Highlights:

- Hartshead has completed the Farm-Out Agreement with RockRose Energy for the divestment of a 60% equity interest in its UK Southern Gas Basin License P2607.

- Farm-out provides Hartshead with a gross consideration of approximately A$196.3m for Phase I.

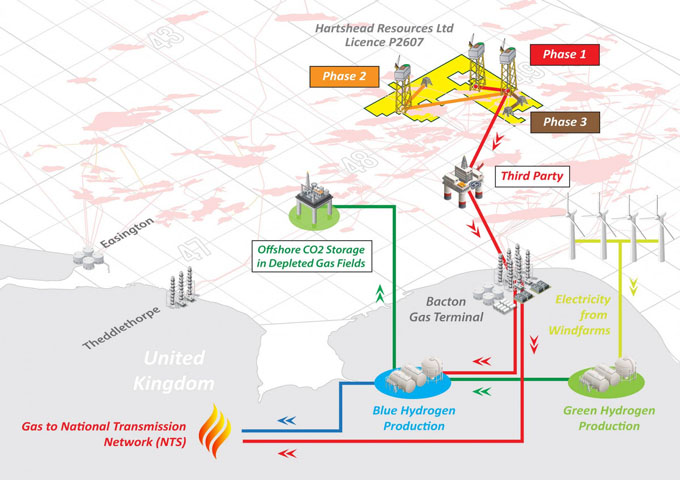

- Farm-out materially de-risks the project and provides A$536 million of gross project expenditure and a clear pathway to full financing and subsequent project development of the previously

- producing gas fields.Initial cash payment of over A$12 million made by RockRose takes Hartshead’s cash balance to over A$35 million.

- Additionally, A$135.7 million consideration committed by RockRose for purchasing Hartshead’s 60% interest will meet Hartshead’s equity requirement for the project development costs of Phase I.

Hartshead Resources has announced the completion of the Farm-Out Agreement (FOA) with established UK North Sea independent RockRose Energy for a divestment of a 60% equity interest in its UK Southern Gas Basin License P2607.

The FOA will provide Hartshead with a total gross consideration of approximately A$196.3 million, which includes reimbursement of past costs, a partial carry on HHR’s share of development costs, bonus milestone payments, and $48.4 million of UK government Investment & Capital Allowance.

The completion of the Farm-out is a major milestone for Hartshead, as it materially de-risks the project and provides a clear pathway to the full financing and subsequent development. The transaction implies a significant uplift in value for the project and secures over $536 million of gross project expenditure, which provides both technical and commercial validation of the Company’s gas development.

A Final Investment Decision (FID) for Phase 1, which includes the redevelopment and drilling of the Anningvand Somerville fields, will be taken in Q3 2023. Six production wells are planned and are forecast to come onstream in 2025 at gross peak production rates of 140 mmcfd (net 56 mmcfd to Hartshead, or over 9,000 boepd).

The Company has recently advanced discussions with a number of groups on the debt financing of its remaining share of development costs and has strong confidence in successfully concluding these discussions. At this stage the remaining development financing will likely comprise of a bond issue, pre-sale of Hartshead’s net gas sales, or a combination of both. The Company is currently working through proposals in order to deliver an optimal solution.

Chris Lewis, Hartshead CEO, stated:

"The completion of our FOA with RockRose Energy represents a significant milestone for the Company, as it not only derisks the project but importantly, with the ~A$148 million Phase 1 CAPEX contribution as part of the divestment, combined with the cash position of over $35 million, Hartshead has the equity funding required to meet the Company’s share of non-debt project development costs for Phase I. Retaining the EPL tax benefit to Hartshead takes the gross consideration for the divestment of Phase 1 to A$196m, which is an outstanding achievement for our shareholders. The Hartshead team is advancing the project work streams with completion of FEED and FDP imminent and our FID planned for Q3 of this year."

KeyFacts Energy: Hartshead UK country profile l RockRose Energy UK country profile

KEYFACT Energy

KEYFACT Energy