Orrön Energy is an independent, publicly listed pure play renewables company, with high quality and low-cost renewables assets in the Nordics.

As part of the entrepreneurial Lundin Group of Companies, and with a management and Board with a proven track record of successful organic growth, Orrön Energy is well positioned to create value for shareholders, local communities and wider stakeholders for a sustainable energy future.

The initial focus for the business is to continue to invest in renewable energy projects in the Nordics, which has a stable and mature market for renewable energy, followed by a potential expansion in Europe. The long-term vision is to grow into an industry leading energy company, with scale and sufficient cash flow to be able to provide progressive shareholder returns and explore new ideas and solutions to help drive the energy transition.

History

Orrön Energy was born in 2022, but can trace its roots back to Lundin Energy and its predecessor company Lundin Petroleum, formed in the early 2000s.

Over more than 20 years, Lundin Energy delivered on its successful organic growth strategy and created significant value for its shareholders, with a compound annual average return of 28 percent – becoming one of the most admired independent E&P companies with a market leading Decarbonisation Plan. Following this outstanding history of value creation, Lundin Energy’s oil and gas business was acquired by Aker BP in 2022, to create the leading exploration and production company for the future.

As part of the transaction with Aker BP, Orrön Energy was created with the renewables assets from Lundin Energy as a base and became the new renewables vehicle within the Lundin Group of Companies. Orrön Energy has retained key members of Lundin Energy’s Board and management team, with knowledge of the renewables asset base and a proven track record of building companies which have delivered significant value for shareholders over many years.

Europe operations

Finland

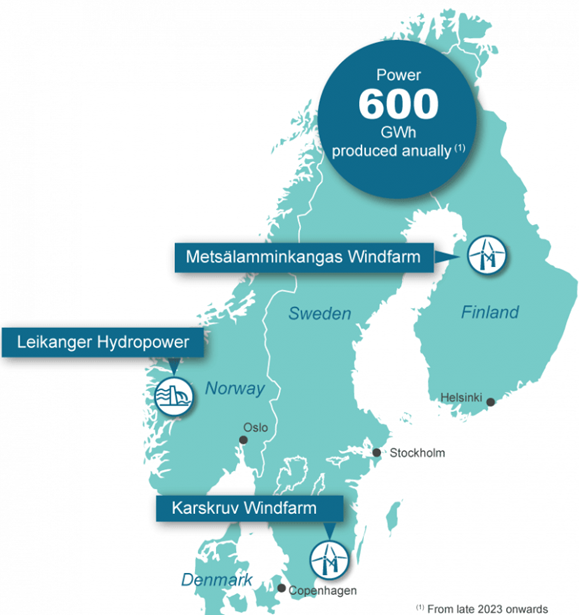

Orrön Energy's renewable energy assets have a combined net power generation capacity of around 600 GWh per annum from 2024 onwards, which is equivalent to the energy consumption of approximately 150,000 European households. All of the assets are newly constructed and equipped with modern technology to ensure low cost and efficient operations. The early life asset base means the cost for estimated maintenance is low, with high availability and efficiency during a long-term asset lifetime.

Metsälamminkangas (“MLK”) wind farm

Orrön Energy owns a 50 percent interest in the MLK wind farm, the third largest in Finland, with the remaining 50 percent held by Sval.

OX2 AB has constructed the wind farm under an engineering, procurement and construction contract and will remain responsible for the operations, maintenance and technical management of the wind farm. Commercial handover took place in March 2022 and the wind farm is now operating at full capacity.

The turbines have been purchased from, installed by and will be maintained by GE, with an availability warranty which guarantees the availability and power production levels from the turbines through their operational life, giving the Company significant protection against downtime and outages. MLK will produce around 400 GWh per annum gross, from 24 wind turbines of 5.5 MW each. The wind farm’s turbines have a hub height of 141-151 meters and the total installed capacity is 132 MW.

- Annual estimated gross production of 400 GWh

- 50 percent ownership, with Sval Energi AS (“Sval”) as the partner

- 24 turbines with total installed capacity of 132 MW

- Situated in the high priced FI region in Finland

- Estimated lifespan for the turbines of at least 30 years

Norway

Orrön Energy's renewable energy assets have a combined net power generation capacity of around 600 GWh per annum from 2024 onwards, which is equivalent to the energy consumption of approximately 150,000 European households. All of the assets are newly constructed and equipped with modern technology to ensure low cost and efficient operations. The early life asset base means the cost for estimated maintenance is low, with high availability and efficiency during a long-term asset lifetime.

Leikanger hydropower plant

The Company owns a 50 percent interest in the Leikanger hydropower plant north of Bergen in Western Norway.

The power plant was constructed by and remains operated by Sognekraft, which also owns the remaining 50 percent. The hydropower plant became fully operational in March 2021, with water sourced from two river systems (Grindselvi and Henjaelvi) and eight river inlets. The capacity of the plant is 77 MW and gross annual production is estimated to be about 200 GWh.

Leikanger delivered strong performance during the first quarter of 2022, with net production of 6.3 GWh, at an average power price of above EUR 135 per megawatt hour (MWh). As the asset is a river based hydropower plant, the production is forecast to increase in the second and third quarters of 2022 due to snow melting during the spring and summer months and increasing precipitation in the autumn season. With the facility located in the NO5 price region, continued strong power prices are forecasted for 2022.

- Leikanger Hydropower - Norway

- Annual estimated gross production of 200 GWh

- 50 percent ownership in the hydropower plant, with Sognekraft AS (“Sognekraft”) as the partner

- Single turbine with a total installed capacity of 77 MW

- Situated in the NO5 price region in Norway, with strong price fundamentals

- Cost efficient operations with an estimated lifespan of around 60 years

- Long-term operations and maintenance agreement with Sognekraft providing certainty for cost elements

- Proximity to the new export grid connections to UK and Northern Europe

- Designed as a river run off system without a reservoir for lowest environmental impact

Sweden operations

Orrön Energy's renewable energy assets have a combined net power generation capacity of around 600 GWh per annum from 2024 onwards, which is equivalent to the energy consumption of approximately 150,000 European households. All of the assets are newly constructed and equipped with modern technology to ensure low cost and efficient operations. The early life asset base means the cost for estimated maintenance is low, with high availability and efficiency during a long-term asset lifetime.

Karskruv onshore wind farm

As of March 2022, the Karskruv onshore wind farm in southern Sweden has started construction and civil works which are progressing on schedule with the facility planned to be operational in late 2023.

The 20 4.3MW wind turbines are expected to be installed in 2023, generating total production of an estimated 290 GWh per annum. The total investment in Karskruv, including the acquisition cost, amounts to 130 MEUR with approximately 90 MEUR remaining spend from the second half of 2022 until project completion. The project is expected to be cash flow positive from late 2023 when fully operational and connected to the grid.

Orrön Energy owns a 100 percent interest in the wind farm, which is located in the municipality of Uppvidinge, Kronoberg County, in southern Sweden. OX2 is constructing the wind farm as part of an EPC contract, with a fixed cost until the commercial handover of the wind farm. The turbines have been purchased from, installed by and will be maintained by one single supplier, with an availability warranty which guarantees the availability and power production levels from the turbines through their operational life, giving the Company significant protection against downtime and outages. The wind farm’s turbines have a hub height of 116 meters and the total installed capacity is 86 MW.

Projects for local stakeholder engagement and biodiversity are ongoing in the area surrounding the wind farm. This includes grazing projects with local farmers, planting of wildflowers and investments in developing a recreational area next to the wind farm.

- Annual estimated net production of 290 GWh

- 100 percent ownership and on tran fully online

- Estimated lifespan of the turbines of atck for production start in late 2023

- Situated in the high priced SE4 region in southern Sweden

- 20 turbines with total installed capacity of 86 MW

- Approximately 90 MEUR capital expenditure remaining from the second half of 2022 until commercial handover

- Cash flow positive from late 2023 whe least 30 years

- Stakeholder engagement and biodiversity projects ongoing in the local area

Leadership

Grace Reksten Skaugen Chair of the Board

Daniel Fitzgerald CEO

Carl Sixtensson Technical Director

Espen Hennie Espen Hennie

Henrika Frykman General Counsel

Robert Eriksson Director, Corporate Affairs and Investor Relations

Contact

Orrön Energy AB (publ)

Hovslagargatan 5

SE – 111 48 Stockholm

Sweden

Tel: +46 8 440 54 50

Orrön Energy AB (publ)

Hovslagargatan 5

SE – 111 48 Stockholm

Sweden

Tel: +46 8 440 54 50

KeyFacts Energy: Company Profile l KeyFacts Renewable Energy Directory: Orrön Energy

KEYFACT Energy

KEYFACT Energy