- Hartshead continued to progress an investment process for industry partnering on the Company’s Phase I development of the Anning and Somerville gas fields in June, following growing interest in the asset from several industry players. The process is aimed at selecting an industry partner for the Phase I field development.

- A Letter of No Objection has been received from UK North Sea Transition Authority (NSTA) for Phase I Development Concept of Anning and Somerville fields.

- Completion of an over-subscribed Placement to raise A$11.0 million (before costs) at a Placement price of A$0.0275 per share supported by Australian and UK institutional and family office investors.

- An agreement with Shell to conduct an Engineering Study for the preferred offtake route and agreed tie-in option for the Phase I field development.

- Cash and cash equivalents at the end of the quarter of A$11.0 million

Commenting on the Quarter, CEO of Hartshead, Chris Lewis, said:

“The latest quarter has once again seen the delivery of some key milestones for Hartshead.

Receiving our “green light” from the NSTA to prepare our Phase I FDP based on the selected development concept is another important step along the road to bringing the project into production. The very short timeframe taken to receive this letter demonstrates the quality of the concept and the desire for the UK regulator to move projects through development and into production as efficiently as possible.

Securing our gas export route has always been a key part of delivering a commercial gas development project. I am delighted to be working with Shell & Petrofac to further refine the engineering and costs required to tie our planned infrastructure into the Shell network.

Thank you to the Hartshead team for their continued work and effort in delivering time and again with our Phase I development. I would also like to thank shareholders and CPS Capital for their continued support, which has been demonstrated in the result of our recent capital raise, being significantly oversubscribed.

During the quarter ahead, we continue to work on the Phase I Field Development Plan preparation and the partial divestment process is underway with LAB energy advisors. I look forward to updating shareholders in due course as we maker further progress on these and other key workstreams.”

SEAWARD PRODUCTION LICENSE P2607, OFFSHORE UNITED KINGDOM

(HARTSHEAD RESOURCES 100% AND OPERATOR)

Hartshead Resources today provides an overview of the Company’s quarterly activities for the period ending 30 September 2022.

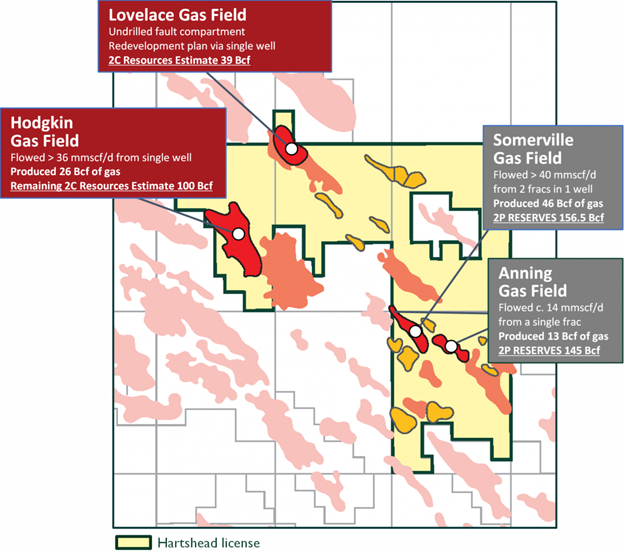

The Company’s Seaward Production License P2607 covers five contiguous blocks (48/15c, 49/6c, 49/11c, 49/12d and 49/17b) located in the Southern North Sea (Figure 1) with 301.5 Bcf1 of independently audited 2P Reserves and 139 Bcf2 of 2C Contingent Resources within four existing discoveries.

Figure 1. Hartshead Resources Seaward License P2607 holds multiple gas fields and prospects.

Further progress in the Phase I development of the Anning and Somerville gas fields was achieved during the Quarter with the following key announcements:

- The receipt of a “Letter of No Objection” from the North Sea Transition Authority (“NSTA”) in respect of the development concept for the Phase I development of the Anning and Somerville gas fields;

- Completion of an over-subscribed Placement to raise A$11.0 million (before costs) at a Placement price of A$0.0275 per share;

- Agreement with Shell UK Exploration & Production Limited (Shell) to conduct an Engineering Study for the preferred offtake route and agreed tie-in option for the Phase I field development.

The recent capital raise provided investors with an opportunity to invest in Hartshead's strategy to develop and produce indigenous gas to assist with the UK’slong-term strategic gas requirements amid government focus on strategic energy security and the importance of domestic energy production.

The capital raise, coupled with the Shell Engineering Study, will also enable the Company to advance the development of the Anning and Somerville gas fields into the “Define” stage of Field Development Planning, together with preparations for project financing of the Phase I development, prior to taking a Final Investment Decision (FID) in 2023.

PHASE I FIELD DEVELOPMENT – ANNING AND SOMERVILLE GAS FIELDS

Concept Select Report (CSR) – NSTA Letter of No Objection

Six weeks following the submission of its Phase I CSR for the Anning and Somerville gas field developments in May 2022 the Company was able to announce that it had received a “Letter of No Objection” from the NSTA.

The selected development concept submitted to the NSTA consists of six production wells from two wireline capable Normally Unmanned Installation (NUI) platforms at Anning and Somerville connected via a subsea umbilical to third party infrastructure for onward transportation and processing to entry into the UK gas network.

The Letter of No Objection confirmed finalisation of the “Assessment Phase”, entry into the “Authorisation Phase” and also provided no objection to the Company preparing a Field Development Plan (FDP) for the Anning and Somerville fields as described in the Concept Select Report.

Shell Engineering Study Agreement

During the reporting period Hartshead announced that it had entered into an agreement with Shell UK Exploration & Production Limited (Shell), to undertake an Engineering Study for tie-in of Hartshead’s Phase I gas field development to Shell’s infrastructure. The Study agreement provides a basis of design and cost estimate for the tie-in of facilities through Shell’s infrastructure detailing the required brownfield modifications as part of the gas offtake route for the Anning and Somerville gas fields.

The study work, which has now commenced, is being undertaken by Petrofac and managed by Hartshead. Shell will provide project assurance, prior to entering the next phase of engineering work, which is the FEED, prior to FDP submission to the UK government.

The Engineering Study will enable Hartshead to define its route to transport its natural gas and condensate to the prospective points of sale and is, therefore, a critical component of the future FEED and FDP workstreams.

CORPORATE & FINANCIAL

During the reporting quarter, and concurrently with the commencement of the Shell Engineering Study, the Company announced an over-subscribed Placement of A$11.0 million (before costs) by way of the issue of 400 million new Shares at an issue price of A$0.0275 per Share. The Placement was supported by a number of Australian institutional and UK institutional and family office investors.

Hartshead Directors, in support of the Company and the Placement, subscribed for a total of A$500,000 of new shares at an issue price of A$0.0275, which are subject to shareholder approval at the upcoming Annual General Meeting (AGM) on 31 October 2022.

KeyFacts Energy: Hartshead UK country profile

If you would like to discover more about KeyFacts Energy, contact us today and we can arrange a 15-minute online meeting to review our database of over 2,600 continually updated 'country-specific' oil and gas and renewable energy profiles from a selection of 144 countries. Find out how you can instantly identify companies with operational activity in your chosen country, 'fine-tune' your news or company selection based on industry category, energy type or regional location and additionally benefit from one to one contact with us to ensure maximum online and social media exposure for your company.

KEYFACT Energy

KEYFACT Energy