By Kathryn Porter, Watt-Logic

On 30 March, the French Parliament published a report entitled “D’enquête visant à établir les raisons de la perte de souveraineté et d’indépendance énergétique de la France” or “Inquiry aimed at establishing the reasons for the loss of sovereignty and energy independence of France”. It opened saying that it was only through a combination of lower industrial output and a decline in the comfort levels of ordinary citizens through reduced heating that the country avoided blackouts this past winter – something that had not been required of the country since the Second World War – and asked what led to this situation the parliamentarians described as a “loss of energy sovereignty”. And how did the country go from a leading energy exporter to what former high commissioner for atomic energy, Yves Brechet, described as a “headless duck”?

The introduction goes on to say that the successful post-war energy policy was gradually undermined by a mixture of complacency and increasing entrenchment of an anti-nuclear dogma at the expense of energy sovereignty and de-carbonisation.

I was inclined to wonder at this point whether by “sovereignty” they meant “security” but there follows a discussion on the difference between sovereignty and independence which shows that the clear priority is self-determination. The authors state that their work shows that energy independence is a “mirage” since France has neither the uranium needed to fuel its nuclear reactors nor the extensive minerals required to build renewable generation available on French soil. They therefore conclude that the focus should not be on independence but on self-determination and the ability to determine and control all aspects of the supply chains required for energy production. By creating a situation where energy itself needs to be imported, the authors say that France has surrendered its energy sovereignty. They recommend that France undertakes detailed studies of its energy dependencies on other countries at all points in its energy supply chains to inform future policy.

As in the UK, 2022 saw a renewed focus on security of supply and a recognition that this should not be compromised by efforts to de-carbonise.

And a central recommendation that runs throughout is a desire to put the French Parliament at the heart of decision-making, to give decisions legitimacy and to reduce the risk of changes in course every 5-7 years as administrations change.

Here is a translation of the report which I made using the translation function in Word (which is not always entirely reliable, but in I think delivers the general gist). Unfortunately, the original formatting has been lost, and the pagination is now approximate, but the report is an interesting read. The tone is refreshingly direct – I struggle to imagine a group of British politicians expressing themselves this way, however, it should be noted that some members of the Committee rejected the report, believing it did not accurately reflect the evidence presented during the hearings.

The French energy landscape

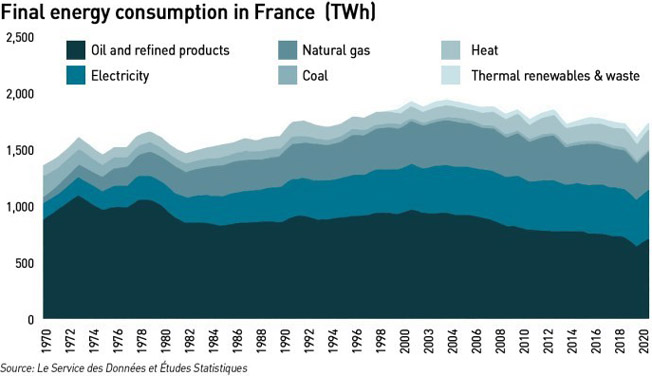

Large parts of the report describe the energy landscape in France, across all energy vectors. While nuclear power dominates energy production in France, the country relies heavily on imported hydrocarbons since little is produced domestically. There has been a downward trend in consumption over the past two decades as a result of de-industrialisation with certain heavy industries re-locating outside France over this period. Imports have followed a similar (related) downward trend. However, while overall demand has fallen, peak demand has increased rapidly this century with increased use of electrical appliances in the home, leading to security of supply concerns. (The report criticises demand forecasting used by policy-makers – while it correctly anticipated the demand reductions observed over the past two decades, the forecasts were arguably too short-term and failed to take account of the future impact of electrification.)

Since the development of the French nuclear fleet, France imports about two-thirds of the primary energy it consumes.

The scale of these energy imports contributes to a significant trade deficit of between €10 and €20 billion, something which has been significantly aggravated by the increase in electricity imports over the past year resulting from the stress corrosion issues in the nuclear fleet and poor hydro levels. However, the key concern for the committee was the country’s high dependence on fossil fuels, noting that exiting these, as required by climate ambitions, will not be easy or quick.

The report also considers the critical dependencies for the energy sector including access to the minerals required for the energy transition and water used not just in hydro but also for cooling the nuclear fleet, noting the risks associated with heatwaves such as that experienced last summer.

The authors are critical of the way in which the energy markets have been planned in France in recent years, saying that even though planning tools exist, such as the multiannual energy programming system, these tools are little or poorly used. In addition, electricity consumption forecasts from RTE (Réseau de Transport d’Électricité) only cover the short or medium term, and do not properly integrate climate objectives or provide the long-term modelling required by energy market participants. They note that in 2015, three out of five trajectories predicted a decline or near stagnation in electricity consumption, with an assumption that France would rely on imports should it be unable to generate enough electricity to meet its own needs.

Damaging anti-nuclear ideology needs to be addressed

The report describes the closure of the Superphénix fast breeder reactor in 1998 as the “original sin” of anti-nuclear ideology that has harmed the French nuclear power sector. The plant would have re-processed fuel from conventional nuclear reactors, and produced uranium, generating more fuel than it produced, reducing the need for imports. It was closed largely for political reasons, and there had been no recommendations from the nuclear regulator for closure on safety grounds at the time. The authors say this de-railed France’s ability to become a world leader in fast-breeder reactors, a position which has now been taken by other nations (India in particular is very active in the area). It also undermined confidence in the French nuclear sector both domestically and internationally.

There is strong criticism of the failure of successive governments since the early 1990s to consider the impact of nuclear closures – much of the fleet was built at the same time and can therefore be expected to retire at the same time – a “cliff-edge” effect. There was also a hiatus of around a decade when no new construction activity took place, and when it did resume it was with the European Pressurised Water Reactor (“EPR”) which was authorised in 2004 before its design had even been completed, and was limited to a single project (Flamanville 3). By then there had been a significant skills exodus which further harmed new-build efforts.

The authors also point to anti-nuclear ideology in Germany as harming the French nuclear sector – previously German companies had worked alongside French companies to develop nuclear technologies. Their withdrawal from the market created technical challenges for the French, which they say was partly responsible for the delays in delivering the EPR which has been such a challenge for EDF. (The authors include a jibe here at the Germans, pointing out their “backward step” in returning to a reliance on coal in the aftermath of the Ukraine war, given their rejection of nuclear power.)

There is strong criticism of energy policy under President François Hollande, who championed a significant reduction in nuclear output. The authors point out that the underlying assumption that electricity demand would fall, despite electrification, was unrealistic, and say that the focus should have been on reducing fossil-fuel use rather than nuclear power. In the period 2005-2010 in particular there had been a focus on diversifying sources of zero caron electricity, without much explanation of the necessity, and at the expense of reducing France’s reliance on fossil fuels. His successor, current president Emmanuel Macron, campaigned on a promise to reduce nuclear generation to below 50% of the electricity mix by 2025, something the authors say was both known to be unrealistic at the time, and not subject to any impact study. Shortly after his election, this target was delayed to 2035. Furthermore, Marcon has appointed a succession of energy ministers known to be hostile to nuclear energy.

“In particular, the objective of reducing the share of nuclear power in electricity production to 50% by 2025 was not based on a rigorous study to ensure its feasibility…this measure, like that of capping nuclear production capacity, was more a symbolic and political choice than an energy strategy,”

– Assemblé Nationale energy sovereignty report, 2023

In the 2019 energy programme, there were binding objectives to reduce the share of nuclear power in the energy mix. The closure of 14 reactors would see nuclear as a share of final energy consumption of fall by 7.6% by 2023 and 16.5% by 2028 compared to 2012. The authors describe this as “very restrictive since they de facto force us to drastically reduce our energy consumption in a short time”. Energy policy assumed that demand would fall and this was the justification for plant closures, something the authors say is inconsistent with even green re-industrialisation plans. All energy forecasts actually predict that demand will rise.

The authors go on to describe what they term the “duplicity” of the current Government. In 2022, Macron gave a speech in which he appeared to endorse a reversal in the nuclear decline, with new reactors and the EPR2 being announced. However, ministerial testimony to the Committee which produced this report, as well as policy action / inaction undermine this apparent change in direction. The premature closure of the Fessenheim plant and the suspension of the Astrid (the advanced sodium demonstration reactor) project further weakened the sector.

The authors also criticise France’s two nuclear energy companies – EDF and Areva for competing rather than co-operating with each other in international markets (partly as a result of the near total suspension of domestic new-build activity) – which was ultimately damaging for both companies and for the French nuclear industry.

The authors recommend a renewed commitment to nuclear power. In fact, 12 of the 30 detailed proposals in the report relate to nuclear energy covering both short term (resolving the stress corrosion issues, delivering EPRs and securing funding for the Jules Horowitz materials testing reactor which is currently under construction) and long-term (managing the retirement cycle, developing Gen IV reactors, SMRs and re-starting breeder-reactor programmes). There are also proposals relating to management of uranium supplies and increasing enrichment capabilities within France, support the expansion of the spent fuel storage capability in The Hague, and increased headcount at within the nuclear safety regulators.

Information and science in political decision-making

The report contains an interesting discussion on the way in which information, mis-information and incomplete information spread in the modern age, to inform both the public and policymakers. The authors decry the lack of nuance and context in social media, and highlighted one scientist interviewed by the committee, who eventually withdrew their remarks which were found to be personal opinions unsubstantiated by any actual data. The authors used this example to highlight the way in which supposed experts are deployed by groups with specific agendas to further their particular ideologies, rather than to contribute hard scientific facts to the debate.

I was particularly interested by this part of the report since similar trends are seen in the UK where neither politicians nor civil servants generally have the hard science backgrounds needed to cut through the noise and identify what is and is not real in all the information they are given. I suspect that the picture in France is somewhat different given the greater emphasis on scientific study within the education system which focuses more on technical rigor than the British system. This has its pros and cons – while I expect it means that French policymakers are better equipped to analyse the information they receive, they may not be as able to intuit the appropriate response. My experience working with newish French graduates was that they were technically competent but lacked initiative, requiring a higher level of direction than non-French colleagues. They were much less likely to generate ideas adjacent to the task at hand, but would complete the actual task better.

The authors cited several examples of politicians interviewed by the Committee who struggled to explain the rational for certain decisions, citing a “casualness and disregard for facts and physical and technical constraints,” and attempts to use science to justify what were essentially political decisions. Another politician had apparently commissioned a report he had never read, and was therefore unaware of its pro-nuclear conclusions.

They also describe what they call the role of “symbols” in politics – the idea being that the public expects near instantaneous reactions to challenges as they arise, meaning there is a lack of time for properly considered responses. The responses they get are therefore symbolic – easy to digest headlines designed to appeal to certain interest groups – which often fail to translate into a coherent policy later on. Politicians are then elected based on promises they cannot keep, undermining public confidence in the entire political process.

They go on to say that they don’t necessarily think science has to direct policy, but that policy must be subjected to long-term impact assessments to ensure they are technically robust. Ultimately reality will always catch up – “the circumstances of this winter 2022/2023 have cruelly reminded us that politics does not live next to physical rules”.

That the authors of this report took time to consider how information, science, special interests and advisors inform energy policy was a very useful exercise and one which policymakers everywhere should also consider.

How increased integration with Europe harmed the French electricity market

The report bemoans the impact of European regulation on the French market, essentially arguing that the French market is unique in Europe and should therefore receive special treatment. It’s tempting to dismiss this as typical French self-interest, but I do think they have a point…the French market with its huge reliance on nuclear power is unique, and the economics of nuclear should arguably be treated differently.

The EU has pushed for France to open up its energy markets to competition, reflecting liberalisation in other markets. This a reasonable request, not least because EDF is able to compete in markets outside France, leveraging its cheaper cost of capital as a state owned, (or as was the case until recently, majority state owned) entity. The expected quid pro quo for this is for the French market to be opened to non-French companies.

However, it is more complicated than that, since the barriers to entry are much higher for new entrants in France: nuclear power stations have very high capital costs, so private companies generally do not build them, but once built, the operating costs are low, so it would be hard for a company to enter the French market by building thermal power stations because they would be out of merit compared with nuclear and hydro, which is the second largest type of generation in France.

France could have un-bundled its market, and forced EDF to sell its output in the wholesale market to independent suppliers, but it has not done this. Instead, under EU direction, it set up something called ARENH (L’Accès Régulé à L’Electricité Nucléaire Historique), a regulated tariff which allows French electricity suppliers to sell cheap nuclear electricity bought from EDF to end consumers.

“…the end of the 2000s and the beginning of the 2010s will remain irremediably the years of the conception of a European framework harmful to the French model. The idea of consolidating export opportunities for our electricity has led to weakening EDF in France and Europe, to installing a sword of Damocles on our hydroelectric concessions, and to creating a market for electricity responds to concerns about margin allocation rather than industrial success and security of supply at reasonable cost…”

– Assemblé Nationale energy sovereignty report, 2023

ARENH was established under the NOME law passed in 2010, and was envisaged as a way to enable customers of other companies to benefit from the legacy investment in the nuclear fleet by EDF. It was designed to cover EDF’s ongoing operating costs since the capital costs had by this time already been recovered. The measure was intended to be temporary and the ARENH price was initially set at €40 /MWh, later increased to €42 /MWh to cover the costs of safety upgrades required in the wake of the Fukushima disaster.

From around 2016 when wholesale prices fell to €30 /MWh, EDF began to experience significant losses leading to a need for re-structuring, although the authors challenge assertions by previous EDF CEOs that ARENH was the reason for the company’s difficulties. The authors also note that despite the law allowing the ARENH rate to be reviewed annually, it was not adjusted in the 2010s despite warnings from EDF that this was necessary. There were issues with agreeing review methodology with the European Commission, and ultimately the methodology was not agreed, meaning no increases were made. ARENH was asymmetric – when wholesale prices fell below the tariff levels, EDFs competitors bought their electricity on the open market at that lower rate, leaving EDF unable to recover its costs (which were intended to be reflected in the ARENH).

ARENH has also failed to encourage alternative suppliers to develop their own generating resources. It has however helped to insulate French consumers from the full impact of high wholesale prices over the past 18 months.

The other area of concern relating to EU influence over the French market relates to hydro concessions (see below). Again, I find myself in sympathy with the idea that these are not assets that easily lend themselves to full market opening. When I worked for EDF Trading, there was a strong internal focus on the way that hydro assets were optimised, taking account of safety above financial optimisation. This was because, some years previously, there had been an incident where a reservoir had overflowed flooding villages and I believe leading to loss of life, because the water level had not been properly controlled. Many of the alpine reservoirs are connected, so it is difficult to see how water levels could be effectively and safely managed if they were operated by different companies, all trying to maximise their own profits, where those profits are linked to optimisation of the “stock” of water. The report also notes security concerns suggesting that allowing foreign companies to own such assets would leave the country vulnerable should those foreign states turn hostile.

The authors say that, despite being strongly pro-European, they want to take back control of certain aspects of energy policy, and remove selected impacts of EU law on the French energy market. They want to suspend ARENH pending a full review, and see an urgent need to “reform the entire European framework for energy policies”.

“What may appear from afar as anti-nuclear ideology at the European level looks more like, on closer inspection, the national interests of states that do not have the excellence of the French nuclear industry and that have better defended their interests,”

– Assemblé Nationale energy sovereignty report, 2023

The discussion on interconnectors seems incomplete – the authors note that for many years France has been the main exporter of electricity in Europe, and that imports helped the country to avoid blackouts during periods of extended nuclear unavailability for example due to stress corrosion. Exports were also a means of monetising surplus domestic generation capacity, and EDF had a strategic objective to export electricity.

Yet there seems to be a largely unspoken “but” in the narrative. The authors suggest that France has been a victim of more effective protectionism by other countries where an apparently anti-nuclear ideology has been used as cover for neutralising French market dominance. There are also concerns that imports might not be available in times of greatest need, for example if neighbouring countries reduce exports to protect their own markets. The authors take particular aim at Germany (apparently reflecting strong anti-German narratives in the hearings), saying that country’s opposition to nuclear has resulted in increased fossil fuel consumption, while also claiming that this stance led to Germany taking an excessive interest in the French market, for example pushing for the closure of Fessenheim which is located close to the German border (despite Germany being a major importer of French nuclear power).

So while the authors note the benefits European integration has brought to France, they also bemoan what they see as detriments, and at the heart of this is a reduction in French self-determination where its energy market is concerned. There is no discussion as to whether these trade-offs have been beneficial, but rather a “have your cake and eat it” attitude where they seem to want the benefits but are unwilling to accept that there may be some cost to these, for example, some loss of energy “sovereignty”.

The French hydro-electric market

French hydroelectricity is regulated under a 1919 law which stipulates that “no-one may dispose of the energy of tides, lakes and rivers […] without a concession or authorisation from the State “. Installations of less than 4.5 MW are subject to authorisation and the concession regime applies above this threshold. There are 340 existing concessions covering more than 90% of installed hydropower capacity (25.4 GW with production of 62.5 TWh in 2021). The concession holders are responsible for the construction and operation of hydro facilities and are receive the profits of their use throughout the duration of the concession. At the end of the concession, the plant is transferred to the State, which may then decide to renew the concession. These concessions are primarily managed by EDF, which supplies 70% of French hydro production, Compagnie Nationale du Rhône, which has 25%, and by Société Hydro- Électrique du Midi with 3%

French hydroelectric plants vary widely in design and profitability but all fall under the same concession regime, which inhibits the development of new pumped hydro plant which has high capital costs.

The concessions have expired or are gradually expiring according to a timetable covering the period between 2003 and 2080, and there have been years of uncertainty regarding the terms of their renewal, in part due to EU requirements for liberalisation of the energy market. 38 concessions have so far expired and not been renewed, and there may be as many as 61 expired but not renewed concessions by the end of 2025, growing rapidly thereafter. The continued operation of expired concessions is authorised by law under the “rolling deadlines” regime. However, this interim solution various limitations, with uncertain recovery of maintenance or upgrading capex.

The European Commission has given formal notice to the France to apply the Directive relating to the award of concession contracts twice since 2015, requiring the French state to select the method of awarding renewals (which by law can be done in one of two ways: either through competitive tender, or by awarding it to a public operator over which it exercises control ie, a “quasi-governance” approach).

There are various difficulties in setting the terms of these concessions – in particular, the desire of the State to properly capture rents relating to significant increases in wholesale electricity prices, through the fee structure, and the term that should be offered. There are also concerns that introducing new operators would disrupt the operation of related chains of plants – with implications for managing flood risk or availability of water for nuclear power stations – and would undermine economies of scale such as pooling of staff across facilities. There are also concerns that foreign operators could enter the market, potentially being able to influence strategic issues around water management, and a key element of energy security.

These issues are hampering the development of new hydro capacity, which grid operator RTE believes could be increased by 5 GW.

Better co-ordination needed in the energy transition

The authors criticise the way that renewable energy has been developed in France to date, and in particular the failure to develop the necessary industrial resources for example turbine or solar panel manufacturing, and the competition with the nuclear fleet where a desire to diversify the sources of low carbon generation has been articulated without evidence to identify why this is necessary. This has distracted from the need to exit from fossil fuels. Environmental regulations and emissions limits are driving fossil fuels out of the electricity mix, but this is leading to concerns over security of supply.

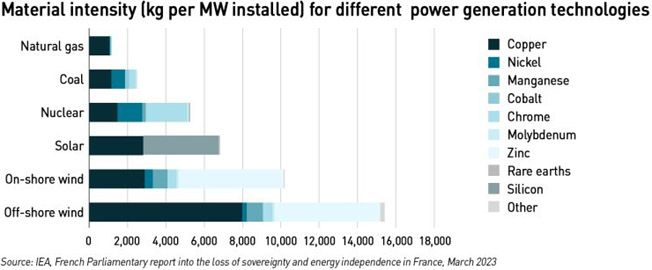

The report’s authors recommend that the use of renewable energy be expanded, but caution that it is important to assess the robustness of the supply chains involved, particularly in relation to access to minerals. The mineral requirements for renewable energy are significantly higher than for conventional energy – for example the Office of Geological and Mining Research (“BRGM”) has indicated that an offshore wind turbine requires six times more mineral resources than a coal-fired power station per MWh, and an electric vehicle contains six times more metals than an internal combustion vehicle. The BRGM also believes that more mineral resources will have to be produced by 2050 than since the beginning of humanity if climate goals are to be met. Access to copper is a particular concern since many of the world’s mines are already well on the way to being exhausted, and the prospect for new discoveries is limited.

The report notes that many of these minerals are under Chinese control, with either mines or foundries being located in China or under Chinese ownership.

There is less focus in the report on the demand side, but the authors express a desire to promote demand reduction and a concept of “energy sobriety”, by which they mean behavioural and lifestyle changes that would lead to reduced energy consumption. They also want to promote energy efficiency in the true sense of its meaning, ie reducing energy use by improving the performance of appliances.

France has a lot more electric heating that the UK. In part, this came from a desire to find markets for excess electricity following a period of over-capacity created by a combination of new nuclear power stations opening at a time when industrial decline caused overall reductions on French electricity demand. From a policy perspective, the focus was on installing electric heating in well-insulated new-build properties, but the supply of cheap electricity meant that even poorly insulated older homes converted to electric heating. This also means that French electricity demand is much more sensitive to temperature than that in neighbouring countries which rely less on electric heating. This temperature sensitivity is of concern to the authors, who want to see improvements to the French housing stock to reduce heat losses in leaky homes.

The six mistakes of French energy policy

The report outlines what the authors see as six key mistakes in recent French energy policy…

- Energy forecasts: electricity remand has been under-estimated due to environmental objectives and the need to exit from fossil fuels, without considering long-term industrial and climate ambitions;

- Conflict between renewable and nuclear energy: the focus on the electricity mix, which is already dispatchable (French reactors were designed to operate flexibly*) and de-carbonised, has compromised the exit from fossil fuels, which will impose significant challenges such as electrification with its consequent impact on the grid; and prevented a focus on more effective management of energy resources;

- Nuclear fleet: not having considered life-extensions of nuclear plant as part of the wider industrial landscape rather than on a site-by-site basis, has weakened the nuclear industry, and degraded workforce skills, and the harmed ability to launch a major new projects;

- Renewable energy: not building industrialised renewable energy supply chains to replace fossil fuels more quickly, as targets were set;

- European market: allowing a framework to develop over the past 20 years that weakened the French energy model, through the NOME law, the ARENH system, the status of hydroelectric concessions and electricity trading rules;

- Research: having shut down the Superphénix reactor and not having preserved France’s lead in the research and development of Gen IV nuclear reactors after 2019.

(* although this can lead to performance issues and increase wear on the plant.)

Six energy lessons for the next 30 years

…and propose that six key lessons are learned for the future:

- The long term counts: climate, industrial and energy policy must be consistent across long-term time-scales (ie several decades);

- Energy, and in particular electricity, is not a good like any other: within the European Union, each country first defends its energy balance, France must do the same;

- Energy is an industry, and the third largest in France: France should continue to manage the entire value chain of the energy sector and to have a suitably skilled workforce. It must also choose renewable energy technologies and sources, noting that hydro is the most important since it is the only one which is dispatchable, and is the most profitable and the most able to ensure security of supply;

- Electricity is not everything: energy policy must not focus solely on electricity when its production is already almost entirely carbon-free in France. France must also accelerate the development of heat networks and thermal renewable energies to replace fossil fuels;

- Increased attention to the demand side: it is important to assess to extent to which the thermal properties of residential properties can be improved, and to ensure workforce skills are maintained, and that this is factored in to decision-making;

- Without research, delays are inevitable: the needs of the next five decades need to be considered in terms of the nuclear cycle, the requirement for large amounts of electricity storage, the recycling of critical materials, etc.

The report calls for a new commitment to nuclear and reduction in the impact of EU rules on the French market

Last year, President Macron renewed the commitment to nuclear power in France, arguing that nuclear together with renewables formed the most economic and technically feasible approach to achieving climate objectives. The new nuclear strategy includes:

- Extending the lives of existing reactors beyond 50 years where possible

- A programme of new reactors starting with six EPR2s and studies to evaluate a possible further eight EPR2s

- A programme to create small modular reactors.

Also last year, the commitment to reduce nuclear generation to 50% of the electricity mix, and the outright cap on nuclear capacity of 63.2 GW were formally abandoned. At the same time laws were passed to accelerate the development of renewable generation, with a focus, also seen in the UK, of removing some of the logistical barriers such as planning delays.

The report highlights a number of challenges for the new nuclear strategy: how the new EPRs will be financed, what impact the re-nationalisation of EDF would have, and whether the nuclear industry in France retains the capability to deliver on these ambitious given 20 years of degradation. The authors stress that lessons need to be learned from the difficult development of the EPR when formalising the design for the EPR2. They also say that there needs to be a better awareness of the vulnerability of uranium supplies, and that there should be an increase in enrichment activities in France and the creation of facilities to re-enrich spend fuel without having to send it outside the country (currently it is done in Russia). They also would like to see renewed research into the fuel cycle and fast neutron reactions, and area in which France has fallen behind other countries.

The report also recommends that the number of personnel in the nuclear industry is increased and that the various regulators whose remits overlap are rationalised and streamlined.

The authors of the report believe a general awareness is needed within France of the challenges faced by the electricity system, both in terms of the cliff-edge of nuclear retirements, and the urgent need to address both immediate and long-term energy security, particularly given expected increases in electricity demand. RTE’s base case for 2050 shows a production gap of 400 TWh that will need to be filled – more if re-industrialisation is increased. This implies a doubling of generation capacity, and more when retirements of existing plant are considered. Stronger re-industrialisation would increase demand by a further 100 TWh per year. Of course, where intermittent renewable generation is used, even more capacity will be needed, along-side large-scale use of storage and flexibility, which to date has not been available.

The authors would like to see what they term the “French specificity” explicitly recognised by the EU with calls for France to be allowed to suspend ARENH pending full reform, arguing that the recent EU cap on gas prices renders it obsolete (although the cap has not been activated since gas prices have remained below the cap level). They also want the French Government to resolve the hydro concessions issue by adopting the quasi-governance framework to avoid competition and enable investment.

The report also highlights the over-riding objective to reduce fossil fuel consumption, and that a significant contribution will be required from demand reduction, including from energy intensive users. The authors recommend making the energy sobriety plan that was in place last winter, permanent.

I think this report provides an interesting insight into French energy policy and the current fragile state of the French electricity market. The country has undoubtedly benefitted from European integration, exporting large amounts of electricity, securing imports at times of low nuclear availability, and enabling EDF to gain significant market share in other countries without giving up very much of its domestic position.

But EDF and the French electricity sector have been badly mis-managed. The country became complacent after over-investing in capacity in the 1980s and 1990s – a position that was not dis-similar to the UK which began privatisation with a significant capacity overhang – but this resulted in a new-build hiatus, a rather inexplicable desire to reduce the dominance of nuclear in the generation mix, and a consequent loss of skills in the nuclear workforce which will be difficult to recover.

France also seems to be grappling with its relationship with the EU – chafing against EU “interference” in its electricity market, while reaping the benefits of integration. While I have some sympathy with arguments that ARENH should be abolished, and that Germany should not involve itself in domestic French energy matters, France needs to be realistic about the need to take the rough with the smooth and that no relationships, international or otherwise, are 100% beneficial – compromises are inevitable.

Without doubt, France has benefitted from its early commitment to nuclear power, more so with the relatively recent drive to de-carbonise, but the country lost focus causing completely un-necessary damage to its nuclear industry. It now needs to seriously re-commit. Nuclear power is the most secure means of de-carbonising the electricity mix, and France has a significant, if reduced, head start. The country needs to re-instate the nuclear industry as the crème de la crème of its industrial landscape to encourage a new generation of engineers to enter the workforce. It needs to build on the Iter project, one of the few remaining areas of French global nuclear leadership, and reinvigorate its nuclear research programme.

And it needs to think more deeply about its relationship with Europe. It is useful to consider the risks as well as the benefits of interconnection – the report briefly touches on the possibility that imports might not be available when needed – but it should also consider more carefully how policy decisions in neighbouring countries impact its energy markets. The German nuclear exit had some very direct impacts on France with German companies withdrawing from shared nuclear projects, but there is a major indirect impact which is German reliance on French exports. Germany is in this way substituting its own domestic capacity investments with legacy French investments, which may not entirely be to the benefit of French tax-payers.

Unlike many of its neighbours, France has actually had a fairly good energy policy. Unfortunately it has been badly executed. This report indicates that the mistakes are being acknowledged, which is the first step to correcting them.

Original article l KeyFacts Energy Industry Directory: Watt-Logic

KEYFACT Energy

KEYFACT Energy