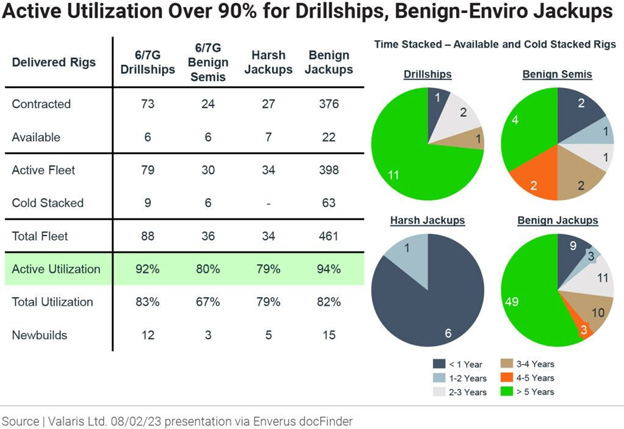

Valaris Ltd. will issue $350 million in 8.375% senior secured second-lien notes due 2030 as it prepares to buy two newbuild drillships currently in South Korean shipyards, more than 10 years, two mergers and one bankruptcy after the rigs were originally ordered. The offshore driller will exercise its option to buy both rigs with a delivery date of Dec. 31, in part because the utilization rate for existing sixth- and seventh-generation drillships has averaged above 90% for the past 12 months.

“They are the only remaining drillships available at the South Korean shipyards with two BOPs, and we estimate that it would cost approximately $50 million to add a second BOP to a ship that is only equipped with one,” Valaris CEO Anton Dibowitz said during an Aug. 2 earnings call. The transaction leaves six drillships unclaimed in South Asian shipyards after the companies that ordered them walked away during the offshore downturn.

Valaris will pay $119 million to take delivery of the Valaris DS-13 and $218 million for the Valaris DS-14. The rigs were originally ordered from Daewoo Shipbuilding & Marine Engineering in 2012 and 2013 with original targeted delivery dates in 2015.

Drillships ordered in 2012 and 2013 by Atwood will finally leave shipyard.

Dibowitz said the other newbuilds stuck at shipyards will likely go for $300 million or higher when including the cost of a second blowout preventer, so the purchase option represents a “discount of 60% and 30% respectively to the current market rate for a comparable asset.” After those unclaimed vessels are activated, the world’s drillship pool should be maxed out. “We currently believe it is highly unlikely that we will see another floater newbuild cycle given high build costs, long lead times and limited shipyard availability,” Dibowitz said.

Atwood Oceanics placed the original order with DSME for the drillships. But Atwood put off delivery a couple of times, then the drillship order transferred to Ensco when it acquired Atwood in 2017. Ensco merged with Rowan Cos. in 2019 to form Valaris, which went into Chapter 11 in 2020. Along the way, Atwood’s drillship order was amended to a Valaris purchase option. Despite their long wait, the rigs are “in fantastic shape. I was out there looking at them myself recently,” Dibowitz said.

The new notes offering, which is a private placement, will serve as an addition to the $700 million 8.375% second-lien notes due 2030 that the company issued in April. The net proceeds of that offering were used to redeem $550 million outstanding of 8.25% senior secured first-lien notes due 2028, which were issued when Valaris exited bankruptcy in 2021.

With the recent agreement to reactivate the drillship Valaris DS-7 for a 12-well contract off West Africa, the company has only one drillship remaining in stack, the DS-11. Dibowitz said he sees “good opportunities” to find a contract for one more drillship by YE23, but it could go to the DS-13 or DS-14 instead of the DS-11.

Valaris is reactivating a drillship after more than two years in stack for a 12-well contract off West Africa with an effective day rate of roughly $428,000, matching the highest announced day rate in its latest fleet status report.

KEYFACT Energy

KEYFACT Energy