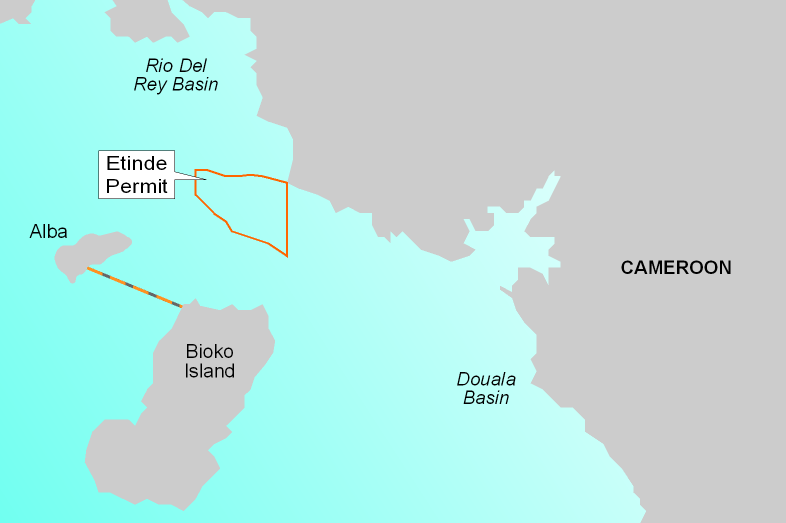

Bowleven, the Africa focused oil and gas, exploration and production company with key interests in Cameroon, has provided a corporate and operational update.

New Age Etinde stake sale to Perenco

Despite the elapse of time since the signing of the agreements for the sale by New Age (African Global Energy) of its 37.5% stake in, and the operatorship of, the Etinde project to Perenco, completion remains outstanding.

The Company understands that a number of conditions to the completion of the Transaction remain, principally including the approval of Société Nationale des Hydrocarbures ('SNH'), the national oil and gas company of Cameroon. The Company notes that SNH's approval, the next key milestone towards completion of the Transaction, has remained outstanding for a significant period and it remains uncertain when a decision will be made by SNH whether to approve the Transaction, if at all.

Whilst Bowleven is not a party to Transaction discussions, the Company understands that, although the formal long-stop date under the agreement between New Age and Perenco passed on the 30th June 2023, both parties continue to seek to progress with the Transaction. Nevertheless, given the passage of time and the geopolitical disruptions in neighbouring countries, Bowleven reminds stakeholders that there can be no guarantee either that the Transaction will complete, or as to the timing of completion.

Corporate and Financing

In its interim results statement on 30 March 2023, the Company highlighted a material uncertainty regarding the going concern status of the Group; noting that it had been considering its fundraising options and expects to seek to raise additional equity capital in 2023 to help to finance the Group's ongoing corporate activities and to assist with financing its share of future expenditure as the Etinde project progresses towards FID.

As at 23rd September 2023, the Group had unaudited cash of c. $1.25 million, having divested of any remaining financial investments during 2023. The Company noted on 30 March 2023 that it had significantly reduced the Group's cost base. The Board of the Company believes that its cash resources will currently only allow it to fund the Group through to the end of calendar Q1 2024, assuming that Bowleven's contribution towards costs at Etinde remains at current low levels throughout that period (which may or may not be the case depending on whether the Transaction completes).

As set out in the Company's announcement on 21 July 2023, planning for a fundraising during 2023 has continued and the Company continues to seek, consider and evaluate possible options to raise additional capital to fund the Group's operations. The Board had originally expected that the Transaction would have closed substantially earlier. The extended delay, with no established timeline to closing of the Transaction, has created uncertainty as regards potential additional risks associated with the Etinde project and the Company is currently considering a fundraising proposal from a shareholder which contemplates the shareholder providing equity capital at a very substantial discount to the current market price of Bowleven's ordinary shares, whilst allowing all current shareholders to participate at the same price. The fundraising is not yet at an advanced stage and therefore there can be no certainty that a fundraising will be concluded, nor as to the structure or terms of any such fundraising.

KeyFacts Energy: Bowleven Cameroon country profile

KEYFACT Energy

KEYFACT Energy