By Kathryn Porter, Watt-Logic

This morning the Government has announced the measures it is putting in place to support businesses with the high cost of energy (more detail is here). This follows the Energy Price Guarantee provided to domestic consumers on 8 September and applies to non-domestic energy customers incuding businesses, charities and public sector organisations such as schools and hospitals.

An equivalent scheme will be offered to non-domestic consumers in Northern Ireland, and businesses that use fuels other than gas and electricity such as heating oil or LPG (heat networks are not mentioned, but there is support for domestic consumers on heat networks so that may also apply to this scheme since it appears to mirror the domestic scheme in terms of eligibility).

How will the scheme work?

Under the Government Energy Bill Relief Scheme, the Government is effectively fixing wholesale gas and electricity prices for all non-domestic consumers whose gas and electricity prices have experienced significant recent increases. It will apply to fixed contracts agreed on or after 1 April 2022, as well as to deemed contracts and contracts with variable and flexible tariffs and will cover energy usage from 1 October 2022 to 31 March 2023.

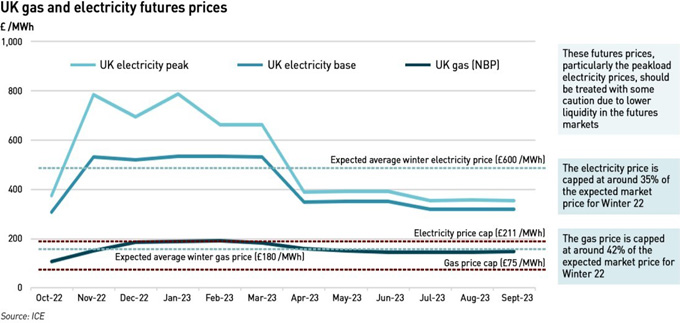

The Supported Wholesale Price is expected to be £211 /MWh for electricity and £75 /MWh for gas – less than half of the expected winter wholesale prices and is considered by the Government to be equivalent to the wholesale element of the Energy Price Guarantee for households. The plan also includes the removal of green levies paid by non-domestic customers, which will be funded directly by the Government for the duration of the scheme.

The level of price reduction for each business will vary depending on their contract type and circumstances:

- Non-domestic consumers with existing fixed price contracts agreed after 1 April this year will receive the discount provided the wholesale component of their tariff is higher than the Government Supported Price. The Government will publish the wholesale prices it will use for calculating this for each day from 1 April 2022. Consumers entering new fixed price contracts after 1 October will receive support on the same basis;

- Consumers on default, deemed or variable tariffs will receive a per-unit discount on energy costs, up to a maximum of the difference between the Supported Price and the average expected wholesale price over the period of the Scheme. The amount of this Maximum Discount is likely to be around £405 /MWh for electricity and £115 /MWh for gas, depending on wholesale prices for the winter – the Government says it will announce the Maximum Discount level on 30 September and makes it clear that businesses may pay more if prices rise above this level.

As a result, the Government is working with suppliers to ensure all consumers in England, Scotland and Wales are given the opportunity to switch to a fixed contract/tariff for the duration of the scheme. This would have the benefit of fixing the costs to the taxpayer.

The scheme for the non-domestic market is more difficult to design and administer than the domestic equivalent. Due to the price cap, suppliers tend to align their procurement and hedging for domestic consumers with the methodology used by Ofgem to set the wholesale component of the price cap, but as there is no cap in the non-domestic sectors, suppliers have much more discretion about their hedging and procurement, and there can be significant variation depending on the consumer type and the contract type.

In this sense there is no such thing as “The Wholesale Price” there is just a range of different products covering different parts of the forward curve and suppliers manage their exposures using all available tools. Gas and electricity contracts cover calendar years, seasons, quarters, months, balance of month, weeks, weekends, balance of week, days, blocks and hours with different products becoming liquid or available to trade at different points in time. There are also baseload and peakload variations available for some forward contracts.

Another complexity is that the prices paid for these instruments will vary depending on the time at which they are entered, the volume of the trade and potentially also the credit worthiness of the supplier. Bid-offer spreads vary based on a number of factors, and suppliers may include transaction costs including collateral requirements in the wholesale component of their tariffs.

For simplicity, the Government intends to publish the effective market rates for fixed deals for each day since 1 April but this will be an abstraction – a supplier agreeing a fixed price deal for a client at 10 am would charge a different price than that for an identical transaction at 3 pm due to intraday price changes. If the volumes were different but the times of the trades were the same, the prices might still be different due to liquidity costs (volumes that are higher or lower than “normal” market sizes will attract higher transaction costs).

For consumers on variable deals, the Government has indicated that the support will be limited. This incentivises both suppliers to re-hedge in order to avoid passing on higher costs to consumers – they are entitled to pass these costs on, but there might be reputational damage from doing so – and it incentivises consumers to move to a fixed deal, at least for the winter, in order to cap the costs they will face. This means that the Government is not writing a blank cheque for energy prices.

I understand from market contacts that suppliers will receive discounts for variable price customers based on the weighted average price arising from all the trades they have made in their portfolios for this customer base. Presumably this will need to be audited or validated by the suppliers’ statutory auditors in order to ensure the integrity of the scheme, but this will be administratively complex.

“Non-domestic suppliers and consumers must not profit from the scheme other than for its intended purpose of providing relief on necessary energy bills. Any such activity will result in support being refundable to government and may be liable to further penalties,”

– BEIS

For smaller businesses, supply contracts are generally similar to those seen in the domestic market (although the absence of the price cap results in wider variability of procurement and hedging strategies underpinning them). However for larger businesses and energy intensive industries, contracts can contain more sophisticated features such as volume limits and different rates for different consumption levels, they can have a closer market indexation and varying degrees of time-of-use elements.

The Government will publish a review into the operation of the scheme in three months to inform decisions on future support after March 2023 which will focus on identifying the most vulnerable non-domestic customers which are to receive longer-lasting support.

How will it be paid for?

The Government has been pretty silent about how this will all be funded. It seems unlikely that it will be covered through future bills – I would have expected that would have been announced already if that was the intention. This means it must be funded through taxation, although in the short term the Government intends to broadly cut taxes which means that it will likely have to borrow to meet these commitments. (The question of tax cuts is interesting – the Prime Minister appears to believe that cutting tax rates can increase tax revenues. This is not a particularly unorthodox view – lower tax rates can stimulate economic growth, encourage businesses to locate in the UK, and reduce the incentives for tax avoidance, meaning that the overall tax take can rise despite lowering individual rates. Whether that happens in practice depends on a number of factors, but it certainly can be the case.)

One potential source of additional taxation is a windfall tax on renewable generators. Back on 8 September, the Prime Minister said:

“Renewable and nuclear generators will move onto Contracts for Difference to end the situation where electricity prices are set by the marginal price of gas. This will mean generators are receiving a fair price, reflecting their cost of production, further bringing down the cost of this intervention.”

Since then the market has been awash with rumours that renewable generators would prefer a windfall tax to hurried conversion of their legacy subsidies into CfDs. This makes sense, a windfall tax based on revenues (to avoid penalising generators selling on long-term fixed price contracts far below current market prices) can be easily and quickly implemented, whereas converting existing Renewables Obligations (“RO”) to CfDs would be complex, likely requiring different strike prices based on both technology and the date of the original subsidies.

My choice would be for a windfall tax on renewable generators that do not have active CfDs (some CfD holders have delayed the start of their contracts in order to benefit from current market prices) to be taxed on their excess profits from 1 January this year, in other words they keep the profits earned last year but cannot keep the higher excess profits received this year. I believe this is fair – the RO became far more generous for generators than was originally intended and it is an expensive scheme for consumers. For these subsidised generators to then rake in millions in additional un-earned profits driven by high gas prices, is unjustified and should be returned for the benefit of consumers who pay for the subsidies in the first place (and now taxpayers who will fund green levies for the time being).

I would also consider re-negotiating the ROs and moving generators from ROs to CfDs with an ongoing windfall tax for any that refuse, but the Government should not rush this to ensure that it does not create other difficulties particularly where a generator has a long-term fixed price PPA at a legacy price level.

What else is happening?

While today’s announcement is focused on the support package for businesses, the Government is also working on various plans to boost security of supply, and it is interesting that the comments from the Prime Minister, Chancellor and Business Secretary that accompanied the press release all focused on energy security as well as mentioning the price support.

“This, alongside the measures we are taking to boost the amount of domestic energy we produce to improve both energy security and supply, will increase growth, protect jobs and support families with their cost of living this winter,”

– Jacob Rees-Mogg, Secretary of State for Business, Energy & Industrial Strategy

We are yet to see much detail on this, in part due to the period of national mourning following the death of Queen Elizabeth II, but the Prime Minister’s announcement indicated that the Government would like to see more long-term fixed price supply deals. There is scope for this in the gas markets because new projects and infrastructure will be needed to deliver the new global gas supplies that will replace Russian gas, and providers of project finance tend to like to see exactly such long-term fixed price deals to support debt repayments, so there is a natural synergy. Securing such deals for existing projects might be harder, but high prices will not last forever, so sellers might be willing to enter into long-term deals that discount at the front end in exchange for higher prices later, although inevitably consumers will complain if they are not able to benefit as much as they might otherwise when prices fall.

There will be a budget statement of sorts on Friday which should provide more clarity on how these energy support schemes will be funded. The Government will be betting that the high costs of this scheme will be lower ultimately than the costs of not doing anything and allowing inflation to rise and businesses to fail. Only time will tell…

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy