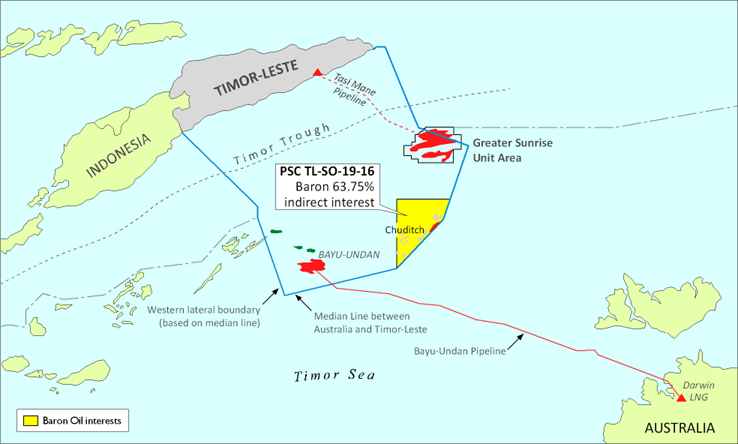

Baron Oil, the AIM-quoted oil and gas exploration and appraisal company, provides an update on the TL-SO-19-16 Production Sharing Contract, offshore Timor-Leste and the preliminary interpretation of the reprocessed Chuditch 3D seismic data.

Chuditch Highlights

- Best case aggregate gross Gas-In-Place estimate of approximately 5,500 BCF versus an equivalent estimate of 3,889 BCF prior to 3D seismic data reprocessing

- Best case Recoverable Resource estimate of 3,625 BCF, using preliminary gas recovery factors of between 50% and 75%, versus an equivalent estimate of 2,924 BCF prior to 3D seismic data reprocessing

- Chuditch-1 gas discovery best case Recoverable Resource estimate of 1,350 BCF is materially larger and may independently represent a Liquefied Natural Gas ("LNG") scale resource

- ERCE engaged to prepare a Competent Person's Report ("CPR") - potential for contingent resources to be assigned to the Chuditch-1 discovery

- Chuditch SW prospect Gas-In-Place estimate has increased, but greater structural complexity may imply a lower recovery factor

- Extension of sizable Chuditch NE Lead onto 3D seismic data area confirmed

- The previously unevaluated 'Quokka' Lead extends onto the 3D seismic data area

Technical Update

Preliminary interpretation of the Chuditch PSC reprocessed 3D seismic data is leading to significant increases in management's aggregate Gas-in-Place and Recoverable Gas Resource estimates (the "Update") compared to the previous independent Prospective Resource estimates by THREE60 Energy.

The preliminary interpretation has led to a significant uplift in seismic imaging quality and has significantly reduced subsurface risk. Mapping indicates a greater concentration of resources into the Chuditch-1 discovery in a simplified and robust structure with relatively high gas recovery expected. The adjacent prospectivity has evolved; its understanding is now more robust, including confirmation of leads extending onto the 3D seismic data area.

Consultancy group ERCE has been engaged to prepare a CPR to provide an independent validation of Baron's internal resource estimates to a SPE PRMS compliant standard, which will include a probabilistic estimate of Resources and revised risk factors.

SundaGas, a wholly owned subsidiary of Baron, is the operator of the Chuditch PSC and holds a 75% effective interest in the Chuditch PSC.

PSC Extension

As announced on 18 October 2022, SundaGas was granted a six-month extension to Contract Year Two of the PSC which now expires on or before 18 June 2023.

Development and gas commercialisation

As the preliminary subsurface interpretation is indicating an uncomplicated structural configuration for Chuditch, and subject to an ongoing revision of the Chuditch engineering concept study, a simpler field development concept is likely. The apparent increase in gas resources in the Chuditch-1 discovery itself suggests that a single appraisal well will suffice to determine commerciality of the project without the need for immediate follow-on exploration wells.

Multiple potential export solutions for gas have been previously identified which are not dependent on any single concept or route. The fastest development and export option is expected to be to utilise a hybrid floating and platform LNG system, which does not require export pipelines or border crossings.

A revision of the Chuditch engineering concept study has commenced. It is anticipated that this work will illustrate and quantify a fast-track development pathway that targets first production in 2028.

Management estimates of project economics continue to be attractive at current and long term average gas prices in Asia.

Development strategies for handling carbon dioxide could include Carbon Capture and Storage ("CCS") at Bayu-Undan or for disposal within the Chuditch PSC. SundaGas aspires to achieve net zero LNG through long term supply arrangements with buyers that have an effective Scope 3 strategy.

Farmout

The Company continues to evaluate options to secure further investment for the Chuditch project, including an ongoing farmout process, which is accelerating with the availability of the revised interpretation. The Company remains in talks with multiple potentially interested parties.

The combination of the PSC extension, availability of the new reprocessed 3D seismic data, and the external validation of Resources that are to be provided via the CPR will be of significant benefit to this process.

KeyFacts Energy: Baron Oil Timor Leste country profile

KEYFACT Energy

KEYFACT Energy