not tend to cause electricity demand to spike, and unlike the winter, solar output is strong.

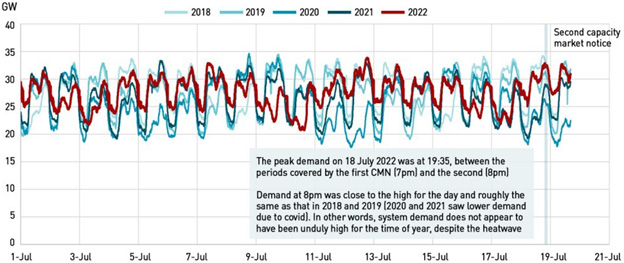

The chart indicates that although demand on Monday evening was higher than for the past 2 years, it was in line with the pre-covid years. In other words, high demand does not explain the system tightness.

GB electricity demand

Source: Gridwatch Templar, Watt-Logic

Instead, what we saw were inadequate supplies. Summer is when conventional generators carry out regular maintenance – demand and therefore prices are lower in summer than winter so the opportunity cost of being offline for maintenance is lower in summer than winter. Also, there is less likelihood of a system stress event in the summer, so the chances of facing a non-delivery penalty under the Capacity Market would be lower. According to REMIT data available on BM Reports, 12.3 GW of conventional generation (coal, gas, nuclear, biomass and hydro) capacity was offline for planned maintenance on Monday. This was only the second time since the Capacity Market launched that a Capacity Market Notice had been issued in the summer.

According to EnAppSys, “every power station that was available was fully committed to run with additional power brought in on the interconnectors, we even saw the rare sight of all pumped storage units self-dispatched into the wholesale market”.

Very hot weather can also reduce the output of various forms of generation. Solar panels are less efficient when it is hot – they work by using incoming photons to excite electrons in a semiconductor to a higher energy level. When the panel is hot, more electrons will already in the excited state, which reduces the voltage that can be generated by the panel, and also increases electrical resistance in the circuits which convert the photovoltaic charge into electricity.

Thermal power stations also become less efficient since it becomes more difficult to cool them and more energy is wasted as heat – this has been seen with thermal power stations in GB whose maximum output notifications have been lowered as a result. These within-day variations can be seen from the Maximum Export Limit declared in their Final Physical Notifications, for example the MEL for Pembroke Unit 1 varied between 404 MW and 429 MW on Monday, with the lowest value being between 4-5pm which was the hottest time of the day. There are five 440 MW units at Pembroke, so the total reduction across the power station (all units showed similar patterns, and some units actually saw larger reductions) was around 125 MW. Multiplying this effect across the entire thermal fleet would have a very significant impact on output.

Hot weather also increases heat losses in the electricity system. Overhead power lines can slacken and sag with the heat, which increases their electrical resistance, leading to a drop in efficiency. Transformers produce heat when they operate, as temperatures rise they become less efficient, and if temperatures rise too much they become unsafe and can explode. High temperatures also reduce the life of transformers with elevated temperatures being the largest cause of reduced life in transformers.

Interconnector flows to/from GB on 18 July 2022

Source: Gridwatch Templar, Watt-Logic

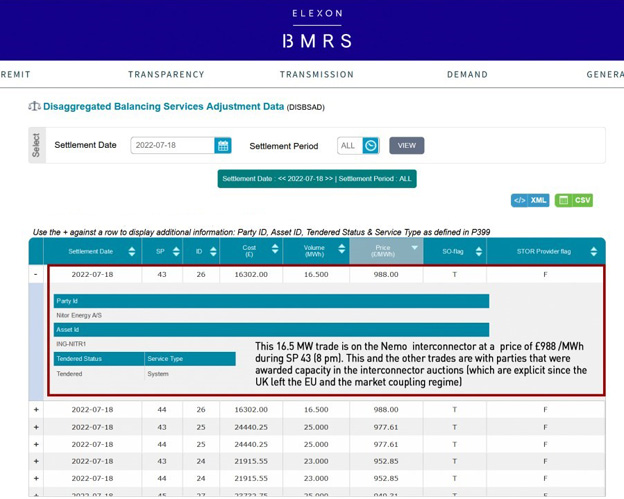

Looking at interconnector flows we can see that exports to France reduced significantly in the evening. We can also see from interconnector balancing trade data on BM Reports (DISBSAD) that there were significant trades on the interconnectors. The most expensive of these was on Nemo for £2,059 /MWh at 6:30pm. We can see from wholesale trading data that French power prices briefly traded above GB during Monday evening, reducing the drive for exports.

Intraday electricity prices

Source: BM reports, EPEXSpot

Interconnector balancing trades on 18 July

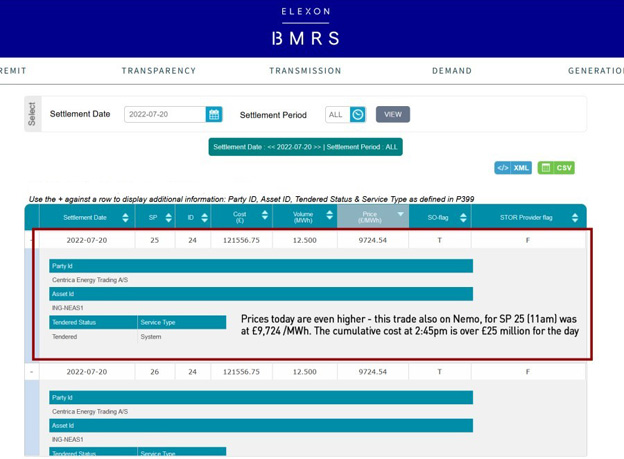

The market has continued to be tight, and while no more system warnings have been issued, interconnector balancing trades today have cleared at even higher prices and by the end of the day, almost £64 million of trades had been executed with the highest individual price being £9,724 /MWh on Nemo.

Interconnector balancing trades on 20 July

What does this mean for the coming winter?

These trends are concerning. While in winter we would expect more conventional generation to be available, we would also expect to see higher demand, and while that would see 12:5 GW of plant returning form maintenance, demand could be more than 20 GW higher. The early Winter Outlook is expected from NG ESO imminently, and is expected to show that the capacity margin has collapsed since last year.

The real question will be the extent to which we can reduce exports to France when France will need to rely on imports – while this might be possible for a few hours in the summer, I wonder about the dynamics in winter when low wind conditions over days and weeks could lead to an extended requirement for imports in both countries. With the possibility of reduced imports from Norway, either because system operator Statnett decides to reduce capacity or because Norway runs out of water (hydro levels are close to 20-year lows), the system could be even more stressed than it was on Monday.

For decades we have consistently imported electricity from France – I struggle to see how it would be acceptable for Britain to refuse to export now that France needs imports. There don’t appear to have been any trades between NG ESO and French system operator RTE on Monday, with the interconnector flows appearing to vary based on normal market trading. But under normal market trading, power flows are determined by the short-term price differentials between the markets, moving from the lower to higher priced region. If both countries are short, prices could rise very high.

The dynamics for the winter across the Europe are worrying. Germany is very short of gas and has closed its nuclear power stations meaning it is turning to coal and imports. Norway and France have traditionally been major exporters, but Norway’s hydro levels are already stressed and Statnett has warned rationing may be necessary in southern Norway this winter, while half of the French nuclear fleet is offline. The entire Continent will be very vulnerable to low wind conditions, and since these can extend across several countries at once, the associated difficulties could be very wide-spread.

We can expect to see industrial rationing and even appeals to the public to reduce demand at peak times. And we should keep our fingers crossed that the weather is warm and windy…

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy