Justin Anderson

ESG Technology, Innovation | Former Head of Technology CoE KPMG International

ESG value creation

Companies that make decisions informed by the impact of their actions on the environment and society are building more resilient organisations that deliver higher future earnings and lower levels of volatility.

This post will explore this statement and consider research that supports it.

Firstly, in an era of high energy prices, if you can change your operations to reduce your use of fuel, not only will that reduce carbon emissions, it will also directly impact the bottom line. In an era of increased interest rates, if you are able to reduce your refinancing interest rates due to demonstrating sustainability, you will directly impact the bottom line. Both of these cases directly lead to both improved ESG impact and increased enterprise value.

These simple examples just scratch the surface of the potential for positive ESG impact to lead to increased enterprise value. Leading investors have been integrating ESG due diligence into their process for several years. Company boards and CEOs are starting to understand the ESG value creation opportunity and recognise that with higher levels of inflation and the expectation of a recession ahead, an ESG value creation strategy is not a ‘nice to have’, it is now essential to protect and create future enterprise value.

Materiality & value creation

In 2015, HBS published a paper ‘Corporate Sustainability: First Evidence on Materiality’. They used calendar-time portfolio stock return regressions and showed that firms with good performance on material sustainability issues significantly outperform firms with poor performance on these issues, suggesting that investments in sustainability issues are shareholder-value enhancing. Key to their research was the concept of materiality (they based their model on SASB materiality, see below).

Materiality has long been a guiding principle for disclosure in the capital markets. It is a term used to distinguish what must be disclosed to investors and other users of financial statements. “Materiality” is also a term used to guide decisions about what sustainability information should be disclosed. The term “double materiality” refers to the two types of materiality in use by sustainability disclosure frameworks and standards: (1) materiality in the context of enterprise value creation, and (2) materiality in the context of significant impacts on the economy, environment, and people.

ESG standards, including Sustainability Accounting Standards Board (SASB) and Global Reporting Initiative (GRI), provides guidance on materiality by industry, topic and indicator. These standards are developed and regularly reviewed with industry experts. The intent of the guidance is to identify issues that should be disclosed to users. These economic material issues, assessed with input from stakeholders, provide a systematic way to initiate an ESG value creation strategy.

International Value Standards Council

The International Value Standards Council (IVSC) is the independent global standard setter for the valuation profession engaging experts and managing public consultation. In 2021 they published their ‘Perspectives Paper: ESG & Business Valuation’ which provides an approach to the incorporation of ESG into business valuation practice and standards. They conclude that ESG frameworks should be a matter of incorporation to existing valuation methods, but valuers will need reliable ESG metric reporting that is consistent between companies, across geographies, and over time. This paper was followed by ‘Perspectives Paper: A Framework to Assess ESG Value Creation’ which explores the close link between ESG investment and intangible asset value creation and the interconnection between assets that lead to scalable investment from a positive feedback cycle. ESG benefits often accrue to the enterprise as a whole rather than a specific product, the benefits are often long term and often risk reducing and may only maintain existing cash flows rather than generate incremental discrete cash flow.

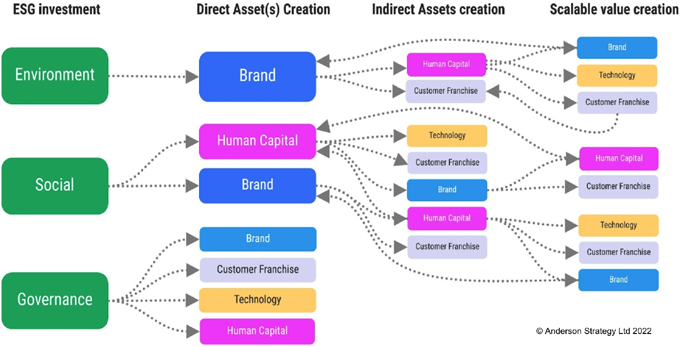

The following chart summarises the IVSC ESG value creation framework:

The greater the reliance of an organisation to create value based on these criteria, the greater the ability to create or maintain value through ESG investments. The IVSC framework recognises that these characteristics are neither collectively exhaustive or required to be utilised in a framework, but they do provide a way to consider the value from ESG investment by industry and company.

Value creation through ‘impact innovation’

According to Gartner’s 2022 CEO Survey, of the 80% of CEOs who intend to invest in new or improved products this year and next, environmental sustainability was cited as the third largest driver, just behind functional performance and general quality.

This driver is a reflection of the importance of adopting an ESG value creation strategy to satisfy a combination of stakeholder requirements. ‘Impact innovation’ that makes a positive impact on the planet and people (or at the least reduced negative impact) meets the requirements of today’s climate conscious customer and can provide competitive differentiation.

Companies approach innovation management in many different ways, however best practice innovation management standards recognise that ‘innovation intent’ is a key input to the ideation process. If the intent is to make a faster car, then the focus will be on optimising aerodynamics or engine performance and of course better brakes. If ‘sustainability’ is included in the innovation intent, it changes the nature of the ideation and design process. This approach will not only lead to products that are manufactured with less waste, less energy, using less water, ultimately it will lead to reconsidering the entire lifecycle of a product, its raw materials and the broader value chain. as well as what happens to the product at the end of its useful life and beyond.

It follows that companies that adopt best practice design-led impact innovation incorporating ESG thinking into this process are more likely to meet the expectations of their customers and create greater future enterprise value than companies that don’t. Impact innovation is leading to the development of ‘circular economy’ principles. These principles not only result in more sustainable products, they lead to completely new business models and ecosystems.

ESG value creation and the circular economy

In our current economy, we take materials from the Earth, make products from them, and eventually throw them away as waste – the process is linear. In a circular economy, by contrast, we stop waste being produced in the first place.

An estimate from the 2021 Circularity Gap Report claims that a circular economy could reduce global GHG emissions by 39%. They also forecast that if we double global circularity from 8.6% to 17% it will keep our world 'liveable and thriving'.

The circular economy is based on three principles, driven by design and underpinned by a transition to renewable energy and materials:

- Eliminate waste and pollution

- Circulate products and materials (at their highest value)

- Regenerate nature, shift the focus from extraction to regeneration

A circular economy decouples economic activity from the consumption of finite resources. It is a resilient system that is good for business, people and the environment. The circular economy gives us the tools to tackle climate change and biodiversity loss together, while addressing important social needs.

Refining a company’s business model to increase profitability and creating a circular economy ecosystem will lead to economic value creation, but other types of value will also be created including: sustainability; political; ecological; social & safety & quality.

Six economic dimensions of ESG value creation

The growing body of literature assessing the relation between sustainability and financial performance supports the opening statement. Six economic dimensions of value creation can be drawn from it:

- Customer acquisition: Enhanced brand selling sustainable products will attract new customers. Stronger community and government relations will also achieve better access to resources and markets.

- Customer retention: Building customer satisfaction, loyalty and lifetime value will lead to increased revenues at a lower cost of sale and advocacy will lead to new customer acquisition.

- Cost reductions: Continuously and automatically monitor your environment and analyse data to identify opportunities to optimise operations.

- Productivity uplift: Purpose driven organisations, that maintain diversity and inclusion, can attract and retain top talent and lead to a more motivated and creative workforce.

- Regulatory and legal interventions: Achieve greater strategic freedom through deregulation, reduce fines and penalties. Reduce restrictions on advertising.

- Investment and asset optimisation: Attract investors. Reduce costs of refinancing. Enhance returns by better long term capital allocation. Reduce risk on longer term environmental issues.

Creating this value requires a strategy that will meet the expectations and requirements of many different groups of stakeholders. Engaging stakeholders in the process to determine their requirements, consider materiality, develop a value creation roadmap and drive impact innovation is the key to unlocking this potential.

KeyFacts Energy: Commentary

KEYFACT Energy

KEYFACT Energy