ound Energy, the transition energy company, provides the following project financing update.

Farm-Out Update

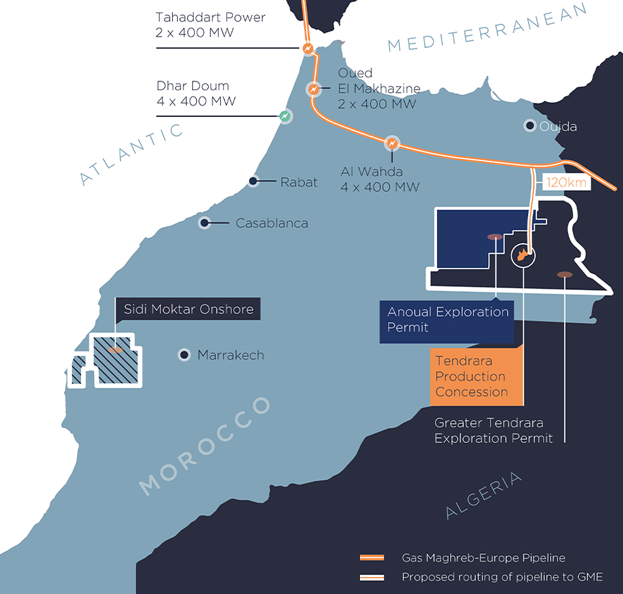

The Company announced on 9 August 2022 that it had initiated a formal farm-out process for the Tendrara Production Concession and the surrounding Grand Tendrara and Anoual exploration permits. The objective of the area-wide farm-out is to seek a co-investing partner in each licence to both fund the expected balance of Phase 2 development costs to first gas of approximately US$60 million net to the Company's working interest in the Tendrara Production Concession and also to progress an exploration and appraisal drilling programme in the Grand Tendrara and Anoual exploration permit areas.

The Company has received strong interest in the process from a wide range of credible and well-funded parties. Management presentations and data room evaluations are ongoing, and further announcements will be made, as appropriate, in due course.

Phase 2 Development Financing Update - Lead Finance Arranger Mandate

The Company announced on 23 June 2022 that it had entered into an Arrangement and Mandate letter ("Mandate") with Attijariwafa bank (the "Arranger"), a Moroccan multinational bank and one of the leading banks in Morocco, under which the Company mandated the Arranger in relation to the arrangement of project debt financing for the development of Sound Energy's Tendrara Production Concession (the "Agreement").

Pursuant to the Agreement, the Arranger was mandated, and provided with exclusivity by the Company for a period of eight months, to arrange a long-term project senior debt facility with a term of no more than 12 years of up to 2.250 billion Moroccan dirhams (approximately US$206 million using current exchange rates) for the partial financing of the currently estimated approximately US$330 million total Phase 2 development cost (including development wells post-first gas) of the Tendrara Production Concession (the "Financing").

Under the terms of the Mandate, the parties agreed to seek to negotiate binding terms for the Financing within 120 days of entry of the Agreement. Whilst discussions between the parties are progressing well, the Company announces that the parties have entered into an amendment to the Mandate in order to extend the date by which they will seek to negotiate binding terms for the Financing to 15 December 2022. For the avoidance of doubt, the eight-month period of exclusivity provided to the Arranger in order to arrange the Financing remains as per the original Mandate.

Phase 2 Development Gas Sales Agreement

The Company announced on 30 November 2021 that it had entered into a binding gas sale and purchase agreement (the "GSA") in respect of the Phase 2 development of the Tendrara Production Concession with Morocco's state-owned power company ONEE (Office National de l'Electricite et de l'Eau potable) for the sale of natural gas from the Tendrara Concession in Eastern Morocco over a 10-year period.

The GSA remains conditional upon, inter alia: (i) all necessary authorisations and permits having been granted for the construction of the Phase 2 gas installations; and (ii) the final investment decision, when taken, by the Tendrara joint venture partners, being approved by the Moroccan Ministries of Transition Energy and Sustainable Development and Economy and Finance;

Pursuant to the terms of the GSA, the Company announced on 9 March 2022 that it had agreed with ONEE a 90-day extension to the period by which the conditions would be required to be satisfied in order for the GSA to become effective. Whilst good progress is being made in order to satisfy the conditions, the Company announces that it has agreed with the parties to the GSA to extend the date by which the conditions should be satisfied to 30 June 2023.

Commenting, Garry Dempster (CFO) said:

"Alongside the Company continuing to make good progress on executing the Tendrara Phase 1 gas development, I am pleased with the progress that the Company is making in advancing project funding for the proposed Tendrara Phase 2 gas development. Strategically, for Sound Energy, its licence partner ONHYM and for Morocco, this is a critical project that will propel the Company's future growth along with forming a key pillar of Morocco's energy strategy centred around the energy transition.

There is a complex series of inter-related steps necessary to be advanced and completed in order that the Company and its partner, ONHYM, can take a final investment decision on the development. Consequently, and whilst the Company is making good progress in this regard, I am pleased that we have agreed an extension to the back-stop date of the ONEE GSA to June 2023 to allow us to focus on delivery of the various pre-FID activities, including conclusion of ongoing discussions with EPC contractors to execute development activities.

Furthermore, I am encouraged by the strong level of interest in the ongoing farm-out process, from well-established and notable industry players. This is testimony not just to the increased appetite for investment in well-positioned gas portfolios such as ours but to the quality of the underlying opportunity upon which Sound Energy's strategy is centred.

We look forward to further positive updates as the various planned milestones are delivered."

KeyFacts Energy: Sound Energy Morocco country profile

KEYFACT Energy

KEYFACT Energy