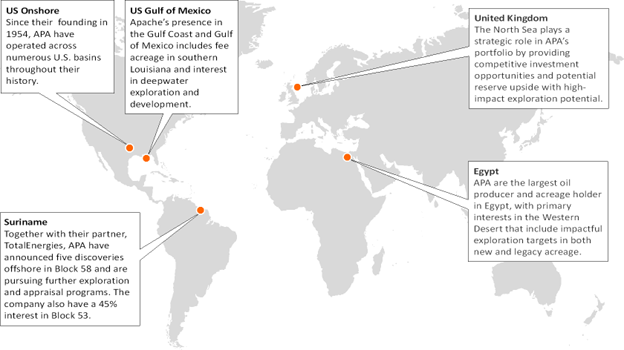

APA Corporation’s subsidiaries have operations in the United States, Egypt’s Western Desert and the United Kingdom’s North Sea and exploration opportunities offshore Suriname.

In 2021, Apache Corporation moved to a holding company structure under APA Corporation, the public company trading on the Nasdaq stock exchange. APA acquired the Suriname and Dominican Republic subsidiaries from Apache. Apache Corporation is a direct, wholly-owned subsidiary of APA and continues to hold assets in the U.S., subsidiaries in Egypt and the U.K., and economic interests in Altus Midstream Company and Altus Midstream LP.

Reserves and production

Worldwide estimated proved reserves totaled 913 million BOE at year-end 2021, up 4% from year-end 2020. More than 90% of APA’s estimated proved reserves at year-end 2021 were classified as proved developed. During the year, APA added approximately 102 million BOE in field extensions and discoveries. Production and divestitures reduced proved reserves by 142 million BOE and 28 million BOE, respectively.

APA achieved production of 386,000 barrels of oil equivalent (BOE) per day in 2021. Adjusted production, which excludes Egypt noncontrolling interest and tax barrels, was 331,000 BOE per day.

Global operations

UNITED STATES

Subsidiary: Apache Corporation

Apache's U.S. operations and interests are primarily focused in the Permian Basin but also include assets in the Eagle Ford shale and Austin Chalk areas of southeast Texas, the Gulf Coast and the Gulf of Mexico.

Apache has been operating in the Permian Basin of Texas and New Mexico since the 1990s. The area has played a significant role in the company’s long-term strategy, offering both conventional and unconventional opportunities. As of Dec. 31, 2021, the company has nearly 6,000 wells covering a gross acreage position of 3.8 million acres with exposure to numerous plays primarily located in the Midland Basin, the Central Basin Platform/Northwest Shelf and the Delaware Basin. The company has estimated proved reserves of 616 MMboe, representing 67% of its worldwide proved reserves. In 2021, the U.S. total production was 83.7 MMboe or 59% of total production.

Apache also holds an interest in the Eagle Ford shale and Austin Chalk areas of southeast Texas play in Burleson and Brazos Counties.

Apache’s presence in the Gulf Coast and Gulf of Mexico includes fee acreage in southern Louisiana and interest in deepwater exploration and development. In Louisiana, Apache manages 270,000 acres of land to protect swamps and marshes and the species that call these areas home. The company’s efforts include rebuilding shorelines to keep out saltier waters that harm marsh grasses and supporting sustainable harvesting and ranching operations that have helped bring back alligators from the brink of extinction.

In the Gulf of Mexico, the company has interest in several deepwater exploration and development offshore leases. In 2013, when the company sold substantially all of its offshore assets in water depths less than 1,000 feet, it retained a 50% ownership interest in deeper targets and access to existing infrastructure, providing future optionality.

UNITED KINGDOM

Subsidiary: Apache Corporation

The North Sea plays a strategic role in APA Corporation’s portfolio by providing competitive investment opportunities leveraging existing infrastructure, strong cash flow generation and potential reserve upside with low-moderate risk exploration potential.

Apache entered the North Sea in 2003 after acquiring an approximate 97% working interest in the Forties Field (Forties). Since acquiring Forties, Apache has actively invested in the North Sea and has established an inventory of drilling prospects through successful exploration programs and the interpretation of 4-D seismic data. Building upon its success at Forties, in 2011, Apache acquired additional assets from Mobil North Sea Limited, providing new exploration and development opportunities across numerous fields, including operated interests in the Beryl, Ness, Nevis, Nevis South, Skene and Buckland Fields and a non-operated interest in the Maclure Field. Apache also has a non-operated interest in the Nelson Field, which it acquired in 2011. The Beryl Field, a geologically complex area with multiple fields and stacked pay potential, provides significant exploration opportunity.

In addition to optimizing efficiency and production at its legacy assets, Apache has maintained an inventory of new exploration and development opportunities through the acquisition and interpretation of 3-D and 4-D seismic data. The company looks for resources that can be easily developed by tying into existing infrastructure, as evidenced by the Garten discovery in 2018. Apache also has a portfolio of other prospects that represent a higher risk/higher reward opportunity than its traditional North Sea activities.

As of year-end 2021, Apache had interests in approximately 494,000 gross acres in the U.K. North Sea, which contributed 11% of Apache’s 2021 production and approximately 11% of year-end estimated proved reserves.

EGYPT

Subsidiary: Apache Corporation

Apache has operated in Egypt for more than 26 years and is one of the largest American investors and the largest oil producer in the country. The company’s primary interests are in the Western Desert and include high-impact exploration targets in both new and legacy acreage. Apache employs thousands of people in Egypt through its joint venture companies – a diverse team whose members share the values of continuous improvement, innovation and a drive to succeed with a sense of urgency.

A key component of Apache’s success has been the ability to acquire and evaluate 3-D seismic surveys that enable the technical teams to consistently high-grade existing prospects and identify new targets across multiple pay horizons in the Cretaceous, Jurassic and deeper Paleozoic formations. As of 2020, the company has completed seismic surveys covering more than 3 million acres.

On December 27, 2021, the company announced the ratification of a modernized production sharing contract (PSC) with the Ministry of Petroleum and the Egyptian General Petroleum Company. The new PSC places Egypt at the top of APA’s investment portfolio, bolstering its position as an emerging regional energy hub and attractive investment destination.

At year-end 2021, the company held 5.3 million gross acres in six separate concessions. Approximately 68% of the company’s gross acreage in Egypt is undeveloped, providing Apache with considerable exploration and development opportunities for the future. The operations in Egypt, including a one-third noncontrolling interest, contributed 30% of 2021 production and 21% of year-end estimated proved reserves.

SURINAME

Subsidiary: APA Corporation Suriname

In Suriname, APA Corporation has a leading position in arguably the most watched new basin on the globe. Those assets were transferred to APA Corporation Suriname in 2021.

Apache entered Suriname after winning bids for Block 53 and Block 58 offshore in 2012 and 2015, respectively.

The company expanded its understanding of the basin through extensive geologic modeling and seismic acquisition. In 2019, Apache began drilling the Maka Central-1 well in Block 58 and subsequently brought in TotalEnergies as a 50-50 Joint Venture partner to explore and develop the block. The partners have announced several discoveries beginning with Maka Central-1 in January 2020.

Block 58 comprises 1.4 million acres. APA Corporation, Suriname also owns a 45% interest in Block 53, which covers 867,000 acres.

In February 2022, APA announced an oil discovery at the Krabdagu-1 (KBD-1) exploration well. KBD-1 is located on Block 58 offshore Suriname, approximately 18 kilometers southeast of the Sapakara South-1 appraisal well. APA Suriname holds a 50% working interest in the block, with TotalEnergies, the operator, holding a 50% working interest.

In August 2022, APA announced an oil discovery offshore Suriname at Baja-1 in Block 53. Baja-1 was drilled to a depth of 5,290 meters (17,356 feet) and encountered 34 meters (112 feet) of net oil pay in a single interval within the Campanian. Preliminary fluid and log analysis indicates light oil with a gas-oil ratio (GOR) of 1,600 to 2,200 standard cubic feet per barrel, in good quality reservoir.

APA is operator and holds a 45% working interest in Block 53, with Petronas holding a 30% working interest and CEPSA holding a 25% working interest. Baja-1 was drilled using the Noble Gerry de Souza in water depths of approximately 1,140 meters (3,740 feet). The drillship will mobilize to Block 58 following the completion of current operations, where it will drill the Awari exploration prospect, approximately 27 kilometers (north) of the Maka Central discovery.

LEADERSHIP

John E. Lowe Non-Executive Chair of the Board

John J. Christmann IV Chief Executive Officer and President

Stephen J. Riney Executive Vice President and Chief Financial Officer

Clay Bretches Executive Vice President, Operations

P. Anthony Lannie Executive Vice President and General Counsel

David A. Pursell Executive Vice President, Development

Mark J. Bright Senior Vice President, Planning

Timothy R. Custer Senior Vice President, Land

W. Brad Eubanks Senior Vice President, Production Operations

Tracey K. Henderson Senior Vice President, Exploration

CONTACT

APA Corporation

2000 Post Oak Blvd, Suite 100

Houston, TX 77056-4400

United States

Tel: 713 296 6000

KeyFacts Energy: APA US onshore country profile l KeyFacts Energy: Company Profile

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy