Jersey Oil & Gas today announced its unaudited Interim Results for the six month period ended 30 June 2022.

Highlights

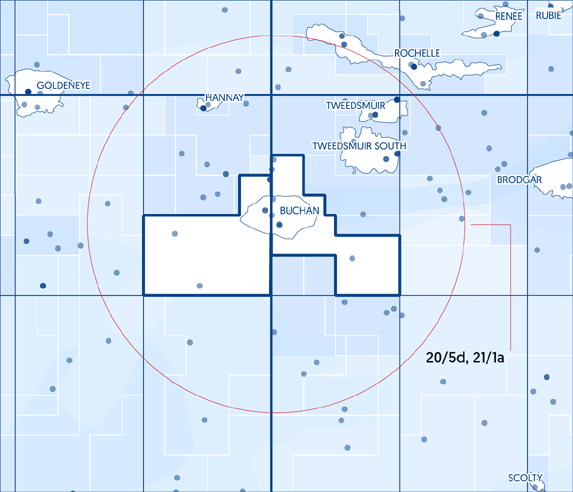

- Favourable fiscal and macroeconomic developments have further bolstered interest in our on-going "Greater Buchan Area" ("GBA") farm-out process

- GBA farm-out process advancing as planned, with continued active engagement with multiple counterparties

- Substantial progress has been made, with the majority of interested parties forecast to complete their technical due diligence in October 2022

- Constructive commercial discussions are taking place with potential counterparties

- Cash position of approximately £8.7 million, with no debt, as at 30 June 2022 - well ahead of the group's forecast

Andrew Benitz, CEO of Jersey Oil & Gas, commented:

"Great progress is being made with our GBA farm-out process - the key activity for the Group in 2022. Interest is strong, technical studies across the various development solutions are well advanced and commercial discussions are ongoing with serious, well-funded counterparties. Since launching the process, the Company's engagement strategy has been broadened to advance a range of competing development solutions, thereby providing increased optionality."

GBA Farm-out Process Update

Encouraging progress continues to be made on our GBA farm-out process, and the Company remains actively engaged with multiple counterparties. Joint technical studies for the various different development solutions are now at an advanced stage.

As previously highlighted, since launching the farm-out process, a broad range of competing development solutions has been generated to supplement the initial work on the proposed installation of a new processing platform. The alternative solutions include tiebacks to existing platforms and the re-use of available floating production, storage and offloading ("FPSO") vessels.

Since confirming the technical and economic attractiveness of the potential GBA development solutions earlier this year, JOG's most recent operational focus has been centred on completing confirmatory pre-Front End Engineering and Design studies for the various options with the different counterparties. The studies are being undertaken in collaboration with the infrastructure owners and cover areas that serve to validate and de-risk the different solutions and associated capital expenditure forecasts. While the precise studies are specific to each potential solution, they broadly cover work on flow assurance, host facility "brownfield" modification requirements and potential future electrification workscopes. This technical work is expected to conclude in October 2022.

Regional Electrification Opportunities

The different GBA development solutions that are being assessed all have the potential to be a component of the future Outer Moray Firth offshore wind electrification plans that are currently being considered as part of the Government's Innovation and Targeted Oil and Gas ("INTOG") leasing round process. As such, JOG were pleased to provide a leading offshore wind developer with a letter of support as a potential power user to assist them in their application for a lease in the upcoming INTOG offshore wind licence round. This operator has experience in both development and operations for floating offshore wind. In addition to the GBA being a potential off-taker of locally sourced wind power, there are also complimentary investment opportunities in offshore wind that require further evaluation.

Licensing activity

JOG continues to work closely and constructively with the North Sea Transition Authority ("NSTA") on their licence commitments. On Licence P2498, which includes the Buchan field as well as the J2 and part of the Verbier discoveries, JOG's milestone related to delivery of a Field Development Plan ("FDP") has been adjusted to align with the current scheduled licence expiry in August 2023 and, pending conclusion of a successful farm-out, the Company are on track to deliver on this. Upon approval of an FDP, the licence would then move into the "third phase", which covers all future development and production activities. On Licence P2170, there is a requirement to submit an FDP for the Verbier discovery in order to advance the licence into the third term. Verbier is part of JOG's phased area wide GBA development plan, with production scheduled to commence following the start of production from the Buchan field. The P2170 Licence is due to expire on 22 November 2022, therefore JOG are in close consultation with the NSTA to agree an appropriate way forward.

JOG's Acquisition Strategy

JOG's priority is to secure a GBA farm-out and any M&A activity has been focused around this objective. The Company have evaluated potential asset swaps as part of their ongoing discussions, but remain of the view that an industry farm-out provides the best solution to advance the planned GBA development and thereby deliver greater value for shareholders. Building a full cycle upstream business focused on the UKCS remains the ultimate goal for JOG.

Financial Review

JOG's cash position was approximately £8.7 million as of 30 June 2022. The cash spend of the business will continue to be comfortably below the £1.5 million per quarter run rate previously forecast. As an oil and gas exploration and development company, JOG had no production revenue during the period and received only a small amount of interest on its cash deposits.

The loss for the period, before and after tax, was approximately £1.2m (2021: £1.9m). The Company's main expenditure during the first half of 2022 related to technical studies assessing parallel development options for our GBA Development project. The Company remains well funded to fulfil its farm-out objective.

KeyFacts Energy: Jersey Oil and Gas UK country profile

KEYFACT Energy

KEYFACT Energy