By Kathryn Porter, Watt-Logic

My blog is 7 years old today!

This past year has seen some interesting and unexpected developments for my business and my blog. The blog has been more widely read than ever, particularly my articles about Norway, one of which went genuinely viral on LinkedIn. I’ve also been quoted a lot in the press and appeared on radio and television regularly since last summer. People have even recognised me in the street, which is a little bit strange, but, it’s a fantastic opportunity for me to build my business.

What I find most interesting though is the way that the conversation around energy has evolved over the past year. Unfortunately, there are some aspects in which it hasn’t changed but needs to – energy companies still attract a disproportionate amount of negativity from the media and to a certain extent from the Government. Energy suppliers continue to be vilified by both the energy ministry in its new guise as the Department for Energy Security and Net Zero (I prefer “Department for Energy” and wish we could stop using the names of ministries for spin) and by Ofgem. This is unhelpful and drives an approach to policy and regulation that continues to strangle the industry.

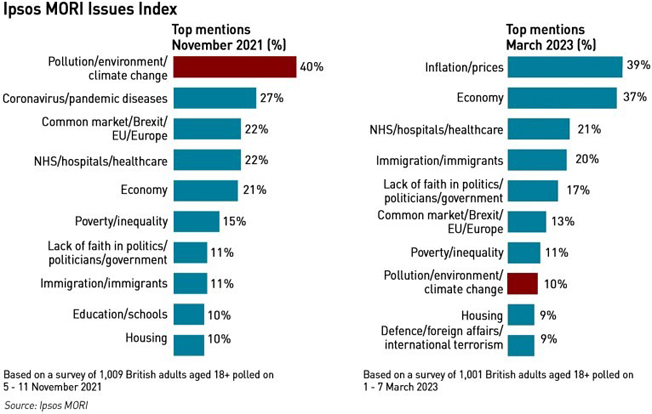

But there are more promising signs elsewhere. There is a growing realisation that security of supply has been neglected in the pursuit of net zero and that this is inappropriate. The “trilemma” is back with de-carbonisation being de-prioritised in favour of affordability and security, reflecting public concerns. Since the UK hosted COP 26 in November 2021, the number of people seeing climate and environment as a key issue has fallen from 40% to 10%.

While there is still room for improvement, Government policy now has a stronger emphasis on energy security, with efforts to boost domestic oil and gas production, develop more nuclear power, and continue to support gas-fired generation including building new unabated CCGTs. However, targets are still expressed as limits (“up to XX MW” rather than “at least XX MW”) which sets the scene for failure, as does the persistent focus on the troubled European Pressurised Water reactor. The fact that Olkiluoto has finally started commercial operation – 14 years late, 18 years after it broke ground, and €8 billion over budget – does not really provide comfort.

Another interesting development is a recent change in attitude towards ESG (Environmental, Social and Governance) concerns among investors. Over the past few years, ESG investing has been all about moving away from fossil fuels and supporting investments in the energy transition, but often in a one-dimensional way that has ignored sensible, sustainable investments for superficial reasons. For example, projects to replace the use of solid fuels, often dried dung, with LPG as a cooking fuel in parts of Africa, something which would have both remove immediate health detriments for households and have wider environmental benefits, have been declined on the basis that “we don’t do fossil fuels”. This condemns the people concerned to continuing with a more harmful status quo to satisfy the smug virtue signalling of privileged people in developed nations.

This is starting to change, as concerns over greenwashing and economic pressures have seen ESG falling down corporate agendas. Hopefully this will see the start of a more thoughtful approach to the subject, with funds flowing towards projects which deliver tangible benefits: perfection is often the energy of the good as noted in the example above. There is a mixed picture in the fund management industry with some surveys suggesting an increasing focus on ESG while others suggesting the opposite. However, the base is low – in the UK just 6% of funds under management are invested in ESG-oriented assets, using a broad definition of ESG.

My sense is that there is a change in the air – when I speak with analysts and fund managers my impression is that the days of carbon dioxide being the primary measure of environmental sustainability are coming to an end. This is welcome – the pursuit of net zero carbon is boosting demand for dirty lithium-ion batteries which cause water pollution, water shortages, and are plagued with issues of child labour. There is also a growing understanding that the energy transition will create huge increases in demand for minerals where environmental concerns over extraction, processing and shipping are not insignificant.

Across the energy landscape there is also a much higher recognition of geo-political considerations. The war in Ukraine is sadly continuing, and had re-drawn global energy maps. Europe has turned to the US and Africa for its gas, while Russia is now looking to sell to China and India rather than the EU. Western countries are also conscious that those growing requirements for minerals come with an increased dependence on China and Chinese-controlled assets.

But there are still many ways in which Western governments are inflicting harm on their own economies and citizens. Germany has just closed its last three nuclear reactors, extending its reliance on coal – last year 30% of Germany’s electricity came from coal. Of course, Germany is still using nuclear power, it just now imports more of it from France. These three reactors all opened in 1988 which means they are slightly younger than the median age of the French fleet which is around 37.5 years – the German reactors may well be in better condition than those producing the electricity it now buys from France. Perhaps Germans believe radiation from a French nuclear accident will stop at the border and not affect them?

And here in Britain, the Government is pressing ahead with plans to force the owners of buildings to achieve higher Energy Performance Certificate (“EPC”) ratings despite the scheme being widely discredited, and it often being impossible to increase the rating without unreasonable levels of expenditure. Demolition and re-building is likely to be a preferred route for many, assuming planning permission can be obtained, but this will release large amounts of embodied emissions. Reform of the EPC essential if a prolonged down-turn in the real estate market is to be avoided and there is a real risk of wealth destruction as home-owners are forced into retrofits that are extremely expensive and likely to reduce their comfort levels.

Norway appears to be taking the lead in some restoration of common sense to energy policy. This year it plans to legislate to enable electricity exports to be restricted in order to avoid domestic shortages. It is also considering pausing the electrification of some gas infrastructure due to concerns over electricity supplies (among other things). Norway is continuing to develop its gas assets, with plans for new extraction and pipelines.

France is also waking up to the risks of being depended upon as the other main source of backup power to northern Europe’s reliance on wind and solar energy. Earlier this month, the French Parliament produced a long report criticising EU energy policy and pointing out that: the EU must “take an interest in the coordination of means of production and not only in interconnections”, even if they are essential to the energy sovereignty of member states. This is essentially the point I have been making over the past couple of years – reliance on interconnectors for imports allows countries to outsource investments in generation (and at times also transmission) capacity, often to the detriment of citizens (tax and bill payers) of the exporting countries. Both France and Norway have realised that their interconnection with other electricity markets is both raising costs for domestic consumers, both households and businesses, and reducing security of supply.

Security of supply has been threatened in other ways, with the sabotage of the Nord Stream pipelines last September. Since then, there have been various troubling sightings of Russian vessels around key off-shore energy infrastructure belonging to both Britain and Norway – both countries have stepped up military surveillance in their territorial waters.

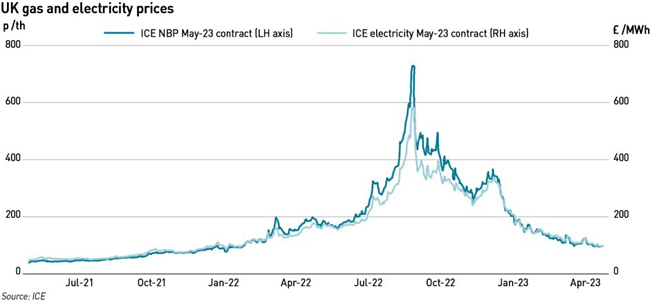

But the really big news of the past year was the levels to which gas and electricity prices rose and the policy responses to those price increases. Here in the UK, the Government handed out subsidies to almost all consumers – at generous levels for the winter, and rather less generous levels thereafter, although wholesale prices have also fallen. With most forms of consumption being subsidised as well as large portions of generation (almost all wind under the Renewables Obligation and its successor scheme the Contract for Difference, most solar under the now discontinued FiT scheme, and large amounts of thermal generation under the Capacity Market) we only need a few subsidies for networks, and we’ll be subsidising the entire electricity value chain.

Similar subsidies for end consumers have been deployed across the EU which has also followed the Iberian countries in imposing a cap on gas prices, despite mixed results from the Iberian experience. So far this EU-wide cap has had limited impact since prices have stayed well below the cap level.

In addition to subsidising end consumers, governments have also rushed to impose windfall taxes on the “excess” profits earned by energy companies as a result of higher prices. There is a popular narrative that these profits are “un-earned” but this ignores the significant effort required to find and develop new upstream assets, and while a windfall tax on electricity generated by subsidised windfarms is understandable, applying the tax to oil and gas is much less so. Development of upstream oil and gas assets is not subsidised in the UK, and as many as 70% of exploration wells are dry, for which companies receive no compensation. The windfall tax in the UK, and in particular its extension in the autumn, have been particularly damaging for domestic oil and gas production and needs to be urgently re-visited. The EU windfall tax is subject to a legal challenge by ExxonMobil.

The past couple of years have been genuinely dramatic in the energy markets, beginning in September 2021 with the asymmetric recovery from covid, and the Russian invasion of Ukraine in February 2022. Over the past year, the markets have been adjusting to the impact of these events, and while prices have fallen back to levels last seen at the end of 2021, before the invasion they are still more than double where they were two years ago. For now, the trend is downwards, although there are still risks as we move through the summer. Lower prices mean more competition from Asia for LNG, and if Europe cannot re-build its storage inventories by the start of winter, prices will rebound, and security of supply will be at risk. While Britain’s gas supply balance is more comfortable, it will still be affected by price contagion should the EU be short.

Electricity security concerns have not reduced since last year. Last summer’s heatwaves stressed grids across Europe, and although Norway’s reservoirs have recovered and French nuclear output has risen the entire market is becoming increasingly vulnerable to low wind conditions – as I write this (Wednesday 26 April) there is almost no wind on the GB grid and we are relying on imports. Last summer, a high pressure weather system saw low wind across northern Europe for weeks on end – a repeat, whether in summer or winter, will create shortages, and the more we close conventional generation – Germany having just closed its last three nuclear reactors – the more vulnerable we will be to blackouts. Outages in summer are inconvenient, but outages in winter may well cause fatalities with increased accidents on roads and in homes during the hours of darkness.

Hopefully that won’t be the topic of next year’s anniversary blog…

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy