NEO was founded in July 2019 as an independent full-cycle energy business in the UKCS, backed by HitecVision, a leading private equity investor focused on Europe’s offshore energy industry.

In October 2019, HitecVision integrated its other North Sea firm, Verus Petroleum into NEO; a significant step towards NEO becoming a leading UKCS independent. Verus Petroleum was a successful company in itself that had built a strong portfolio from 2014 onwards, and through this portfolio NEO acquired historic operating experience.

HitecVision

HitecVision is a leading private equity investor focused on Europe’s offshore energy industry, with USD 6.7 billion under management. HitecVision is headquartered in Stavanger, Norway, with other offices in Oslo and London.

Acquisitions

In July 2021, NEO Energy completed its acquisition of independent oil and gas company Zennor Petroleum, further strengthening NEO’s position among the largest oil and gas producers in the UKCS.

This transaction, alongside their acquisition of a package of assets from ExxonMobil, increased NEO’s production to circa 80,000 barrels of oil equivalent per day (boepd) in 2021 with further developments providing a stable production base in the period 2022 - 2026 of between 90,000 and 100,000 boepd.

Throughout 2020 and 2021, NEO completed several major acquisitions, creating a solid platform for further growth, and securing their position as one of the top 5 independent producers in the region.

Operations

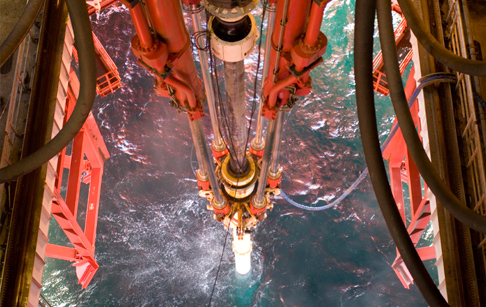

NEO operates and holds interests in high quality UK North Sea assets offering organic growth opportunities, including infill drilling and development of discoveries close to existing infrastructure.

Boa (Neo equity: 11.4%)

The Boa field was developed as part of the wider Alvheim area development, with four subsea development wells tied-back to the Alvheim FPSO.

Alba (Neo equity: 17%)

Alba is a heavy oil field. Its facilities include a fixed steel platform (the Alba Northern Platform), and a Floating Storage Unit, the first to be purpose built for the UK sector of the North Sea.

Babbage (Neo equity: 60%)

The Babbage field produces high quality gas from five horizontal multi-fracced wells. The Babbage platform is operated as a Not Permanently Attended Installation (NPAI) with temporary living quarters for up to 30 persons on board during well interventions operations, maintenance or annual shutdowns. The platform is controlled remotely from Dimlington. There are spare well slots available for future expansion.

Golden Eagle (Neo equity: 31.56%)

The Golden Eagle Area Development (GEAD) consists of the Golden Eagle, Solitaire and Peregrine oil fields. The development contains a wellhead platform, and a production, utility and quarters (PUQ) platform, which are connected by a 70m bridge.

Scott (Neo equity: 5.16%)

The Scott field is located on the southern flank of the Witch Ground Graben in the Outer Moray Firth basin. Scott was developed as a twin steel platform complex, with platform drilling covering 28 slots.

Telford (Neo equity: 2.36%)

The Telford field produces via a 10 km subsea tie-back to the Scott platform.

Dumbarton (Neo equity: 100%)

Part of the Quad 15 area, the Dumbarton field is tied back to the Global Producer III (GPIII) FPSO via subsea manifolds.

Balloch (Neo equity: 100%)

Part of the Quad 15 area, the Balloch field is tied back to the Global Producer III (GPIII) FPSO via subsea manifolds.

Lochranza (Neo equity: 100%)

Part of the Quad 15 area, the Lochranza field is tied back to the Global Producer III (GPIII) FPSO via subsea manifolds.

Affleck (Neo equity: 100%)

Affleck was discovered by Shell in 1975. The primary reservoir is Tor chalk formation with a small gas cap. The field was developed via two horizontal production wells tied back to the then Maersk-operated Janice field, 28 kilometres to the west. Oil was routed via Janice into the Norpipe pipeline, and Gas was routed via the Clyde platform and onwards to the Fulmar gas line to St Fergus. The Affleck field ceased production in May 2016 and the Affleck wells have remained closed in since then after producing a total of 4.3 mmbbl of oil. Work is currently ongoing to assess host options for the redevelopment of the Affleck field with a tie-back to two potential host facilities. The redevelopment would make use of the existing infrastructure still in place at Affleck.

Britannia (Neo equity: 8.97%)

Britannia field is currently produced by 33 wells from the main platform and a further 5 from the subsea manifold tied back to the platform. Facilities comprise a fixed steel platform incorporating drilling rig linked by bridge to a satellites processing platform. Gas is exported to SAGE system St Fergus and liquids to Forties FPS.

Finlaggan (Neo equity: 100%)

Finlaggan is a 2 well tie back to Britannia platform. Gas is exported to SAGE system, St Fergus and liquids exported to Forties FPS.

ETAP (Neo equity: Mungo 12.65%, Monan 12.65% & CPF 4.76%)

Mungo is a satellite normally unmanned platform to ETAP CPF and Monan is a subsea tie-back to the ETAP CPF. The CPF processes fluids from Marnock, Machar, Mungo, Monan, Mirren and Madoes. In future, Seagull (operated by Neptune) will also flow through the CPF. Oil from the CPF is exported to Forties Pipeline system and gas exported via CATS to Teeside.

Bacchus (Neo equity: 20%)

Bacchus is a subsea tie-back to the Forties field via Forties Alpha. Oil exported to FPS.

Cormorant (Neo equity: 40%)

Cormorant is a subsea tie-back to North Cormorant platform.

Western Isles (Neo equity: 23%)

The Western Isles is producing from two oil fields, Harris and Barra. It involves a subsea development of production and water injection wells tied back to an FPSO.

West Teal (Neo equity: 30%)

West Teal is a single well oil discovery in Upper Jurassic Fulmar sandstones. Field development plan in preparation.

Penguins (Neo equity: 50%)

Penguins is a redevelopment project in the Northern North Sea. Existing wells (currently shut-in) and 8 new wells will be tied into a new Sevan 400 FPSO. Gas will be exported to SEGAL and oil will be via tanker offloading.

Nelson (Neo equity: 23.23%)

Nelson produces via a fixed steel platform. Gas is currently exported to via the Fulmar Gas Line and oil is exported via the Forties Pipeline System.

Shearwater (Neo equity: 44.5%)

Shearwater is an HP-HT field producing via fixed steel platform and a separate wellhead platform. The Shearwater infrastructure acts as a hub for other fields, namely Fram, Scoter, Meganser and Starling. Baroli is an extended reach well drilled from the platform, which has the same owners group as Shearwater. Third party production is planned from Arran and Columbus, due onstream in 2021. Gas is currently exported to Bacton via SEAL pipeline, however this is being re-routed in 2021 to feed into the Fulmar Gas Line to St Fergus. Condensate is exported via GAEL pipeline into the Forties Pipeline System.

Fram & Starling (Neo equity: Fram 68%, Starling 72%)

Starling is a three well subsea development tied back to the Shearwater platform. Fram is a two well subsea tie-back to Starling. Fram shares its infrastructure with the Starling field.

Elgin-Franklin (Neo equity: 4.38%)

Elgin-Franklin (including West Franklin & Baroli) are a series of HP-HT fields producing via a fixed steel platform and a series of separate wellhead platforms. Gas is currently exported to Bacton via the SEAL pipeline and condensate is exported via GAEL pipeline into the Forties Pipeline System.

Gannet (Neo equity: 50%)

Gannet is a cluster of six oil fields producing via the Gannet A platform. Its facilities comprise a fixed steel platform at Gannet A with subsea tie-backs from clusters B, C, D, F &G. Gas is exported to SEGAL system and oil exported to Teesside via Norpipe.

Culzean (Neo equity: 18.01%)

Culzean is an HP-HT gas and condensate field that was discovered in 2008. It is located in the Central North Sea. Culzean was developed using three bridge-linked platforms including a 12-slot wellhead platform (WHP), a central processing platform (CPF) and a separate living quarters and utility platform (ULQ). From the CPF, liquids are exported to the Ailsa Floating Storage Offloading (FSO) vessel, for onward shuttle tanker loading. Gas is exported via the Central Area Transmission System (CATS) to the terminal facilities at Teesside.

Mariner (Neo equity: 20%)

Mariner is a heavy oil field, located in the Northern North Sea, 100 kilometres east of the Shetland Islands. It was discovered in 1981 and sanctioned in 2012 following new seismic and technologies. Mariner has been developed with a fixed platform, tied back to a floating storage unit (FSU) The field has two reservoirs: the Tertiary Maureen Sandstone and the shallower Heimdal Sandstone. Oil from the Mariner development is tanker loaded for export.

Victoria Field

NEO Energy has taken the decision to decommission the subsea installations, pipeline & umbilical and well associated with the Victoria Field.

Community Investment

The Centre for Doctoral Training in Geoscience and the Low Carbon Energy Transition

NEO has committed £2.5 million to the Centre for Doctoral Training in Geoscience and the Low Carbon Energy Transition to support their carbon reduction studies and initiatives. The centre is led by John Underhill, Professor or Exploration geoscience at Heriot-Watt University in Edinburgh and it has more than 100 PhD students whose expertise can be used across the energy and environmental sectors.

GeoBus

NEO has committed £0.5 million to GeoBus is an educational outreach project supporting Earth Science learning in schools in the UK. Geobus was developed by the Department of Earth & Environmental Sciences at the University of St Andrews in 2012, and has been running ever since. Supported by the Natural Environment Research Council, Scottish Government and industry, GeoBus has been visiting schools across Scotland, reaching all educational regions and over 250 schools.

STEM Scholarships at University of Aberdeen

NEO has agreed a partnership with the University of Aberdeen to support the development of STEM students with new scholarship programmes. Over the course of a number of years, NEO is providing funding and mentoring to support a number of ‘widening access’ undergraduates, and postgraduates to help them throughout their degree. The first four successful undergraduate applicants and first two postgraduates will begin their degrees in 2022/23. NEO is also offering summer placements for study projects.

Low Carbon Transition Plan

NEO will seek to reduce the carbon intensity per barrel of oil equivalent produced by NEO’s portfolio by 50 per cent by 2030. To achieve this, NEO will invest in technology and systems, such as the full or partial electrification of their operations, required to reduce carbon output.

NEO is aligned with the UK’s net zero by 2050 target and is proactively working with partners, regulators, and industry bodies to play its part in achieving this goal. In line with The OGA Strategy, a key aspect of NEO’s approach will be to maximise economic recovery from its assets, bringing down the carbon impact per barrel of production.

KeyFacts Energy: NEO Energy UK country profile

KEYFACT Energy

KEYFACT Energy