Tower Resources today provide an update on its activities in respect of its Thali Production Sharing Contract ("PSC"), in the Rio Del Rey sedimentary basin offshore Cameroon.

Highlights:

- Applied for a one-year extension of the initial exploration period of the PSC, following positive discussions with the Minister of Mines, Industry and Technological Development and ("MINMIDT") and the Prime Minister of the Republic of Cameroon.

- Discussions continue with rig owners and operators with the aim to secure rig availability in the third and fourth quarter of this year to drill at NJOM-3.

- Discussion for a term loan of approximately $7 million with BGFI Bank Group ("BGFI") is ongoing and the Company is also actively discussing asset-level financing with several parties.

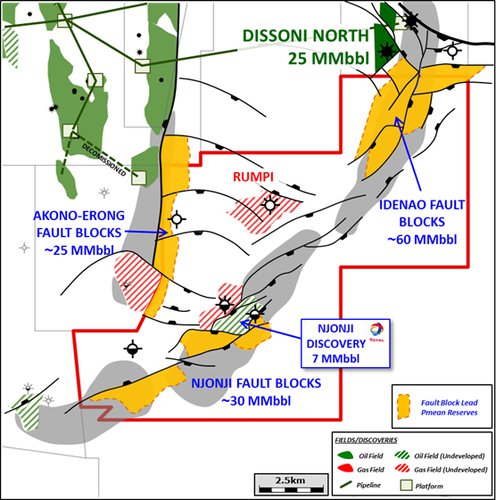

- Updated resource estimates and risks for the reservoirs connected to the NJOM-1 and the NJOM-2 discovery wells, substantially lowering risk attributed to PS9 Sup and PS3 HW reservoirs, and increasing total risked pMean prospective resources to 35.4 million bbls.

- Deployment of Paradise® software[1] to conduct detailed attribute analysis of the reprocessed 3D seismic data to identify the oil and gas elements of the reservoirs in the Njonji-1 and Njonji-2 fault blocks, resulting in a clearer picture of the pay zones in both fault blocks.

Jeremy Asher, Tower's Chairman and CEO, commented:

"We are very pleased with the progress that we are making on the Thali PSC and the NJOM-3 well, and we believe that we are close to having a final schedule for this well, which will be transformational for the Company.

"We are finally able to see viable rig slots appearing, and we are now working on the assumption that we will be able to get the NJOM-3 well spudded over the next nine months.

"Every additional piece of subsurface work also increases our confidence in the size and value of the resource that we are targeting, both in terms of the volumes connected to the existing discovery wells and the substantial upside in additional reservoirs.

"We also have a number of different financing options, which we expect to combine to obtain the funds needed for the well.

"We are as excited as ever about the Thali PSC, and very grateful to MINMIDT and the Republic of Cameroon for their continued support."

Extension of the initial exploration period of the PSC

The Company has formally applied to MINMIDT, with copy to the Societe Nationale de Hydrocarbures, for a further one-year extension of the initial exploration period of the PSC (which currently runs to 11 May 2023) following meetings with the Minister of MINMIDT and the Prime Minister of the Republic of Cameroon. During those meetings, in which the Company explained the status of current rig discussions, both Ministers indicated that they would support the further extension.

Rig availability and NJOM-3 well timing

The Company has continued to maintain discussions with rig owners and operators throughout the past year. As previously announced, rig owners are reluctant to commit rigs to a single well except when gaps appear in other operators' schedules, this is due to balancing the risk of losing long term contracts for a single well contract. At present, the Company is looking closely at two possible rig availabilities, with different rigs and owners, one in the third quarter of 2023 and one in the fourth quarter. In order to take advantage of either, when available, the Company will need to have put sufficient financing in place to cover a significant level of prepayments. The expected cost of the well is discussed in more detail below. At this stage there is no certainty on availability of the rigs; however, as soon as this changes the Company will update the market.

Cameroon financing

As announced on 29 June 2022, the Company has been discussing a term loan of approximately $7 million with BGFI Bank Group, the largest bank group in Central Africa, which is supported by the Cameroon bank but is now subject to a review by the bank's group credit committee. The Company understands that this review is linked to a broader review of the capital available to the Cameroon bank for writing new business in the year ahead, which has impacted the time taken, and therefore the outcome remains uncertain. However, the Company has been assured that the process is still ongoing, and that the Cameroon bank continues to support the Company's plan.

Tower has also continued to pursue possible financing at the asset level, whether in the form of a farm-out or a financial investment in the Company's operating subsidiary, Tower Resources Cameroon SA ("TRCSA"), to achieve a similar economic result without the need for a formal approval process. Discussions are taking place with multiple credible groups, who have all executed NDAs and are all currently working within the virtual data room.

The Company's objective remains to raise up to $15 million through a combination of asset financing in the form of debt or equity, with asset-level financing preferred to issuing corporate level equity. Tower will update the market as, and when, any agreements are reached.

Cameroon updated internal resource estimates

Since the Company's updated internal resource estimates last year, Tower has continued to undertake further G&G work with two objectives: first, to further refine the Company's understanding of the additional reservoir potential that was identified, and second, to refine the choice of well location for the NJOM-3 well.

In particular, the Company has conducted a more detailed attribute analysis of the reprocessed 3D seismic data which Tower obtained in 2018, using the AI-driven Paradise® workbench software from Geophysical Insights, to identify more clearly the location of the oil and gas elements of the reservoirs in the Njonji-1 and Njonji-2 fault blocks which were connected to the original NJOM-1 and NJOM-2 wells drilled by Total.

The Paradise AI workbench analysis has resulted in higher resolution of the PS9 (Sup) and PS3 pay zones in the Njonji-1 fault block which has both confirmed the additional volumes identified in Tower's previous estimates and also substantially de-risked them. The analysis also provides better resolution of the PS9-R1 reservoir in the Njonji-2 fault block, including identifying an additional potential oil leg below the gas encountered in the NJOM-2 well, which was not included in the contingent resource estimates as only its gas cap was connected to the well.

The Company has therefore prepared updated internal resource estimates and risk estimates for the reservoirs connected to the NJOM-1 and the NJOM-2 discovery wells, and has also reviewed the risking of the PS9 Sup 1 and 2 reservoirs which appear to be present in the Njonji-1 fault block but were not connected to the NJOM-1 well. These updated internal resource estimates are set out in detail in the linked presentation, and also in the Notes section of this announcement. While the underlying volumetrics are unchanged, the improved risking has led to an increase in the risked pMean recoverable resources compared with the estimates of prospective resources published in June 2022, which were themselves a little higher than those contained in the OIL Reserves/Resources Report dated 12 March 2020.

The latest company estimate of risked pMean recoverable resources is now 35.4 million barrels. The changes from previous internal company estimates can be summarised as follows:

- Risked pMean recoverable resources in fault block 1 increased from 10.5 to 12.9 million bbls

- Risked pMean recoverable resources in fault block 2 increased from 4.1 to 4.9 million bbls

- Risked pMean recoverable resources in South fault block unchanged at 17.6 million bbls

The Company will update its CPR to SPE/PRMS standards in due course.

NJOM-3 well budget

One outcome of the better imaging of the PS9-R1 and PS-3 reservoirs afforded by the attribute analysis has been a review of the optimal point of intersection for the NJOM-3 well. Based on Tower's latest prognosis, the Company believes that the NJOM-3 well can intersect as much as 75 metres of net pay in the PS9-R1 and PS3-R1 sands alone, with substantial further pay zones expected to be encountered in the PS9 Sup 1 & 2 and the PS3-HW reservoirs. However, this will require either moving the well somewhat to the northwest or deviating the well to achieve the same result.

The Company has had to take account of additional factors that may increase the expected cost to drill the well, including: higher costs associated with the well planning (including the survey costs and change of location or deviation); and higher rig rates and service company and vessel costs. On the other hand, these may be somewhat mitigated by lower fuel costs (since the peak level of oil prices) and Tower also expects lower mobilisation/demobilisation costs with the rigs it is currently considering. Furthermore, the Company is now working on the assumption that it may no longer be practical to undertake a full DST (flow test to surface) immediately, given the long lead times on test equipment, especially if the Company is to drill in the third quarter or early in the fourth quarter of this year, but the Company is working on an alternative method to achieve a shorter period flow test which will also reduce costs.

The Company's current cost estimate to complete the NJOM-3 well is approximately $15.5 million.

KeyFacts Energy: Tower Resources Cameroon country profile

KEYFACT Energy

KEYFACT Energy