Hartshead Resources (HHR) today advised that Chief Executive Officer Chris Lewis has delivered a video update on the Company’s Transformational Farm-Out Agreement.

In the video, Mr Lewis discusses:

- A Hartshead Resources company update

- The recent transformational farm-out deal with Rock Rose Energy

- An update on the phase one gas fields development project

- Overview of the macroenvironment

The video update can be viewed here.

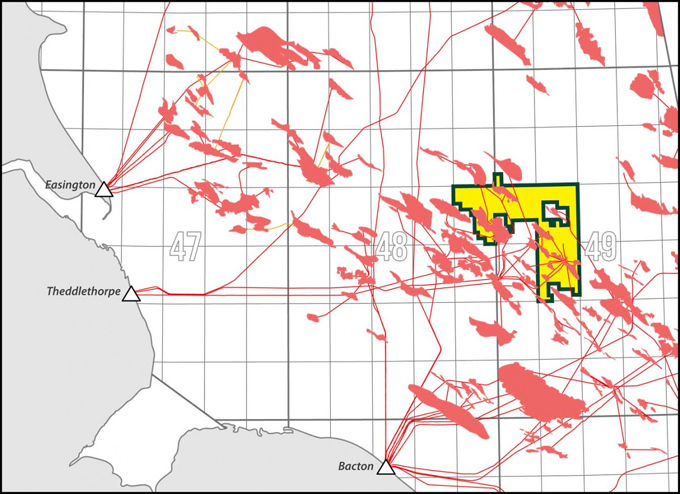

HHR announced the partial divestment of 60% of their 100% interest in the P2607 licence to RockRose Energy (independent U.K. North Sea producer of ~27,000 bopd) for up to a A$205 million consideration. Importantly, the deal was structured to ensure HHR achieves maximum benefit of the tax relief associated with the Energy Profits Levy (91.4% tax relief for Capex spent on new developments).

When the divestment consideration is paired with the $20 million placement and the $100 million of debt funding that management is confident in securing (Q3 CY23), HHR is on a path to being funded to execute on the Phase I development. Importantly, HHR retains operatorship (transfer at a future date) to drive the project to FID targeted for Q3 CY23.

Impact

The partial divestment is a key de-risking event partial divestment is a key de-risking event partial divestment is a key de-risking event partial divestment is a key de-risking event partial divestment is a key de-risking event partial divestment is a key de-risking event partial divestment is a key de-risking event for the project, bringing in a well-funded competent JV partner, reducing net Capex requirements and providing funds for HHR's net remaining Capex share. In addition to the recently announced agreement of commercial terms for gas transport and processing with Shell, the project is now set on the path for the project is now set on the path for the project is now set on the path for the project is now set on the path for the project is now set on the path for the project is now set on the path for the project is now set on the path for execution post the upcoming completion of FEED and successful FID.

While the deal was on good terms and is a significant de-risking event, it does reduce HHR's equity interest in the project to 40% (we previously modelled 50%) and the company has now communicated that first gas has been delayed to H1 CY25 (previous target of end-CY24). When incorporating lower pricing on the gas price futures curve out to CY2027 (compared to when we initiated in January) and dilution due to the placement, we decrease our unrisked valuation to $0.18/sh.

Risks for the projects have been materially reduced with the farm-out resulting in HHR being fully-funded to meet its estimated share of the non-debt project development costs. Due to the tax relief on new developments we view any potential cost overruns as relatively low risk (91.4% tax relief). Remaining risks are securing debt (which management is confident on due to a number of potential options, most likely pre-payments) and timeline associated with lead times on procuring, constructing and installing development infrastructure.

Potential upside is the discussion on potentially reducing the 75% Windfall Profits Tax below a certain gas price, which could have a significant positive impact on project NPV. Acreage awarded through the up and coming results of the 33rd licensing round could also provide additional upside for the company.

Source: Euroz Hartleys Limited

KeyFacts Energy: Hartshead UK country profile

KEYFACT Energy

KEYFACT Energy