In February 2023, Block Energy closed a senior secured loan facility of USD 1.06 million (c. £0.86 million on 2 February 2023).

The Loan Facility permitted the Company to borrow an additional contingent amount of up to USD 2.00 million during the term of the loan from the USD 1.06 million already committed, with the existing lenders having a right of first refusal for a period of 20 business days to participate in any extension.

The Company has now increased the Loan Facility by USD 0.94 million (c. £0.75 million on 10 May 2023), and entered into an updated Loan Agreement, with the only changes made to reflect the increased amount of the Loan Facility and to allow new lenders to participate in the current tranche, together with those of the existing lenders who have elected to participate.

The funds raised will provide liquidity to maintain momentum around scheduled crude liftings allowing the Company to accelerate the procurement of materials for the drilling of its next Project I wells. The first in the drilling sequence is KRT-45Z, located approximately 1,500 metres from the recently drilled and successful WR-B01Za well and will be spud in July.

Commenting, Phil Dimmock, Chairman of Block Energy plc, said:

"Existing Group production is now over 620 boepd (April average rate), and it is important that we keep the momentum going with the drilling campaign. The success of both JKT-01 and WR-B01Za has given us great confidence as to the full potential of Project I. These additional funds assist in the timely procurement and execution of the next development wells. We look forward to updating shareholders on further developments in due course."

The further USD 0.94 million is being lent on the same terms as the initial Loan Facility, that being for a term of 18 months from the date on which the Loan Facility was initially drawn down (2 February 2023), at which point the principal is repayable in full. The Loan Facility carries an interest rate of 16% p.a., payable quarterly in arrears in cash. The Company may elect to repay amounts outstanding under the Loan at the end of each quarter, in part or in full, subject to a 2% early repayment fee concerning the outstanding principal amount.

The Company has provided a debenture to the lenders as security, providing a fixed and floating charge over the Company's property and assets.

Each lender will receive warrants exercisable at any point during the three years from the Closing Date of the original agreement (2 February 2023). The exercise price of each warrant shall be 1.92 pence per ordinary share. The number of warrants issued to each lender shall correspond to an exercise value equal to 50% of their respective loan commitment under the Loan Facility. Therefore, the number of warrants to be issued to lenders as part of the USD 0.94 million loan in aggregate is 19,352,394.

Related Party Transactions

The Company's Chief Executive Officer, Paul Haywood, has provided a further USD 25,000 of the Loan Facility (in addition to the USD 90,000 already committed). Its current Chief Operating Officer and former board director, Ken Seymour, has provided a further USD 25,000 of the Loan Facility (in addition to the USD 100,000 already committed).

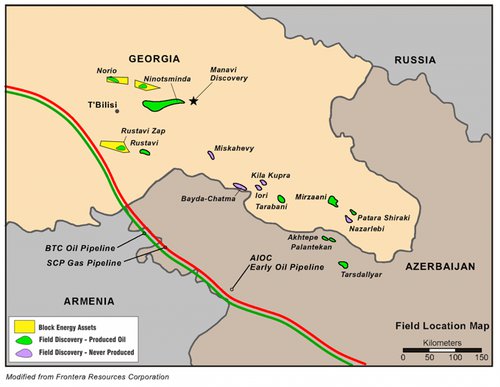

KeyFacts Energy: Block Energy Georgia country profile

KEYFACT Energy

KEYFACT Energy