On 7 October of this year, the North Sea Transition Authority (NSTA) officially introduced a new round of offshore licensing applications in the North Sea. This round is an opportunity for oil and gas operators to explore and potentially develop up to 898 blocks and part blocks, which may lead to over 100 licenses being awarded.

Phil Crookall, Principal Advisor - Energy, RPS Energy

Unlike previous rounds, the NSTA has identified four priority cluster areas this time. These locations are known to have hydrocarbons and are close to existing infrastructure. They are in the West of Shetland, Northern North Sea, Central North Sea, Southern North Sea and East Irish Sea.This licensing round aims to quickly increase UK oil and gas production, reducing reliance on international imports. While the UK has made great strides in renewable energy production, especially offshore wind, oil and gas currently still provides 75% of UK energy requirements.

Unlike previous rounds, the NSTA has identified four priority cluster areas this time. These locations are known to have hydrocarbons and are close to existing infrastructure. They are in the West of Shetland, Northern North Sea, Central North Sea, Southern North Sea and East Irish Sea.This licensing round aims to quickly increase UK oil and gas production, reducing reliance on international imports. While the UK has made great strides in renewable energy production, especially offshore wind, oil and gas currently still provides 75% of UK energy requirements.

According to the NSTA, the average time between discovery and first production is nearly five years. By focusing the 33rd licensing round on known areas of hydrocarbons, successful applicants should be able to speed through the early asset lifecycle phases of exploration and appraisal and concentrate on the development and production phases, reducing the timeline considerably.

To be considered for a licence, all applicants must show financial, environmental, and governance capabilities, including a path to Net Zero.

Environmental appendices and Net Zero pledges

The Climate Change Act set a Net Zero greenhouse gas (GHG) emissions target in law, requiring the UK to reduce all greenhouse gas emissions to Net Zero by 2050. The UK has also committed to reducing greenhouse gas emissions from offshore oil and gas activities to make the UK continental shelf a net zero basin by 2050. Additionally, the UK is accelerating the elimination of routine flaring beyond the targets set by the World Bank's Zero Routine Flaring by 2030 initiative.

How does this impact applications for the 33rd licensing round?

- The commitments made by the UK government require all submissions to include both historical and forward-looking data. The application must now address five environmental factors, including:

- Consideration and evaluation of potential climate change impacts from the proposed work programme

- A strategy for reducing and mitigating greenhouse gas emissions, including CO2

- Targets and measures to avoid, mitigate or offset emissions resulting from the proposed work programme

- A detailed plan to review the strategy and monitor emissions and offsets

- A summary of the measures implemented and progress made towards reducing greenhouse gas emissions since 2018 from existing UK well operations and offshore petroleum operations.

RPS experience with tying fields to existing infrastructure

The idea of smaller fields being tied back to existing infrastructure is, of course, not a new one.

RPS has previously played a significant role in supporting companies' approach the challenges of these types of assets. Examples include the Don Fields (Don Southwest and West Don) for Valiant Petroleum and, prior to that, as part of the Mature Asset Strategy Team (MAST) where RPS was part of a consortium that was hired by bp to cast "fresh eyes on old fields". We successfully identified infill locations with a high probability of success and advised bp on their opportunities in the Thistle, Beatrice, Buchan and Clyde clusters.

The Don Fields

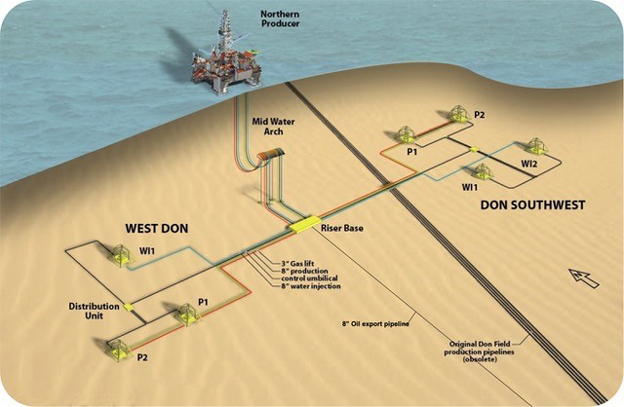

The Don field had been previously developed by bp but was abandoned in 2002. Valiant Petroleum acquired the rights to the Don Southwest and West Don areas from bp. Partnership groups for the assets consisted of Petrofac (subsequently Enquest) for Don Southwest and a consortium made up of Petrofac, FirstOil, Stratic and Nippon for West Don. Valiant also later became the operator for the Causeway development another near infrastructure tieback.

Image source: Valiant Petroleum PLC

Several regulatory and financial hurdles needed to be addressed before Valiant Petroleum was accepted as a development partner and operator in the North Sea.

RPS worked in collaboration with Valiant Petroleum to commission, build and implement their Environmental Management System (EMS) to address its environmental policy documentation and to comply with governmental regulations. The regulatory authorities subsequently approved the systems allowing Valiant to become both an exploration and production operator.

To raise further funds to bring the fields into production Valiant was admitted to the Alternative Investment Market (AIM) on the London stock exchange through an initial public offering. RPS conducted the Competent Persons Report(CPR) to support the funding. A CPR provides an independent view of the Reserves or Resources of a company's asset for potential investors and is critical in raising funds.

The two Don fields and surrounding panels were examined in detail by RPS for the CPR. A range of economically recoverable oil for the area was calculated as lying between 33.5 million barrels and 57.5 million barrels, depending on oil price and other external cost factors.

The fields were developed with subsea completions tied to the Northern Producer floating production facility and tied back through the Thistle platform. Between 2009 and 2021, the fields and surrounding panels recovered more than 52 million barrels of oil.

KeyFacts Energy Industry Directory: RPS Energy

KEYFACT Energy

KEYFACT Energy